Guardian Announces Third Successful Discovery Well With Initial Flow Rate in Excess of 800 Barrels of Oil Per Day

July 17 2008 - 1:17PM

Marketwired Canada

Guardian Exploration Inc. (TSX VENTURE:GX) ("Guardian" or the "Company" or the

"Corporation") is pleased to announce that on July 7, 2008 Guardian's operating

partner completed drilling and testing the third Girouxville light oil pool.

Initial flow tests over a four hour period produced 156 barrels with stable

pressures. Extrapolated over a 24 hour period the flow rate would equal

approximately 936 barrels of oil per day. As of July 12, production data

indicates the well is flowing at a restricted rate of approximately 530 barrels

of oil per day with stable pressures, and no water. Guardian has a 55% WI

(working interest) in this well, approximately 300 net barrels of oil per day to

Guardian.

This well qualifies for Alberta's new pool royalty holiday program which allows

for the first million dollars of sales to be royalty free. The oil from the

Girouxville area is very high quality light, sweet crude that had an average

sale price of approximately $145 per barrel in the first half of July.

Girouxville Project Update

03-21-76-22W5M (first farm-in well)

This well is currently flowing at an ERCB (Energy Resources Conservation Board)

MRL (Maximum Rate Limitations) allowable rate of approximately 87 BOPD with no

signs of water. Guardian's partner has applied for GPP in May and is still

awaiting this approval. Guardian owns a 50% WI in this well.

02-29-74-21W5M (second farm-in well)

Flowing at 30 barrels of oil per day, this well has encountered a water cut,

typical of these reservoirs. Guardian is currently evaluating a water disposal

or a water injection well in the area for the produced water to increase

netback. Guardian owns a 55% WI in this well.

Future Girouxville Project Wells

Guardian is evaluating the next farm-in well location in the area to be drilled.

Under the terms of the farm-in agreement, Guardian has a rolling option to drill

11 more locations with its operating partner.

Cut Bank, Montana

The wells in this region are continually producing approximately 40 BOE per day.

Future Montana Wells

Guardian is reviewing a 100% owned seismic program over its solely owned Tesoro

field. A title opinion is nearing completion. Guardian foresees no issues and

will enter the next phase of the exploration program and applying for well

approvals. Management is optimistic that the Tesoro project has the potential to

yield the largest amount of production in Guardian's current portfolio.

Ft. Nelson, British Columbia - Kotcho Lake Project

The purchase of additional working interest in Guardian's Kotcho Lake field has

been producing very well to date. Guardian owns 100% of the two flowing wells,

B-71-H-94P-4, and B-100-E-94-P-3. These wells' combined; flow rate is 300 BOE,

with a manageable amount of water. Guardian, is negotiating with its 3 partners

on a third well, C-68-E/94-P-3, 32.5% owned by Guardian, to be brought on in the

coming months. A trial period will be established and given no issues with

current productions, be brought on.

Future Ft. Nelson Operations

Guardian is negotiating with two large producers in the area to purchase

production from these companies' non-core assets. Guardian is confident these

negotiations will be successfully closed in the near future. The Company has

received a statement of claim from a third party relating to before payout

earning in the B-100-E well. The position of the Company is that the claimed

earning did not occur and intends to defend the claim vigorously.

About Guardian Exploration Inc.

Guardian Exploration Inc. is an Alberta-based oil and natural gas company.

Guardian is engaged in the exploration for, and the acquisition, development and

production of, natural gas and crude oil with emphasis on the shallow to

mid-depth hydrocarbon rich zones of Canada's Western Sedimentary Basin focusing

on Alberta and northeastern British Columbia.

The term barrels of oil equivalent ("BOE") may be misleading, particularly if

used in isolation. In accordance with NI 51-101, a BOE conversion ratio of six

thousand cubic feet per barrel (6mcf/bbl) of natural gas to barrels of oil

equivalence is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value equivalency at the

wellhead. All BOE conversions herein are derived from converting gas to oil in

the ratio mix of six thousand cubic feet of gas to one barrel of oil.

Investors are cautioned that the preceding statements of the Corporation may

include certain estimates, assumptions and other forward-looking information.

The actual future performance, developments and/or results of the Corporation

may differ materially from any or all of the forward-looking statements, which

include current expectations, estimates and projections, in all or part

attributable to general economic conditions and other risks, uncertainties and

circumstances partly or totally outside the control of the Corporation,

including natural gas/oil prices, reserve estimates, drilling risks, future

production of gas and oil, rates of inflation, changes in future costs and

expenses related to the activities involving the exploration, development and

production of gas and oil hedging, financing availability and other risks

related to financial activities. The Corporation undertakes no obligation to

update forward-looking statements if circumstances or management's estimates or

opinions should change. The reader is cautioned not to place undue reliance on

forward-looking statements.

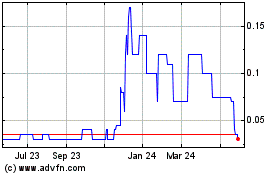

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Jun 2024 to Jul 2024

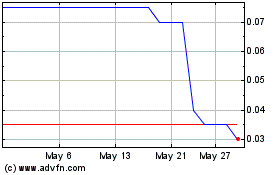

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Jul 2023 to Jul 2024