NOT FOR DISTRIBUTION IN THE UNITED STATES

OR OVER UNITED STATES WIRE SERVICES

-

Company reports record annual revenues of $14.9

million, showing 41% growth

-

-

Management to host conference call

today, May

1, 2023

at

12:00

PM ET -

CARLSBAD,

Calif. – May 1, 2023 -- Aurora

Spine Corporation (“Aurora Spine” or the “Company”) (TSXV: ASG)

(OTCQB: ASAPF), a designer and manufacturer of innovative medical

devices that improve spinal surgery outcomes, today announced the

financial results for fiscal 2022 ended December 31, 2022. All

figures are in U.S. dollars.

Financial and Business

Highlights

- 41% Annual Sales Growth

– The Company has experienced strong sales in each quarter

in 2022. Compared to the previous year sales grew more than 41%

from $10.5 million in 2021 to $14.9 million in 2022. The increases

have been led by a 21% increase of ZIP sales to the pain management

market and a 200% increase in sales of the SiLO Joint fusion

system.

- Increased Margin –

Margins increased to 52.5% for 2022 from 45.8% in 2021 due to

higher margin sales to surgery centers and increased pricing on

certain products.

- Dexa-C

release – The Company released the Dexa-C cervical implant

on a limited basis in Q1 2022 and it accounted for 8% of overall

sales in 2022.

- Patent Issued -

The issuance of United States Patent No: 11,331,199 entitled

"Spinal Implant for Motion Preservation or Fusion". This patent

covers Aurora's ZIPFlex™ Technology for a minimally invasive

posterior interlaminar implant for motion preservation that could

be adapted into a fusion or non-fusion device while implanted in a

patient via a small modular attachment.

- FDA 510(K) Clearance

– The Company received FDA 510(k) clearance for its

patented SiLO TFX MIS Sacroiliac Joint Fixation System.

- FDA 510(K) Clearance

– Received FDA 510(k) clearance for its DEXA SOLO-L™

spinal fusion system. The 3D printed standalone anterior lumbar

interbody fusion device (ALIF) was developed as part of the world’s

first bone density matched implant based on Aurora’s patented DEXA

Technology Platform.

- Zip Stenosis

Indication – The Company received FDA clearance of a new

Lumbar Spinal Stenosis Indication for Use for its ZIP™ family of

MIS implants.

- Award – The

Company received the 2022 Best New Spine Technology Award for its

DEXA bone density-matched spine implant innovation at the annual

North American Spine Society (NASS) meeting.

- Training – The

Company continued to conduct advanced training sessions and cadaver

labs that introduced leading orthopedic, neurosurgical, and pain

management physicians to the ZIP™ and SiLO™ implants.

Management Commentary

Mr. Trent Northcutt, President and Chief Executive Officer of

Aurora Spine, stated, “Fiscal 2022 was an exceptional year for

Aurora Spine. We were able to emerge from the pandemic and deliver

our proprietary products to the marketplace. We were also very

successful in obtaining FDA clearances for a few key products,

including the SiLO TFX, which we believe will pave the way for

future growth. As a result, the company now has several new

products and platforms that enabled us to pivot and focus more on

commercialization and profitability. Along those lines, the company

has made some key improvements and additions to bolster its sales

efforts. We believe we are still in the early stages in many of our

initiatives, including SiLO TFX, which has recently been

successfully implanted into patients.”

Mr. Northcutt continued, “Our other product lines, including ZIP

and DEXA, have also contributed nicely to our results. ZIP

continues to grow its applications, as it received FDA clearance

for a new stenosis indication. In addition, we received positive

interim results from a clinical study that is using the ZIP for

interspinous fusion therapy as a treatment of lumbar spinal

stenosis. So far initial results show the ZIP to be effective and

safe and this data will assist us in detailing it to surgeons and

pain interventionalists. Looking at DEXA, we were very honored to

receive the 2022 Best New Spine Technology Award at this year’s

NASS meeting. We have several kits for DEXA-C in the marketplace

and was a great contributor to Aurora during 2022 on a beta-launch

basis. We have several more kits ready to ship and are in the midst

of placing them over the next few months.”

Mr. Northcutt concluded, “We are very pleased with the progress

we are making at Aurora Spine. We accomplished many things in 2022,

including several successful product launches and we believe 2023

will be another year of growth. As we look to 2023 and beyond, we

have been working diligently in making key improvements to get the

company to the next level and experience continued growth for many

years to come. Our focus is now executing on growing revenues

through the commercialization of the products that received

approvals in 2022, especially SiLO TFX. We have many positive

accomplishments in 2022 and are well positioned to capitalize in

2023 and beyond.”

Mr. Chad Clouse, Chief Financial Officer of Aurora Spine, added,

“Fiscal 2022 was a strong financial year for Aurora, with revenues

growing 41% and achieving improved gross margins. We also invested

heavily back into the business, using our cash flow to improve our

sales team, attend more industry tradeshows, but also ramp up

several clinical studies, which will provide additional data on our

products. Also, subsequent to the fiscal year end, the company also

received approximately $700,000 in proceeds from exercised

warrants, which has enhanced our capital structure.”

Financial Results

Total revenues for the fourth quarter of 2022 were $3.61 million

an increase of 21.7% when compared to $2.96 million in the same

quarter one year ago. The improvement in revenues over 2021 were

due to more procedures conducted in ambulatory surgical and pain

centers that incorporated Aurora products like the ZIP and SiLO. In

addition, due to increased marketing and development (clinical

studies) efforts, the company experienced increases in ZIP sales in

the quarter. Total revenues for fiscal 2022 were $14.88 million

compared to $10.54 million for fiscal 2021, an increase of 41.1%,

primarily due to increased activity at surgical centers and pain

centers, where patients stays are much shorter in duration through

the usage of Aurora products like ZIP and SiLO.

Gross margin on total revenues were 50.6% for the fourth quarter

of 2022, compared to 46.0% in Q4 of 2021. Gross margin on total

revenues for fiscal year 2022 were 52.5%, compared to 45.8% for

fiscal 2021. The year-over-year improvement in gross margins is

attributable to the company’s strategy of selling more proprietary,

Aurora Spine products and into the markets with improved pricing,

like ambulatory surgery centers. As the company continues to focus

on growing sales of proprietary products, gross margin has the

capabilities for additional improvements, dependent upon sales mix

and shipping costs.

Total operating expenses were $2.67 million for the fourth

quarter of 2022, compared to $2.267 million in the fourth quarter

of 2021. Total operating expenses for fiscal 2022 were $9.379

million, which included $1.010 million of non-cash expenses,

compared to $7.543 million, which included $0.790 million of

non-cash expenses for fiscal 2021. Operating expenses increased

during the fourth quarter primarily due to an increase in ZIP study

fees.

EBITDAC (a non-GAAP figure non IFRS measure defined as Earnings

before Interest, Tax, Depreciation, Amortization and Stock based

compensation) was $(0.36) million for the fourth quarter of 2022,

compared to $(0.57) million in the fourth quarter of 2021. EBITDAC

was $(0.26) million for fiscal 2022, compared to $(1.76) million in

fiscal 2021. EBITDAC improvements were due to higher revenue and

gross margin levels from selling more proprietary products.

Net loss was $(0.840) million for the fourth quarter of 2022,

compared to the fourth quarter of 2021 with a loss of $(0.903)

million. Basic and diluted net (loss) income per share was $(0.01)

per share in the fourth quarter of 2022 and $(0.01) per share for

the fourth quarter of 2021. Net loss was $(1.501) million for

fiscal 2022, compared to a loss of $(2.359) million in fiscal 2021.

Basic and diluted net (loss) income per share was $(0.02) per share

for fiscal 2022 and $(0.04) per share in fiscal 2021.

Full financial statements can be found on SEDAR at

(www.sedar.com).

SELECTED BALANCE SHEET INFORMATION

The following table summarizes selected key financial data.

|

As at |

December 31, 2022$USD |

September 30, 2022$USD |

December 31, 2021$USD |

|

Cash |

423,401 |

644,669 |

3,172,575 |

|

Trade receivables |

3,666,310 |

3,736,634 |

2,668,174 |

|

Prepaid expenses and deposits |

186,800 |

678,150 |

674,687 |

|

Inventory |

3,054,173 |

2,708,416 |

1,889,640 |

|

Current assets |

7,330,684 |

7,767,988 |

8,405,076 |

|

Intangible assets |

881,354 |

945,464 |

854,331 |

|

Property and equipment |

1,910,940 |

2,202,319 |

1,304,242 |

|

Total assets |

10,122,978 |

10,915,652 |

10,563,649 |

|

Current liabilities |

3,029,599 |

3,136,410 |

2,627,281 |

|

Long-term liabilities |

2,773,919 |

2,769,376 |

2,367,056 |

|

Share capital |

25,218,093 |

25,087,474 |

25,087,474 |

SELECTED ANNUAL

INFORMATION

The Company’s functional currency is the US

dollar (USD). The functional currency of the Company’s US

subsidiary Aurora is USD. Operating results for each year for the

last two fiscal years are presented in the table below.

|

Fiscal year ended |

December

31,

2022$ |

December 31, 2021$ |

|

Revenue |

14,877,324 |

|

10,544,807 |

|

|

Cost of goods sold |

(7,067,596 |

) |

(5,711,255 |

) |

|

Gross profit |

7,809,728 |

|

4,833,552 |

|

|

Operating expenses |

9,379,029 |

|

7,543,017 |

|

|

EBITDAC** |

(265,311 |

) |

(1,760,222 |

) |

|

Net income (loss) |

(1,501,466 |

) |

(2,359,325 |

) |

|

Basic and diluted income (loss) per share*** |

(0.02 |

) |

(0.04 |

) |

** EBITDAC is a non-GAAP, non

IFRS measure defined as Earnings before Interest, Tax,

Depreciation, Amortization and Stock based compensation. This

amount includes Gains (losses) on sale of property and equipment

and Other income (expense).*** Outstanding options

and warrants have not been included in the calculation of the

diluted loss per share as they would have the effect of being

anti-dilutive.

SELECTED QUARTERLY INFORMATION

The Company’s functional currency is the US

dollar (USD). The functional currency of the Company’s US

subsidiary Aurora is USD. Operating results for each quarter for

the last two fiscal years are presented in the table below.

|

Quarters ended |

December

31,

2022$ |

September 30, 2022$ |

June 30, 2022$ |

March 31, 2022$ |

December 30, 2021$ |

September 30, 2021$ |

June 30, 2021$ |

March 31, 2021$ |

|

Revenue |

3,609,514 |

|

3,648,680 |

|

4,067,166 |

|

3,551,964 |

|

2,964,980 |

|

2,892,540 |

|

2,425,397 |

|

2,261,890 |

|

|

Cost of goods sold |

(1,783,881 |

) |

(1,706,677 |

) |

(1,926,683 |

) |

(1,650,355 |

) |

(1,602,047 |

) |

(1,536,244 |

) |

(1,421,393 |

) |

(1,151,572 |

) |

|

Gross profit |

1,825,632 |

|

1,942,003 |

|

2,140,483 |

|

1,901,609 |

|

1,362,933 |

|

1,356,296 |

|

1,004,004 |

|

1,110,318 |

|

|

Operating expenses |

2,665,203 |

|

2,057,655 |

|

2,367,985 |

|

2,288,186 |

|

2,266,897 |

|

1,724,513 |

|

1,879,479 |

|

1,672,131 |

|

|

EBITDAC** |

(358,311 |

) |

150,687 |

|

96,285 |

|

(153,972 |

) |

(566,569 |

) |

(171,247 |

) |

(480,837 |

) |

(191,430 |

) |

|

Net income (loss) |

(839,570 |

) |

(115,652 |

) |

(159,667 |

) |

(386,577 |

) |

(903,964 |

) |

(368,217 |

) |

(700,405 |

) |

(386,743 |

) |

|

Basic and diluted income (loss) per share*** |

(0.01 |

) |

(0.00 |

) |

(0.00 |

) |

(0.01 |

) |

(0.01 |

) |

(0.01 |

) |

(0.01 |

) |

(0.01 |

) |

* Adjusted by gains and

(losses) on sale of equipment.** EBITDAC is a

non-GAAP, non IFRS measure defined as Earnings before Interest,

Tax, Depreciation, Amortization and Stock based compensation. This

amount includes Gains (losses) on sale of property and equipment

and Other income (expense).*** Outstanding options

and warrants have not been included in the calculation of the

diluted loss per share as they would have the effect of being

anti-dilutive.

Conference Call Details

Date and Time: Monday, May 1, 2023, at 12:00 pm

ET/9:00 am PT

Call-in Information: Interested parties can

access the conference call by dialing (844) 861-5497 or (412)

317-5794.

Webcast: Interested parties can access the

conference call via a live webcast, which is available via the

following link: https://app.webinar.net/bnqyeKXxQ2N or in the

Investor Relations section of the Company's website at

https://www.aurora-spine.com/investors-v02.

Replay: A teleconference replay of the call

will be available until May 8, 2023, at (877) 344-7529 or (412)

317-0088, replay access code 7462834. Additionally, a replay of the

webcast will be available in the Investor Relations section of the

Company's website at https://www.aurora-spine.com/investors-v02 or

at https://app.webinar.net/bnqyeKXxQ2N for 90 days.

About Aurora Spine

Aurora Spine is focused on bringing new solutions to the spinal

implant market through a series of innovative, minimally invasive,

regenerative spinal implant technologies. Additional information

can be accessed at www.aurora-spine.com or

www.aurorapaincare.com.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Forward-Looking Statements

This news release contains forward-looking information that

involves substantial known and unknown risks and uncertainties,

most of which are beyond the control of Aurora Spine, including,

without limitation, those listed under "Risk Factors" and

"Cautionary Statement Regarding Forward-Looking Information" in

Aurora Spine's final prospectus (collectively, "forward-looking

information"). Forward-looking information in this news release

includes information concerning the proposed use and success of the

company’s products in surgical procedures. Aurora Spine cautions

investors of Aurora Spine's securities about important factors that

could cause Aurora Spine's actual results to differ materially from

those projected in any forward-looking statements included in this

news release. Any statements that express, or involve discussions

as to, expectations, beliefs, plans, objectives, assumptions or

future events or performance are not historical facts and may be

forward-looking and may involve estimates, assumptions and

uncertainties which could cause actual results or outcomes to

differ unilaterally from those expressed in such forward-looking

statements. No assurance can be given that the expectations set out

herein will prove to be correct and, accordingly, prospective

investors should not place undue reliance on these forward-looking

statements. These statements speak only as of the date of this

press release and Aurora Spine does not assume any obligation to

update or revise them to reflect new events or circumstances.

Contact:

Aurora Spine Corporation

Trent Northcutt

President and Chief Executive Officer

(760) 424-2004

Chad Clouse

Chief Financial Officer

(760) 424-2004

www.aurora-spine.com

Adam Lowensteiner

LYTHAM PARTNERS, LLC

Phoenix | New York

Telephone: 646-829-9700

asapf@lythampartners.com

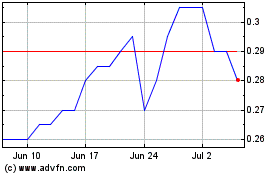

Aurora Spine (TSXV:ASG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aurora Spine (TSXV:ASG)

Historical Stock Chart

From Nov 2023 to Nov 2024