Giyani Metals Corp. (TSXV:EMM, GR:A2DUU8)

("

Giyani" or the "

Company") is

pleased to announce that as part of the ongoing Feasibility Study

(

"FS") work, a

processing trade-off study (

“Study”) has been

completed for its K.Hill manganese project in Botswana (the

“

Project”). The results from the Study do not

materially change the robust project economics from the Project’s

Preliminary Economic Assessment, as announced on 28 April 2020

(“

PEA”).

Highlights

- The post-tax Project net present

value at a 10% discount rate (“NPV”) from the PEA

is US$275m ($359m), with an IRR of 82% and a capex of US$110m

($143m).

- The operating and capital cost

estimates modelled in the Study are in-line with those used in the

PEA. Therefore, the Project NPV is unchanged and continues to be

robust.

- The Study was conducted by Tetra

Tech, together with Royal IHC, (the “Engineering

Consultants”) to identify the optimal processing route for

the Project in the FS.

- The Study only focussed on the

reductant phase of the process, which occurs upstream of solvent

extraction and electrowinning. The following three reductive

leaching processes were considered; º

Sulphur dioxide (SO2) º Sulphuric

acid leaching with reducing sugars º

Carbothermic reduction (rotary kiln), followed by sulphuric

acid leaching

- The PEA assumed a sulphuric acid

and reducing sugar-based process. The Study assessed two additional

alternatives, as well as the PEA process. The study showed that the

sulphur dioxide based process is the optimal route, as there is

less process risk. The operating costs and capital associated with

this route were also in line with those modelled in the PEA.

Therefore, the sulphur dioxide process has been selected for the

FS.

- There is no alternative trade-off

to the solvent extraction and electrowinning process for the

production of high purity electrolytic manganese metal

(HPEMM).

The study included a financial comparison of the

three process options, taking into consideration capital cost,

operating cost, recovery and incremental NPV over a 10-year Project

life. The Engineering Consultants’ analysis also included

qualitative considerations such as flow sheet simplicity, level of

complexity, security of reagent supply and market acceptance.

The PEA is considered preliminary in nature and

includes Inferred Mineral Resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as Mineral

Reserves, and accordingly there is no certainty that the

preliminary economic assessment will be realized. The expected

accuracy of costs in the PEA is within a -35% to +45% level of

confidence, as is appropriate for the level of study and accuracy

of the input data provided.

Mineral Resources that are not Mineral Reserves

do not by definition have demonstrated economic viability.

Robin Birchall, CEO of Giyani Metals

Corp. commented:

"I would like to congratulate the Giyani team

and the Engineering Consultants for their work on the Study. The

change in the reductant process means that we have reduced our

process risk, without any increase to capital or operating costs.

We are fortunate that our process is simple, thanks to the

deposit’s grade, quality and proximity to the processing plant.

Following recent insights into the direction

that cathode manufacturers and battery electric vehicle

manufacturers are moving, we will update the PEA in due course to

include high purity manganese sulphate monohydrate (HPMSM) as an

additional product stream. We expect to further increase the NPV,

as well as improve the operating and capital costs as a result of

this work.

The Engineering Consultants will also be

including the addition of HPMSM into the FS, which will be released

after the updated PEA, expected in H1 2021.”

NI 43-101 Disclosures

EUR ING Andrew Carter BSc, CEng, MIMMM, MSAIMM,

SME Technical Director Coffey Geotechnics Ltd – A Tetra Tech

Company, is a Qualified Person under National Instrument 43-101 and

has reviewed and approved the scientific and technical information

in this news release.

About Giyani

Giyani Metals Corp. is a mineral resource

company focused on the development of its K. Hill, Lobatse &

Otse manganese oxide prospects in the Kanye Basin, Botswana,

Africa. The Company's flagship K. Hill project is a near-surface

deposit currently going through a feasibility study to produce

high-purity electrolytic manganese metal and manganese sulphate,

both key cathode ingredients for batteries in the expanding

electric vehicle (EV) market.

Additional information and corporate documents

may be found on www.sedar.com and on Giyani Metals Corp. Website:

https://giyanimetals.com/.

On behalf of the Board of Directors of Giyani

Metals Corp.

Robin Birchall, CEO

Contact:Giyani Metals CorporationRobin

BirchallCEO, Director+447711313019 rbirchall@giyanimetals.com

Neither the TSX Venture Exchange (the "TSXV")

nor its Regulation Services Provider (as that term is defined in

the policies of the TSXV) accepts responsibility for the adequacy

or accuracy of this news release.

The securities described herein have not been

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act"), or any state securities laws,

and accordingly, may not be offered or sold to, or for the account

or benefit of, persons in the United States or "U.S. persons," as

such term is defined in Regulation S promulgated under the U.S.

Securities Act ("U.S. Persons"), except in compliance with the

registration requirements of the U.S. Securities Act and applicable

state securities requirements or pursuant to exemptions therefrom.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy any of the Company's securities to,

or for the account of benefit of, persons in the United States or

U.S. Persons.

Forward Looking Information

This press release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. All statements in this news release, other than

statements of historical fact, that address events or developments

that Giyani expects to occur, are "forward-looking statements".

Forward-looking statements are statements that are not historical

facts and are generally, but not always, identified by the words

"expects", "does not expect", "plans", "anticipates", "does not

anticipate", "believes", "intends", "estimates", "projects",

"potential", "scheduled", "forecast", "budget" and similar

expressions, or that events or conditions "will", "would", "may",

"could", "should" or "might" occur. Specific forward-looking

statements and forward-looking information herein includes

completion of receipt of TSXV approval for the private placement

and completion of the private placement.

All such forward-looking statements are based on

the opinions and estimates of the relevant management as of the

date such statements are made and are subject to certain

assumptions, important risk factors and uncertainties, many of

which are beyond Giyani's ability to control or predict.

Forward-looking statements are necessarily based on estimates and

assumptions that are inherently subject to known and unknown risks,

uncertainties and other factors that may cause actual results,

level of activity, performance or achievements to be materially

different from those expressed or implied by such forward-looking

statements. In the case of Giyani, these facts include their

anticipated operations in future periods, planned exploration and

development of its properties, and plans related to its business

and other matters that may occur in the future. This information

relates to analyses and other information that is based on

expectations of future performance and planned work programs.

Forward-looking information is subject to a

variety of known and unknown risks, uncertainties and other factors

which could cause actual events or results to differ from those

expressed or implied by the forward-looking information, including,

without limitation: inherent exploration hazards and risks; risks

related to exploration and development of natural resource

properties; uncertainty in Giyani's ability to obtain funding;

commodity price fluctuations; recent market events and conditions;

risks related to the uncertainty of mineral resource calculations

and the inclusion of inferred mineral resources in economic

estimation; risks related to governmental regulations; risks

related to obtaining necessary licenses and permits; risks related

to their business being subject to environmental laws and

regulations; risks related to their mineral properties being

subject to prior unregistered agreements, transfers, or claims and

other defects in title; risks relating to competition from larger

companies with greater financial and technical resources; risks

relating to the inability to meet financial obligations under

agreements to which they are a party; ability to recruit and retain

qualified personnel; and risks related to their directors and

officers becoming associated with other natural resource companies

which may give rise to conflicts of interests. This list is not

exhaustive of the factors that may affect Giyani's forward-looking

information. Should one or more of these risks and uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those described in the

forward-looking information or statements.

Giyani's forward-looking information is based on

the reasonable beliefs, expectations and opinions of their

respective management on the date the statements are made, and

Giyani does not assume any obligation to update forward looking

information if circumstances or management's beliefs, expectations

or opinions change, except as required by law. For the reasons set

forth above, investors should not place undue reliance on

forward-looking information. For a complete discussion with respect

to Giyani and risks associated with forward-looking information and

forward-looking statements, please refer to Giyani's financial

statements and related MD&A, all of which are filed on SEDAR at

www.sedar.com.

GIYANI METALS CORP.1155

North Service Road West, Unit 11Oakville, Ontario

L6M 3E3T:

289-291-4032www.giyanimetals.com

TSX.V-EMM

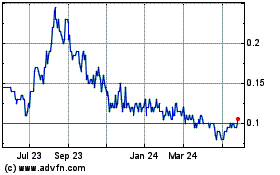

Giyani Metals (TSXV:EMM)

Historical Stock Chart

From Oct 2024 to Nov 2024

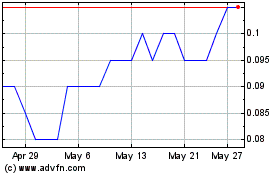

Giyani Metals (TSXV:EMM)

Historical Stock Chart

From Nov 2023 to Nov 2024