Eurasian Minerals Announces Royalty Interests on Timok Joint Venture Copper-Gold Properties in Serbia

February 04 2014 - 7:00AM

Marketwired

Eurasian Minerals Announces Royalty Interests on Timok Joint

Venture Copper-Gold Properties in Serbia

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Feb 4, 2014) -

Eurasian Minerals Inc. (TSX-VENTURE:EMX)(NYSEMKT:EMXX) (the

"Company" or "EMX") is pleased to announce the acquisition of an

uncapped 0.5% net smelter return ("NSR") royalty covering Reservoir

Minerals Inc.'s ("Reservoir" or "RMC") share of minerals and metals

mined from the "Brestovac" and "Jasikovo East" properties in

Serbia. These properties occur in the Timok Magmatic Complex, and

are included in the Timok Project joint venture between Reservoir

(45%) and Freeport-McMoRan Exploration Corp. ("Freeport") (55%).

The Brestovac property hosts porphyry and epithermal copper-gold

mineralization at the Cukaru Peki discovery, and the Jasikovo East

property occurs to the north in the Timok copper-gold belt.

Reservoir recently announced an initial NI 43-101 compliant

resource estimate for the Cukaru Peki deposit. EMX congratulates

Reservoir and Freeport on achieving this important milestone, as

well as their continuing Timok Project exploration successes.

EMX's royalty acquisition complements the Company's existing

royalty portfolio in Serbia, which includes the "Brestovac West"

property located adjacent to Brestovac. Together, EMX's Brestovac

and Brestovac West royalty properties comprise RMC's

Brestovac-Metovnica exploration permit. EMX's consolidation of the

Brestovac, Brestovac West, and Jasikovo East Timok royalty

properties strategically positions the Company to participate in

ongoing discoveries in one of the richest copper-gold mineral belts

in Europe.

EMX's Timok Royalty Properties. The Brestovac and Jasikovo East

(Durlan Potok) royalty was purchased from Euromax Resources Ltd. in

2013 for CAD $200,000. The 0.5% NSR royalty is proportionately

reduced to RMC's interest in the properties as Freeport earns-in by

making exploration expenditures under the circumstances provided in

the NSR agreement. The two royalty properties covered by the NSR

agreement, along with the Company's existing "Brestovac West"

royalty property (2% NSR on gold and silver and 1% NSR on all other

minerals), occur adjacent to and along trend from the world-class

copper-gold mines of eastern Serbia's Bor-Majdanpek mining

complex.

Reservoir reported an initial resource estimate for the Cukaru

Peki deposit's High Sulphidation Epithermal (HSE) zone of

copper-gold mineralization in a January 27, 2014 news release.

According to Reservoir, the HSE inferred resource above a 1% copper

equivalent (CuEq% = Cu% + (Au g/t x 0.6)) cut-off was

estimated to be "65.3 million tonnes (Mt) at an average grade of

2.6% copper and 1.5 grams per tonne (g/t) gold, or 3.5%

copper-equivalent, containing 1.7 million tonnes (3.8 billion

pounds) copper and 3.1 million ounces gold or 2.3 million tonnes

(5.1 billion pounds) copper-equivalent." Reservoir stated that the

underlying porphyry type mineralization had not been modeled or

included in the resource estimate "due to the lack of drill data

and geometrical understanding."

RMC also commented on the project's upside exploration

potential: "The extent of the associated porphyry copper-gold

mineralization has not been determined and remains an important

target for further definition drilling. Reconnaissance drilling

elsewhere in the Brestovac-Metovnica Exploration Permit continues

to intersect alteration and mineralization that provides

encouragement for further discovery within the permit area."

Reservoir remarked that the discovery at Cukaru Peki "demonstrates

the potential for additional blind discoveries within the Timok

Magmatic Complex."

EMX's Brestovac West royalty property is just 700 meters west of

the Cukaru Peki discovery, and contains the Corridor Zone

high-grade gold prospect and the Ogashu Kucajna epithermal gold

occurrence. These targets illustrate the exploration potential

described by Reservoir, and underscore the upside of EMX's Timok

Project royalty holdings. Brestovac West was conveyed by an earlier

agreement between EMX and Reservoir (see EMX news release dated

October 30, 2006).

Other EMX Royalty Portfolio Properties in Serbia. EMX also holds

interests in the Deli Jovan, Plavkovo and Stara Planina royalty

properties, sold to Reservoir in 2006 along with Brestovac West. As

with Brestovac West, the terms of the sale for these other

properties include uncapped NSR royalties payable to EMX at a rate

of 2% for gold and silver, and 1% for all other metals.

- Deli Jovan is located in eastern Serbia, and covers an eight

kilometer trend of shear-hosted mesothermal gold veins that include

the historic Ginduša and Rusman gold mines. The property is in

joint venture with AIM listed Orogen Gold Plc.

- Plavkovo occurs in southwest Serbia's Vardar Zone of epithermal

and porphyry copper mineralization, and hosts outcropping

gold-copper mineralization within an 800 meter long, east-west

trending zone.

- Stara Planina hosts auriferous polymetallic vein and

intrusion-related gold-copper targets. There was minor historic

production from this mineralization in the 20th century.

The Deli Jovan, Plavkovo, and Stara Planina descriptions are

based upon information provided by RMC at

www.reservoirminerals.com.

EMX Prospect Generation and Royalty Growth Business Models.

EMX's initial portfolio of precious and base metal royalty

properties in Serbia resulted from early stage prospect generation

and subsequent organic royalty growth via the sale of the portfolio

to Reservoir in 2006. The Company's Timok Project JV royalty

properties add strategic upside potential in an ongoing copper-gold

discovery funded and aggressively being explored by Freeport, and

occurring in the world-class Bor-Majdanpek district.

About EMX. Eurasian is a global gold and copper exploration

company utilizing a partnership business model to explore the

world's most promising and underexplored mineral belts. Eurasian

generates wealth via grassroots prospect generation, strategic

acquisition and royalty growth.

Mr. Michael P. Sheehan, CPG, a Qualified Person as defined by

National Instrument 43-101 and employee of the Company, has

reviewed, verified and approved the disclosure of the technical

information contained in this news release.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

Forward-Looking Statements

This news release may contain "forward-looking statements"

that reflect the Company's current expectations and projections

about its future results. When used in this news release, words

such as "estimate," "intend," "expect," "anticipate," "will" and

similar expressions are intended to identify forward-looking

statements, which, by their very nature, are not guarantees of the

Company's future operational or financial performance, and are

subject to risks and uncertainties and other factors that could

cause Eurasian's actual results, performance, prospects or

opportunities to differ materially from those expressed in, or

implied by, these forward-looking statements. These risks,

uncertainties and factors may include, but are not limited to:

unavailability of financing, failure to identify commercially

viable mineral reserves, fluctuations in the market valuation for

commodities, difficulties in obtaining required approvals for the

development of a mineral project, increased regulatory compliance

costs, expectations of project funding by joint venture partners

and other factors.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this

news release or as of the date otherwise specifically indicated

herein. Due to risks and uncertainties, including the risks and

uncertainties identified in this news release, and other risk

factors and forward-looking statements listed in the Company's

MD&A for the nine-month period ended September 30, 2013 (the

"MD&A") and most recently filed Annual Information Form for the

year ended December 31, 2012 (the "AIF"), actual events may differ

materially from current expectations. More information about the

Company, including the MD&A, the AIF and financial statements

of the Company, is available on SEDAR at www.sedar.com and on the

SEC's EDGAR website at www.sec.gov.

Eurasian Minerals Inc.David M. ColePresident and Chief Executive

Officer(303) 979-6666 Dave@EurasianMinerals.comEurasian Minerals

Inc.Scott CloseDirector of Investor Relations(303)

973-8585Scott@EurasianMinerals.comwww.EurasianMinerals.com

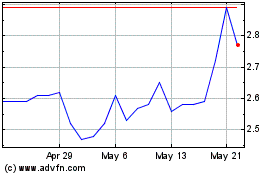

EMX Royalty (TSXV:EMX)

Historical Stock Chart

From Oct 2024 to Nov 2024

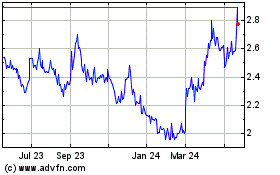

EMX Royalty (TSXV:EMX)

Historical Stock Chart

From Nov 2023 to Nov 2024