Aben Increases Land Holdings at Chico Gold Project in Saskatchewan, Drill Program to Begin Feb. 2018

December 11 2017 - 8:00AM

Aben Resources Ltd. (TSX-V:ABN) (OTCBB:ABNAF)

(Frankfurt:E2L2) (the “Company”) is pleased to announce the Company

has increased its land position at its 4,716-hectare Chico Gold

Project located 125 kilometres east of La Ronge, Saskatchewan and

40 kilometres south of SSR Mining's (formerly Silver Standard

Resources) Seabee gold operation. Aben Resources holds the

exclusive right to earn an undivided 80-per-cent interest in the

property by completing $3.5-million in exploration expenditures,

issuing 2.5 million shares and making $150,000 in cash payments to

Eagle Plains Resources (TSX-V:EPL) by 2020.

Chico Gold Project, Saskatchewan location

map:http://www.abenresources.com/i/maps/ABN_Chico_Location_and_Highlights.jpg

Eagle Plains has recently acquired six

additional mineral dispositions for a total area of 1,799 hectares

located adjacent to the original holdings through a combination of

staking and the completion of a purchase agreement with V. Mitchell

(an unrelated third-party vendor) whereby Mr. Mitchell will receive

a combination of $10,000 cash and 100,000 common shares of Eagle

Plains at a deemed price of 15 cents per share. These specific

dispositions will be subject to a 1-per-cent net smelter return

royalty which includes a buy-down provision. All additional tenures

will be included in the current option agreement with Aben and

subject to the terms and conditions of that agreement.

Chico Property Highlights and Exploration

Activity:

The overall objective of the 2016 and 2017

programs was to identify mineralization, alteration and structural

features similar to those at the nearby Seabee and Santoy deposits

that were recently acquired by SSR Mining (formerly Silver Standard

Resources). The Seabee Gold operation has been in continuous

production since 1991, producing1.2 million ounces of gold from the

Seabee and the Santoy deposits.

Chico property highlights include the presence

of a 1.5 kilometre-long mineralized structural corridor (Chico

Trend) which is confirmed by geophysical surveys, geological

mapping and soil geochemical surveys. Historical drilling,

trenching and sampling have been completed on the property and have

returned high-grade gold results. Highlights include:

- High grade intercepts from historic drilling include 0.424

oz/ton gold or 14.5 grams/tonne (g/T) gold over 0.4m at Chico

showing and 0.281 oz/ton gold or 9.6 g/T gold over 2.0m at Royex

showing;

- Historic sampling and trenching on the Chico Trend has returned

over 100 samples greater than 500 ppb gold in eight trenched

areas.

TerraLogic Exploration completed systematic

fieldwork for Aben in 2016 on the Chico property, including a 661

line-kilometre airborne magnetometer geophysical survey, mapping,

trenching and soil geochemical surveys. Rock samples collected

along this structural corridor ranged from trace quantities to 20.2

grams per tonne (g/T) gold. During 2017, Aben conducted a detailed

induced polarization geophysical survey designed to define

high-grade gold targets for future drilling activity. This work

resulted in numerous high-priority drill targets being identified.

Permits have been issued and drilling is expected this

winter.

Chico Exploration History:

Trenching and drilling activities carried out by

Corona Corporation and Cameco from 1988 to 1993 defined a

mineralized strike length of over 1400 metres. Trenching by Corona

at the Royex showing returned five chip samples greater than 1000

ppb gold with a best (chip) sample of 14.3 g/T gold over 1 metre

(AR 63M06-0034). Follow-up diamond drilling by Cameco near the

Royex trench returned five significant intercepts ranging from 0.51

g/T gold over 1.5 metres, to 36.3 g/T gold over 0.3 metres (AR

63M06-0041).

Mineralized shear zones and quartz veining that

define the Chico Zone are hosted in diorite and granite rocks and

especially along the sheared contact between these two units. The

Chico and the adjacent parallel Ed and Western structural zones are

related splay structures off the larger Tabbernor fault system.

Despite the significant surface discoveries of gold along these

structural trends, mineralization remains largely untested at depth

and along strike extensions.

The Tabbernor fault is a 1,500 kilometre-long

regional structure which has been traced from as far north as the

Rabbit Lake uranium mine in northern Saskatchewan to as far south

as the Black Hills of South Dakota, the latter of which hosts the

40-million-ounce Homestake gold deposit. The shared proximity to

the Tabbernor structure and similarities in terms of age and

tectonic history to the Homestake and Seabee/Santoy deposits was

the main driving force behind Aben's interest in the Chico

property. Management cautions that past results or discoveries on

proximate land are not necessarily indicative of the results that

may be achieved on the subject properties. Aben has not been able

to independently verify the methodology and results from historical

work programs within the property boundaries. However, management

believes that the historical work programs have been conducted in a

professional manner and the quality of data and information

produced from them are relevant.

Cornell McDowell, P.Geo., V.P. of Exploration of

Aben Resources, has reviewed and approved the technical aspects of

this news release and is the Qualified Person as defined by

National Instrument 43-101.

About Aben Resources:

Aben Resources is a Canadian gold exploration

company developing gold-focused projects in British Columbia,

Saskatchewan and the Yukon Territory. Aben is a well-funded junior

exploration company with approximately 53.2 million shares issued

and outstanding. For further information on Aben Resources Ltd.

(TSX-V:ABN), visit our Company’s web site at:

www.abenresources.com.

ABEN RESOURCES LTD.

“Jim Pettit”_____________________JAMES G.

PETTITPresident & CEO

For further information contact myself or:Don

MyersAben Resources Ltd.Director, Investor RelationsTelephone:

604-639-3851Toll Free: 800-567-8181Facsimile: 604-687-3119Email:

info@abenresources.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This release includes certain statements that

may be deemed to be "forward-looking statements". All statements in

this release, other than statements of historical facts, that

address events or developments that management of the Company

expects, are forward-looking statements. Although management

believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, and actual results or

developments may differ materially from those in the

forward-looking statements. The Company undertakes no obligation to

update these forward-looking statements if management's beliefs,

estimates or opinions, or other factors, should change. Factors

that could cause actual results to differ materially from those in

forward-looking statements, include market prices, exploration and

development successes, continued availability of capital and

financing, and general economic, market or business conditions.

Please see the public filings of the Company at www.sedar.com for

further information.

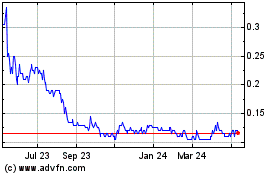

Common Stock (TSXV:EPL)

Historical Stock Chart

From Oct 2024 to Nov 2024

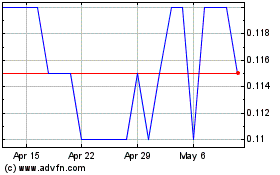

Common Stock (TSXV:EPL)

Historical Stock Chart

From Nov 2023 to Nov 2024