Anfield Energy Inc. (TSX.V: AEC; OTCQB: ANLDF; FRANKFURT:

0AD) (“Anfield” or “the Company”) is pleased to

report the results of its Preliminary Economic Assessment (PEA) for

the recently-acquired Wyoming-based Charlie Uranium Project

(“Charlie Project”). The independent PEA was prepared in accordance

with National Instrument 43-101 standards of disclosure for mineral

properties.

The PEA is based on mining the uranium deposits

via the In-Situ Recovery (ISR) method and delivering the wellfield

solutions via pipeline to Uranium One Inc.’s Christensen Ranch ion

exchange facility for initial processing. The resulting loaded

resin will be shipped to the Irigaray Central Processing Plant

(ICPP) for final processing. The terms under which both the resin

capture and processing will take place are found in the Resin

Capture and Processing Agreement recently signed between Uranium

One and Anfield.

The project area consists of one State of

Wyoming mining lease, totaling approximately 720 acres. The current

10-year mineral lease will expire on June 20, 2026 and is renewable

under an exclusive right.

Highlights include:

- The PEA shows a pre-tax project

Internal Rate of Return (IRR) of 60% and a Net Present Value (NPV)

of US$18.9 million, based on a discount rate of 8% and a uranium

price of US$65 per pound;

- Average annual production would be

approximately 297,400 pounds of uranium per year;

- Estimated capital expenditure

(CAPEX) includes an initial US$6.7 million during pre-production

and US$20.8 million in sustaining capital during production for a

total life of mine CAPEX of US$27.5 million; and

- Estimated LOM total operating costs

of US$23.09 per pound of uranium.

Corey Dias, Anfield CEO, states, “We are

extremely pleased with the outcome of this preliminary economic

assessment as it underlines both the true potential of the Charlie

project and our interest in commencing the process of moving it

forward to production. Anfield continues to add shareholder value

to its undervalued story through both asset acquisition and

development, and the Company’s ability to leverage Uranium One’s

existing processing facilities underscores the attractiveness of

this project. The Charlie Project, with its favourable capital and

operating costs, is a realistic investment opportunity as the

uranium price heads higher.

We also look forward to the recommendations of

the U.S. Nuclear Fuel Working Group to be presented to the Trump

Administration by October 10, 2019 with regard to an examination of

the entirety of the nuclear fuel cycle outcome of the US Working

Group. This Group is expected to outline ways to both facilitate

and expand U.S. uranium production. A positive outcome, coupled

with the confirmation of the underlying value of our assets, should

provide Anfield with enhanced prospects and increased market

valuations.”

The PEA completed for the Charlie Project has

been authored by Douglas L. Beahm, P.E., P.G. Principal Engineer,

of BRS Inc. The purpose of the PEA is to provide an independent

analysis of the potential economic viability of the mineral

resources of the project.

The Charlie Project

The Charlie Project is located in the Powder River Basin in

Wyoming near an existing uranium ISR mine and operating oilfields

which have an infrastructure of roads and power lines. Previous

owners and operators of the Charlie Project have conducted

sufficient exploration drilling to delineate a portion of a major

roll-front system which crosses the property and continues on to

adjacent lands. As a result of this previous work, a database of

over 1300 drill holes is available as well as several hydrological,

analytical and mineralogical reports. Previous reports have shown

that the uranium mineralization underlying the Charlie Project

exist as narrow and sinuous multiple roll-fronts which are commonly

developed in the Tertiary sedimentary formations of the Powder

River Basin. Roll-fronts of this type are currently or have

recently been mined by ISR methods on the adjacent Christensen

Ranch Project and further south at Smith Ranch/Highland.

The resource estimate includes:

- an Indicated Mineral Resource of

1,260,000 tons of mineralized material with an average grade of

0.12% eU3O8 (equivalent to an Indicated Resource of 3,100,000

pounds of eU3O8); and

- an Inferred Mineral Resource of

411,000 tons of mineralized material with an average grade of 0.12%

eU3O8 (equivalent to an Inferred Resource of 988,000 pounds of

eU3O8).

(Source: Charlie Uranium Project, Mineral

Resource NI 43-101 Technical Report, Johnson County, Wyoming, USA,

October 5, 2018, BRS, Inc.)

Project Economics

The PEA provides for a two-year pre-production

period. The first year’s forecasted capital expenditures of US$1.7

million include initial mine permitting, along with wellfield

delineation and a US$450,000 contingency. The second year’s capital

expenditures, forecasted at US$5.0 million (and including a

US$830,000 contingency) include further permitting, well

installation, header-house construction and trunk line

construction. Sustaining capital of US$20.8 million consists

primarily of wellfield-related costs. Total capital for Life of

Mine is estimated at US$26.7 million.

Direct operating costs per recovered pound of

uranium oxide are estimated to be US$11.88 per pound. These include

staff and labour costs, toll charges for both resin capture and

processing and regulatory compliance. Ground water restoration and

wellfield reclamation and decommissioning costs are estimated to

total US$4.21 per pound, while local taxes and royalties are

estimated to total US$7.00 per pound.

The PEA shows a return on investment with a

pre-tax IRR ranging from 42% to 76% with uranium prices ranging

from US$55 per pound to US$75 per pound. The NPV of the Project at

an 8% discount rate ranges from US$10.0 million to US$27.9 million.

After-tax IRR ranges between 35% and 67%, while after-tax NPV at an

8% discount rate ranges between US$7.0 million and US$21.7

million.

NI 43-101 Disclosure

The PEA completed for Velvet-Wood has been authored by Douglas

L. Beahm, P.E., P.G. Principal Engineer, of BRS Inc. The author has

reviewed and approved the technical content of this news

release. A technical report on the Preliminary Economic

Assessment will be published on the System for Electronic Analysis

and Retrieval (“SEDAR”) and the Company’s website within the 45

days permitted under NI 43-101.

Results of the PEA represent forward-looking

information. This economic assessment is preliminary in nature and

it includes inferred mineral resources that are considered too

speculative, geologically, to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves. There is no certainty that the preliminary economic

assessment will be realized. Conditions and parameters of the

project are subject to change based on the final filing of the PEA

on SEDAR within 45 days of this release. Mineral resources

are not mineral reserves as they do not have demonstrated economic

viability.

About BRS

BRS, Inc. is an engineering and geology

consulting corporation with expertise in mining and mineral

exploration. Of particular note, it specializes in uranium

exploration, mineral resource evaluation, mine design, feasibility,

mine operations, and reclamation. It has completed numerous uranium

projects including technical reports and feasibility studies for

underground, open pit, ISR, and conventional uranium mills.

Representative projects include technical reports and due diligence

for project financing for conventional uranium projects including

the Sheep Mountain and the JAB-RD open pit in Wyoming, the Cibola

Project in New Mexico, the Coles Hill, Virginia open pit and

underground mine, and numerous ISR uranium projects in Wyoming and

Paraguay.

Douglas L. Beahm, P.E., P.G., the principal

engineer at BRS, is a Qualified Person as defined in NI 43-101 with

40 years of professional and managerial experience. Mr. Beahm has a

proven track record in a variety of mining and mine reclamation

projects including surface and underground mining, heap leach

recovery, ISR, and uranium mill tailings projects. Mr. Beahm’s

experience includes coal, precious metals, and industrial minerals,

but his emphasis throughout his career has been on uranium.

About Anfield

Anfield is a uranium and vanadium development

and near-term production company that is committed to becoming a

top-tier energy-related fuels supplier by creating value through

sustainable, efficient growth in its assets. Anfield is a

publicly-traded corporation listed on the TSX-Venture Exchange

(AEC-V), the OTCQB Marketplace (ANLDF) and the Frankfurt Stock

Exchange (0AD). Anfield is focused on two asset centres, as

summarized below:

Wyoming – Resin Capture and Processing

Agreement

Anfield has signed a Resin Capture and

Processing Agreement with Uranium One whereby Anfield may process

up to 500,000 pounds per annum of its mined material at Uranium

One’s Christensen Ranch and Irigaray processing plants in

Wyoming.

Anfield’s 24 ISR mining projects are located in

the Black Hills, Powder River Basin, Great Divide Basin, Laramie

Basin, Shirley Basin and Wind River Basin areas in Wyoming.

Anfield’s two projects in Wyoming for which NI 43-101 resource

reports have been completed are Red Rim and Clarkson Hill.

The Charlie Project, the asset which was the

core component of a recently-announced transaction between Anfield

and Cotter Corporation, is located in the Pumpkin Buttes Uranium

District in Johnson County, Wyoming. The Charlie Project consists

of a 720-acre Wyoming State uranium lease which has been in

development since 1969. An NI 43-101 resource report has been

completed for the Charlie Project.

Arizona/Utah/Colorado – Shootaring Canyon

Mill

A key asset in Anfield’s portfolio is the

Shootaring Canyon Mill in Garfield County, Utah. The Shootaring

Canyon Mill is strategically located within one of the historically

most prolific uranium production areas in the United States, and is

one of only three licensed uranium mills in the United States.

Anfield’s conventional uranium assets consist of

mining claims and state leases in southeastern Utah, Colorado and

Arizona, targeting areas where past uranium mining or prospecting

occurred. Anfield’s conventional uranium assets include the

Velvet-Wood Project, the Frank M Uranium Project, the West Slope

Project as well as the Findlay Tank breccia pipe. An NI 43-101

Preliminary Economic Assessment has been completed for the

Velvet-Wood Project. The PEA is preliminary in nature, and

includes inferred mineral resources that are considered too

speculative geologically to have economic considerations applied to

them that would enable them to be categorized as mineral reserves,

and there is no certainty that the preliminary economic assessment

would be realized. All conventional uranium assets are situated

within a 200-mile radius of the Shootaring Mill.

On behalf of the Board of DirectorsANFIELD

ENERGY INC.Corey Dias, Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contact:Anfield Energy, Inc. Clive Mostert

Corporate Communications 780-920-5044contact@anfieldenergy.com

www.anfieldenergy.com Safe Harbor StatementTHIS NEWS RELEASE

CONTAINS “FORWARD-LOOKING STATEMENTS”. STATEMENTS IN THIS NEWS

RELEASE THAT ARE NOT PURELY HISTORICAL ARE FORWARD-LOOKING

STATEMENTS AND INCLUDE ANY STATEMENTS REGARDING BELIEFS, PLANS,

EXPECTATIONS OR INTENTIONS REGARDING THE FUTURE.

EXCEPT FOR THE HISTORICAL INFORMATION PRESENTED

HEREIN, MATTERS DISCUSSED IN THIS NEWS RELEASE CONTAIN

FORWARD-LOOKING STATEMENTS THAT ARE SUBJECT TO CERTAIN RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM ANY FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR

IMPLIED BY SUCH STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL

FACTS, INCLUDING STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR

THAT INCLUDE SUCH WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,”

“PLAN” OR “EXPECT” OR SIMILAR STATEMENTS ARE FORWARD-LOOKING

STATEMENTS. RISKS AND UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT

ARE NOT LIMITED TO, THE RISKS ASSOCIATED WITH MINERAL EXPLORATION

AND FUNDING AS WELL AS THE RISKS SHOWN IN THE COMPANY’S MOST RECENT

ANNUAL AND QUARTERLY REPORTS AND FROM TIME-TO-TIME IN OTHER

PUBLICLY AVAILABLE INFORMATION REGARDING THE COMPANY. OTHER RISKS

INCLUDE RISKS ASSOCIATED WITH SEEKING THE CAPITAL NECESSARY TO

COMPLETE THE PROPOSED TRANSACTION, THE REGULATORY

APPROVAL PROCESS, COMPETITIVE COMPANIES, FUTURE CAPITAL

REQUIREMENTS AND THE COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS

EXPLORATION AND DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE

THAT THE COMPANY WILL BE ABLE TO COMPLETE THE PROPOSED TRANSACTION,

THAT THE COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY

WILL ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY MANAGEMENT

OF THE COMPANY WHO TAKES FULL RESPONSIBILITY FOR ITS CONTENTS.

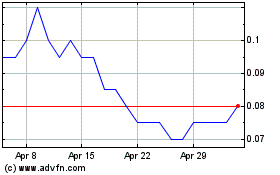

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Anfield Energy (TSXV:AEC)

Historical Stock Chart

From Nov 2023 to Nov 2024