Erdene Reports 2009 Second Quarter Financial Results and Provides Project Updates

August 17 2009 - 2:22PM

Marketwired Canada

Erdene Resource Development Corp. ("Erdene") (TSX:ERD), today provided an update

on its principal projects in conjunction with the release of its 2009 second

quarter financial results.

2009 Second Quarter Highlights

- Donkin coal project work progressed with planning for the Exploration and

Development Phase implementation and some tenders being provisionally awarded.

Coal sales discussions are continuing.

- Finalizing Zuun Mod mineral resource estimate expected to be released in the

third quarter of 2009

- Final stages of installation of process equipment in new kaolin processing

facility in Dearing, Georgia with commercial production to begin in the third

quarter of 2009.

- $17,012,520 of cash and cash equivalents as at June 30, 2009

"Erdene is committed to generating shareholder value through its concentration

on coal, molybdenum and copper, and industrial minerals focused on two regions:

China-Mongolia and the eastern seaboard of North America," said Peter Akerley,

President and CEO. "While focusing on strategically located projects and

commodities that have strong, long-term market fundamentals, we will be

advancing our projects using a measured and disciplined approach, effectively

managing risk."

Project Summaries and Updates

Donkin Coal Project

Erdene has a 25% joint venture partnership in the Donkin Coal Alliance ("DCA")

with Xstrata Coal Donkin Limited. The DCA was formed to secure the rights to

the Donkin coal project and to explore, assess, study and if feasible, develop

the high-grade Donkin coal resource. The Donkin coal project is located in Cape

Breton, Nova Scotia, proximal to deep water ideal for seaborne shipping into the

major markets on North America's east coast and Europe. The Donkin coal project

is being evaluated as a 4 million tonne per annum underground longwall operation

with both domestic and export markets. The project is within 35 kilometers of a

coal-fired electrical generating plant and a deep-water coal loading facility.

In May, 2008 the DCA announced a commitment to fund a feasibility study of an

Evaluation and Development Program ("Program") for the Donkin coal project. The

Program, utilizing a continuous miner, is an interim step in the development

path leading towards establishing a large scale underground longwall mining

operation.

The project partners endorsed this interim step in the project to obtain further

information deemed critical to the assessment of the feasibility of the large

scale underground mining options under consideration.

During the latter part of 2008 and first half of 2009 work progressed on the

feasibility study for the Program with some tenders being provisionally awarded

and requests for pricing issued for the long lead time items and major contracts

associated with the project. The feasibility study for the Program will be

finalized upon conclusion of sales agreements.

Zuun Mod Molybdenum Project

The Zuun Mod project is a porphyry molybdenum ("Mo") (with copper and rhenium)

deposit and consists of a single license totaling 49,538 hectares. It is

located in Bayankhongor Province approximately 950 kilometres southwest of

Ulaanbaatar and 215 kilometres from railhead on the Mongolia-China border at

Ceke. The railhead is located 20 kilometres south of the Nariin Sukhait and

Oyuut Tolgoi coal mines.

The Zuun Mod project has been under exploration and evaluation since 2002.

Subsequent to signing an agreement with Gallant Minerals Limited in March 2005

to acquire the license, the Company carried out extensive exploration that has

resulted in establishing Zuun Mod as one of the largest and most advanced

pre-development molybdenum projects in the North Asia Region.

In May 2008 the Company received a NI 43-101 compliant resource report for the

project from Minarco. The Zuun Mod resource includes 110Mt in the measured and

indicated resource categories with an average grade of 0.06% Mo. This equates to

148 million pounds of contained Mo metal.

Following the release of the resource estimate, additional drilling was carried

out in 2008 to test for high-grade mineralization at depth, to explore areas

peripheral to the deposit and to better define localized zones of higher grade

mineralization, particularly those nearer surface. A total of 32 new holes were

completed and eight holes were deepened, totaling 10,785 metres.

The 2008 program was successful in defining localized higher grade zones and

enlarging the overall deposit, both vertically and laterally. The deposit was

confirmed to extend to depths exceeding 500 metres over a minimum strike length

of 1.7 kilometres while locally coming to within 22 metres of surface. Drilling

confirmed several continuous intersections exceeding 350 metres of 0.06% Mo and

multiple high grade zones exceeding 50 metres of 0.10% Mo.

In the second quarter, 2009, Minarco carried out work to incorporate the 2008

drilling results into the May 2008 resource estimate with a focus on

higher-grade zones. The updated Minarco mineral resource estimate is expected

to be released in August 2009.

Erdene also initiated a license-wide exploration program in 2009 consisting of

stream sediment and rock chip geochemical surveys along with geological and

alteration mapping. Much of the field work was completed by the end of June.

Preliminary results include a newly identified molybdenum in rock geochemical

anomaly 4 kilometres northeast of the main deposit area. The geochemical

results for this area are of the same magnitude as those overlying the main

deposit area. Anomalous gold values (up to 1.3 g/t) were also identified to the

southwest of the main deposit, approximately 2.5 kilometres from a previously

identified gold in soil geochemical anomaly.

In addition to Zuun Mod the company is carrying out evaluations of multiple

metal and coal projects throughout southern Mongolia.

Advanced Primary Minerals Corp.

As a result of an aggressive exploration and acquisition program in the late

1990s, the Company acquired a large high brightness primary kaolin (clay)

resource through its U.S. subsidiary, Erdene Materials Corporation ("EMC").

EMC's in-ground, "premium" quality, primary kaolin resource in Georgia has a

total NI 43-101 compliant resource of 25.5 million tons (Measured and

Indicated).

As part of Erdene's business plan, Erdene created a dedicated vehicle for its

primary kaolin operations by initiating a reverse takeover of Beta Minerals Inc.

("Beta"), a TSX Venture-listed company. Beta changed its name to Advanced

Primary Minerals Corporation ("APM") and is listed on the TSX Venture Exchange

(TSXV:APD) with Erdene as its majority shareholder.

The goal of APM is to be North America's leading specialized kaolin producer.

Much of the premium kaolin clay deposits in Georgia and the UK have been

depleted over the past century. APM's primary kaolin products meet or exceed

the quality of comparable foreign imports and domestic sources. APM looks to

take advantage of that situation with its unique, high quality primary clay

deposits and modern processing facilities to focus on small to moderate-volume

opportunities and high-margin specialty products. Proximity to domestic markets

and elimination of foreign exchange risk add a strong competitive advantage over

comparable foreign imports. Kaolin is used in the manufacture of value-added

products within a number of industries which include ceramics, paint and paper.

APM is currently producing kaolin products for its initial customers in the

ceramics industry as well as continuing trials with potential customers. It is

in the final stages of installing the process equipment in its new

state-of-the-art kaolin processing facility in Dearing, Georgia that is

scheduled to begin commercial production in the third quarter of 2009.

Granite Hill

The Company's Granite Hill project is a former producing granite aggregate

quarry in central Georgia. The Company owns the 342-acre property, which holds

in excess of a 120 million-ton resource and is situated on an existing rail

line. Ready Mix USA ("RMU") holds, through a lease with the Company, an

exclusive right to mine, process, and sell aggregate from the Granite Hill

property. The sale of all aggregate from the property is subject to an industry

competitive royalty payable to the Company.

RMU's quarry development plan provides for an estimated start-up production rate

of one million tons of granite aggregate per year, with an initial design

capacity of up to 2.5 million tons. Based on current production projections, the

Granite Hill quarry will have an estimated lifespan in excess of 30 years. RMU

has designed a quarry mining plan, processing plant and facilities, and produced

an environmental impact plan. RMU has also acquired additional land adjacent to

the Granite Hill property to secure rail access to the site. The construction

phase is expected to be completed nine to twelve months after a production

decision by RMU. RMU is responsible for fully funding the development and

operating program.

Production from the Granite Hill project will target markets in the southeastern

U.S. where urban sprawl, depleted resources and the shutdown of mining in

Florida's Lake Belt aggregate district have combined to create a pending

shortage of crushed stone. At the same time the U.S. government stimulus package

is expected to initiate over $90 billion in infrastructure spending over the

next 12 to 18 months expected to spark demand for aggregate material. The Lake

Belt district is in northwestern Miami-Dade County and on average produces

approximately 45 million tons of limestone or about half the state of Florida's

annual production. There is currently no mining taking place in this area as a

U.S. District Judge has stayed all mining permits over concerns regarding impact

on the Everglades' watershed and the environment.

In addition to the Granite Hill project, the company is completing evaluations

of aggregate opportunities in eastern Canada and the Caribbean.

2009 Second Quarter Financial Results Summary

Erdene's 2009 second quarter financial statements and Management's Discussion

and Analysis were filed with regulatory authorities on August 14, 2009 and are

available on the Company's website at www.erdene.com and on SEDAR at

www.sedar.com. These statements are provided on a consolidated basis

incorporating that of its controlled subsidiary, Advanced Primary Minerals Corp.

For the three months ended June 30, 2009, exploration and operating expenses

amounted to $681,862 compared to $222,477 in the second quarter 2008. Including

capitalized costs and excluding write-offs, exploration expenses were $1,041,685

for the second quarter of 2009 and $2,870,442 for the second quarter of 2008

respectively.

Erdene's second quarter expenditures were primarily directed toward the

continued advancement of the Company's primary projects, namely the Donkin coal

project and Zuun Mod molybdenum project as well as approximately $422,168 in

purchases of plant and equipment for a new processing plant being constructed by

Erdene's controlled subsidiary APM.

Administrative expenses totaled $551,654 (including $99,120 in stock based

compensation) for the second quarter of 2009, compared to $498,141 in second

quarter 2008.

The Company recorded a loss of $1,478,796, or $0.02 per share, in the second

quarter of 2009 compared with a loss of $724,571, or $0.01 per share, in the

second quarter of 2008. The loss in the second quarter of 2009 includes a write

down of non performing assets of $960,986, compared to a write down of $75,723

in the same quarter in 2008. At June 30, 2009, Erdene had approximately

$17,012,520 of cash and cash equivalents on hand, including cash acquired on

closing of the Beta Transaction, compared with $16,195,175 million at December

31, 2008.

About Erdene

Erdene Resource Development Corp. is a diversified resource company with

multiple projects at various stages of development from exploration to

production, all focused on high-growth commodities. Erdene has a current

working capital position of approximately $16.3 million, including that of its

controlled subsidiary APM, with 89,230,877 common shares issued and outstanding

and a fully diluted position of 94,208,377 common shares.

Forward-Looking Statements

Certain information regarding Erdene contained herein may constitute

forward-looking statements within the meaning of applicable securities laws.

Forward-looking statements may include estimates, plans, expectations, opinions,

forecasts, projections, guidance or other statements that are not statements of

fact. Although Erdene believes that the expectations reflected in such

forward-looking statements are reasonable, it can give no assurance that such

expectations will prove to have been correct. Erdene cautions that actual

performance will be affected by a number of factors, most of which are beyond

its control, and that future events and results may vary substantially from what

Erdene currently foresees. Factors that could cause actual results to differ

materially from those in forward-looking statements include market prices,

exploitation and exploration results, continued availability of capital and

financing and general economic, market or business conditions. The

forward-looking statements are expressly qualified in their entirety by this

cautionary statement. The information contained herein is stated as of the

current date and subject to change after that date.

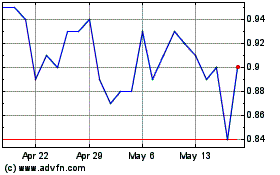

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jul 2023 to Jul 2024