Full Metal Reprices Private Placement Financing and Closes 1st Tranche

September 25 2008 - 4:33PM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRES

Full Metal Minerals Ltd. (TSX VENTURE:FMM) (the "Company") has approved the

repricing of its non-brokered private placement announced on September 11, 2008.

The Company will place up to 6,230,000 units at $0.65 per unit (the Company

previously announced a total of 5,400,000 units priced at $0.75 per unit).

Each unit will consist of one common share and one-half of one transferable

share purchase warrant. Each whole warrant will entitle the holder to acquire

one additional common share exercisable for a period of two year following the

closing of the private placement at a price of $1.00 per common share.

A finder's fee of 8% of the gross proceeds may be payable in cash or shares on a

portion of the financing. The net proceeds from the financing will be used for

exploration expenses on the Company's projects and for general working capital.

The Company reports the first tranche of the private placement financing has

closed for total proceeds of $3,000,000. A total of 4,615,385 units at $0.65

each were issued. The securities have a hold period and may not be traded until

January 26, 2009. No finder's fees were paid in connection with this first

tranche placement.

Full Metal is a generative exploration company with multiple precious and base

metal projects in Alaska and the Yukon. Drilling and underground development is

currently underway at the high-grade Lucky Shot Gold Project. The Company has

Exploration Agreements with Kinross Gold, Freeport-McMoRan Exploration

Corporation, BHP Billiton, New Gold, Triex Minerals, Altair Ventures, Highbury

Projects, and Ashburton Ventures Inc.

ON BEHALF OF THE BOARD OF DIRECTORS

Michael Williams, President and Director

Full Metal Minerals (TSXV:FMM)

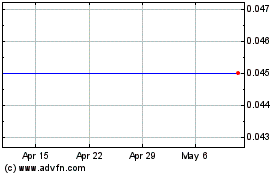

Historical Stock Chart

From Jun 2024 to Jul 2024

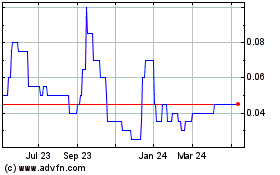

Full Metal Minerals (TSXV:FMM)

Historical Stock Chart

From Jul 2023 to Jul 2024