Entourage Health Corp. (

TSX-V:

ENTG) (

OTCQX: ETRGF)

(

FSE:4WE) (“

Entourage” or the

“

Company”), a Canadian producer and distributor of

award-winning cannabis products, announced today its financial

results for the three months ended March 31, 2023. The Company

reported total revenue of $15.1 million (net revenue of $11.8

million, before excise duties and discounts), up 24% sequentially

from Q4 2022. The Company will host a conference call to

discuss its financial and business highlights on Tuesday, May 30,

2023, at 10 a.m. Eastern Time.

"Over the first quarter, we noted significant

growth in our medical stream representing a 61% increase compared

to the previous quarter. This aligns with the escalating demand,

fueled by the introduction of innovative products, a rise in new

patient acquisitions, and substantial renewal rates,” CEO and

Executive Chairman George Scorsis affirmed. "Additionally, our

pre-rolls sales in the adult-use segment witnessed a notable rise,

with Color capturing approximately 5% of the pre-roll market. Our

revenue growth and the successful implementation of our strategic

transformation initiatives and cost improvements propel our

business toward enhanced profitability. This allows us to

accomplish our financial objectives and paves the way to expand our

market reach and diversify our product offerings. Through this

calculated approach, we are establishing a solid foundation for

sustainable growth and long-term success in the cannabis

market."

Summary of

Results

|

For the Quarter-Ended |

|

Mar. 31, 2023 |

Dec. 31, 2022 |

| |

|

($000’s) |

($000’s) |

| Total revenue |

|

15,107 |

12,141 |

| *Net revenue (less

Excise Tax) |

|

11,834 |

8,702 |

| Gross profit

(loss) before changes in fair value |

|

3,002 |

(7,509) |

| Gross margin %

before changes in fair value |

|

25% |

(86)% |

| Loss and

comprehensive loss |

|

(9,516) |

(87,923) |

|

Adjusted EBITDA** |

|

(3,374) |

(9,265) |

|

|

|

|

|

|

As at |

|

Mar. 31, 2023 |

Dec. 31, 2022 |

| |

|

($000’s) |

($000’s) |

| Cash and cash

equivalents |

|

15,551 |

9,075 |

| Inventory |

|

15,305 |

14,089 |

| Biological

assets |

|

- |

696 |

| Working

Capital |

|

(111,036) |

(101,794) |

*Net revenue defined as revenue (i.e., gross

revenue less discounts and customer incentives but inclusive of

freight) less excise taxes**Adjusted EBITDA is not a recognized

measurement under International Financial Reporting Standards

(“IFRS”) and this data may not be comparable to data presented by

other companies. Management defines Adjusted EBITDA as EBITDA

adjusted to exclude interest, tax, and depreciation, stock

compensation, fair value changes and other non-cash items, and

non-recurring items. This data is furnished to provide additional

information and does not have any standardized meaning prescribed

by IFRS. The Company uses this non-IFRS measure to provide

shareholders and others with supplemental measures of its operating

performance. The Company also believes that securities analysts,

investors and other interested parties, frequently use this

non-IFRS measure in the evaluation of companies, many of which

present similar metrics when reporting their results. As other

companies may calculate Adjusted EBITDA differently than the

Company, this metric may not be comparable to similarly titled

measures reported by other companies. We caution readers that

Adjusted EBITDA should not be substituted for determining net loss

as an indicator of operating results, or as a substitute for cash

flows from operating and investing activities. See the Company’s

management’s discussion and analysis for the three months ended

March 31, 2023 (the “Q1 2023 MD&A”) for a detailed

reconciliation of Adjusted EBITDA to Net Income / (Loss). The

Company’s financial statements for the three months ended March 31,

2023 and the Q1 2023 MD&A are available on SEDAR at

www.sedar.com

"Through our strategic emphasis on revenue

generation from our high-performing products and our commitment to

reinforcing financial discipline, we have established a strong

position for future growth and fortified our balance sheet," stated

Vaani Maharaj, CFO of Entourage. "As we consistently enhance

operational efficiencies, optimize costs of sale, and minimize cash

burn, we are well-prepared to amplify revenue growth and strengthen

our financial stability. Our steadfast commitment to creating value

for our stakeholders remains at the forefront of our efforts.”

Revenue Highlights

|

|

|

Q1 2023 |

Q4 2022 |

Q1 2022 |

Change YOY |

| |

|

($000’s) |

($000’s) |

($000’s) |

% |

| Net Revenue by

Channel |

|

|

|

|

|

| Medical |

|

5,973 |

3,702 |

6,223 |

(4%) |

| Adult-Use |

|

5,861 |

5,000 |

5,982 |

(2%) |

| Bulk |

|

- |

- |

218 |

(100%) |

|

Total Net Revenue |

|

11,834 |

8,702 |

12,424 |

(5%) |

| |

|

|

|

|

|

Financial Highlights

- For the quarter that ended March

31, 2023, Entourage recorded total revenue of $15.1 million

compared to $12.1 million for the fourth quarter ended December 31,

2022, representing a 24% increase.

- Gross profit before changes in fair

value was $3.0 million for Q1 2023, representing an increase in

gross profit of $10.5 million compared to Q4 2022 due to improved

operational efficiencies and partly due to lower inventory

write-down in Q1 2023.

- Gross margins were 25% in Q1 2023

compared to (86%) for Q4 2022 and 22% in Q1 2022. The improvement

in Q1 2023 over Q4 2022, resulted from increased automation in the

production process of finished and semi-finished goods, resulting

in lower direct labour costs.

- The cost of goods sold was reduced

by $7.4 million for the three months ended March 31, 2023, compared

to Q4 2022. This reduction was achieved by continued efforts to

optimize our operational platform and further automation

initiatives.

- Adjusted EBITDA improved by

$5,890,211 to $(3,374,484) in Q1, 2023, compared with $(9,264,695)

in Q4, 2022, primarily driven by strategic transformation

initiatives to lower costs and partly due to generating

higher-margin revenue.

Corporate Highlights During and Subsequent to First

Quarter 2023

- In January, the Company signed an

amendment to its senior secured amended and restated credit

facility entered into on October 28, 2022 (the "Credit Facility").

The amendment provides a waiver to the breach of certain financial

covenants for the period that ended September 30, 2022, and

modifies certain financial covenants set out in the Credit

Facility.

- Also in January, the Company

announced the closing of the second $15 million tranche of its

upsized Credit Facility with an affiliate of the LiUNA Pension Fund

of Central and Eastern Canada (LPF), as announced on October

31, 2022.

- In March, Entourage announced it

had added a new union group to its full-service, proprietary

medical cannabis program in partnership with leading benefits

provider Union Benefits - the administrator of union group benefits

to over 12,000 members. With these additions, Entourage confirms it

has ten union groups, five insurance providers and 24 clinics under

agreement for preferred medical cannabis coverage.

- In April, the Company announced the

issuance of deferred share units and entered into shares-for-debt

agreements, effectively promoting share ownership and incentive for

management.

- In April, the Company entered into

a firm agreement to sell the Strathroy facility to a third party

for $9,400,000, less customary transaction costs, land transfer

tax, and brokerage fees. The facility is collateral for the senior

credit facility payable to BMO. The sale of the Strathroy

facility closed on May 18, 2023.

Commercial Highlights

- In April, Entourage, in partnership

with the Boston Beer Company (BBC), expanded distribution of

cannabis-infused iced tea beverage, known as TeaPot, into the

Quebec market.

- The Company has expanded its Color

and Saturday adult-use product portfolio, introducing several

noteworthy additions, including Mint Cookie Kush and Baked Grape

Pie, bringing unique flavours to the market. Furthermore, the

Company has unveiled infused pre-rolls, launching Night Sweet &

Sour Berry. The Company remains dedicated to consistently offering

diverse products and formats that cater to consumers' varied

preferences.

- Starseed Medicinal's active patient

base experienced a notable 11% growth. The Company also reported an

increase of 20% in patient renewals. These substantial increases

highlight the Company's ability to attract and retain a growing

customer base.

- Additionally, Starseed has been

consistently enhancing its product portfolio. Among these notable

additions, the Company recently announced the launch of CBD Chewing

Gum. This expansion not only broadens the selection available to

medical cannabis patients but also showcases Starseed's continuous

efforts to offer innovative products.

- Recently, Irwin

Naturals Cannabis, a reputable nutraceuticals and herbal supplement

formulator, partnered with Entourage to introduce an exclusive

range of softgel products for medical patients through

Starseed.

Company Update - Equity

Grant

The Company is pleased to announce that its

Board of Directors has approved a one-time grant of Performance

Share Units (PSUs) to certain members of the Company’s management

team under the Company’s Amended and Restated Omnibus Equity

Incentive Plan. In total, the Board approved a grant of 6,200,000

PSUs, of which 5,100,000 will be granted to officers of the

Company.

Earlier this year, the Board of Directors

approved a cap limiting the number of Deferred Share Units (DSUs)

each Director receives as part of their compensation for the 2023

year; and the reduction in Directors’ DSU entitlements was intended

to be used to create equity incentives for management. The PSUs

will vest only if and to the extent the Company achieves certain

financial objectives, as approved by the Board of Directors, in the

2023 fiscal year, thereby directly aligning management incentives

with shareholders' interests.

Conference Call Details

A conference call will be hosted by Mr. Scorsis

and Ms. Maharaj, with management available for questions following

opening remarks:

|

Date: |

Tuesday, May 30, 2023 |

| Time: |

10 a.m. Eastern Time |

| Dial-in Number: |

Canada/USA: 1-800-319-4610.

International Toll: 1-604-638-5340Participants, please dial in and

ask to join the Entourage call |

| Replay Dial-in: |

Canada/USA: 1-800-319-6413.

International Toll: 1-604-638-9010Replay Access Code: 0167Available

after 12:00 p.m. Eastern Time, until June 30, 2022 |

(1) Source data: Buddi Retail Data, as of March

31, 2023.

About Entourage Health

Corp.

Entourage Health Corp. is the publicly traded

parent Company of Entourage Brands Corp. and CannTx Life Sciences

Inc., licence holders producing and distributing cannabis products

for both the medical and adult-use markets. The Company owns and

operates a fully licensed 26,000 sq. ft. Aylmer, ON processing

facility. With its Starseed Medicinal medical-centric brand,

Entourage has expanded its multi-channeled distribution strategy.

Starseed’s industry-first, exclusive partnership with LiUNA, the

largest construction union in Canada, along with employers and

union groups complements Entourage’s direct sales to medical

patients. With the launch of Syndicate, Entourage now hosts another

unique medical marketplace that offers patients a collective of

Canadian micro-cultivators’ products, along with Entourage’s family

of brands. Entourage’s elite adult-use product portfolio includes

Color Cannabis and Saturday Cannabis – sold across eight provincial

distribution agencies. It is the exclusive Canadian producer and

distributor of award-winning U.S.-based wellness brand Mary’s

Medicinals sold in both medical and adult-use channels. Under a

collaboration with The Boston Beer Company subsidiary, Entourage is

also the exclusive distributor of cannabis-infused

beverages ‘TeaPot’ in Canada, which launched in summer 2022,

starting in select provinces. In addition, Entourage also entered

into an exclusive agreement with Irwin Naturals, a renowned

nutraceutical and herbal supplement formulator of popular branded

wellness products sold across North America. The new line of CBD

soft gels is now available on Starseed’s medical platform.

Follow Entourage and its brands

on LinkedInTwitter: Entourage, Color

Cannabis, Saturday Cannabis, Starseed

& SyndicateInstagram: Entourage, Color

Cannabis, Saturday Cannabis, Starseed, &

Syndicate

For Investor & Media

Enquiries:Catherine FlamanSenior Director, Communications

& Corporate

Affairs416-910-0279Catherine.flaman@entouragecorp.com

Forward Looking Information

This press release contains "forward-looking information" within

the meaning of applicable Canadian securities legislation which are

based upon Entourage's current internal expectations, estimates,

projections, assumptions and beliefs and views of future events.

Forward-looking information can be identified using forward-looking

terminology such as "expect", "likely", "may", "will", "should",

"intend", "anticipate", "potential", "proposed", "estimate" and

other similar words, including negative and grammatical variations

thereof, or statements that certain events or conditions "may",

"would" or "will" happen, or by discussions of strategy.

The forward-looking information in this news

release is based upon the expectations, estimates, projections,

assumptions, and views of future events which management believes

to be reasonable in the circumstances. Forward-looking information

includes estimates, plans, expectations, opinions, forecasts,

projections, targets, guidance, or other statements that are not

statements of fact. Forward-looking information necessarily involve

known and unknown risks, including, without limitation, risks

associated with general economic conditions; adverse industry

events; loss of markets; future legislative and regulatory

developments; inability to access sufficient capital from internal

and external sources, and/or inability to access sufficient capital

on favourable terms; the cannabis industry in Canada generally; the

ability of Entourage to implement its business strategies; the

COVID-19 pandemic; competition; crop failure; and other risks.

Any forward-looking information speaks only as

of the date on which it is made, and, except as required by law,

Entourage does not undertake any obligation to update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise. New factors emerge from

time to time, and it is not possible for Entourage to predict all

such factors. When considering this forward-looking information,

readers should keep in mind the risk factors and other cautionary

statements in Entourage’s disclosure documents filed with the

applicable Canadian securities' regulatory authorities on SEDAR

at www.sedar.com. The risk factors and other factors noted in

the disclosure documents could cause actual events or results to

differ materially from those described in any forward-looking

information.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE

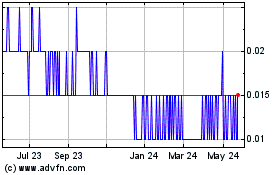

Entourage Health (TSXV:ENTG)

Historical Stock Chart

From Feb 2025 to Mar 2025

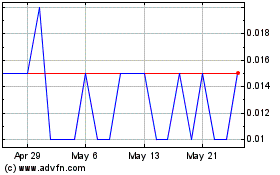

Entourage Health (TSXV:ENTG)

Historical Stock Chart

From Mar 2024 to Mar 2025