Amerix Reports 10.2 Grams/Ton Over 10.7 Metres at Ouro Roxo

December 13 2007 - 8:00AM

Marketwired

TORONTO, ONTARIO (TSX VENTURE: APM)(FRANKFURT: NJG) today

reported that Kluane International Drilling, Inc. ("Kluane") and

Geologica e Sondagens Ltda. ("GEOSOL") have drilled 28 new holes

for a total of more than 4500 metres of core at the Ouro Roxo

deposit on Amerix's Vila Porto Rico Property ("VPR") in the Tapaj?s

District, Brazil. This drilling program commenced in early

September as reported in the Amerix's press releases of October 1

and October 24, 2007; each company has been contracted to drill

3000 metres of core. This program is expanding upon the 69

drill-hole program that was completed previously at the Ouro Roxo

Deposit. In total over 11,000 metres of core has been drilled at

the Ouro Roxo project by Amerix; an additional 5,000 metres of core

was previously drilled by RTZ. The drilling program will be paused

over the holiday break, but will begin again in January. Funding

for the drilling was raised through a brokered private placement

which closed on August 9, 2007 and raised gross proceeds of

approximately $3,750,000. Amerix also is pleased to announce that

initial assay results for eight complete holes from the Ouro Roxo

North ("ORN") zone have been received from SGS Geosol Laboratorios

Ltda located in Belo Horizonte, Brazil. Gold values in hole AORN64

ranged as high as 10.2 grams/ton ("g/t") over 10.7 metres

(including two zones within this interval of 17.2 g/t over 3.05

metres and 14.1 g/t over 4 metres). Visible gold is present in some

of these analyzed cores as well as other ORN cores that await

assay. Significantly, the drilling, assaying, and visual

description of the cores from ORN also show that gold

mineralization extends at least 600 metres farther north than known

before this new drilling program and is open-ended to the

north.

The drilling program is designed to explore the northward

extension of ORN towards the Pacï¿1/2 River and the sparsely

drilled intermediate zone between ORN and Ouro Roxo South. The 69

drill holes drilled to date have demonstrated the continuity of a

gold-mineralized zone for more than three kilometres from the ORN

zone to the Ouro Roxo South zone through a relatively unexplored

middle zone. It is anticipated that as drilling continues the main

Ouro Roxo mineralized zone will extend another two kilometres to

the north for a total length of at least 5.5 kilometres.

Management's Discussion and Analysis: The following table shows

mineralized zones in five of eight analyzed cores from ORN that

contain zones with 1.0 g/t gold or greater. A single sample in hole

AORN62 yielded 26.3 g/t gold over 1.0 meter. In hole AORN64, from

135.0 to 145.7 metres, the average grade is 10.2 g/t over this 10.7

-m wide interval; however, within this interval there are two zones

of 17.2 g/t over 3.05 metres and 14.1 g/t over four metres

separated by a two metres wide zone of lower grade. As a group

these results are highly encouraging for Amerix's exploration

effort. Throughout these five cores are numerous less than 1 g/t

zones of thicknesses ranging from 1 to 12 metres. In hole AORN56, a

core with many narrow high-grade zones had a total depth of only

127.8 metres due to loss of circulation when the drill encountered

a garimpeiro tunnel that had been drifted along a very high-grade

zone that obviously was unsampled by Amerix's core.

Three holes, AORN52, 53, and 54 produced low gold analyses. The

location of these holes with respect to a mapped surface structure

places them west of a right-lateral-sense fault zone. Subsequent

analysis indicates that these holes were drilled in the footwall of

the gold-mineralized zone. The following table summarizes the

results of five of the eight analyzed cores.

Drill Hole Interval Width Au Assay Interval

# (m) (m) (ppm) And Grade

-------------------------------------------------------

AORN55 18.0-19.0 1.0 0.5 1.0m@0.5g/t

-------------------------------------------------------

-------------------------------------------------------

AORN55 36.0-37.0 1.0 2.0 1m@2.0g/t

-------------------------------------------------------

-------------------------------------------------------

AORN56 42.8-44.0 1.2 1.0 1.2m@1.0g/t

-------------------------------------------------------

-------------------------------------------------------

AORN56 49.0-50.0 1.0 1.0 1.0m@1.0g/t

-------------------------------------------------------

-------------------------------------------------------

AORN56 60.0-61.0 1.0 1.6 1.0m@1.6g/t

-------------------------------------------------------

-------------------------------------------------------

AORN56 76.0-77.0 1.0 2.2 1.0m@2.2g/t

-------------------------------------------------------

-------------------------------------------------------

AORN56 89.2-90.2 1.0 8.5 1.0m@8.5g/t

-------------------------------------------------------

-------------------------------------------------------

AORN56 96.2-97.1 0.9 9.9 0.9m@9.9g/t

-------------------------------------------------------

-------------------------------------------------------

AORN56 115.5-116.5 1.0 4.3

-------------------------------------------------------

" 116.5-117.5 1.0 0.33

-------------------------------------------------------

Total 115.5-117.5 2.0m@2.3g/t

-------------------------------------------------------

AORN58 149.3-151.2 1.9 1.1 1.9m@1.1g/t

-------------------------------------------------------

-------------------------------------------------------

AORN62 75.9-76.9 1.0 22.9

-------------------------------------------------------

" 76.9-77.9 1.0 26.3

-------------------------------------------------------

" 77.9-78.9 1.0 3.5

-------------------------------------------------------

" 78.9-79.9 1.0 3.9

-------------------------------------------------------

Total 75.9-79.9 4m@14.15g/t

-------------------------------------------------------

-------------------------------------------------------

AORN62 104.0-105.0 1.0 1.35 1.0m@1.3g/t

-------------------------------------------------------

-------------------------------------------------------

AORN62 127.6-128.6 1.0 0.29

-------------------------------------------------------

" 128.6-129.6 1.0 16.0

-------------------------------------------------------

" 129.6-130.6 1.0 2.4

-------------------------------------------------------

Total 127.6-130.6 3.0m@6.2g/t

-------------------------------------------------------

-------------------------------------------------------

AORN62 150.5-151.5 1.0 2.2 1.0m@2.2g/t

-------------------------------------------------------

-------------------------------------------------------

AORN62 171.6-172.7 1.1 1.4 1.1m@1.4g/t

-------------------------------------------------------

" 172.7-173.8 1.1 0.04

-------------------------------------------------------

" 173.8-174.9 1.1 0.07

-------------------------------------------------------

" 174.9-176.0 1.1 0.27

-------------------------------------------------------

" 176.0-177.2 1.2 15.3 1.2m@15.3g/t

-------------------------------------------------------

" 177.2-178.3 1.1 0.15

-------------------------------------------------------

Total 171.6-178.3 6.7m@3.6g/t

-------------------------------------------------------

-------------------------------------------------------

AORN64 129.0-130.0 1.0 2.4 1m@2.4g/t

-------------------------------------------------------

-------------------------------------------------------

AORN64 135.0-135.6 0.6 0.46

-------------------------------------------------------

" 135.6-136.7 1.1 5.0

-------------------------------------------------------

" 136.7-137.7 1.0 14.4

-------------------------------------------------------

" 137.7-138.7 1.0 32.8

-------------------------------------------------------

" 138.7-139.7 1.0 0.14

-------------------------------------------------------

" 139.7-140.7 1.0 0.09

-------------------------------------------------------

" 140.7-141.7 1.0 3.4

-------------------------------------------------------

" 141.7-142.7 1.0 8.4

-------------------------------------------------------

" 142.7-143.7 1.0 24.8

-------------------------------------------------------

" 143.7-144.7 1.0 19.7

-------------------------------------------------------

" 144.7-145.7 1.0 0.41

-------------------------------------------------------

Total 135.0-145.7 10.7m@10.2g/t

-------------------------------------------------------

-------------------------------------------------------

QA/QC: The drilling operations are being conducted by GEOSOL and

Kluane under the direct guidance and supervision of Amerix

geologists and management. Both companies are well-established and

have worked with Amerix in the past. Cores are being drilled at 50

degrees to 70 degrees angles at HQ or NQ diameter for up to 100

metres in depth after which diameter NQ or BQ is used to depths

that generally will be in the range 150 to 250 metres. Local

geologic mapping and regional reconnaissance geologic mapping are

being conducted in concert with the drilling program. All cores are

split and described at the Amerix camps near the drill sites.

Assays are being conducted at SGS Geosol Laboratorios Ltda. These

assays are multi-element analyses that include both gold and silver

determinations among the suite of 38 analyzed elements.

About the Vila Porto Rico (VPR) Property: The VPR Property is

located in the Tapajos District, one of the largest gold-producing

provinces in Brazil. Amerix owns 100% of the mining rights within

the 670 km2 comprising the VPR property. Gold-rich zones are found

within the one to two kilometres wide, N-S trending Ouro Roxo fault

zone. This fault zone has been traced along a strike length of more

than 25 kilometres. The Ouro Roxo mineralized zone occurs in the

southern part of this major shear zone. Gold is present in a

variety of structures throughout the property, but the best gold

values at Ouro Roxo have been found within faults, shears, and

brecciated zones that dip moderately to the east at 40degrees to

50degrees. The mineralized structures contain variable amounts of

sulfides, and quartz-chalcopyrite-pyrite-gold veins, below a

saprolite zone that extends to a depth of 50 metres or more. The

Ouro Roxo Project includes exploring a 5.5 -kilometre-long segment

of this structural zone. A total of 69 angle core holes have been

drilled at Ouro Roxo; the results of assays for these holes have

been previously reported.

About Amerix Precious Metals Corporation: Amerix Precious Metals

Corporation is an Ontario company exploring for precious metals in

Brazil. VPR is the Corporation's main project, covering over 67,000

hectares. VPR has proven gold potential, as it contains historic

and active gold mines that anecdotal evidence suggests have

produced more than two million ounces from placer and weathered

bedrock (saprolite) mining operations. Amerix's objective is to

create value for shareholders through expansion of bedrock gold

resources, and development of placer and tailings gold resources.

Brazil has enormous gold potential and is a proven mining-friendly

country. Amerix staff has more than 50 years of combined experience

in Brazil, and the Corporation has been active for more than 10

years. The Corporation's shares trade on the TSX Venture Exchange

under the symbol "APM" and on the Frankfurt Stock Exchange under

the symbol "NJG."

The technical and scientific information in this release has

been reviewed by Lawrence W. Snee, Senior Consulting Geologist of

Amerix, a Qualified Person as described in NI 43-101, a geologist

with more than 30 years of experience. Some of the statements in

this news release contain forward-looking information, which

involves inherent risk and uncertainty affecting the business of

Amerix. The grades identified herein are not fully defined, there

is insufficient exploration to define a mineral resource and it is

uncertain if further exploration will result in the discovery of an

economic mineral resource on any of the properties. Actual results

may differ materially from those currently anticipated in such

statements.

If you would like to receive press releases via email, please

contact valerie@chfir.com and specify "Amerix press releases" in

the subject line.

The TSX Venture Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release. We

seek safe harbour.

Contacts: Amerix Precious Metals Corporation Jeffrey Reeder

President and CEO (647) 302-3290 CHF Investor Relations Jeanny So

Director of Operations (416) 868-1079, Ext. 225 Email:

jeanny@chfir.com Studer Consulting Marlies E. Studer +41 44 215 28

03 Email:consulting@studer-ir.ch

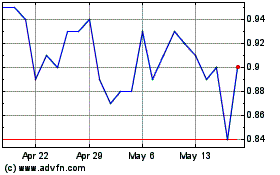

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Jul 2023 to Jul 2024