Denarius Metals Corp. (“Denarius” or “the Company”) (TSXV: DSLV;

OTCQB: DNRSF) is pleased to announce that it has signed a letter of

intent for an option and joint-venture arrangement (the “Letter of

Intent”) with Europa Metals Ltd. (“Europa”) (AIM: EUZ), pursuant to

which Europa granted Denarius the right to acquire up to an 80%

ownership interest in the Toral Zn-Pb-Ag Project (the “Toral

Project”), Leon Province, Northern Spain in two stages (the

“Proposed Transaction”).

Serafino Iacono, Executive Chairman and CEO of

Denarius, commented, “We are extremely pleased to have agreed the

commercial parameters for this proposed farm-in transaction

subject, inter alia, to definitive documentation which will enable

Denarius to lead the development of this high-grade polymetallic

project located in a well-mineralized historic mining area and

proactive jurisdiction that also offers potential further

exploration opportunities. The high-grade concentrates that could

be produced at Toral in the future make this a unique opportunity

for Denarius to seek to develop a high-quality base metal project

in the heart of western Europe.”

“Surging demand from industry, combined with

increasing geopolitical risks, have served to increase raw metals

prices over the last year. The production capacity to service the

European automotive and lead-acid battery industry is declining and

there is an urgent need to develop safer and more sustainable

alternative raw material supply systems in the region. The Proposed

Transaction could also provide future strategic synergy with our

wholly owned Lomero-Poyatos polymetallic project in respect of the

commercialization of concentrates from both potential future

operations”.

The Proposed Transaction is subject, inter alia,

to confirmatory due diligence by Denarius, the finalization and

entering into of definitive documentation (the “Definitive

Agreement”) and Europa receiving all requisite shareholder and

regulatory approvals, as appropriate.

The Toral Project is located approximately 400

km or 4 hours’ drive northwest of Madrid in the province of León,

within the autonomous region of Castilla-Leon. The Project area is

situated within the administrative subdivision of El Bierzo, the

capital of which is the city of Ponferrada, approximately 30 km

east of the project area by road. The Toral exploration license

15.199, referred to as a Permiso de Investigacion (the “Permit”),

covers an area of 20.29 km². The Toral Project is located next to a

main highway and is very well connected to several industrial ports

in northern Spain as well as a major zinc smelter in the Asturias

region.

The Toral Project is a carbonate hosted,

Mississippi Valley Type (“MVT”) Zn-Pb-Ag deposit situated along the

contact between middle Cambrian aged slates in the footwall and

upper Cambrian aged limestone and dolomite host rocks in the

hanging wall. The mineralization is continuous along the contact

and has been tested by drilling over at least 1.7 km strike length.

It remains open along strike and down dip.

Mineral Resource Estimate for the Toral

Project

Europa published an updated JORC 2012 compliant

Mineral Resource Estimate for the Toral Project in 2021, prepared

by Addison Mining Services Ltd (“Addison”), with an effective date

of September 14, 2021, comprising:

- An Indicated resource of

approximately 5.9 million metric tons (Mt) at 7.1% Zn Equivalent

(including Pb credits) (“Zn Eq”) or 7.8% Zn Equivalent (including

Pb and Ag credits (“Zn Eq(PbAg)”), grading 4.2% Zn, 3.3% Pb and 27

g/t Ag, containing:

- 251,000 tonnes of Zn, 196,000

tonnes of Pb and 5.2 million ounces of Ag.

- An Inferred resource of

approximately 14 Mt at 6.0% Zn Eq or 6.5% Zn Eq(PbAg), grading 3.8%

Zn, 2.5% Pb and 20 g/t Ag, containing:

- 540,000 tonnes of Zn, 350,000

tonnes of Pb and 9 million ounces of Ag.

Scientific and technical information about the

Toral Project is summarized, derived or extracted from the Toral

Technical Report titled “Updated JORC 2012 Technical Report and

Resource Estimate for the Europa Metals Toral Pb-Zn Project, Leon,

Spain” prepared by Addison for Europa dated October 20, 2021 and

with an effective date of September 14, 2021. The Toral Technical

Report was prepared to the standards of the 2012 JORC code by James

Hogg MSc MAIG, Richard Siddle MSc MAIG, and Lewis Harvey MSc MAIG.

The “Competent Person” pursuant to the 2012 JORC code is James

Hogg. The JORC code is an acceptable foreign code as defined by NI

43-101.

Mineral Resources are not Mineral Reserves and

do not have demonstrated economic viability. Mineral resources for

the Toral Project are reported at a 4.0% Zn equivalent cut-off

grade (including Pb and Ag credits) (“Zn Eq (PbAg)”). Zn equivalent

calculations were based on 3-year trailing average price statistics

obtained from the London Metal Exchange and London Bullion Market

Association giving an average Zn price of US$2,516/t, Pb price of

US$1,961/t and Ag price of US$19.4/oz. Recovery and selling factors

were incorporated into the calculation of Zn Eq values. It is the

opinion of Addison that all the metals included in the metal

equivalents calculation (zinc, lead and silver) have a reasonable

potential to be recovered and sold. According to the JORC code, Zn

Eq (PbAg)% is the calculated Zn equivalent incorporating silver

credits as well as lead and is the parameter used to define the

cut-off grade used for reporting resources (Zn Eq (PbAg)% = Zn +

Pb*0.867 + Ag*0.027). Zn Eq is the calculated Zn equivalent using

lead credits and does not include silver credits (Zn Eq = Zn +

Pb*0.867). All figures are rounded to reflect the relative accuracy

of the estimate.

Metallurgical testing undertaken by Wardell

Armstrong International in 2020 culminated in a locked cycle test

which achieved 77.0% zinc recovery to a zinc concentrate grading

59.1% Zn. A separate lead and silver concentrate with recoveries of

83.7% and 87.1%, respectively, was obtained with grades of 60.2% Pb

and 1,350 ppm Ag.

Description of the

Transaction

The transaction involves the formation of an

unincorporated joint-venture between Denarius and Europa for the

development of the Toral Project, which will include the Permit and

the incorporation of a certain other nearby mineral license when it

is approved by the Junta of Castilla and Leon (the “Junta”),the

local mining authority. The transaction will be completed in two

phases and be subject to certain conditions precedent, as described

below.

The Definitive Agreement will include an option

for the acquisition of a 51% interest in the Toral Project by way

of a farm-in by Denarius or its designee, from Europa Metals Iberia

S.L. (“EMI”), a wholly owned Spanish subsidiary of Europa, which

owns the Permit (the “First Option”).

In order to exercise the First Option and

acquire a 51% interest in the Toral Project: (i) Denarius and

Europa shall agree on a work program and budget, and (ii) Denarius

will fund a minimum of US$4,000,000 (including US$100,000 to be

paid on execution of the Definitive Agreement and US$550,000 to be

advanced to Europa on completion of a financing by Denarius, which

is expected to be concluded by March 31, 2023) towards:

- a 6-month due diligence twin drilling project of up to 2,000

meters to confirm mineralization and grades and allow Denarius to

obtain cores from the mineral resource wireframes; and

- the completion of a Pre-Feasibility Study for the Toral Project

to be presented to the Junta (the “Pre-Feasibility Study”).

Notwithstanding the foregoing, Europa and Denarius understand that

a Pre-feasibility Study on the Toral Project, acceptable to the

Junta, must be presented before the end of October 2023 to comply

with the obligations under the Permit.

The disbursement of the remaining amounts to

exercise the First Option (a minimum of US$3,350,000), will be

contingent on the effective incorporation of a certain other

mineral permit to the Toral Project (the “Permit Condition

Precedent”). Denarius will have the right to terminate the

joint-venture if (i) Europa is unable to secure the certain nearby

mineral rights within the 18-month period following the date of

execution of the Definitive Agreement or (ii) results of the due

diligence twin drilling project finds significant assay

discrepancies with the values previously reported by Europa.

The Definitive Agreement will include an option

(the “Second Option”) for the acquisition by Denarius or its

designee, from EMI of an additional 29% interest in the Toral

Project to take its interest in the Toral Project to 80% by (i)

delivering the Pre-Feasibility Study demonstrating positive

economic results over the enlarged Toral Project and (ii) making a

cash payment of US$2,000,000 to Europa, within the 12-month period

following the date of exercise of the First Option.

Qualified Persons Review

The technical information in this news release

has been reviewed and approved by Stewart D. Redwood, BSc (Hons),

PhD, FIMMM, FGS, who is a “Qualified Person” as defined under

National Instrument 43-101.

About Denarius

Denarius is a Canadian junior company engaged in

the acquisition, exploration, development and eventual operation of

mining projects in high-grade districts, with its principal focus

on the Lomero-Poyatos Project in Spain. The Company also owns the

Zancudo and Guia Antigua Projects in Colombia.

Additional information on Denarius can be found

on its website at www.denariusmetals.com and by reviewing its

profile on SEDAR at www.sedar.com.

Cautionary Statement on Forward-Looking

Information

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release contains "forward-looking

information", which may include, but is not limited to, statements

with respect to anticipated business plans or strategies, including

exploration programs, expected exploration results and Mineral

Resource estimates. Often, but not always, forward-looking

statements can be identified by the use of words such as "plans",

"expects", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates", or "believes" or variations

(including negative variations) of such words and phrases, or state

that certain actions, events or results "may", "could", "would",

"might" or "will" be taken, occur or be achieved. Forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of Denarius to be materially different from any future

results, performance or achievements expressed or implied by the

forward-looking statements. Factors that could cause actual results

to differ materially from those anticipated in these

forward-looking statements, include but are not limited to: the

execution of the Definitive Agreement; approval of the nearby

mineral license by the Junta; the agreement of Denarius and Europe

on a work program and budget; the ability of Denarius to disburse

the minimum funding in order to exercise the First Option;

completion of the Permit Condition Precedent; results of the due

diligence twin projects; delivery of a positive Pre-Feasibility

Study; the ability of Denarius to make the cash payment in order to

exercise the Second Option; and those factors which are described

under the caption "Risk Factors" in the Company's Filing Statement

dated as of February 18, 2021 which is available for view on SEDAR

at www.sedar.com. Forward-looking statements contained herein are

made as of the date of this press release and Denarius disclaims,

other than as required by law, any obligation to update any

forward-looking statements whether as a result of new information,

results, future events, circumstances, or if management's estimates

or opinions should change, or otherwise. There can be no assurance

that forward-looking statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements.

For Further Information,

Contact:

Christopher HaldaneVice President, Investor

Relations(416) 360-4653investors@denariusmetals.com

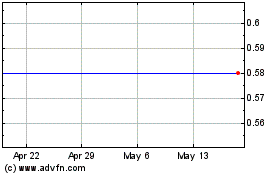

Denarius Metals (TSXV:DSLV)

Historical Stock Chart

From Feb 2025 to Mar 2025

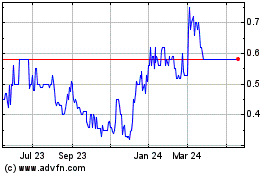

Denarius Metals (TSXV:DSLV)

Historical Stock Chart

From Mar 2024 to Mar 2025