Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG)

provides an inaugural quarterly update on the development of its

Media Luna Project (“Media Luna”), for which a Feasibility Study

was included as part of an updated Technical Report released on

March 31, 2022 (“Technical Report”). Unless otherwise stated,

progress and milestones referenced in this press release are as of

December 31, 2022.

Jody Kuzenko, President & CEO of Torex,

stated:

“Development of Media Luna is well underway with

the project tracking to schedule and to budget. At year-end,

project completion stood at 15%, with first production still

anticipated in late 2024. Capital expenditures are tracking well to

the original budget, with 26% of the upfront costs committed at

year-end including 14% incurred. Project activity is expected to

ramp-up significantly in the months ahead, with 2023 expected to be

the peak year of spending.

“During the quarter, procurement activities

continued to advance with purchase orders executed for the Guajes

conveyor radial stacker, cleaner flotation circuits, hydro cyclones

and tailings positive displacement pumps, rock breakers, and

electrical transformers and switchgear. Letters of intent were

signed for the production mobile equipment fleet in December and

support mobile equipment fleet post year-end, with purchase orders

(including for battery electric vehicles) nearing completion. The

Guajes Tunnel remains on track for breakthrough in Q1 2024, with

the tunnel successfully crossing under the Balsas River in

December. Approval was also received to increase the power draw at

our Morelos Property to 65 megawatts from 45 megawatts, building on

approvals received earlier in 2022.

“We are off to a solid start as we continue to

de-risk and advance Media Luna. With budget and schedule on track,

$590 million of available liquidity at the end of the third quarter

and strong forecast cash flow over the next two years, we are in a

strong position to fund the development of the project, continue to

invest in value enhancing exploration and drilling, and maintain

$100 million of liquidity on the balance sheet.”

CAPITAL EXPENDITURES

Total upfront expenditures related to the

development of Media Luna are unchanged at $874.5 million. As at

year-end, the Company had commitments in place for $229.7 million

of project expenditures (approximately 26%), including $124.7

million of expenditures incurred (approximately 14%). Based on

purchase orders and contracts awarded to date, project costs in

general are tracking well to the costs outlined in the Technical

Report.

Table 1: Media Luna Project – Project

Expenditures (April 1, 2022 through December 31, 2022)

|

|

Project To DateQ4 2022 |

|

Project expenditures per 2022 Technical Report |

$848.4 |

|

Adjustment for underspend in Q1 2022 |

$26.1 |

|

Total project expenditures |

$874.5 |

|

Total project expenditures accrued to date |

($124.7) |

|

Remaining project expenditures |

$749.8 |

|

Committed expenditures (inclusive of total project expenditures

accrued to date) |

$229.7 |

|

Uncommitted expenditures |

$644.8 |

1) Project period commenced on

April 1, 2022; excludes capital expenditures incurred prior to

Board approval on March 31, 2022.2) Project period

is defined as April 1, 2022 through December 31,

2024.3) Excludes borrowing costs capitalized.

Torex expects to incur $390 to $440 million of

capital expenditures at Media Luna in 2023, which is forecasted to

be the peak year of investment. Quarterly expenditures are expected

to remain relatively consistent through H1 2024, before declining

as development activities wind down ahead of commercial production,

which is anticipated in early 2025.

PROJECT COMPLETION

With project completion at 15% as at year-end,

Media Luna remains on track for first production in late 2024,

following the tie-in of the copper and iron flotation circuits with

the existing processing plant.

Table 2: Media Luna Project – Project

Completion (April 1, 2022 through December 31, 2022)

|

|

Project To DateQ4 2022 |

|

Procurement |

24.9% |

|

Engineering |

33.7% |

|

Underground development/construction |

18.6% |

|

Surface construction |

10.2% |

|

Total Project |

15.0% |

Notes to Table1) Physical

progress measured starting as of April 1, 2022; excludes progress

made prior to Board approval on March 31,

2022.2) Project period is defined as April 1, 2022

through December 31, 2024.3) Total Project is

weighted average based on activity levels.

ProcurementAs noted with the

release of Q3 2022 financial results, the procurement phase for

high volume, non-schedule critical procurement packages has taken

additional time, given the push to expand the pool of vendors with

a view to securing competitive pricing.

During the quarter, the Company awarded multiple

contracts and issued multiple purchase orders, including the Guajes

conveyor radial stacker, cleaner flotation cells, samplers and

analyzers, pumps, rock breakers, as well as electrical transformers

and switch gear. Letters of intent were signed for the production

mobile equipment fleet in December and support mobile equipment

fleet post year-end, with purchase orders nearing completion. The

upfront costs and delivery windows for both the battery electric

vehicle and diesel vehicle portions of the fleet are in line with

the lead times assumed in the original project schedule.

EngineeringDetailed engineering

is tracking ahead of procurement activity. All critical path

engineering is on track. Surface engineering during the period

focused on finalization of key process equipment sizing and

specifications as well as continued detailing of the new flotation

plant. Underground engineering advanced layout work related to

infrastructure such as maintenance bays, refuge stations, west vent

adit, as well as ore and waste handling

systems.

Underground Development and

ConstructionSteady progress was made in advancing the

Guajes Tunnel and South Portals. Breakthrough of the Guajes Tunnel

on the south side of the Balsas River remains on track for Q1 2024,

which is expected to provide ample time to hang the conveyor

(approximately four months) and ensure all services are in place to

connect Media Luna with the upgraded processing plant on the north

side of the Balsas River.

Daily advance rates in the Guajes Tunnel

averaged 6.4 metres during Q4 2022, including a record average

daily advance rate of 7.2 metres during December. As at year-end,

the Guajes Tunnel had advanced approximately 3,250 metres (3,455

metres as of end of January 2023), and successfully crossed under

the Balsas River with no issues related to ground conditions or

water. At South Portal Lower, development of the main lower ramp

has commenced, with the main tunnel drive recently completed.

Steady progress was made on ventilation during the quarter, with

Guajes Tunnel ventilation raise bore advancing (70 metres of 180

metres completed) and additional vent fans installed at both South

Portal Upper and Lower.

Figure 1: Breakthrough of Guajes Tunnel

on schedule for Q1 2024 (advance rates as at end of

January)

Surface ConstructionDuring the

quarter, multiple surface construction projects were advanced,

including slope stabilization along the access road to South Portal

Lower, pad preparation for the paste plant and back-up generators

adjacent to South Portal Upper, and development of the Mazapa

bypass road. Key projects that kicked off in Q4 include

construction of settling and decant ponds, and expansion of the MML

construction camp.

Operational ReadinessIn

parallel with development and construction activities, the surface

and underground operational readiness teams have been staffed, and

planning is progressing. These operational readiness teams are

accountable for ensuring that processes and systems for all new

work areas are established and ready in advance of the handover

from the project team to operations. This includes workforce

transition planning and training, developing the operating

strategy, including all standard operating procedures, the

maintenance plans for all fixed and mobile equipment, blend and

feed strategies, detailed commissioning plans, first fills,

concentrate shipment logistics, and all other requirements to

ensure a smooth ramp up to commercial production in Q1 2025.

PROJECT EXECUTION PLAN

Based on progress to date as well as refreshed

assumptions following the completion of the Technical Report last

year, the Company has refined the project execution plan

accordingly.

Key adjustments to the project execution plan

include:

- Engineering and procurement phase

has been extended six months to June 2024, mainly related to

non-schedule critical procurement packages.

- Early installation of the iron

sulphide (FeS) concentrator and the water treatment plant pushed

back by four months, with completion dates well ahead of

commissioning the process plant in October 2024.

- Breakthrough of the Guajes Tunnel

advanced two months to early January 2024, resulting in the

anticipated installation of Guajes conveyor a month earlier than

originally scheduled.

- Completion of the paste plant

pushed out three months to October 2024, reflecting additional time

take for a peer review and subsequent refinements to the original

design.

Figure 2: Refined project execution plan

for Media Luna

The updated plan reflects the Company’s latest

estimates for the completion of key project deliverables, which

have not impacted the overall project schedule given the original

plan had assumed the potential for adjustments within the schedule

and potential supply chain disruptions.

ABOUT TOREX GOLD RESOURCES

INC.

Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development, and operation of

its 100% owned Morelos Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal asset is the

Morelos Complex, which includes the El Limón Guajes (“ELG”) Mine

Complex, the Media Luna Project, a processing plant, and related

infrastructure. Commercial production from the Morelos Complex

commenced on April 1, 2016 and an updated Technical Report for the

Morelos Complex was released in March 2022. Torex’s key strategic

objectives are to optimize and extend production from the ELG Mine

Complex, de-risk and advance Media Luna to commercial production,

build on ESG excellence, and to grow through ongoing exploration

across the entire Morelos Property.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

|

TOREX GOLD RESOURCES INC.Jody KuzenkoPresident and

CEODirect: (647) 725-9982jody.kuzenko@torexgold.com |

Dan RollinsSenior Vice President, Corporate

Development & Investor RelationsDirect: (647)

260-1503dan.rollins@torexgold.com |

|

|

|

QUALIFIED PERSONThe technical

and scientific information in this press release has been reviewed

and approved by Dave Stefanuto, P. Eng, Executive Vice President,

Technical Services and Capital Projects of the Company, and a

qualified person under National Instrument 43-101.

CAUTIONARY NOTES

Forward-Looking StatementsThis

press release contains “forward-looking statements” and

“forward-looking information” within the meaning of applicable

Canadian securities legislation. Forward-looking information

includes, but is not limited to, statements that: development of

Media Luna is well underway with the project tracking to schedule

and to budget; total upfront expenditures related to the

development of Media Luna are unchanged; at year-end, first

production for the project is still anticipated in late 2024;

capital expenditures tracking well to the original budget;

expectation of project activity to ramp-up significantly in the

months ahead, with 2023 expected to be the peak year of spending;

the Guajes Tunnel remains on track for breakthrough in Q1 2024; the

Company to continue to de-risk and advance Media Luna; the Company

is in a strong position to fund the development of the project,

continue to invest in value enhancing exploration and drilling, and

maintain $100 million of liquidity on the balance sheet; project

costs in general are tracking well to the costs outlined in the

Technical Report; expected capital expenditures at Media Luna in

2023; forecast that 2023 to be the peak year of investment in Media

Luna; expectation of quarterly expenditures remaining relatively

consistent through H1 2024, before declining as development

activities wind down ahead of commercial production anticipated in

early 2025; Media Luna remains on track for first production in

late-2024; all critical path engineering is on track; breakthrough

of the Guajes Tunnel on the south side of the Balsas River remains

on track for Q1 2024, which is expected to provide ample time to

hang the conveyor (approximately four months) and ensure all

services are in place to connect Media Luna with the upgraded

processing plant on the north side of the Balsas River; and the

Company’s key strategic objectives are to optimize and extend

production from the ELG Mining Complex, de-risk and advance Media

Luna to commercial production, build on ESG excellence, and to grow

through ongoing exploration across the entire Morelos Property.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as “expects”, “plan”,

“strategy” or variations of such words and phrases or statements

that certain actions, events or results “will” occur or are “on

track” to occur. Forward-looking information is subject to known

and unknown risks, uncertainties and other factors that may cause

the actual results, level of activity, performance or achievements

of the Company to be materially different from those expressed or

implied by such forward-looking information, including, without

limitation, risks and uncertainties identified in the technical

report (“Technical Report”) titled ELG Mine Complex Life of Mine

Plan and Media Luna Feasibility Study, with an effective date of

March 16, 2022, and a filing date of March 31, 2022 and in the

Company’s annual information form (“AIF”) and management’s

discussion and analysis (“MD&A”) or other unknown but

potentially significant impacts. Forward-looking information is

based on the reasonable assumptions, estimates, analyses and

opinions of management made in light of its experience and

perception of trends, current conditions and expected developments

as set out in the Technical Report, AIF and MD&A, and other

factors that management believes are relevant and reasonable in the

circumstances at the date such statements are made. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information, there may be other factors that

cause results not to be as anticipated. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, whether as a

result of new information or future events or otherwise, except as

may be required by applicable securities laws.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/cc7e3db6-fd7b-4b8c-b67e-d38ff0ff46b1

https://www.globenewswire.com/NewsRoom/AttachmentNg/d2ef0e3b-73da-426f-9ace-8ce4a41d76b0

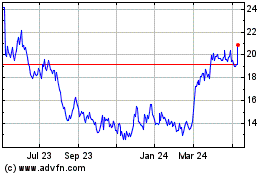

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

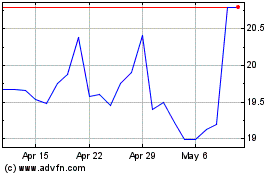

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Dec 2023 to Dec 2024