(“Amaroq” or the

“Corporation” or the

"Company")

Closing of Debt Financing

TORONTO, ONTARIO – September 1, 2023 – Amaroq

Minerals Ltd. (AIM, TSXV, NASDAQ First North: AMRQ), an independent

mine development company with a substantial land package of gold

and strategic mineral assets in Southern Greenland, is pleased to

announce the successful closing of its previously announced US$50.9

million senior secured package (see press releases dated March 28,

2023 and August 11, 2023), consisting of:

(i) US$18.5

million senior debt term loans ("Senior Debt Term

Loans") pursuant to revolving credit facilities provided

by Landsbankinn hf. and Fossar Investment Bank

(“Fossar”);

(ii) A total

of US$22.4 million convertible notes (the "Convertible

Notes"), with US$16 million of Convertible Notes issued to

ECAM LP, US$4 million of Convertible Notes issued to JLE Property

Ltd. and US$2.4 million of Convertible Notes issued to Livermore

Partners LLC (the "Convertible Note Offering");

and

(iii) an

overrun loan from JLE Property Ltd. of up to US$10 million under a

revolving credit facility (the "Overrun Loan" and

together with the Senior Debt Term Loans, the

"Facilities").

Eldur Olafsson, CEO of Amaroq,

commented:

“I am pleased to announce the successful closing

of our debt funding package. This marks a further milestone for

Amaroq Minerals, enabling the transition to staged, full scale

production at the Nalunaq gold project. I would like to extend my

thanks to our investors and debt funding partners.

We are working with a highly qualified team of

professionals as we accelerate our progression to trial mining

activities. We now look forward to commencing the next stage of

operations at Nalunaq as we enter this new chapter.”

The Convertible Notes will bear interest at a

rate of 5% per annum and will mature on September 1, 2027, being

the date that is four years from the Convertible Note Offering

closing date. The principal amount of the Convertible Notes will be

convertible, in whole or in part, at any time from one month after

issuance into common shares of the Company ("Common

Shares") at a conversion price of Cdn$0.90 (£0.525) per

Common Share for a total of up to 33,629,068 Common Shares. The

Company may repay the Convertible Notes and accrued interest at any

time, in cash, subject to providing 30 days’ notice to the relevant

noteholders, with such noteholders having the option to convert

such Convertible Notes into Common Shares at the conversion price.

If the Company chooses to redeem some but not all of the

outstanding Convertible Notes, the Company shall redeem a pro rata

share of each noteholder's holding of Convertible Notes. The

Company shall pay a commitment fee to the holders of the

Convertible Notes of, in aggregate, US$4,484,032, which shall be

paid pro rata to each noteholder's holding of Convertible Notes.

The commitment fee is payable on the earlier of (a) the date

falling 20 business days after all amounts outstanding under the

Senior Debt Term Loans have been repaid in full, but no earlier

than the date that is 24 months after the date of issuance of the

Notes; and (b) the date falling 30 (thirty) months after the date

of the subscription agreement in respect of the Notes, irrespective

of whether or not Notes have converted at that date or been

repaid.

The Facilities have a two year term and will

bear interest at the CME Term SOFT Rates by CME Group Inc. and have

a margin of 9.5% per annum. The Landsbankinn hf. and Fossar

revolving credit facilities under the Senior Debt Term Loans

contain (i) a commitment fee of 0.40% per annum calculated on the

undrawn facility amount and (ii) an arrangement fee of 2.00% on the

facility amount where 1.5% is to be paid on or before the closing

date of such facility and 0.50% is to be paid on or before the

first draw down. The Overrun Loan contains a stand-by fee of 2.5%

on the amount of committed funds. The Facilities are not

convertible into any securities of the Company.

The Facilities and Convertible Notes will be

secured by (i) bank account pledge agreements from the Company and

Nalunaq A/S, (ii) share pledges over all current and future

acquired shares in Nalunaq A/S and Gardaq A/S held by the Company

pursuant to the terms of share pledge agreements, (iii) a proceeds

loan assignment agreement, (iv) a pledge agreement in respect of

owner’s mortgage deeds and (v) a licence transfer agreement.

The proceeds from the Convertible Notes and the

Facilities will be used to fund the transition of the Company’s

Nalunaq mining licence from a bulk sample trial mining development

plan to staged, full scale production of gold doré on site by

bringing forward construction of a processing plant and associated

infrastructure.

Related Party Transactions

Livermore Partners LLC

("Livermore") subscribed for US$2.4 million in

principal amount of Convertible Notes under the Convertible Note

Offering (the "Insider Participation"). The

subscription by Livermore is considered to be a "related party

transaction" for purposes of Multilateral Instrument 61-101 -

Protection of Minority Security Holders in Special Transactions

("MI 61-101"). The Insider Participation is exempt

from the formal valuation and minority shareholder requirements

under MI 61-101 in reliance upon the exemptions contained in

section 5.5(a) and 5.7(1)(a), respectively, of MI 61-101. The

Company did not file a material change report more than 21 days

before the expected closing date of the Convertible Note Offering

as the details of the Convertible Note Offering and the Insider

Participation was not settled until shortly prior to the closing of

the Convertible Note Offering, and the Company wished to close the

Convertible Note Offering on an expedited basis for sound business

reasons.

For the purposes of the AIM Rules for Companies,

Fossar, ECAM and Livermore are related parties of

Amaroq. Fossar is a company in which Sigurbjorn

Thorkelsson, Non-Executive Director of the Company, is Chairman of

the board and indirectly controls over 30% of the

capital. ECAM LP is an affiliate of GCAM LP, which owns a 49%

interest in Gardaq A/S, an Amaroq subsidiary, and has

appointed two directors to the subsidiary company

board. Livermore is a company in which David Neuhauser,

Non-Executive Director of Amaroq Minerals, is Managing

Director.

As such, the elements of the debt financing

with Fossar (US$1.0 million off the Senior Debt

Term Loans), Livermore Partners LLC (US$2.4

million of the Convertible Notes), and ECAM

LP (US$16.0 million of the Convertible Notes)

constitute Related Party Transactions in accordance with AIM Rule

13.

The Independent Directors, being the Amaroq

Directors other than Sigurbjorn

Thorkelsson and David Neuhauser, consider, having

consulted with the Company's Nominated Adviser, that the terms of

the transaction are fair and reasonable insofar as the Company's

shareholders are concerned.

The Convertible Note Offering is subject to

final acceptance of the TSX Venture Exchange.

Enquiries:

Amaroq Minerals Ltd.Eldur

Olafsson, Executive Director and CEOeo@amaroqminerals.com

Eddie Wyvill, Corporate Development+44 (0)7713

126727ew@amaroqminerals.com

Stifel Nicolaus Europe

Limited (Nominated Adviser and Broker)Callum

StewartVarun TalwarSimon MensleyAshton Clanfield+44 (0) 20 7710

7600

Panmure Gordon (UK)

Limited (Joint Broker)John PriorHugh RichDougie

Mcleod+44 (0) 20 7886 2500

Camarco (Financial PR)Billy

CleggElfie KentCharlie Dingwall+44 (0) 20 3757 4980For

Company updates:

Follow @Amaroq_minerals on TwitterFollow Amaroq

Minerals Inc. on LinkedIn

Further Information:

About Amaroq Minerals

Amaroq Minerals' principal business objectives

are the identification, acquisition, exploration, and development

of gold and strategic metal properties in Greenland. The Company's

principal asset is a 100% interest in the Nalunaq Project, an

advanced exploration stage property with an exploitation license

including the previously operating Nalunaq gold mine. The

Corporation has a portfolio of gold and strategic metal assets

covering 7,866.85km2, the largest mineral portfolio in

Southern Greenland covering the two known gold belts in the region.

Amaroq Minerals is incorporated under the Canada Business

Corporations Act and wholly owns Nalunaq A/S, incorporated

under the Greenland Public Companies Act.

This news release is not for release,

publication, distribution, directly or indirectly, in or into the

United States of America or any other jurisdiction in which such

release, publication or distribution would be unlawful. This news

release is for information purposes only and does not constitute an

offer to sell or issue, or a solicitation of an offer to buy,

subscribe for or otherwise acquire any of the securities described

herein in the United States of America (including its territories

and possessions, any state of the United States and the District of

Columbia (collectively, the “United States”)) or

any other jurisdiction in which such offer or solicitation would be

unlawful or to any person to whom it is unlawful to make such offer

or solicitation. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act"), or any state

securities laws. The securities may not be offered or sold within

the United States, except pursuant to an applicable exemption from

the registration requirements of the U.S. Securities Act and in

compliance with any applicable securities laws of any state or

other jurisdiction of the United States.

Certain statements in this release constitute

"forward-looking statements" or "forward-looking information"

within the meaning of applicable securities laws, including but not

limited to, the expected use of proceeds from the Facilities and

Convertible Notes. Such statements and information involve known

and unknown risks, uncertainties and other factors that may cause

the actual results, performance or achievements of the company, its

projects, or industry results, to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements or information. Such statements can

be identified by the use of words such as "may", "would", "could",

"will", "intend", "expect", "believe", "plan", "anticipate",

"estimate", "scheduled", "forecast", "predict" and other similar

terminology, or state that certain actions, events or results

"may", "could", "would", "might" or "will" be taken, occur or be

achieved. These statements reflect the Company's current

expectations regarding future events, performance and results and

speak only as of the date of this release.

Forward-looking statements and information

involve significant risks and uncertainties, should not be read as

guarantees of future performance or results and will not

necessarily be accurate indicators of whether or not such results

will be achieved. A number of factors could cause actual results to

differ materially from the results discussed in the forward-looking

statements or information, including, but not limited to: the

failure to obtain the final acceptance of the Convertible Note

Offering from the TSX Venture Exchange, material adverse changes,

unexpected changes in laws, rules or regulations, or their

enforcement by applicable authorities; the failure of parties to

contracts with the company to perform as agreed; social or labour

unrest; changes in commodity prices; and the failure of

exploration, refurbishment, development or mining programs or

studies to deliver anticipated results or results that would

justify and support continued exploration, studies, development or

operations.

Inside InformationThis

announcement contains inside information for the purposes of

Article 7 of the UK version of Regulation (EU) No.

596/2014 on Market Abuse ("UK MAR"), as it forms part

of UK domestic law by virtue of the European

Union (Withdrawal) Act 2018, and Regulation (EU) No. 596/2014

on Market Abuse ("EU MAR").

- Amaroq - Debt Financing Closing Press Release - September 1-23

(2).docx

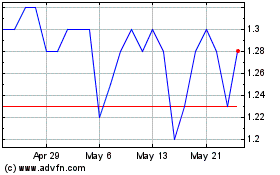

Amaroq Minerals (TSXV:AMRQ)

Historical Stock Chart

From Apr 2024 to May 2024

Amaroq Minerals (TSXV:AMRQ)

Historical Stock Chart

From May 2023 to May 2024