Alaska Energy Metals Corporation (TSX-V: AEMC, OTCQB: AKEMF)

(“

AEMC” or the “

Company”) is

pleased to announce the closing of the first tranche of the

previously announced non-brokered offering of 22,255,429 special

warrants (the “

Special Warrants”) issued at the

price of $0.15 per Special Warrant for gross proceeds of

approximately $3,338,314 (the “

Offering”). The

Offering has been increased from $3,000,000 to up to $3,500,000.

Each Special Warrant will automatically convert

into one unit of the Company (each a “Unit”), as

described below. Each Unit shall consist of one common share of the

Company (a “Share”) and one common share purchase

warrant (a “Warrant”). Each Warrant shall entitle

the holder thereof to acquire one Share at a price of $0.20 per

Share for a period of three years following the date of issue.

Each Special Warrant will automatically convert,

for no additional consideration, into Units on the date that is the

earlier of: (i) the date that is three business days following the

date on which the Company files a prospectus supplement to a short

form base shelf prospectus with the applicable securities

regulatory authorities qualifying distribution of the Units

underlying the Special Warrants (the “Prospectus

Supplement”), and (ii) the date that is four months and

one day after the closing of the Offering.

The Company will use its commercially reasonable

efforts to file the Prospectus Supplement within 60 days of the

closing of the Offering (not including the date of closing),

provided, however, that there is no assurance that a Prospectus

Supplement will be filed with the securities commissions, prior to

the expiry of the statutory four-month hold period.

The Company paid aggregate cash finder’s fees of

approximately $181,261 to certain finders, being 7% of the gross

proceeds raised by each such finder. As additional compensation the

Company issued an aggregate of 1,208,409 non-transferable broker

warrants (each a “Broker Warrant”) to such

finders. Each Broker Warrant is exercisable for one Share at the

exercise price of $0.20 for a period of three years.

The net proceeds from the Offering will be used

for Canwell prospect drilling at the Nikolai Nickel Project in

Alaska, metallurgical studies, working capital and marketing

purposes.

Prior to the filing of the Prospectus Supplement

and the automatic conversion of the Special Warrants, the

securities issued under the Offering will be subject to a

four-month hold period from the date of closing of the Offering in

addition to any other restrictions under applicable law.

The Company is also pleased to announce that it

will undertake a non-brokered private placement

(“NBPP”) of units (the “NBPP

Units”) for gross proceeds of up to $341,250. Each

NBPP Unit will consist of one common share of the Company (a

“Share”) and one common share purchase warrant (a

“Warrant”). Each Warrant shall entitle the holder

thereof to acquire one Share at a price of $0.20 per Share for a

period of three years following the date of issue. The Company

intends to pay the same cash finder’s fee and issue the same number

of Broker Warrants as is described under the Offering. The NBPP is

subject to TSX.V approval. The securities issued in connection with

the NBPP will be subject to a four-month hold period, in accordance

with applicable securities laws.

For additional information, visit:

https://alaskaenergymetals.com/

About Alaska Energy Metals

Alaska Energy Metals Corporation is an

Alaska-based corporation with offices in Anchorage and Vancouver

working to sustainably deliver the critical materials needed for

national security and a bright energy future, while generating

superior returns for shareholders.

AEMC is focused on delineating and developing

the large-scale, bulk tonnage, polymetallic Eureka deposit

containing nickel, copper, cobalt, chromium, iron, platinum,

palladium, and gold. Located in Interior Alaska near existing

transportation and power infrastructure, its flagship project,

Nikolai, is well-situated to become a significant domestic source

of strategic energy-related metals for North America. AEMC also

holds a secondary project, ‘Angliers-Belleterre,’ in western

Quebec. Today, material sourcing demands excellence in

environmental performance, carbon mitigation, and the responsible

management of human and financial capital. AEMC works every day to

earn and maintain the respect and confidence of the public and

believes that ESG performance is measured by action and led from

the top.

ON BEHALF OF THE BOARD“Gregory

Beischer”Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:Sarah

Mawji, Public RelationsVenture

StrategiesEmail: sarah@venturestrategies.com

Forward-Looking Statements

Some statements in this news release may contain

forward-looking information (within the meaning of Canadian

securities legislation), including, without limitation, the

statements as to the closing of the Offering, the closing of the

offering of Units, the filing of the Prospectus Supplement, the use

of proceeds, to drill exploratory drill holes at the Canwell

prospects, and to perform metallurgical studies. These statements

address future events and conditions and, as such, involve known

and unknown risks, uncertainties, and other factors which may cause

the actual results, performance, or achievements to be materially

different from any future results, performance, or achievements

expressed or implied by the statements. Forward-looking statements

speak only as of the date those statements are made. Although the

Company believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guaranteeing of future performance and actual results may

differ materially from those in the forward-looking statements.

Factors that could cause the actual results to differ materially

from those in forward-looking statements include regulatory

actions, market prices, and continued availability of capital and

financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees

of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements.

Forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are

made. Except as required by applicable law, the Company assumes no

obligation to update or to publicly announce the results of any

change to any forward-looking statement contained or incorporated

by reference herein to reflect actual results, future events or

developments, changes in assumptions, or changes in other factors

affecting the forward-looking statements. If the Company updates

any forward-looking statement(s), no inference should be drawn that

it will make additional updates with respect to those or other

forward-looking statements.

This news release does not constitute an offer

for sale, or a solicitation of an offer to buy, in the United

States or to any “U.S Person” (as such term is defined in

Regulation S under the U.S. Securities Act of 1933, as amended (the

“1933 Act”)) of any equity or other securities of the Company. The

securities of the Company have not been, and will not be,

registered under the 1933 Act or under any state securities laws

and may not be offered or sold in the United States or to a U.S.

Person absent registration under the 1933 Act and applicable state

securities laws or an applicable exemption therefrom.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

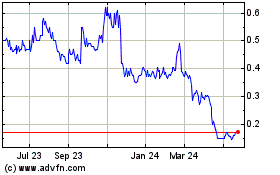

Alaska Energy Metals (TSXV:AEMC)

Historical Stock Chart

From Dec 2024 to Jan 2025

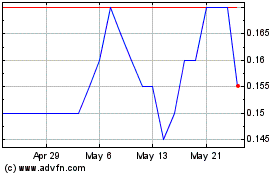

Alaska Energy Metals (TSXV:AEMC)

Historical Stock Chart

From Jan 2024 to Jan 2025