Yellow Media Limited (TSX:Y) released its fourth-quarter and full-year results

today, ending 2012 with a stronger capital structure and continued progress on

its business transformation.

On July 23, 2012, Yellow Media Limited proposed a recapitalization transaction

(the "Recapitalization") aimed at significantly reducing the Company's debt and

improving its maturity profile, with new debt first maturing in 2018. The

Recapitalization aligns the Company's capital structure with its operating

strategy, providing it with the necessary financial flexibility to invest in its

digital transformation.

The Recapitalization was approved by the requisite majority of its debtholders

and shareholders on September 6, 2012. A settlement was later reached with the

lenders under the Company's senior unsecured credit facility on December 10,

2012.

The Quebec Superior Court issued its final order and approved the

Recapitalization on December 14, 2012. Closing and implementation of the

Recapitalization occurred on December 20, 2012.

"The completion of the Recapitalization allows us to accelerate our business

transformation into an industry-leading, technology and digitally-focused

marketing solutions company," said Marc P. Tellier, President and Chief

Executive Officer of Yellow Media. "We plan to provide superior value to

Canadian businesses by offering smarter, simpler ways to manage their digital

marketing needs and grow their customer base."

Board of Directors

Pursuant to the implementation of the Recapitalization on December 20, 2012, a

new Board of Directors of Yellow Media Limited was appointed and is comprised of

Craig Forman, David A. Lazzarato, David G. Leith, Robert F. MacLellan, Judith A.

McHale, Martin Nisenholtz, Kalpana Raina, Michael G. Sifton and Marc P. Tellier.

Robert F. MacLellan will serve as Chairman of the Board of Directors.

The new Board of Directors brings forth extensive expertise within the online,

media and communications industries necessary to further accelerate the

Company's digital transformation, alongside corporate finance, capital markets

and corporate development.

Lenders under the Company's senior unsecured credit facility are currently in

the process of proposing a nominee for the Board of Directors, who will also be

a member of the Audit Committee. The nominee is subject to approval from the

Board of Directors.

Full Year 2012 Results

Revenues in 2012 decreased 16.6% to $1.11 billion, compared to $1.33 billion

last year. The decline is due principally to lower print revenues, the

discontinuation of duplicate directories published by Canpages, the divestiture

of LesPAC.com in November 2011, and the sale of Deal of the Day in August 2012.

On a comparable basis, excluding the impact of the changes to the Canpages

business, the LesPAC.com divestiture, the sale of Deal of the Day, and YPG USA,

revenues decreased by 11.9% versus last year's results.

Online revenues in 2012 grew to $367.2 million compared to $346.1 million the

year prior, representing growth of 6.1%. On a comparable basis, excluding the

impact of the changes to the Canpages business, the LesPAC.com divestiture, the

sale of Deal of the Day, and YPG USA, online revenues grew 15.7% versus the same

period last year. Online revenues represented approximately 38% of total

revenues during the fourth quarter of 2012, compared to 29% in 2011.

As at December 31, 2012, the number of advertisers, excluding Canpages, was

309,000. During the year, the Company experienced an advertiser renewal rate of

86% and acquired approximately 17,000 new advertisers.

"Our business continues to experience a decline in revenues, as online growth is

currently unable to fully compensate for print revenue pressure. This trend was

expected, and we do not anticipate it to reverse in the near future. We're

focused on delivering long-term value through improvement of services to larger

advertisers, as well as on the successful execution of our 360 degrees Solution.

Our Yellow Pages 360 degrees Solution addresses Canadian small to medium-sized

enterprises' fundamental need to generate valuable leads to grow their

business," continued Tellier.

EBITDA declined from $679.7 million in 2011 to $570.6 million in 2012, mainly

attributable to print revenue pressure. The EBITDA margin for the year remained

stable at 51.5%, compared to 51.1% last year. EBITDA margins are reflective of

lower margins associated with our growing digital products, offset by the impact

of our significant cost containment initiatives.

Free cash flow for the year decreased from $275.2 million in 2011 to $198.3

million, mainly attributable to lower EBITDA.

For the fiscal year ending December 31, 2012, the Company recorded a net loss of

$2.0 billion. The net loss was affected by an impairment charge of $3.3 billion

on our goodwill, and certain of our intangible assets and property, plant and

equipment. This impairment charge was partly offset by a gain on settlement of

debt pursuant to the Recapitalization of $978.6 million. In 2011, the Company

recorded a net loss from continuing operations of $2.7 billion, which was

impacted by a $2.9 billion goodwill impairment charge and a $50.3 million

impairment of investment in associate.

For the fiscal year ending December 31, 2012, net earnings before impairment and

the gain on settlement of debt decreased to $189.5 million, compared to net

earnings from continuing operations before impairment of $222.8 million in 2011.

Net earnings per share before impairment and gain on settlement of debt was of

$6.02 for 2012, compared to net earnings per share from continuing operations

before impairment of $8.98 last year.

Fourth Quarter 2012 Results

Fourth quarter revenues were $264.4 million, as compared to $313.3 million in

the last quarter of 2011, mainly due to lower print revenues, the

discontinuation of duplicate directories published by Canpages, the divestiture

of LesPAC.com, and the sale of Deal of the Day. On a comparable basis, excluding

the impact of the changes to the Canpages business, the LesPAC.com divestiture,

the sale of Deal of the Day and YPG USA, fourth quarter revenues decreased by

9.7% versus last year's results.

Online revenues for the quarter were $99.7 million, as compared to $89.9 million

in the last quarter of 2011. On a comparable basis, excluding the impact of the

changes to the Canpages business, the LesPAC.com divestiture, the sale of Deal

of the Day and YPG USA, fourth quarter online revenues grew by 20.9% versus last

year's results.

EBITDA for the fourth quarter declined from $147.2 million in 2011 to $141.6

million, mainly attributable to print revenue pressure. The EBITDA margin for

the quarter increased to 53.5%, as compared to 47.0% last year, as a result of

various cost containment initiatives.

Free cash flow for the fourth quarter decreased from $78.2 million in 2011 to

$48.0 million in 2012. The decrease was due to a lower EBITDA and higher cash

interest paid pursuant to the Recapitalization, partly offset by lower cash

taxes.

During the fourth quarter of 2012, the Company recorded net earnings of $823.5

million. When adjusting for the $300 million impairment charge related to

certain of our intangible assets and property, plant and equipment, alongside

the gain on settlement of debt, the Company recorded net earnings of $24.0

million. This compares to net earnings from continuing operations of $48.2

million recorded in 2011.

Net earnings per share before impairment and gain on settlement of debt was of

$0.70 during the fourth quarter of 2012, compared to net earnings per share from

continuing operations of $1.53 last year.

Successful Execution of Yellow Pages 360 degrees Solution

Launched in 2011, Yellow Pages 360 degrees Solution offers Canadian small to

medium-sized enterprises ("SMEs") dedicated single-point access to a

comprehensive suite of products and services. Its value proposition resides in

how customers can access expert support and visibility through online, mobile

and print media platforms, in addition to services such as managed website

services, customized search engine marketing and search engine optimization, and

performance reporting tools such as Yellow Pages(TM) Analytics.

As at December 31, 2012, the advertiser penetration of YPG's 360 degrees

Solution (defined as advertisers who subscribe to three product categories or

more) was 16.5% compared to 5.5% at the end of the same period last year.

In order to further expand its product and service offering, the Company

established a High Priority Accounts ("HPA") program in early 2012 to best serve

the needs of larger advertisers. Fully deployed across the country, the HPA

program is aimed at mitigating revenue risk and optimizing revenue growth of

larger advertisers through a differentiated product and servicing model. A

comprehensive advertiser profiling methodology is currently in place to guide

the evaluation of account needs and opportunities through the review of Yellow

Pages Analytics results, website audits and competitive rankings, search engine

marketing estimates, and social media and search engine reviews. This profiling

is also followed by the definition of an appropriate strategy, determined by the

sales representative, sales manager and performance marketing advisor.

Mediative is also supporting YPG's efforts to best serve the needs of larger

advertisers through a new product line called Digital PowerPlay. Introduced

during the third quarter of 2012, Digital PowerPlay establishes and optimizes a

business' digital presence by determining the necessary steps to maximize

qualified leads across various digital channels while offering the highest level

of service and support.

To promote and demonstrate the relevance of the Company's digital tools,

platforms and expertise in connecting consumers with businesses, YPG launched a

new ad campaign in the fourth quarter of 2012. The campaign focuses on "Meet the

New Neighborhood," and communicates the Company's ability to address the

societal, cultural and technological trends that have changed the way consumers

and local businesses find and interact with one another.

Continued Growth in Mobile

Mobile remains a growing component of the Yellow Pages 360 degrees Solution

product suite. As at December 31, 2012, the Company had approximately 24,600

Canadian SMEs purchasing mobile products, representing approximately 46,600

mobile units.

YPG's mobile applications continue to earn positive industry recognition. The

Company was awarded "Best in Digital Advertising" at the 2012 Digi Awards for a

mobile contest which promoted the deals feature on the YellowPages.ca(TM) mobile

application. The award marks the second Digi Award for YPG, having won "Best in

Mobile" at last year's event for the location-based services of the

YellowPages.ca mobile application.

In an effort to further enhance its mobile offering to advertisers, the Company

launched two new mobile products during the fourth quarter of 2012: Mobile

Sponsored Placement Prestige and Mobile Placement Leader. Mobile Sponsored

Placement Prestige secures maximum, exclusive visibility for business listings

by offering larger displays and ensuring listings appear in the top spot of

mobile search results. Mobile Placement Leader also promotes enhanced visibility

by positioning business listings within a search's top five results.

Proving Advertiser Value through an Enhanced User Experience

To promote increased traffic across its network of properties and provide

valuable business leads to Canadian advertisers, YPG continues to invest in the

online user experience. YPG's network of sites currently reaches 9 million

unduplicated unique visitors, representing 32% of Canada's online population.

During 2012, the Company improved the search engine optimization of

YellowPages.ca to ensure increased indexation on search engines. YPG also

launched a redesigned Canpages.ca(TM) website based on the concept of "Life

Around Me." The website proposes a new user experience, focusing on the user's

geographic location and life needs within the context of a local search.

The Company's mobile applications also continue to grow in popularity, with

total downloads having exceeded 5 million by year-end 2012. This compares to 3.7

million downloads at the same period last year.

In 2012, the YP.ca application was fully redesigned to include more user

relevant content, including quick access to relevant groupings of business

listings and neighborhood deals pertaining to the user's search category. The

YP.ca application continues to rank high among productivity applications, and

was selected as one of Apple's "Best of 2012".

The ShopWise(TM) mobile application was also enhanced in 2012 to include

improved content and functionalities. Innovations included the integration of a

product catalogue featuring more than seven million items, and a list of 600

local and national retailers. The product and merchant data stemmed from a

partnership with Shoptoit, whereby the Shoptoit platform was fully integrated

into the ShopWise application. Shoptoit is currently one of the leading shopping

search engines in Canada.

Since its initial launch in late 2010, YellowAPI.com has embodied YPG's digital

leadership and gained industry recognition, having enrolled over 2,500

application developers. These developers generate visibility to Canadian

advertisers by powering their mobile applications with valuable content from

YPG's database of 1.5 million business listings.

In the fourth quarter of 2012, YPG and Yahoo! Canada announced they had expanded

their six-year partnership to provide Yahoo! Canada users with an enhanced local

search experience. Through YPG's YellowAPI technology and database of business

listings, Yahoo! Canada users now have access to local business information

based on their point of location. Partnering with Yahoo! Canada enables YPG to

significantly extend its advertisers' reach on a platform outside its network of

properties.

Mediative

Mediative is a leading Canadian digital media advertising company, offering

extensive display, mobile and other location-based marketing solutions to

national advertisers. Reaching approximately 16.5 million unique visitors per

month, Mediative's online ad network matches advertisers with the websites of

premium online brands.

During 2012, Mediative enhanced its location-based offering with the launch of a

flexible mobile advertising network enabling advertisers to reach consumers

based on their intent to buy. In addition to providing broad and flexible

local-based targeting options via connections to multiple ad exchanges,

Mediative also offers a premium network of 20+ mobile-enabled sites and

applications to help marketers reach specific audiences.

Capital Structure

As at December 31, 2012, Yellow Media had approximately $782 million of net

debt. This compares to $2.1 billion of net debt and preferred shares (Series 1

and 2) as at December 31, 2011.

The net debt to Latest Twelve Month EBITDA ratio as at December 31, 2012 was 1.4

times compared to 2.5 times as at December 31, 2011 respectively.

Pursuant to the Recapitalization, the Company currently has outstanding:

-- $800 million face value of 9.25% Senior Secured Notes maturing November

30, 2018;

-- $107.5 million face value of Senior Subordinated Unsecured Exchangeable

Debentures due November 30, 2022, with interest payable in cash at 8% or

in additional debentures at 12%;

-- 27,955,077 New Common Shares

-- 2,995,506 Warrants.

The Senior Subordinated Unsecured Exchangeable Debentures, New Common Shares and

Warrants are currently trading on the Toronto Stock Exchange under the following

symbols:

-- Senior Subordinated Unsecured Exchangeable Debentures: YPG.DB

-- New Common Shares: Y

-- Warrants: Y.WT

Details of the Recapitalization are currently available on SEDAR (www.sedar.com)

and the Company's website

(http://www.ypg.com/en/investors/recapitalization-transaction).

Investor Conference Call

Yellow Media Limited will hold an analyst and media call at 1:30 p.m. (Eastern

Time) on February 5, 2013 to discuss the fourth quarter and full year 2012

results. The call may be accessed by dialing (416) 340-2218 within the Toronto

area, or 1 866 226-1793 outside of Toronto.

The call will be simultaneously webcast on the Company's website at

http://www.ypg.com/en/investors/financial-reports/2012/quarterly-reports/fourth-quarter.

The conference call will be archived in the Investor Center of the site at

www.ypg.com.

A playback of the call can also be accessed from February 5 to February 12, 2013

by dialing (905) 694-9451 within the Toronto area, or 1 800 408-3053 outside

Toronto. The conference passcode is 3875901.

About Yellow Media Limited

Yellow Media Limited (TSX:Y) is a leading media and marketing solutions company

in Canada. The Company owns and operates some of Canada's leading properties and

publications including Yellow Pages(TM) print directories, YellowPages.ca(TM),

Canada411.ca and RedFlagDeals.com(TM). Its online destinations reach 9 million

unique visitors monthly and its mobile applications for finding local businesses

and deals have been downloaded over 5 million times. Yellow Media Limited is

also a leader in national digital advertising through Mediative, a digital

advertising and marketing solutions provider to national agencies and

advertisers. For more information, visit www.ypg.com.

Caution Concerning Forward-Looking Statements

This press release contains forward-looking statements about the objectives,

strategies, financial conditions, results of operations and businesses of the

Company. These statements are forward-looking as they are based on our current

expectations, as at February 5, 2013, about our business and the markets we

operate in, and on various estimates and assumptions. Our actual results could

materially differ from our expectations if known or unknown risks affect our

business, or if our estimates or assumptions turn out to be inaccurate. As a

result, there is no assurance that any forward-looking statements will

materialize. Risks that could cause our results to differ materially from our

current expectations are discussed in section 6 of our February 5, 2013

Management's Discussion and Analysis. We disclaim any intention or obligation to

update any forward-looking statements, except as required by law, even if new

information becomes available, as a result of future events or for any other

reason.

Financial Highlights

(in thousands of Canadian dollars - except share and per share information)

----------------------------------------------------------------------------

For the three-month periods For the years ended

ended December 31, December 31,

Yellow Media Limited 2012 2011 2012 2011

----------------------------------------------------------------------------

Revenues $264,447 $313,315 $1,107,715 $1,328,866

Income (loss) from

operations ($199,942) $109,731 ($2,846,463) ($2,415,084)

Net earnings (loss)

from continuing

operations $823,536 $48,222 ($1,954,005) ($2,708,122)

Basic earnings

(loss) per share

from continuing

operations

attributable to

common shareholders $29.30 $1.53 ($70.66) ($97.66)

Cash flow from

operating

activities from

continuing

operations $61,749 $92,964 $238,573 $336,573

----------------------------------------------------------------------------

EBITDA(1) $141,564 $147,198 $570,600 $679,707

EBITDA margin(1) 53.5% 47.0% 51.5% 51.1%

----------------------------------------------------------------------------

Weighted average

number of common

shares outstanding 27,955,077 27,955,077 27,955,077 27,955,077

Dividends on common

shares - - - $207,345

Dividends declared

per common share - - - $0.40

----------------------------------------------------------------------------

Non-IFRS Measures(1)

In order to provide a better understanding of the results, the Company uses the

term EBITDA, defined as income from operations before depreciation and

amortization, impairment of goodwill, intangible assets and property, plant and

equipment, acquisition-related costs and restructuring and special charges.

Management believes this measure is reflective of ongoing operations. This term

is not a performance measure defined under IFRS. EBITDA does not have any

standardized meaning and is therefore not likely to be comparable to similar

measures used by other publicly traded companies. Management believes EBITDA to

be an important measure.

FOR FURTHER INFORMATION PLEASE CONTACT:

Investor Relations

Amanda Di Gironimo

Senior Manager, Corporate Finance and Investor Relations

(514) 934-2680

Amanda.DiGironimo@ypg.com

Media

Fiona Story

Senior Manager, Public Relations

(514) 934-2672

Fiona.Story@ypg.com

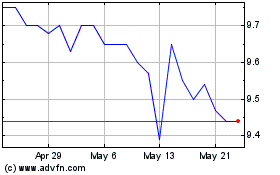

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jun 2024 to Jul 2024

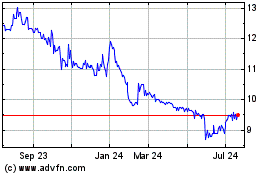

Yellow Pages (TSX:Y)

Historical Stock Chart

From Jul 2023 to Jul 2024