Astur Gold Adds Josh Crumb to the Board of Directors

May 11 2011 - 5:00AM

Marketwired Canada

Astur Gold Corp. (TSX VENTURE:AST)(FRANKFURT:CDC) ("Astur Gold" or the

"Company") is pleased to announce the appointment of Mr. Joshua Crumb to the

Company's Board of Directors.

Mr. Crumb's most recent role was Senior Metals Strategist at Goldman Sachs,

where he analyzed commodity market dynamics, investment strategies, and

corporate risk management programs in the Global Economics, Commodities and

Strategies research division in London. Mr. Crumb holds a Bachelor of Science

degree in Engineering and Master of Science in Mineral Economics from the

Colorado School of Mines. Mr. Crumb also held various positions within the

Lundin group of companies, serving as Director of Corporate Development at

Lundin Mining, and Special Project Analyst for group chairman Lukas Lundin.

"Josh has exceptional mining expertise and market vision. We value his

background in corporate development and his recent successes with the leading

commodity markets firm; we will leverage this strategic insight as Astur Gold

becomes a gold producer", commented Cary Pinkowski, CEO.

Josh Crumb remarked: "I am confident in the company's strategy to develop the

high grade Salave deposit, creating value for shareholders and enabling all

stakeholders to benefit from this extraordinary gold market environment. I also

look forward to working with such an accomplished group of management and

directors, who are essential assets for unlocking the value of the Salave

deposit and growing the company through acquisition and discovery of high value

resources."

Astur Gold has granted Mr. Crumb options to purchase 300,000 common shares in

the Company, exercisable at a price of $1.75 per share for a period of 3 years.

Furthermore, Mr. Paul Conibear is stepping down from the Board of Directors of

the Company. Astur Gold thanks Mr. Conibear for his contribution to the Company.

ABOUT ASTUR GOLD

The Company is developing its 100% owned Salave Gold Project in northern Spain.

Salave is one of the largest undeveloped gold deposits in Western Europe. The

property has a NI 43-101 compliant mineral resource estimate containing

1,683,000 oz of gold in the Measured & Indicated category (2,155,000 tonnes

grading 3.88 g/t Au Measured and 15,790,000 tonnes grading 2.79 g/t Au

Indicated) with an additional 338,000 oz of gold in the Inferred category

(3,770,000 tonnes grading 2.8 g/t Au). Salave is subject to NI 43-101 report,

"Technical Report on Salave Gold Deposit, Spain", dated March 5, 2010 available

on SEDAR.

Salave is also subject to NI 43-101 report, "Preliminary Economic Assessment on

the Salave Gold Project, Asturias Region, Spain", by Golder Associates dated

February 12, 2011. The PEA investigates three mining methods and two processing

options using a base case gold price of US$1,100 per ounce and throughput rate

of 1.1 million tonnes per year. It yields an NPV ranging from US$374 Million to

US$576 Million using a 5% discount rate; IRR ranging from 34% to 54%; and

pre-production capital expenditure payback period ranging from 2.0 to 3.1 years.

There is excellent exploration potential at Salave, with four of the principal

high grade zones of mineralization open at depth. Additional exploration areas

to the west have also yet to be tested. Previous metallurgical tests indicate

gold recoveries in the order of 90% are possible. The region boasts excellent

infrastructure and a history of mining that will help support future mine

development. Astur Gold is advancing Salave towards production and cultivating

an enduring partnership with the people of Asturias in developing economic

prosperity for the region.

ON BEHALF OF THE BOARD

Cary Pinkowski, Chief Executive Officer and Director

Mineral resources that are not mineral reserves do not have demonstrated

economic viability.

This document contains certain forward looking statements which involve known

and unknown risks, delays and uncertainties not under the Company's control

which may cause actual results, performance or achievements of the Company to be

materially different from the results, performance or expectation implied by

these forward looking statements.

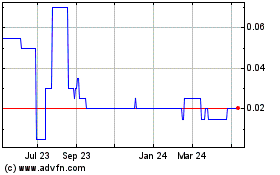

Astron Connect (TSXV:AST)

Historical Stock Chart

From Oct 2024 to Nov 2024

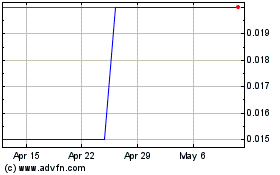

Astron Connect (TSXV:AST)

Historical Stock Chart

From Nov 2023 to Nov 2024