Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG)

reports Mineral Reserves and Resources for the Company’s El Limón

Guajes Complex (“ELG”) for the year ended December 31, 2021.

Ongoing drilling within the ELG Underground led to a 20% increase

in underground Mineral Reserves, while gains in the open pits,

primarily through the addition of a pushback in the El Limón pit,

offset 38% of open pit depletion.

Jody Kuzenko, President & CEO of Torex,

stated:

“Our focus on delivering a smooth transition

between ELG and Media Luna was supported by our drilling efforts in

2021, with the overall addition of 346,000 ounces of gold to

Mineral Reserves, offsetting 65% of the 529,000 ounces processed

during the year. The additions to Mineral Reserves were once again

driven by the ELG Underground, which added 186,000 ounces of gold

to Reserves prior to depletion. In the ELG Open Pit, 160,000 ounces

of Mineral Reserves were added prior to depletion, driven

predominantly by the previously announced pushback of the El Limón

pit.

“The ELG Underground continues to impress, with

Proven & Probable Reserves up 20% in 2021 following a 15%

increase in 2020. The net increase in underground Reserves

primarily reflects the extensive infill drill campaign carried out

in 2021, with the intent on upgrading Inferred Resources to the

Measured and Indicated categories. Details of the year end 2021

Mineral Reserves and Resources will be included in the upcoming

Technical Report, which is on track to be released by the end of

the month.

“The Company has budgeted $6 million towards

step-out and infill drilling within the ELG Underground in 2022,

with a target of drilling 28,000 metres. Step-out drilling is

expected to ramp up during the second half of the year with the

completion of Portal #3, which will allow the Company to establish

drill platforms from which to test vertical extensions and expand

the overall resource potential of the ELG Underground.”

TABLE 1: YEAR-OVER-YEAR COMPARISON OF MINERAL RESERVES

& RESOURCES AT ELG

|

El Limón Guajes Complex |

December 31,

2021 |

December 31,

2020 |

Variance |

|

|

Tonnes |

Au |

Au |

Tonnes |

Au |

Au |

Tonnes |

Au |

Au |

|

|

(Mt) |

(g/t) |

(koz) |

(Mt) |

(g/t) |

(koz) |

(Mt) |

(g/t) |

(koz) |

|

Proven & Probable Reserves |

|

Open Pit (including stockpiles) |

15.18 |

2.55 |

1,246 |

18.48 |

2.54 |

1,510 |

(18%) |

0% |

(18%) |

|

Underground |

2.68 |

5.74 |

494 |

2.03 |

6.32 |

413 |

32% |

(9%) |

20% |

|

Total |

17.85 |

3.03 |

1,740 |

20.51 |

2.92 |

1,923 |

(13%) |

4% |

(10%) |

|

Measured & Indicated Resources |

|

Open Pit |

16.75 |

2.89 |

1,557 |

18.28 |

2.91 |

1,710 |

(8%) |

(1%) |

(9%) |

|

Underground |

4.55 |

6.25 |

915 |

3.26 |

7.31 |

770 |

40% |

(15%) |

19% |

|

Total |

21.31 |

3.61 |

2,472 |

21.55 |

3.57 |

2,480 |

(1%) |

1% |

(0%) |

|

Inferred Resources |

|

Open Pit |

0.81 |

1.80 |

47 |

1.93 |

1.75 |

110 |

(58%) |

3% |

(57%) |

|

Underground |

1.38 |

4.88 |

217 |

2.88 |

5.65 |

520 |

(52%) |

(14%) |

(58%) |

|

Total |

2.19 |

3.74 |

264 |

4.81 |

4.08 |

630 |

(54%) |

(8%) |

(58%) |

Notes to Mineral Reserve and Resource Comparison

Table:

1) The reader is cautioned not

to misconstrue this tabulation as a Mineral Resource statement.

Listed grades and tonnes are shown for comparison purposes

only.

2) The gold price of $1,400/oz

used to estimate Mineral Reserves at year-end 2021 is unchanged

from the price used to estimate Reserves at year-end 2020. The gold

price of $1,550/oz used to estimate Mineral Resources at year-end

2021 is also unchanged with the price used at year-end 2020.

3) Year-end Mineral Reserves

and Resources as well as year-over-year variance subject to

rounding.

4) Mineral Resources are

reported inclusive of Mineral Reserves.

Mineral Resources are classified in accordance

with the 2014 CIM Definition Standards for Mineral Resources and

Mineral Reserves and the 2019 CIM Estimation of Mineral Resources

and Mineral Reserves Best Practice Guidelines (collectively, the

“CIM Standards”).

MINERAL RESERVES – ELG Proven

and Probable Mineral Reserves (contained gold) at ELG declined to

1,740 thousand ounces (“koz”) at an average grade of 3.03 grams per

tonne (“g/t”) compared to 1,923 koz at 2.92 g/t at the end of 2020.

The improvement in the average reserve grade year-over-year

reflects the increasing portion of underground Mineral Reserves

relative to the open pits. The gold price used to estimate year end

Mineral Reserves is unchanged at $1,400 per ounce.

The 183 koz decrease in total contained Mineral

Reserves year-over-year primarily reflects 529 koz of gold

processed in 2021, offset by continued drilling success within the

ELG Underground and the addition of the pushback at the El Limón

open pit.

In the ELG Underground, the 2021 drill campaign,

made up primarily of infill drilling, resulted in the addition of

205 koz of Mineral Reserves. Offsetting the underground additions

was 105 koz of mine depletion and impact of 19 koz due to the

application of a higher cut-off grade. In the ELG Open Pit, pit

design changes and block model updates resulted in the addition of

207 koz to Reserves, with the pushback in the El Limón pit

representing the majority of the increase. Offsetting Reserve gains

in the open pits (including stockpiles) was approximately 425 koz

of depletion and impact of 47 koz from the application of a higher

cut-off grade. The application of higher cut-off grades reflects

the impact of increased cyanide consumption and unit rates on

processing costs experienced in 2021.

The 9% decline in the ELG Underground reserve

grade (5.74 g/t gold versus 6.32 g/t) was driven by two key

factors. Approximately two-thirds of the decline was driven by

inclusion of lower grade resources into the mine plan through

infill drilling and about a third from mining above reserve grade

the past year (average processed gold grade of 7.07 g/t).

Including modest levels of silver and copper in

addition to gold, total Proven & Probable Mineral Reserves

(gold equivalent basis) are estimated at 1,763 koz at an average

gold equivalent grade of 3.07 g/t. Gold equivalent estimates for

ounces and grade account for the underlying metal prices and

metallurgical recoveries used to estimate Mineral Reserves (Table

2).

MINERAL RESOURCES – ELG

Measured and Indicated Mineral Resources (contained gold) decreased

slightly to 2,472 koz at an average grade of 3.61 g/t compared with

2,480 koz at 3.57 g/t at the end of 2020. Infill drilling success

within the ELG Underground as well as additional ounces picked up

through the El Limón pushback were the primary drivers behind the

change year-over-year. Inferred Mineral Resources (contained gold)

declined to 264 koz at an average grade of 3.74 g/t from 630 koz at

4.08 g/t. The gold price used to estimate year-end Mineral

Resources is unchanged at $1,550 per ounce.

On a gold equivalent basis, Measured and

Indicated Mineral Resources are estimated at 2,507 koz at an

average gold equivalent grade of 3.66 g/t. Inferred Mineral

Resources (gold equivalent basis) are estimated at 268 koz at an

average grade of 3.80 g/t. Gold equivalent estimates for ounces and

grade account for the underlying metal prices and metallurgical

recoveries used to estimate Mineral Resources (Table 3).

QUALITY ASSURANCE/QUALITY

CONTROLTorex maintains an industry-standard analytical

quality assurance/quality control (QA/QC) and data verification

program to monitor laboratory performance and to ensure high

quality assay results. Results from this program confirm

reliability of the assay results. All sampling is conducted by

Torex Gold with analytical work for exploration programs at El

Limón Guajes performed by SGS de Mexico S.A. de C.V. (“SGS”) in

Durango, and by SGS in Nuevo Balsas, Mexico (each lab is

independent of the Company). Gold analyses comprise fire assays

with atomic absorption or gravimetric finish. External check assays

for QA/QC purposes are performed by ALS Chemex de Mexico S.A. de

C.V. (independent of the Company). The analytical QA/QC program at

El Limón Guajes is currently overseen by Carlo Nasi, Chief Mine

Geologist for Minera Media Luna, S.A. de C.V.

QUALIFIED PERSONS John Makin,

MAIG, is the qualified person under NI 43-101, and he has reviewed

and approved the scientific and technical information pertaining to

Mineral Resources in this news release. Mr. Makin is a member of

the Australian Institute of Geoscientists (MAIG #7313), has

experience relevant to the style of mineralization under

consideration. Mr. Makin is a Consultant Geologist employed by SLR

Consulting (Canada) Ltd and is independent of Torex. Mr. Makin has

verified the data disclosed, including sampling, analytical, and

test data underlying the drill results, and he consents to the

inclusion in this release of said data in the form and context in

which they appear.

The scientific and technical data contained in

this news release pertaining to Mineral Reserves have been reviewed

and approved by Johannes (Gertjan) Bekkers P.Eng. the Director of

Mine Technical Services for Torex Gold, who is a qualified person

as defined by NI 43-101. Mr. Bekkers is a registered member of the

Professional Engineers of Ontario, has worked the majority of his

career in open pit and underground hard rock mining in Canada and

overseas in progressively senior engineering roles with relevant

experience in mine design and planning, mining economic viability

assessments, and mining studies.

Additional information on ELG, including but not

limited to, sampling and analyses, analytical labs, and methods

used for data verification is available in the Company’s most

recent annual information form and the technical report entitled

“Morelos Property, NI 43-101 Technical Report, ELG Mine Complex,

Life of Mine Plan and Media Luna Preliminary Economic Assessment,

Guerrero State, Mexico ” with an effective date of March 31, 2018

(filing date September 4, 2018) (the “Technical Report”) filed on

SEDAR at www.sedar.com and the Company’s website at

www.torexgold.com.

ABOUT TOREX GOLD RESOURCES

INC.Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development, and operation of

its 100% owned Morelos Gold Property, an area of 29,000 hectares in

the highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal assets are the El

Limón Guajes mining complex (“ELG” or the “ELG Mine Complex”),

comprising the El Limón, Guajes and El Limón Sur open pits, the El

Limón Guajes underground mine including zones referred to as

Sub-Sill and ELD, and the processing plant and related

infrastructure, which commenced commercial production as of April

1, 2016, and the Media Luna deposit, which is an advanced stage

development project, and for which the Company issued the updated

PEA in September 2018 (see the 2018 Technical Report). The property

remains 75% unexplored.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

TOREX GOLD RESOURCES INC.Jody

Kuzenko

President and CEO Direct: (647)

725-9982

jody.kuzenko@torexgold.com

Dan RollinsVice President, Corporate

Development & Investor RelationsDirect: (647)

260-1503 dan.rollins@torexgold.com

CAUTIONARY NOTES

Forward Looking Information This press

release contains "forward-looking statements" and "forward-looking

information" within the meaning of applicable Canadian securities

legislation. While the Company intends to advance the Media Luna

project to production in the first quarter of 2024 and continues

with the early works program to maintain the schedule to first

production, the Company has not taken a production decision in

advance of completing the Feasibility Study for Media Luna.

Forward-looking information also includes, but is not limited to,

statements that: the Company’s focus on delivering a smooth

transition between ELG and Media Luna was supported by the drilling

efforts in 2021; the Company has budgeted $6 million towards

step-out and infill drilling within the ELG Underground in 2022,

with a target of drilling 28,000 metres; and step-out drilling is

expected to ramp up during the second half of the year with the

completion of Portal #3, which will allow the Company to establish

drill platforms from which to test vertical extensions and expand

the overall resource potential of the ELG Underground. Generally,

forward-looking information can be identified by the use of

forward-looking terminology such as “implied”, “focus”, “budget” or

variations of such words and phrases or statements that certain

actions, events or results “will, or “is expected to" occur.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including, without limitation, risks

and uncertainties associated with: the ability to upgrade mineral

resources to mineral reserves; risks associated with mineral

reserve and mineral resource estimation; uncertainty involving

skarns deposits; the ability of the Company to obtain permits for

the Media Luna Project; the ability of the Company to conclude a

feasibility study of the Media Luna Project that demonstrates

within a reasonable confidence that the Media Luna Project can be

successfully constructed and operated in an economically viable

manner; the ability of the Company to fully fund the Media Luna

Project to production; the ability of the Company’s mining and

exploration operations to operate as intended due to shortage of

skilled employees or shortages in supply chains; government or

regulatory actions or inactions; and those risk factors identified

in the Technical Report and the Company’s annual information form

and management’s discussion and analysis or other unknown but

potentially significant impacts. Notwithstanding the Company's

efforts, there can be no guarantee that the Company’s measures to

protect employees and surrounding communities from COVID-19 will be

effective. Forward-looking information is based on the assumptions

discussed in the Technical Report and such other reasonable

assumptions, estimates, analysis and opinions of management made in

light of its experience and perception of trends, current

conditions and expected developments, and other factors that

management believes are relevant and reasonable in the

circumstances at the date such statements are made. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information, there may be other factors that

cause results not to be as anticipated. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, whether as a

result of new information or future events or otherwise, except as

may be required by applicable securities laws.

TABLE 2: MINERAL RESERVE ESTIMATE – ELG MINING COMPLEX

(DECEMBER 31, 2021)

|

As of December 31, 2021 |

Tonnes |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

AuEq |

AuEq |

|

|

(kt) |

(g/t) |

(g/t) |

(%) |

(koz) |

(koz) |

(Mlb) |

(koz) |

(g/t) |

|

Reserves - Open Pit & Stockpiles |

|

|

|

|

|

|

|

|

|

El Limón (including El Limón Sur) |

|

|

|

|

|

|

|

|

|

Proven |

3,314 |

3.84 |

5.1 |

0.14 |

410 |

539 |

10 |

414 |

3.89 |

|

Probable |

4,097 |

2.33 |

4.8 |

0.13 |

307 |

639 |

12 |

312 |

2.37 |

|

Proven & Probable |

7,411 |

3.01 |

4.9 |

0.14 |

716 |

1,178 |

22 |

727 |

3.05 |

|

Guajes |

|

|

|

|

|

|

|

|

|

|

Proven |

1,429 |

4.53 |

3.7 |

0.14 |

208 |

168 |

4 |

210 |

4.57 |

|

Probable |

859 |

3.27 |

2.8 |

0.09 |

90 |

78 |

2 |

91 |

3.29 |

|

Proven & Probable |

2,287 |

4.06 |

3.3 |

0.12 |

298 |

246 |

6 |

301 |

4.09 |

|

Mined Stockpiles |

|

|

|

|

|

|

|

|

|

|

Proven |

4,808 |

1.35 |

3.1 |

0.07 |

209 |

484 |

7 |

213 |

1.38 |

|

Probable |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Proven & Probable |

4,808 |

1.35 |

3.1 |

0.07 |

209 |

484 |

7 |

213 |

1.38 |

|

El Limón Guajes Low Grade |

|

|

|

|

|

|

|

|

|

|

Proven |

158 |

1.02 |

2.3 |

0.07 |

5 |

12 |

0 |

5 |

1.04 |

|

Probable |

515 |

1.02 |

4.0 |

0.11 |

17 |

67 |

1 |

17 |

1.06 |

|

Proven & Probable |

672 |

1.02 |

3.6 |

0.10 |

22 |

79 |

1 |

23 |

1.05 |

|

Total Open Pit & Stockpiles |

|

|

|

|

|

|

|

|

|

|

Proven |

9,708 |

2.67 |

3.9 |

0.10 |

832 |

1,203 |

22 |

843 |

2.70 |

|

Probable |

5,471 |

2.35 |

4.5 |

0.12 |

414 |

784 |

15 |

421 |

2.39 |

|

Proven & Probable |

15,179 |

2.55 |

4.1 |

0.11 |

1,246 |

1,987 |

37 |

1,263 |

2.59 |

|

Reserves - Underground |

|

|

|

|

|

|

|

|

|

|

Sub-Sill |

|

|

|

|

|

|

|

|

|

|

Proven |

110 |

7.23 |

10.5 |

0.59 |

25 |

37 |

1 |

26 |

7.38 |

|

Probable |

1,214 |

5.55 |

4.8 |

0.21 |

217 |

187 |

6 |

219 |

5.61 |

|

Proven & Probable |

1,324 |

5.69 |

5.3 |

0.24 |

242 |

224 |

7 |

245 |

5.76 |

|

ELD |

|

|

|

|

|

|

|

|

|

|

Proven |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Probable |

1,351 |

5.80 |

6.6 |

0.23 |

252 |

287 |

7 |

255 |

5.87 |

|

Proven & Probable |

1,351 |

5.80 |

6.6 |

0.23 |

252 |

287 |

7 |

255 |

5.87 |

|

Total Underground |

|

|

|

|

|

|

|

|

|

|

Proven |

110 |

7.23 |

10.5 |

0.59 |

25 |

37 |

1 |

26 |

7.38 |

|

Probable |

2,566 |

5.68 |

5.7 |

0.22 |

469 |

474 |

13 |

474 |

5.74 |

|

Proven & Probable |

2,675 |

5.74 |

5.9 |

0.24 |

494 |

511 |

14 |

500 |

5.81 |

|

Reserves - Open Pit, Stockpiles &

Underground |

|

|

|

|

|

|

|

|

El Limón Guajes Complex |

|

|

|

|

|

|

|

|

|

|

Proven |

9,817 |

2.72 |

3.9 |

0.11 |

858 |

1,240 |

23 |

869 |

2.75 |

|

Probable |

8,037 |

3.41 |

4.9 |

0.16 |

882 |

1,258 |

27 |

895 |

3.46 |

|

Proven & Probable |

17,854 |

3.03 |

4.4 |

0.13 |

1,740 |

2,498 |

51 |

1,763 |

3.07 |

Notes to accompany the Summary Mineral Reserve

Table:

- Mineral Reserves are founded on

Measured and Indicated Mineral Resources and Stockpiled Ore, with

an effective date of December 31, 2021, for ELG Open Pits

(including El Limón, El Limón Sur and Guajes deposits) and ELG

Underground (including Sub-Sill and ELD deposits).

- Mineral Reserves were developed in

accordance with CIM guidelines.

- Cut-off grades, designed pits and

mining shapes are considered appropriate for a metal price of

$1,400/oz Au and metal recovery of 89% Au.

- Mineral Reserves are based on open

pit mining within designed pits and underground cut and fill mining

where appropriate and include estimates of dilution and mining

losses.

- Mineral Reserves are reported using

a gold price of US$1,400/oz, silver price of US$17/oz, and copper

price of US$3.25/lb

- Average metallurgical recoveries of

89% for gold and 30% for silver and 10% for copper

- ELG AuEq = Au (g/t) + Ag (g/t) *

(0.0041) + Cu (%) * (0.1789) and accounts for metal prices and

metallurgical recoveries.

- Numbers may not add due to

rounding.

- The qualified person for the

Mineral Reserve estimate is Johannes (Gertjan) Bekkers P.Eng. the

Director of Mine Technical Services for the Company

Notes to accompany the ELG Open Pit Mineral Reserves:

- El Limón and Guajes Open Pit

Mineral Reserves are reported above a diluted cut-off grade of 1.1

g/t Au.

- El Limón Guajes Low Grade Mineral

Reserves are reported above a diluted cut-off grade of 1.0 g/t

Au.

- Mineral Reserves within the

designed pits include assumed estimates for dilution and ore

losses.

Notes to accompany ELG Underground Mineral Reserves:

- El Limón Underground Mineral

Reserves are reported above an in-situ ore cut-off grade of 3.58

g/t Au and an in-situ incremental cut-off grade of 1.04 g/t Au

- Mineral Reserves within designed

mine shapes assume mechanized cut and fill mining method and

include estimates for dilution and mining losses.

TABLE 3: MINERAL RESOURCE ESTIMATE – ELG MINING COMPLEX

(DECEMBER 31, 2021)

|

As of December 31, 2021 |

Tonnes |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

AuEq |

AuEq |

|

|

(kt) |

(g/t) |

(g/t) |

(%) |

(koz) |

(koz) |

(Mlb) |

(koz) |

(g/t) |

|

Resources - Open Pit |

|

|

|

|

|

|

|

|

|

|

El Limón (including El Limón Sur) |

|

|

|

|

|

|

|

|

|

Measured |

4,053 |

3.66 |

5.6 |

0.14 |

477 |

727 |

13 |

483 |

3.71 |

|

Indicated |

7,701 |

2.22 |

5.6 |

0.13 |

550 |

1,393 |

22 |

561 |

2.27 |

|

Measured & Indicated |

11,754 |

2.72 |

5.6 |

0.13 |

1,027 |

2,120 |

34 |

1,044 |

2.76 |

|

Inferred |

735 |

1.79 |

3.5 |

0.08 |

42 |

83 |

1 |

43 |

1.82 |

|

Guajes |

|

|

|

|

|

|

|

|

|

|

Measured |

1,674 |

4.44 |

3.6 |

0.12 |

239 |

192 |

4 |

241 |

4.47 |

|

Indicated |

3,326 |

2.73 |

2.5 |

0.08 |

292 |

267 |

6 |

295 |

2.76 |

|

Measured & Indicated |

5,000 |

3.30 |

2.9 |

0.09 |

531 |

459 |

10 |

535 |

3.33 |

|

Inferred |

77 |

1.88 |

3.0 |

0.03 |

5 |

7 |

0 |

5 |

1.90 |

|

Total Open Pit |

|

|

|

|

|

|

|

|

|

|

Measured |

5,727 |

3.89 |

5.0 |

0.13 |

716 |

919 |

17 |

724 |

3.93 |

|

Indicated |

11,027 |

2.37 |

4.7 |

0.12 |

842 |

1,660 |

28 |

856 |

2.41 |

|

Measured & Indicated |

16,754 |

2.89 |

4.8 |

0.12 |

1,557 |

2,579 |

45 |

1,580 |

2.93 |

|

Inferred |

812 |

1.80 |

3.5 |

0.08 |

47 |

90 |

1 |

48 |

1.83 |

|

Resources - Underground |

|

|

|

|

|

|

|

|

|

|

Sub-Sill |

|

|

|

|

|

|

|

|

|

|

Measured |

584 |

7.24 |

10.0 |

0.52 |

136 |

187 |

7 |

138 |

7.37 |

|

Indicated |

2,042 |

6.21 |

6.4 |

0.29 |

408 |

422 |

13 |

413 |

6.29 |

|

Measured & Indicated |

2,626 |

6.44 |

7.2 |

0.34 |

544 |

610 |

20 |

551 |

6.53 |

|

Inferred |

1,125 |

4.92 |

6.3 |

0.25 |

178 |

228 |

6 |

180 |

4.99 |

|

ELD |

|

|

|

|

|

|

|

|

|

|

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Indicated |

1,926 |

5.99 |

7.7 |

0.25 |

371 |

478 |

11 |

376 |

6.07 |

|

Measured & Indicated |

1,926 |

5.99 |

7.7 |

0.25 |

371 |

478 |

11 |

376 |

6.07 |

|

Inferred |

256 |

4.74 |

5.6 |

0.22 |

39 |

46 |

1 |

39 |

4.80 |

|

Total Underground |

|

|

|

|

|

|

|

|

|

|

Measured |

584 |

7.24 |

10.0 |

0.52 |

136 |

187 |

7 |

138 |

7.37 |

|

Indicated |

3,968 |

6.11 |

7.1 |

0.27 |

779 |

900 |

23 |

789 |

6.18 |

|

Measured & Indicated |

4,551 |

6.25 |

7.4 |

0.30 |

915 |

1,088 |

30 |

927 |

6.34 |

|

Inferred |

1,380 |

4.88 |

6.2 |

0.25 |

217 |

275 |

8 |

220 |

4.95 |

|

Resources - Open Pit & Underground |

|

|

|

|

|

|

|

|

|

El Limón Guajes Complex |

|

|

|

|

|

|

|

|

|

|

Measured |

6,311 |

4.20 |

5.5 |

0.17 |

852 |

1,106 |

24 |

862 |

4.25 |

|

Indicated |

14,995 |

3.36 |

5.3 |

0.16 |

1,620 |

2,560 |

51 |

1,645 |

3.41 |

|

Measured & Indicated |

21,305 |

3.61 |

5.4 |

0.16 |

2,472 |

3,667 |

75 |

2,507 |

3.66 |

|

Inferred |

2,193 |

3.74 |

5.2 |

0.18 |

264 |

365 |

9 |

268 |

3.80 |

Notes to accompany the Summary Mineral Resource Table:

- CIM (2014) definitions were

followed for Mineral Resources.

- Mineral Resources are depleted

above a mining surface or to the as-mined solids as of December 31,

2021.

- Mineral Resources are reported

using a gold price of US$1,550/oz, silver price of US$20/oz, and

copper price of US$3.50/lb.

- Average metallurgical recoveries

are 89% for gold, 30% for silver and 10% for copper.

- AuEq = Au (g/t) + (Ag (g/t) *

0.0043) + (Cu (%) * 0.1740) and accounts for metal prices and

metallurgical recoveries.

- Mineral Resources are inclusive of

Mineral Reserves.

- Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability.

- Numbers may not add due to

rounding.

- The estimate was prepared by Mr.

John Makin, MAIG, a consultant with SLR Consulting (Canada) Ltd.

Mr. Makin is independent of the company and is a “Qualified Person”

under NI 43-101.

Notes to accompany the ELG Open Pit Mineral Resources:

- Mineral Resources are reported

above a cut-off grade of 0.9 g/t Au.

- Mineral

Resources are reported inside an optimized pit shell, underground

mineral reserves at ELD within the El Limón shell have been

excluded from the open pit Mineral Resources.

Notes to accompany ELG Underground Mineral Resources:

- Mineral Resources are reported above a cut-off grade of 2.6 g/t

Au.

- The assumed mining method is underground cut and fill.

- Mineral Resources from ELD that are contained within the El

Limón pit optimization and that are not underground Mineral

Reserves have been excluded from the underground Mineral

Resources.

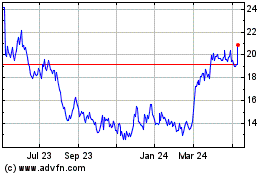

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Nov 2024 to Dec 2024

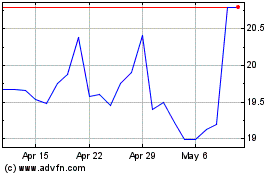

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Dec 2023 to Dec 2024