Desert Gold Signs Guinean Option Agreement

December 22 2010 - 11:38AM

Marketwired Canada

Desert Gold Ventures Inc. (TSX VENTURE:DAU)(OTCQX:DAUGF)(FRANKFURT:QXR1)

("Desert Gold" or the "Company") is pleased to announce the signing of an Option

Agreement (the "Agreement") with Mr. Mohammed Sylla of LA SOCIETE KAI GLOBAL

LTD. (the "Vendor") for the exploration and exploitation of the KAI gold

property located in Guinea.

The KAI gold property (the "Property"), which formed a substantial portion of

the original agreement with SM/HM Guinea SARL, consists of approximately 418

square kilometers in the Region of Kankan, in the Prefecture of Siguiri, about

850km from the capital city of Conakry. In March the Company signed an initial

Option Agreement with SM/HM Guinea SARL, a company registered in Guinea, Conakry

(see news release of March 29th 2010). In June of 2010 the Company carried out

an initial property examination using a team consisting of a contract geologist

and a mining engineer (see news release of June 15th 2010).

The Company has now entered into an Option Agreement with Mr. Mohammed Sylla,

the underlying owner of the claims making up the property. The Agreement

provides for the Company to acquire a 70% undivided right, title and interest in

and to the Property subject to a 2% NSR. Details of the transaction include an

initial cash payment of $75,000 USD upon Exchange approval, a further cash

payment of $75,000 USD 12 months from Exchange approval, and a cash payout of

$1.5-million based on the successful completion of an NI 43-101 Report with a

resource of at least 750,000 ounces of recoverable gold from the Property. The

Company will also issue shares to the vendor in the amount equal to $75,000 USD

upon Exchange approval, with a further share issuance equal to $75,000 USD, 12

months from Exchange approval. The 2% NSR is subject to a buy-out clause by the

Company for 1 % of the agreed NSR for $2-million CAD.

This Agreement is subject to final due diligence by the Company, acceptance of

the Agreement by the Company's Board of Directors and approval of the

transaction by the TSX Venture Exchange.

Contingent on final approvals and successful due diligence the Company intends

to deploy resources into Guinea by developing human resources and a corporate

presence in the country in conjunction with the local Guinean partners. An

initial visit to Guinea and the Property by the Company's Management team is

planned for early January 2011. Initial exploration is planned for Q1 2011 with

the objective of further defining potential gold zones to define a drilling

program.

In addition to this Agreement, the Company will be nominating Mr. Sylla to its

Advisory Board in support of the development of the Guinean properties. Mr.

Sylla will also be charged with utilizing his extensive network to introduce the

Company to other potential mining acquisitions in Guinea and elsewhere in

Africa.

Desert Gold Chairman, Mr. Ayub Khan says, "Mr. Sylla, an active and successful

businessman who played football professionally, notably with the Celtic Rangers,

enjoys a privileged relationship with his home country of Guinea. His

partnership and corporate responsibilities will be an invaluable asset to Desert

Gold for the advancement of our Guinean properties. We intend to make Guinea one

of our key African focuses, and we believe this acquisition will complement and

strengthen our expanding global portfolio of properties."

The Company, pursuant to the Company's stock option plan, has granted a total of

200,000 incentive stock options to directors, officers, employees and

consultants. The options granted will be exercisable at a price of $1.25 per

share for a period of five (5) years and will be subject to a vesting schedule

in accordance with TSX Venture Exchange requirements.

We seek safe harbor.

On Behalf of the Board of Directors,

Ayub Khan, Chairman

This release includes certain statements that may be deemed to be

"forward-looking statements" within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995. All statements in this release, other than

statements of historical facts, that address future production, reserve

potential, exploration and development activities and events or developments

that the Company expects, are forward-looking statements. Although management

believes the expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of future

performance, and actual results or developments may differ materially from those

in the forward-looking statements. Factors that could cause actual results to

differ materially from those in forward-looking statements include market

prices, exploration and development successes, continued availability of capital

and financing, and general economic, market or business conditions. Please see

our public filings at www.sedar.com for further information.

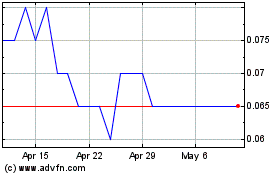

Common Shares (TSXV:DAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Common Shares (TSXV:DAU)

Historical Stock Chart

From Jul 2023 to Jul 2024