Guardian Announces Letter Of Intent for sale of K2 America

June 24 2013 - 5:01PM

Access Wire

Calgary, Alberta

(June 24, 2013): Guardian Exploration ("Corporation") (TSXV: GX) wishes to announce the signing of a binding letter of

intent for the sale of all the issued and outstanding shares of K2

America Corp., the Corporation's US subsidiary, to Graydon

Kowal, President and CEO of the Corporation.

The transaction is subject to shareholder and regulatory approval.

The Corporation will ask shareholders to vote in favour of the

transaction at the Annual and Special Shareholder Meeting to be

held on July 16, 2013.

K2 America Corp.

("K2 America") is a wholly

owned US subsidiary of the Corporation that was acquired through

the 2006 amalgamation with Resilient Resources Ltd. K2 America's

producing oil wells are all located on the Blackfeet Tribe

Reservation near the town of Cut Bank, MT. The average daily

production in 2012 for K2 America was 31 barrels of oil. As part of

this transaction, the Corporation retained the services of a third

party reserve engineering firm located in Billings, MT to conduct a

reserve evaluation of K2 America's properties. The report concluded

the 15% discounted Net Present Value of K2 America's proved

developed producing wells is $1,281,113, before any liabilities of

K2 America are taken into consideration.

In March 2012, K2

America entered into a settlement agreement with the Office of

Natural Resource Revenue ("ONRR") and the Blackfeet

Tribe, whereby it committed itself to drilling one well on a

Blackfeet Tribe lease 180 days upon receiving an approved drill

permit, which has been determined to be July 10, 2013.

Failure to drill the well by the aforementioned date

will result in paying a penalty amount of $371,931 and surrendering

all of its Blackfeet Tribe leases. Neither the Corporation nor K2

America have the required funds to fulfill this obligation and have

not found sufficient interest from the industry to secure a

partner.

Given this current

difficult position, the board of directors believes it is in the

best interest of the Corporation to sell K2 America to Mr. Kowal.

Along with the foregoing liability, the sale will transfer a

$1,000,000 liability associated with an expired farm in agreement

to the purchaser, as the agreement was in K2 America's name. In

assessing the transaction, the independent directors and Mr. Kowal

have agreed to assign a 25% discount to this liability. Another

$360,000 of liability will be removed from Guardian's balance sheet

related to royalties owing by Guardian to various parties. After

taking into account all assets and assumed liabilities associated

with K2 America the independent directors of the Corporation, in

negotiation with Graydon Kowal, have determined to sell the shares

of K2 America for the net amount of $223,845. If Mr. Kowal did not personally provide the funds to drill the

commitment well, Guardian would be forced to pay the aforementioned

fine and surrender its leases to the Blackfeet Tribe.

The independent directors have determined that the

sale does represent a sale of all or substantially all of the

Corporation's assets therefore Shareholders have the right to

dissent pursuant to section 191 of the Business Corporations Act (Alberta).

If the sale of K2

America is approved, the Corporation intends to use the proceeds

from the sale to pay outstanding shareholder loans and debt

obligations to related companies. A cleaner

balance sheet will give Guardian greater options in terms of

possible future mergers, asset acquisitions, and/or

recapitalization efforts.

The sale is a related

party transaction subject to MI 61-101 Protection Of Minority Security Holders In

Special Transactions which is incorporated by

reference into TSX Venture Exchange Policy

5.9. The policy requires that the related

party transaction be subject to approval by an ordinary resolution

of a majority of the minority shareholders who vote at the Meeting.

Accordingly, any shares held by Graydon Kowal, and his respective

associates, affiliates, and joint actors, will be excluded from the

calculation of shareholder approval.

Guardian is a Calgary-based

corporation engaged in the acquisition, exploration and development

of resource properties. Common shares of the company trade on the

TSX Venture Exchange under the trading symbol "GX".

For further information,

contact:

Graydon Kowal

President and CEO

(403) 269-5870

Neither TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange)

accepts responsibility for the adequacy or accuracy of this

release.

Investors are

cautioned that this news release contains forward looking

information. Such information is subject to known and unknown

risks, uncertainties and other factors that could influence actual

results or events and cause actual results or events to differ

materially from those stated, anticipated or implied in the

forward-looking information. Readers are cautioned not to place

undue reliance on forward-looking information, as no assurances can

be given as to future results, levels of activity or

achievements.

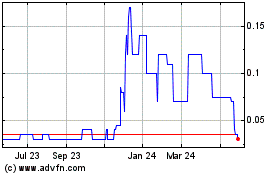

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Jan 2025 to Feb 2025

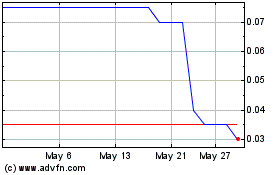

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Feb 2024 to Feb 2025