Erdene Reports Year End Financial Results and Provides Project Updates

April 01 2009 - 9:28AM

Marketwired Canada

Erdene Resource Development Corp. ("Erdene") (TSX:ERD), today provided an

update on the Company's principal projects in conjunction with the release of

its year end financial results.

"In 2008, Erdene made substantial progress in advancing the Company's projects,"

said Peter Akerley, President and CEO. "In 2009, we will continue to pursue our

goal of assisting our partners with the development of the Donkin coal and

Granite Hill aggregate projects to production in 2010, while positioning the

Zuun Mod molybdenum project for start-up when the global economy recovers. Our

focus continues to be on two regions: China and the eastern seaboard of the

United States, where we see tremendous opportunity for long term growth in the

commodities we are targeting. Going into 2009, Erdene is well financed and in

an enviable position compared to our peers. We will be prudently managing our

financial resources while advancing these core projects and investigating growth

opportunities."

Project Summaries and Updates

Donkin Coal Project

The Donkin coal project is a joint venture between Erdene and Xstrata Coal

Canada, who own 25% and 75%, respectively. Located in Cape Breton, Nova Scotia,

the project is within 35 kilometers of a coal-fired electrical generating plant

and a deep-water coal loading facility. Donkin is being evaluated as a

five-million-tonne-per-annum underground longwall mining operation. Markets are

anticipated to be both domestic and export. The short shipping distances by

water to the east coast of the United States places Donkin in an ideal position

to enter this expanding market.

The project is in the feasibility stage of a Continuous Miner Exploration and

Development program designed to test the suitability of the deposit for longwall

production. A workforce of 12 continues to advance tunnel refurbishment and

maintain the site in advance of a development decision. The project has cleared

regulatory requirements, including environmental approval, has distributed

requests for tenders and entered into negotiations with potential consumers.

The goal of the joint venture remains the commencement of production in 2010.

However, one outstanding matter that must be finalized before the commencement

of mining is to have a coal off-take agreement signed with potential domestic

and international customers with whom the joint venture is currently in

discussions.

Thermal coal is expected to remain the principal fuel for long term growth of

electricity production in the industrialized western nations. A large,

high-energy coal resource proximal to a deep-water port is unique and positions

Donkin to be competitive in the Atlantic seaborne thermal coal markets.

Zuun Mod Molybdenum Project

At the Zuun Mod molybdenum project in Mongolia, the fourth quarter saw the

completion of a resource expansion and definition drill program. Several holes

drilled to test the central area of the deposit indicated a deposit thickness of

at least 400 metres averaging 0.06% molybdenum with multiple higher grade zones,

including 70 metres of 0.11% molybdenum in the northeastern portion of the

deposit.

These data add to an initial resource estimate, reported in May 2008, that

totaled 110 million tonnes averaging 0.061% molybdenum in the Measured and

Indicated category. The current focus is on revising the May 2008 resource

estimate by incorporating the 2008 drilling data. During 2009 the project will

be advanced at a pace reflecting the current economic environment, with limited

resource, environmental and hydrogeologic studies focused on moving the project

to a mining licence stage. During this period Erdene will continue to assess

the market to determine when the project should be accelerated toward

feasibility. At the same time, the Company will evaluate options to secure a

strategic partner.

Coal Projects In Mongolia

Erdene is involved in a comprehensive coal generative and acquisition program in

Mongolia that evaluates numerous prospective metallurgical and high-quality

thermal coal deposits. The program is being fully funded by our partner,

Xstrata, with whom we are coordinating operations. Mongolia borders China,

which is the world's largest coal consuming nation. Estimates suggest that over

the next 25 years, China will need to secure approximately six million tonnes

per month of new coal production to meet demand.

During 2008, Erdene conducted numerous property evaluations with three

properties reaching the drill-tested stage. Although results on these

properties do not warrant follow-up exploration, Erdene will continue property

evaluation work during 2009 to identify and secure large-tonnage coal deposits.

The Erdene-Xstrata coal alliance is positioning to become a major participant in

the coal industry of Mongolia.

Advanced Primary Minerals Corp.

In July 2008, Erdene moved forward with its business plan to create a dedicated

vehicle for the Company's primary kaolin operations by initiating a reverse

takeover of Beta Minerals Inc. ("Beta"), a TSX Venture-listed company. With

the conclusion of the deal on February 27, 2009, Erdene took a major step

forward in its development of a specialty mineral products manufacturing

business. Beta changed its name to Advanced Primary Minerals Corporation

("APM") and is listed on the TSX Venture Exchange (TSXV:APD) with Erdene as

majority shareholder.

The goal of APM is to be North America's leading specialized kaolin producer.

Much of the premium kaolin clay deposits in Georgia and the UK have been

depleted over the past century. APM's primary kaolin products meet or exceed

the quality of comparable foreign imports and domestic sources. APM looks to

take advantage of that situation with its unique, high quality primary clay

deposits and modern processing facilities to focus on small to moderate-volume

opportunities and high-margin specialty products. Proximity to domestic markets

and elimination of foreign exchange risk add a strong competitive advantage over

comparable foreign imports. Kaolin is used in the manufacture of value-added

products for the ceramics, paint and paper industries.

APM controls high-quality deposits of primary kaolin clay in Georgia. These

properties currently hold an NI 43-101 resource of 25.5 million tons (Indicated

and Measured). APM is also in the final stages of constructing a new

state-of-the-art kaolin processing facility in Dearing, Georgia that is

scheduled to begin production in the second quarter of 2009.

Granite Hill Aggregate Project

Erdene's Granite Hill project is a former producing granite aggregate quarry in

central Georgia. Erdene owns the 342-acre property, which holds in excess of a

120 million-ton resource and is situated on an existing rail line. It is

currently leased to Ready Mix USA, a major construction materials producer,

which is responsible for fully funding the project in return for a royalty on

sales payable to Erdene.

All necessary permits have been obtained and construction is to be completed

nine to 12 months after a production decision by Ready Mix USA. Their quarry

development plan provides for an estimated start-up production rate of one

million tons of granite aggregate per year, with a design capacity of up to 2.5

million tons. Based on current production projections, the Granite Hill quarry

will have an estimated lifespan in excess of 30 years.

Year End Financial Results Summary

Erdene's year end 2008 financial statements and Management's Discussion and

Analysis were filed with regulatory authorities on March 31, 2009 and are

available on the Company's website at www.erdene.com and on SEDAR at

www.sedar.com.

For the 12 months ended December 31, 2008, exploration and operating expenses

amounted to $1,858,544, compared to $4,146,178 in fiscal 2007. Including

capitalized costs, exploration expenses were $9,415,073 for 2008 and $13,826,792

for 2007 respectively.

The expenditures were directed toward the continued advancement of the Company's

primary projects, namely the Donkin coal project and Zuun Mod molybdenum

project. Specifically, expenditures by project were as follows:

- Zuun Mod: $3,710,393 for the 12 months ended December 31, 2008.

- Donkin: $3,917,644 for the 12 months ended December 31, 2008.

- Coal exploration in Mongolia funded by Xstrata: $1,065,826 for the 12 months

ended December 31, 2008.

Administrative expenses totalled $2,306,334 for the year (including $467,423 in

stock based compensation and $52,752 in depreciation), compared to $2,427,062 in

2007 (including $910,218 in stock based compensation and $49,952 in

depreciation).

The Company recorded a loss of $3,592,391, or $0.04 per share, in fiscal 2008

compared with a loss of $6,651,063, or $0.11 per share, in fiscal 2007. At

December 31, 2008, Erdene had approximately $16.2 million of cash and cash

equivalents on hand compared with $8.7 million at December 31, 2007.

Outlook

Erdene is well positioned to continue project development activities. The

successful share offering in mid-2008 and the recent reverse takeover of Beta,

with nearly $2 million in cash, has funded the Company to continue all budgeted

operations and commitments. These include, upon receipt of all necessary

approvals, Erdene's share of the Donkin continuous miner exploration and

development program. Erdene has instituted cost-cutting measures to reduce

expenses during 2009 by decreasing administrative overhead and scaling down or

postponing early-stage and grassroots exploration programs.

Going forward, Erdene will remain focused on developing projects associated with

the Company's core commodities, which consist of coal, base metals, gold and

industrial minerals. Management continues to believe that these commodities,

especially in Asia and North America, have strong long-term market fundamentals.

At the same time, Erdene will investigate opportunities for further expansion

through organic growth, joint ventures and acquisitions.

New Website Launched

Erdene is pleased to announce the Company's website has been updated to make it

even more user-friendly and informative. Visitors to 'www.erdene.com' will find

Company highlights, project information, commodity data, up-to-date investor

presentations and most recent webcasts, all newly packaged for easy viewing and

reference.

The redesigned 'Featured Items' section of the home page highlights the most

up-to-date investor information and presentations. For example, 'Update

Webcast' is an interview with Peter Akerley, President and CEO, who details the

Company's most recent activities and projects. Another featured item is 'Asia

Mining Congress Presentation', which Mr. Akerley gave in Singapore on March 24,

2009. The session provides a concise overview of Erdene's key projects in the

energy, metals and industrial minerals sectors.

About Erdene

Erdene Resource Development Corp. is a diversified resource company with

multiple projects at various stages of development from exploration to

production, all focused on high-growth commodities. Erdene has a current

working capital position of approximately $17.0 million with 89,230,877 common

shares issued and outstanding and a fully diluted position of 98,445,852 common

shares.

Forward-Looking Statements

Certain information regarding Erdene contained herein may constitute

forward-looking statements within the meaning of applicable securities laws.

Forward-looking statements may include estimates, plans, expectations, opinions,

forecasts, projections, guidance or other statements that are not statements of

fact. Although Erdene believes that the expectations reflected in such

forward-looking statements are reasonable, it can give no assurance that such

expectations will prove to have been correct. Erdene cautions that actual

performance will be affected by a number of factors, most of which are beyond

its control, and that future events and results may vary substantially from what

Erdene currently foresees. Factors that could cause actual results to differ

materially from those in forward-looking statements include market prices,

exploitation and exploration results, continued availability of capital and

financing and general economic, market or business conditions. The

forward-looking statements are expressly qualified in their entirety by this

cautionary statement. The information contained herein is stated as of the

current date and subject to change after that date.

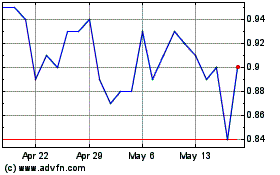

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jul 2023 to Jul 2024