Castle Resources Announces $6.0 Million Brokered Private Placement Flow-Through Financing

September 29 2011 - 8:27AM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES OR THROUGH U.S. NEWSWIRE SERVICES

Castle Resources Inc. (TSX VENTURE:CRI) ("Castle" or the "Corporation") is

pleased to announce a brokered private placement of Flow-Through Common Shares

(the "Shares") led by Scotia Capital Inc. (the "Agent"), in which the Agent will

raise up to $6.0 million on a reasonable commercial efforts basis (the

"Financing") at a price of $0.63 per Share.

The net proceeds from the sale of the securities will be used for Canadian

Exploration Expenses ("CEE") on the Granduc Copper property located near

Stewart, British Columbia.

Under the terms of the Financing, the Agent will receive a cash commission

representing 5% of the gross proceeds of the sale of the securities.

About Castle Resources

Castle is a Toronto-based junior mineral development company focusing on

high-quality, advanced projects. Management's goal is to continue the

redevelopment of the 100% owned past producing Granduc Copper Mine and begin new

exploration activities; as well, management is advancing the Elmtree Gold

Project in New Brunswick toward feasibility in 2011. Castle currently has $6

million in its treasury and has issued and outstanding shares of 106 million.

For more information please visit the Castle Resources' website at

www.castleresources.com.

Disclaimer

Certain statements contained in this news release may contain forward-looking

information within the meaning of Canadian securities laws. Such forward-looking

information is identified by words such as "estimates", "intends", "expects",

"believes", "may", "will" and include, without limitation, statements regarding

the company's plan of business operations (including plans for progressing

assets), estimates regarding mineral resources, projections regarding

mineralization and projected expenditures. There can be no assurance that such

statements will prove to be accurate; actual results and future events could

differ materially from such statements. Factors that could cause actual results

to differ materially include, among others, metal prices, risks inherent in the

mining industry, financing risks, labour risks, uncertainty of mineral resource

estimates, equipment and supply risks, title disputes, regulatory risks and

environmental concerns. Most of these factors are outside the control of the

company. Investors are cautioned not to put undue reliance on forward-looking

information. Except as otherwise required by applicable securities statutes or

regulation, the company expressly disclaims any intent or obligation to update

publicly forwardlooking information, whether as a result of new information,

future events or otherwise.

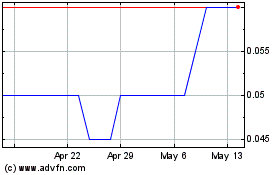

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jul 2024 to Aug 2024

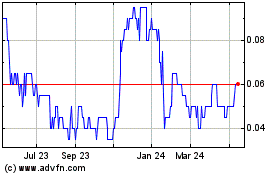

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Aug 2023 to Aug 2024