Net Sales Nearly Flat while Income Before Income Taxes Improves

26.9% or 5.2% on an Underlying Basis in Constant Currency

Returns $353 Million to Shareholders Through Dividend and Share

Repurchases

Reaffirms 2024 Full Year Guidance for Top-Line and Bottom-Line

Growth

Molson Coors Beverage Company ("MCBC," "Molson Coors" or "the

Company") (NYSE: TAP, TAP.A; TSX: TPX.A, TPX.B) today reported

results for the 2024 second quarter.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240806604516/en/

2024 SECOND QUARTER FINANCIAL HIGHLIGHTS1

- Net sales decreased 0.4% reported and 0.1% in constant

currency.

- U.S. GAAP income before income taxes of $559.9 million

increased 26.9% reported.

- Underlying (Non-GAAP) income before income taxes of $531.2

million improved 5.2% in constant currency.

- U.S. GAAP net income attributable to MCBC of $427.0 million,

$2.03 per share on a diluted basis. Underlying (Non-GAAP) diluted

earnings per share of $1.92 per share increased 7.9%.

CEO AND CFO PERSPECTIVES

Molson Coors had strong results this quarter which played out

largely as we expected. In the second quarter of 2024, we

essentially held the top line and grew the bottom line 5.2% while

cycling the strongest second quarter of U.S. GAAP reported net

sales since the 2005 Molson and Coors merger. For the six months

ended June 30, 2024, net sales increased 4.2% on a constant

currency basis, while underlying income before income taxes

increased 20.4% on a constant currency basis.

Our performance in the first half of the year was largely driven

by favorable price and favorable U.S. shipment timing offset by

lower contract brewing volumes. To ensure we met supply needs

during the peak summer season, we deliberately increased our U.S.

distributor inventories ahead of and during the strike at our Fort

Worth brewery which ran 14 weeks from February to May. This dynamic

does not impact our expectations for the full year but does

significantly impact the timing of our results over the course of

the year, which is why we are maintaining our guidance for the full

year 2024. Additionally, our America's financial volume was

impacted by the exit of over 900,000 hectoliters related to the

wind down of a major contract brewing arrangement which terminates

at the end of the year.

We continue to make progress against our strategic priorities

and execute against our Acceleration Plan initiatives. According to

Circana, in the U.S., Coors Light, Miller Lite and Coors Banquet

second quarter combined volume share is down a half share point of

industry versus a year ago when we saw our peak share gains.

However, these brands remain up 2 full share points compared to the

second quarter of 2022. This means that we retained approximately

80% of our peak share gains on our core power brands in the U.S. In

EMEA&APAC, strong core power brand results were supported by

Ožujsko which continues to gain value share in Croatia, and the

launch of a new brand in Romania, Caraiman, which has delivered

about 150,000 hectoliters already.

Progress against our premiumization strategy is at different

stages across our markets as we have had strong success in

EMEA&APAC, Canada and Latin America with focused plans in the

U.S. to drive improvement.

With strong cash flow, we continued to invest in our business,

supporting our brands globally and continuing to build capabilities

that help drive long-term, sustainable and profitable growth. We

did this while returning $564 million in cash to shareholders in

the first half of the year through both our dividends and share

repurchase program, which accelerated during the second

quarter.

______________________ 1 See Appendix for definitions and

reconciliations of non-GAAP financial measures including constant

currency.

Gavin Hattersley, President and Chief Executive Officer

Statement:

"We are confident in our strategy, the trajectory of our total

business, and in our short and long-term growth objectives. We've

just delivered another quarter of bottom-line growth and strong

cash flow, and the highly cash-generative nature of our business

has enabled us to continue investing in our brands and our

capabilities to support our progress against our strategic

initiatives. We are a much different company today than we were

four years ago and we are certainly stronger than we were just 16

months ago."

Tracey Joubert, Chief Financial Officer Statement:

"Given our strong performance for the first half of the year, we

are reaffirming our full year 2024 guidance which would mean top

and bottom-line growth for the third straight year. And while this

guidance implies challenging second half trends related to U.S.

shipment timing, we remain confident in our growth algorithm which

has multiple levers. From our robust revenue management platform,

to our premiumization and innovation plans, to our continued

investments to drive efficiencies and cost savings, these levers

help us to navigate various market circumstances."

CONSOLIDATED PERFORMANCE - SECOND QUARTER 2024

For the Three Months

Ended

($ in millions, except per share data)

(Unaudited)

June 30, 2024

June 30, 2023

Reported Increase

(Decrease)

Foreign Exchange

Impact

Constant Currency Increase

(Decrease)(1)

Net sales

$

3,252.3

$

3,266.6

(0.4

)%

$

(12.2

)

(0.1

)%

U.S. GAAP income (loss) before income

taxes

$

559.9

$

441.1

26.9

%

$

2.6

26.3

%

Underlying income (loss) before income

taxes(1)

$

531.2

$

502.2

5.8

%

$

2.7

5.2

%

U.S. GAAP net income (loss)(2)

$

427.0

$

342.4

24.7

%

Per diluted share

$

2.03

$

1.57

29.3

%

Underlying net income (loss)(1)

$

404.2

$

387.2

4.4

%

Per diluted share

$

1.92

$

1.78

7.9

%

Financial volume(3)

22.430

23.385

(4.1

)%

Brand volume(3)

21.715

22.822

(4.9

)%

For the Six Months

Ended

($ in millions, except per share data)

(Unaudited)

June 30, 2024

June 30, 2023

Reported Increase

(Decrease)

Foreign Exchange

Impact

Constant Currency Increase

(Decrease)(1)

Net sales

$

5,848.7

$

5,612.9

4.2

%

$

0.4

4.2

%

U.S. GAAP income (loss) before income

taxes

$

825.3

$

543.0

52.0

%

$

(5.0

)

52.9

%

Underlying income (loss) before income

taxes(1)

$

790.0

$

660.0

19.7

%

$

(4.8

)

20.4

%

U.S. GAAP net income (loss)(2)

$

634.8

$

414.9

53.0

%

Per diluted share

$

2.99

$

1.91

56.5

%

Underlying net income (loss)(1)

$

607.0

$

503.5

20.6

%

Per diluted share

$

2.86

$

2.31

23.8

%

Financial volume(3)

40.404

40.391

—

%

Brand volume(3)

38.614

39.003

(1.0

)%

(1)

Represents income (loss) before income taxes and net income (loss)

attributable to MCBC adjusted for non-GAAP items. See Appendix for

definitions and reconciliations of non-GAAP financial measures

including constant currency.

(2)

Net income (loss) attributable to

MCBC.

(3)

See Worldwide and Segmented Brand and

Financial Volume in the Appendix for definitions of financial

volume and brand volume as well as the reconciliation from

financial volume to brand volume.

QUARTERLY CONSOLIDATED HIGHLIGHTS (VERSUS SECOND QUARTER 2023

RESULTS)

- Net sales: The following table highlights the drivers of

the change in net sales for the three months ended June 30, 2024

compared to June 30, 2023 (in percentages):

Net Sales Drivers

(unaudited)

Financial volume

(4.1

%)

Price and sales mix

4.0

%

Currency

(0.3

%)

Total consolidated net sales

(0.4

%)

Net sales decreased 0.4%, driven by lower

financial volumes and unfavorable foreign currency impacts,

partially offset by favorable price and sales mix. Net sales

decreased 0.1% in constant currency.

Financial volumes decreased 4.1%, primarily

due to lower contract brewing volumes in the Americas segment.

Brand volumes decreased 4.9%, including a 7.3% decrease in the

Americas, which was partially offset by a 2.0% increase in

EMEA&APAC.

Price and sales mix favorably impacted net

sales by 4.0%, primarily due to increased net pricing as well as

favorable sales mix for both segments, including as a result of

lower contract brewing volumes in the U.S.

- Cost of goods sold ("COGS"): decreased 6.1% on a

reported basis, primarily due to lower financial volumes, lower

cost of goods sold per hectoliter and favorable foreign currency

impacts. COGS per hectoliter: improved 2.1% on a reported

basis, including favorable foreign currency impacts of 0.4%,

primarily due to the favorable changes in our unrealized

mark-to-market derivative positions of $91.5 million and cost

savings initiatives, partially offset by cost inflation related to

materials and manufacturing expenses, volume deleverage and

unfavorable mix driven by lower contract brewing volumes in the

Americas segment. Underlying COGS per hectoliter: increased

2.9% in constant currency, primarily due to cost inflation related

to materials and manufacturing expenses, volume deleverage and

unfavorable mix driven by lower contract brewing volumes in the

Americas segment, partially offset by cost savings

initiatives.

- Marketing, general & administrative ("MG&A"):

decreased 0.9% on a reported basis, primarily due to lower

incentive compensation expense and favorable foreign currency

impacts, partially offset by increased marketing investment to

support our brands and innovations. Underlying MG&A:

decreased 0.4% in constant currency.

- U.S. GAAP income (loss) before income taxes: U.S. GAAP

income before income taxes improved 26.9% on a reported basis,

primarily due to favorable changes to our unrealized mark-to-market

derivative positions, increased net pricing, favorable sales mix

and cost savings initiatives, partially offset by lower financial

volumes and cost inflation related to materials and manufacturing

expenses.

- Underlying income (loss) before income taxes: Underlying

income before income taxes improved 5.2% in constant currency,

primarily due to increased net pricing, favorable sales mix and

cost savings initiatives, partially offset by lower financial

volumes and cost inflation related to materials and manufacturing

expenses.

(Unaudited)

For the Three Months

Ended

June 30, 2024

June 30, 2023

U.S. GAAP and Non-GAAP Underlying

effective tax rate

24

%

22

%

The increase in our second quarter U.S.

GAAP effective tax rate and Underlying effective tax

rate was primarily due to the recognition of tax expense items

in the three months ended June 30, 2024, which in the aggregate

were immaterial, compared to the recognition of tax benefit items

in the prior year, which in the aggregate were also immaterial.

QUARTERLY SEGMENT HIGHLIGHTS (VERSUS SECOND QUARTER 2023

RESULTS)

Americas Segment Overview

The following table highlights the Americas segment results for

the three and six months ended June 30, 2024 compared to June 30,

2023.

For the Three Months

Ended

($ in millions, except per share data)

(Unaudited)

June 30, 2024

June 30, 2023

Reported % Change

FX Impact

Constant Currency % Change

(2)

Net sales(1)

$

2,575.9

$

2,621.7

(1.7

)

$

(6.9

)

(1.5

)

Income (loss) before income taxes(1)

$

487.1

$

487.3

—

$

(1.1

)

0.2

Underlying income (loss) before income

taxes(1)(2)

$

487.4

$

487.6

—

$

(1.1

)

0.2

For the Six Months

Ended

($ in millions, except per share data)

(Unaudited)

June 30, 2024

June 30, 2023

Reported % Change

FX Impact

Constant Currency % Change

(2)

Net sales(1)

$

4,721.3

$

4,560.7

3.5

$

(6.1

)

3.7

Income (loss) before income taxes(1)

$

807.7

$

720.7

12.1

$

(2.4

)

12.4

Underlying income (loss) before income

taxes(1)(2)

$

808.5

$

721.5

12.1

$

(2.4

)

12.4

The reported percent change and the constant currency percent

change in the above table are presented as (unfavorable)

favorable.

(1)

Includes gross inter-segment volumes,

sales and purchases, which are eliminated in the consolidated

totals.

(2)

Represents income (loss) before income

taxes adjusted for non-GAAP items. See Appendix for definitions and

reconciliations of non-GAAP financial measures including constant

currency.

Americas Segment Highlights (Versus Second Quarter 2023

Results)

- Net sales: The following table highlights the drivers of

the change in net sales for the three months ended June 30, 2024

compared to June 30, 2023 (in percentages):

Net Sales Drivers

(unaudited)

Financial volume

(5.6

%)

Price and sales mix

4.1

%

Currency

(0.2

%)

Total Americas net sales

(1.7

%)

Net sales decreased 1.7% driven by lower

financial volumes and unfavorable foreign currency impacts,

partially offset by favorable price and sales mix.

Financial volumes decreased 5.6%, primarily

due to lower contract brewing volumes in the U.S. related to the

wind down of a contract brewing arrangement leading up to the

termination by the end of 2024 and a decrease in U.S. brand

volumes, partially offset by favorable U.S. shipment timing.

Americas brand volumes decreased 7.3%, including a 7.8% decrease in

the U.S., primarily due to cycling double digit growth in our core

power brands, lower above premium volumes versus prior year and

unfavorable holiday load in timing.

Price and sales mix favorably impacted net

sales by 4.1%, primarily due to increased net pricing and favorable

sales mix as a result of lower contract brewing volumes in the

U.S.

- U.S. GAAP and Underlying income (loss) before income

taxes: U.S. GAAP income before income taxes was flat on a

reported basis and underlying income before income taxes improved

0.2% in constant currency, primarily due to increased net pricing,

favorable sales mix, lower MG&A and cost savings initiatives,

partially offset by lower financial volumes and cost inflation

related to materials and manufacturing expenses. Lower MG&A

spend was primarily due to lower incentive compensation expense,

partially offset by increased marketing investment to support our

brands and innovations.

EMEA&APAC Segment Overview

The following table highlights the EMEA&APAC segment results

for the three and six months ended June 30, 2024 compared to June

30, 2023.

For the Three Months

Ended

($ in millions, except per share data)

(Unaudited)

June 30, 2024

June 30, 2023

Reported % Change

FX Impact

Constant Currency % Change

(2)

Net sales(1)

$

683.3

$

649.0

5.3

$

(5.3

)

6.1

Income (loss) before income taxes(1)

$

81.2

$

64.2

26.5

$

(1.9

)

29.4

Underlying income (loss) before income

taxes(1)(2)

$

81.0

$

64.2

26.2

$

(1.8

)

29.0

For the Six Months

Ended

($ in millions, except per share data)

(Unaudited)

June 30, 2024

June 30, 2023

Reported % Change

FX Impact

Constant Currency % Change

(2)

Net sales(1)

$

1,138.0

$

1,059.1

7.4

$

6.5

6.8

Income (loss) before income taxes(1)

$

70.2

$

38.8

80.9

$

(3.8

)

90.7

Underlying income (loss) before income

taxes(1)(2)

$

63.7

$

42.4

50.2

$

(3.5

)

58.5

The reported percent change and the constant currency percent

change in the above table are presented as (unfavorable)

favorable.

(1)

Includes gross inter-segment volumes,

sales and purchases, which are eliminated in the consolidated

totals.

(2)

Represents income (loss) before income

taxes adjusted for non-GAAP items. See Appendix for definitions and

reconciliations of non-GAAP financial measures including constant

currency.

EMEA&APAC Segment Highlights (Versus Second Quarter 2023

Results)

- Net sales: The following table highlights the drivers of

the change in net sales for the three months ended June 30, 2024

compared to June 30, 2023 (in percentages):

Net Sales Drivers

(unaudited)

Financial volume

0.3

%

Price and sales mix

5.8

%

Currency

(0.8

%)

Total EMEA&APAC net sales

5.3

%

Net sales increased 5.3%, driven by favorable

price and sales mix and higher financial volume, partially offset

by unfavorable foreign currency impacts. Net sales increased 6.1%

in constant currency.

Financial volumes increased 0.3% and brand

volumes increased 2.0%, primarily driven by Central and Eastern

Europe volume growth driven by the favorable performance of our

core power brands and above premium brands and the easing

inflationary pressures on the consumer, partially offset by lower

volumes in Western Europe due to soft market demand and high

promotional activity from the competition.

Price and sales mix favorably impacted net

sales by 5.8%, primarily due to increased net pricing and favorable

sales mix driven by premiumization.

- U.S. GAAP and Underlying income (loss) before income

taxes: U.S. GAAP income before income taxes improved 26.5% on a

reported basis and underlying income before income taxes improved

29.0% in constant currency, primarily due to increased net pricing,

favorable sales mix and cost savings initiatives, partially offset

by higher MG&A expense. Higher MG&A expense was primarily

due to increased marketing to support our brands and innovations as

well as cost inflation.

CASH FLOW AND LIQUIDITY HIGHLIGHTS

- U.S. GAAP cash from operations: Net cash provided by

operating activities was $894.6 million for the six months ended

June 30, 2024 which increased $0.2 million compared to the prior

year, primarily due to higher net income offset by lower non-cash

expense and the unfavorable changes in working capital. The

unfavorable changes in working capital were primarily driven by the

timing of cash receipts as well as higher payments for annual

incentive compensation.

- Underlying free cash flow: Cash generated of $505.0

million for the six months ended June 30, 2024 represents a

decrease in cash provided of $64.7 million from the prior year,

which was primarily due to higher capital expenditures driven by

the timing of capital projects.

- Debt: Total debt as of June 30, 2024 was $7,055.7

million and cash and cash equivalents totaled $1,647.3 million,

resulting in net debt of $5,408.4 million and a net debt to

underlying EBITDA ratio of 2.13x. As of June 30, 2023, our net debt

to underlying EBITDA ratio was 2.50x. Subsequent to June 30, 2024,

we repaid our EUR 800 million 1.25% notes upon their maturity on

July 15, 2024 using the proceeds from our EUR 800 million 3.8%

notes issued on May 29, 2024 and cash on hand.

- Dividends: We paid cash dividends of $188.4 million and

$178.2 million for the six months ended June 30, 2024 and June 30,

2023, respectively.

- Share Repurchase Program: We paid $375.3 million and

$26.7 million, including brokerage commissions, for share

repurchases during the six months ended June 30, 2024 and June 30,

2023, respectively. The current year share repurchases were made

under the share repurchase program approved on September 29, 2023

and the prior year share repurchases were made under the share

repurchase program approved on February 17, 2022.

2024 OUTLOOK

We continue to expect to achieve the following key financial

targets for full year 2024:

- Net Sales: low single-digit increase versus 2023 on a

constant currency basis.

- Underlying income (loss) before income taxes: mid

single-digit increase compared to 2023 on a constant currency

basis.

- Underlying diluted earnings per share: mid single-digit

increase compared to 2023.

- Capital expenditures: $750 million incurred, plus or

minus 5%.

- Underlying free cash flow: $1.2 billion, plus or minus

10%.

- Underlying depreciation and amortization: $700 million,

plus or minus 5%.

- Consolidated net interest expense: $210 million, plus or

minus 5%.

- Underlying effective tax rate: in the range of 23% to

25% for 2024.

These targets are based on the following key considerations:

- In the U.S., our sales to wholesalers were deliberately ahead

of sales to retailers by about 1.1 million hectoliters in the first

half of the year as compared to sales to wholesalers being behind

sales to retailers by about 0.4 million in the first half of 2023.

We expect this to reverse in the second half of the year, mostly in

the third quarter, as we currently plan to ship to consumption for

the full year.

- The wind down of a contract brewing agreement leading up to the

termination by the end of 2024 is expected to result in a reduction

in Americas' financial volume by approximately 1.0 million

hectoliters for the balance of the year.

- Underlying COGS per hectoliter are expected to be higher in

full year 2024 as compared to full year 2023. This is due to

expected continued, albeit moderating inflation, mix impacts from

the wind down of contract brewing volume and a lower volume

leverage impact as compared to full year 2023.

- MG&A expense is expected to be lower than 2023 in the

second half of the year.

On July 18, 2024, our Board of Directors declared a dividend of

$0.44 per share, payable September 20, 2024, to shareholders of

record on August 30, 2024. Shareholders of exchangeable shares will

receive the CAD equivalent of dividends declared on Class A and

Class B common stock, equal to CAD 0.60 per share.

NOTES

Unless otherwise indicated in this release, all $ amounts are in

U.S. Dollars, and all quarterly comparative results are for the

Company’s second quarter ended June 30, 2024 compared to the second

quarter ended June 30, 2023. Some numbers may not sum due to

rounding.

2024 SECOND QUARTER INVESTOR CONFERENCE CALL

Molson Coors Beverage Company will conduct an earnings

conference call with financial analysts and investors at 8:30 a.m.

Eastern Time today to discuss the Company’s 2024 second quarter

results. The live webcast will be accessible via our website,

ir.molsoncoors.com. An online replay of the webcast will be

available until 11:59 p.m. Eastern Time on November 6, 2024. The

Company will post this release and related financial statements on

its website today.

OVERVIEW OF MOLSON COORS BEVERAGE COMPANY

For more than two centuries, Molson Coors Beverage Company has

been brewing beverages that unite people to celebrate all life’s

moments. From our core power brands Coors Light, Miller Lite, Coors

Banquet, Molson Canadian, Carling and Ožujsko to our above premium

brands including Madri, Staropramen, Blue Moon Belgian White and

Leinenkugel’s Summer Shandy, to our economy and value brands like

Miller High Life and Keystone, we produce many beloved and iconic

beer brands. While our Company's history is rooted in beer, we

offer a modern portfolio that expands beyond the beer aisle as

well, including flavored beverages like Vizzy Hard Seltzer, spirits

like Five Trail whiskey as well as non-alcoholic beverages. As a

business, our ambition is to be the first choice for our people,

our consumers and our customers, and our success depends on our

ability to make our products available to meet a wide range of

consumer segments and occasions.

Our reporting segments include: Americas, operating in the U.S.,

Canada and various countries in the Caribbean, Latin and South

America; and EMEA&APAC, operating in Bulgaria, Croatia, Czech

Republic, Hungary, Montenegro, the Republic of Ireland, Romania,

Serbia, the U.K., various other European countries, and certain

countries within the Middle East, Africa and Asia Pacific. In

addition to our reporting segments, we also have certain activity

that is not allocated to our reporting segments and reported as

"Unallocated", which primarily includes financing-related costs

such as interest expense and income, foreign exchange gains and

losses on intercompany balances and realized and unrealized changes

in fair value on instruments not designated in hedging

relationships related to financing and other treasury-related

activities and the unrealized changes in fair value on our

commodity swaps not designated in hedging relationships recorded

within cost of goods sold, which are later reclassified when

realized to the segment in which the underlying exposure resides.

Additionally, only the service cost component of net periodic

pension and OPEB cost is reported within each operating segment,

and all other components remain in Unallocated.

Our Imprint strategy is focused on People & Planet

initiatives that support our commitment to raising industry

standards and leaving a positive imprint on our employees,

consumers, communities and the environment. To learn more about

Molson Coors Beverage Company, visit molsoncoors.com,

MolsonCoorsOurImprint.com or on X (formerly Twitter) through

@MolsonCoors.

ABOUT MOLSON COORS CANADA INC.

Molson Coors Canada Inc. ("MCCI") is a subsidiary of Molson

Coors Beverage Company. MCCI Class A and Class B exchangeable

shares offer substantially the same economic and voting rights as

the respective classes of common shares of MCBC, as described in

MCBC’s annual proxy statement and Form 10-K filings with the U.S.

Securities and Exchange Commission. The trustee holder of the

special Class A voting stock and the special Class B voting stock

has the right to cast a number of votes equal to the number of then

outstanding Class A exchangeable shares and Class B exchangeable

shares, respectively.

FORWARD-LOOKING STATEMENTS

This press release includes “forward-looking statements” within

the meaning of the U.S. federal securities laws. Generally, the

words "expects," "intend," "goals," "plans," "believes,"

"continues," "may," "anticipate," "seek," "estimate," "outlook,"

"trends," "future benefits," "potential," "projects," "strategies,"

"implies," and variations of such words and similar expressions are

intended to identify forward-looking statements. Statements that

refer to projections of our future financial performance, our

anticipated growth and trends in our businesses, and other

characterizations of future events or circumstances are

forward-looking statements, and include, but are not limited to,

statements under the headings "CEO and CFO Perspectives" and "2024

Outlook," with respect to, among others, expectations of cost

inflation, limited consumer disposable income, consumer

preferences, overall volume and market share trends, pricing

trends, industry forces, cost reduction strategies, shipment levels

and profitability, the sufficiency of capital resources,

anticipated results, expectations for funding future capital

expenditures and operations, effective tax rate, debt service

capabilities, timing and amounts of debt and leverage levels,

Preserving the Planet and related initiatives and expectations

regarding future dividends and share repurchases. In addition,

statements that we make in this press release that are not

statements of historical fact may also be forward-looking

statements.

Although the Company believes that the assumptions upon which

its forward-looking statements are based are reasonable, it can

give no assurance that these assumptions will prove to be correct.

Important factors that could cause actual results to differ

materially from the Company’s historical experience, and present

projections and expectations are disclosed in the Company’s filings

with the Securities and Exchange Commission (“SEC”), including the

risks discussed in our filings with the SEC, including our most

recent Annual Report on Form 10-K and our Quarterly Reports on Form

10-Q. All forward-looking statements in this press release are

expressly qualified by such cautionary statements and by reference

to the underlying assumptions. You should not place undue reliance

on forward-looking statements, which speak only as of the date they

are made. We do not undertake to update forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

MARKET AND INDUSTRY DATA

The market and industry data used, if any, in this press release

are based on independent industry publications, customer specific

data, trade or business organizations, reports by market research

firms and other published statistical information from third

parties, including Circana (formerly Information Resources, Inc.)

for U.S. market data and Beer Canada for Canadian market data

(collectively, the “Third Party Information”), as well as

information based on management’s good faith estimates, which we

derive from our review of internal information and independent

sources. Such Third Party Information generally states that the

information contained therein or provided by such sources has been

obtained from sources believed to be reliable.

APPENDIX

STATEMENTS OF OPERATIONS - MOLSON COORS

BEVERAGE COMPANY AND SUBSIDIARIES

Condensed Consolidated Statements of Operations

(In millions, except per share data)

(Unaudited)

For the Three Months

Ended

For the Six Months

Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Sales

$

3,838.1

$

3,871.1

$

6,887.4

$

6,645.9

Excise taxes

(585.8

)

(604.5

)

(1,038.7

)

(1,033.0

)

Net sales

3,252.3

3,266.6

5,848.7

5,612.9

Cost of goods sold

(1,922.4

)

(2,047.7

)

(3,555.3

)

(3,623.3

)

Gross profit

1,329.9

1,218.9

2,293.4

1,989.6

Marketing, general and administrative

expenses

(728.5

)

(734.9

)

(1,383.1

)

(1,349.9

)

Other operating income (expense), net

0.1

0.2

6.4

(0.3

)

Equity income (loss)

(1.9

)

4.3

(2.8

)

7.3

Operating income (loss)

599.6

488.5

913.9

646.7

Interest income (expense), net

(51.2

)

(54.6

)

(99.6

)

(113.7

)

Other pension and postretirement benefits

(costs), net

7.3

2.6

14.7

5.2

Other non-operating income (expense),

net

4.2

4.6

(3.7

)

4.8

Income (loss) before income taxes

559.9

441.1

825.3

543.0

Income tax benefit (expense)

(134.6

)

(95.0

)

(190.1

)

(123.7

)

Net income (loss)

425.3

346.1

635.2

419.3

Net (income) loss attributable to

noncontrolling interests

1.7

(3.7

)

(0.4

)

(4.4

)

Net income (loss) attributable to MCBC

$

427.0

$

342.4

$

634.8

$

414.9

Basic net income (loss) attributable to

MCBC per share

$

2.03

$

1.58

$

3.00

$

1.92

Diluted net income (loss) attributable to

MCBC per share

$

2.03

$

1.57

$

2.99

$

1.91

Weighted average shares outstanding -

basic

210.0

216.4

211.3

216.5

Weighted average shares outstanding -

diluted

210.8

217.8

212.5

217.6

Dividends per share

$

0.44

$

0.41

$

0.88

$

0.82

BALANCE SHEETS - MOLSON COORS BEVERAGE

COMPANY AND SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(In millions, except par value)

(Unaudited)

As of

June 30, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

1,647.3

$

868.9

Trade receivables, net

1,073.8

757.8

Other receivables, net

130.8

121.6

Inventories, net

848.5

802.3

Other current assets, net

337.3

297.9

Total current assets

4,037.7

2,848.5

Property, plant and equipment, net

4,473.0

4,444.5

Goodwill

5,321.9

5,325.3

Other intangibles, net

12,393.5

12,614.6

Other assets

1,168.1

1,142.2

Total assets

$

27,394.2

$

26,375.1

Liabilities and equity

Current liabilities

Accounts payable and other current

liabilities

$

3,342.1

$

3,180.8

Current portion of long-term debt and

short-term borrowings

894.2

911.8

Total current liabilities

4,236.3

4,092.6

Long-term debt

6,161.5

5,312.1

Pension and postretirement benefits

455.1

465.8

Deferred tax liabilities

2,760.4

2,697.2

Other liabilities

365.2

372.3

Total liabilities

13,978.5

12,940.0

Redeemable noncontrolling interest

26.7

27.9

Molson Coors Beverage Company

stockholders' equity

Capital stock

Preferred stock, $0.01 par value

(authorized: 25.0 shares; none issued)

—

—

Class A common stock, $0.01 par value

(authorized: 500.0 shares; issued and outstanding: 2.6 shares and

2.6 shares, respectively)

—

—

Class B common stock, $0.01 par value

(authorized: 500.0 shares; issued: 213.2 shares and 212.5 shares,

respectively)

2.1

2.1

Class A exchangeable shares, no par value

(issued and outstanding: 2.7 shares and 2.7 shares,

respectively)

100.8

100.8

Class B exchangeable shares, no par value

(issued and outstanding: 9.4 shares and 9.4 shares,

respectively)

352.3

352.3

Paid-in capital

7,119.4

7,108.4

Retained earnings

7,932.4

7,484.3

Accumulated other comprehensive income

(loss)

(1,217.3

)

(1,116.3

)

Class B common stock held in treasury at

cost (20.3 shares and 13.9 shares, respectively)

(1,110.1

)

(735.6

)

Total Molson Coors Beverage Company

stockholders' equity

13,179.6

13,196.0

Noncontrolling interests

209.4

211.2

Total equity

13,389.0

13,407.2

Total liabilities and equity

$

27,394.2

$

26,375.1

CASH FLOW STATEMENTS - MOLSON COORS

BEVERAGE COMPANY AND SUBSIDIARIES

Condensed Consolidated Statements of

Cash Flows

(In millions) (Unaudited)

For the Six Months

Ended

June 30, 2024

June 30, 2023

Cash flows from operating

activities

Net income (loss) including noncontrolling

interests

$

635.2

$

419.3

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities

Depreciation and amortization

336.7

339.9

Amortization of debt issuance costs and

discounts

2.7

2.9

Share-based compensation

24.2

20.3

(Gain) loss on sale or impairment of

property, plant, equipment and other assets, net

(6.4

)

(1.9

)

Unrealized (gain) loss on foreign currency

fluctuations and derivative instruments, net

(28.0

)

111.6

Equity (income) loss

2.8

(7.3

)

Income tax (benefit) expense

190.1

123.7

Income tax (paid) received

(105.2

)

(78.2

)

Interest expense, excluding amortization

of debt issuance costs and discounts

110.5

118.4

Interest paid

(102.5

)

(109.4

)

Change in current assets and liabilities

and other

(165.5

)

(44.9

)

Net cash provided by (used in) operating

activities

894.6

894.4

Cash flows from investing

activities

Additions to property, plant and

equipment

(392.2

)

(335.1

)

Proceeds from sales of property, plant,

equipment and other assets

10.3

5.5

Other

0.5

(11.0

)

Net cash provided by (used in) investing

activities

(381.4

)

(340.6

)

Cash flows from financing

activities

Dividends paid

(188.4

)

(178.2

)

Payments for purchases of treasury

stock

(375.3

)

(26.7

)

Payments on debt and borrowings

(3.4

)

(6.1

)

Proceeds on debt and borrowings

863.7

7.0

Other

(11.0

)

2.1

Net cash provided by (used in) financing

activities

285.6

(201.9

)

Effect of foreign exchange rate changes on

cash and cash equivalents

(20.4

)

9.0

Net increase (decrease) in cash and cash

equivalents

778.4

360.9

Balance at beginning of year

868.9

600.0

Balance at end of period

$

1,647.3

$

960.9

SUMMARIZED SEGMENT RESULTS (hectoliter volume and $ in

millions) (Unaudited)

Americas

Q2 2024

Q2 2023

Reported % Change

FX Impact

Constant Currency %

Change(3)

YTD 2024

YTD 2023

Reported % Change

FX Impact

Constant Currency %

Change(3)

Net sales(1)

$

2,575.9

$

2,621.7

(1.7

)

$

(6.9

)

(1.5

)

$

4,721.3

$

4,560.7

3.5

$

(6.1

)

3.7

COGS(1)(2)

$

(1,525.7

)

$

(1,556.8

)

2.0

$

4.6

1.7

$

(2,841.2

)

$

(2,780.5

)

(2.2

)

$

4.0

(2.3

)

MG&A

$

(560.7

)

$

(584.1

)

4.0

$

1.8

3.7

$

(1,067.4

)

$

(1,068.8

)

0.1

$

1.6

—

Income (loss) before income taxes

$

487.1

$

487.3

—

$

(1.1

)

0.2

$

807.7

$

720.7

12.1

$

(2.4

)

12.4

Underlying income (loss) before income

taxes(3)

$

487.4

$

487.6

—

$

(1.1

)

0.2

$

808.5

$

721.5

12.1

$

(2.4

)

12.4

Financial volume(1)(4)

16.396

17.368

(5.6

)

30.306

30.304

—

Brand volume

15.670

16.895

(7.3

)

28.561

29.141

(2.0

)

EMEA&APAC

Q2 2024

Q2 2023

Reported % Change

FX Impact

Constant Currency %

Change(3)

YTD 2024

YTD 2023

Reported % Change

FX Impact

Constant Currency %

Change(3)

Net sales(1)

$

683.3

$

649.0

5.3

$

(5.3

)

6.1

$

1,138.0

$

1,059.1

7.4

$

6.5

6.8

COGS(1)(2)

$

(431.9

)

$

(433.3

)

0.3

$

3.3

(0.4

)

$

(753.5

)

$

(737.3

)

(2.2

)

$

(4.7

)

(1.6

)

MG&A

$

(167.8

)

$

(150.8

)

(11.3

)

$

1.7

(12.4

)

$

(315.7

)

$

(281.1

)

(12.3

)

$

(1.9

)

(11.6

)

Income (loss) before income taxes

$

81.2

$

64.2

26.5

$

(1.9

)

29.4

$

70.2

$

38.8

80.9

$

(3.8

)

90.7

Underlying income (loss) before income

taxes(3)

$

81.0

$

64.2

26.2

$

(1.8

)

29.0

$

63.7

$

42.4

50.2

$

(3.5

)

58.5

Financial volume(1)(4)

6.037

6.018

0.3

10.101

10.089

0.1

Brand volume

6.045

5.927

2.0

10.053

9.862

1.9

Unallocated &

Eliminations

Q2 2024

Q2 2023

Reported % Change

FX Impact

Constant Currency %

Change(3)

YTD 2024

YTD 2023

Reported % Change

FX Impact

Constant Currency %

Change(3)

Net sales

$

(6.9

)

$

(4.1

)

(68.3

)

$

(10.6

)

$

(6.9

)

(53.6

)

COGS(2)

$

35.2

$

(57.6

)

N/M

$

39.4

$

(105.5

)

N/M

Income (loss) before income taxes

$

(8.4

)

$

(110.4

)

92.4

$

5.6

87.3

$

(52.6

)

$

(216.5

)

75.7

$

1.2

75.2

Underlying income (loss) before income

taxes(3)

$

(37.2

)

$

(49.6

)

25.0

$

5.6

13.7

$

(82.2

)

$

(103.9

)

20.9

$

1.1

19.8

Financial volume

(0.003

)

(0.001

)

N/M

(0.003

)

(0.002

)

N/M

Consolidated

Q2 2024

Q2 2023

Reported % Change

FX Impact

Constant Currency %

Change(3)

YTD 2024

YTD 2023

Reported % Change

FX Impact

Constant Currency %

Change(3)

Net sales

$

3,252.3

$

3,266.6

(0.4

)

$

(12.2

)

(0.1

)

$

5,848.7

$

5,612.9

4.2

$

0.4

4.2

COGS

$

(1,922.4

)

$

(2,047.7

)

6.1

$

7.9

5.7

$

(3,555.3

)

$

(3,623.3

)

1.9

$

(0.6

)

1.9

MG&A

$

(728.5

)

$

(734.9

)

0.9

$

3.5

0.4

$

(1,383.1

)

$

(1,349.9

)

(2.5

)

$

(0.3

)

(2.4

)

Income (loss) before income taxes

$

559.9

$

441.1

26.9

$

2.6

26.3

$

825.3

$

543.0

52.0

$

(5.0

)

52.9

Underlying income (loss) before income

taxes(3)

$

531.2

$

502.2

5.8

$

2.7

5.2

$

790.0

$

660.0

19.7

$

(4.8

)

20.4

Financial volume(4)

22.430

23.385

(4.1

)

40.404

40.391

—

Brand volume

21.715

22.822

(4.9

)

38.614

39.003

(1.0

)

N/M = Not meaningful

The reported percent change and the constant currency percent

change in the above table are presented as (unfavorable)

favorable.

(1)

Includes gross inter-segment volumes,

sales and purchases, which are eliminated in the consolidated

totals.

(2)

The unrealized changes in fair value on

our commodity swaps, which are economic hedges, are recorded as

COGS within Unallocated. As the exposure we are managing is

realized, we reclassify the gain or loss to the segment in which

the underlying exposure resides, allowing our segments to realize

the economic effects of the derivative without the resulting

unrealized mark-to-market volatility.

(3)

Represents income (loss) before taxes

adjusted for non-GAAP items. See the Non-GAAP Measures and

Reconciliations section for definitions and reconciliations of

non-GAAP financial measures including constant currency.

(4)

Financial volume in hectoliters for the

Americas and EMEA&APAC segments excludes royalty volume of

0.578 million hectoliters and 0.325 million hectoliters,

respectively, for the three months ended June 30, 2024, and

excludes royalty volume of 0.645 million hectoliters and 0.250

million hectoliters, respectively, for the three months ended June

30, 2023. Financial volume in hectoliters for the Americas and

EMEA&APAC segments excludes royalty volume of 1.169 million

hectoliters and 0.543 million hectoliters, respectively, for the

six months ended June 30, 2024, and excludes royalty volume of

1.263 million hectoliters and 0.406 million hectoliters

respectively, for the six months ended June 30, 2023.

WORLDWIDE AND SEGMENT BRAND AND FINANCIAL VOLUME (in millions of

hectoliters)(Unaudited)

For the Three Months

Ended

Americas

June 30, 2024

June 30, 2023

Change

Financial Volume

16.396

17.368

(5.6

)%

Contract brewing and wholesale/factored

volume

(0.930

)

(1.611

)

(42.3

)%

Royalty volume

0.578

0.645

(10.4

)%

Sales-To-Wholesaler to Sales-To-Retail

adjustment and other(1)

(0.374

)

0.493

N/M

Total Americas Brand Volume

15.670

16.895

(7.3

)%

EMEA&APAC

June 30, 2024

June 30, 2023

Change

Financial Volume

6.037

6.018

0.3

%

Contract brewing and wholesale/factored

volume

(0.317

)

(0.341

)

(7.0

)%

Royalty volume

0.325

0.250

30.0

%

Sales-To-Wholesaler to Sales-To-Retail

adjustment and other(1)

—

—

N/M

Total EMEA&APAC Brand

Volume

6.045

5.927

2.0

%

Consolidated

June 30, 2024

June 30, 2023

Change

Financial Volume

22.430

23.385

(4.1

)%

Contract brewing and wholesale/factored

volume

(1.247

)

(1.952

)

(36.1

)%

Royalty volume

0.903

0.895

0.9

%

Sales-To-Wholesaler to Sales-To-Retail

adjustment and other

(0.371

)

0.494

N/M

Total Worldwide Brand Volume

21.715

22.822

(4.9

)%

For the Six Months

Ended

Americas

June 30, 2024

June 30, 2023

Change

Financial Volume

30.306

30.304

—

%

Contract brewing and wholesale/factored

volume

(1.800

)

(2.813

)

(36.0

)%

Royalty volume

1.169

1.263

(7.4

)%

Sales-To-Wholesaler to Sales-To-Retail

adjustment and other(1)

(1.114

)

0.387

N/M

Total Americas Brand Volume

28.561

29.141

(2.0

)%

EMEA&APAC

June 30, 2024

June 30, 2023

Change

Financial Volume

10.101

10.089

0.1

%

Contract brewing and wholesale/factored

volume

(0.591

)

(0.632

)

(6.5

)%

Royalty volume

0.543

0.406

33.7

%

Sales-To-Wholesaler to Sales-To-Retail

adjustment and other(1)

—

(0.001

)

N/M

Total EMEA&APAC Brand

Volume

10.053

9.862

1.9

%

Consolidated

June 30, 2024

June 30, 2023

Change

Financial Volume

40.404

40.391

—

%

Contract brewing and wholesale/factored

volume

(2.391

)

(3.445

)

(30.6

)%

Royalty volume

1.712

1.669

2.6

%

Sales-To-Wholesaler to Sales-To-Retail

adjustment and other

(1.111

)

0.388

N/M

Total Worldwide Brand Volume

38.614

39.003

(1.0

)%

N/M = Not meaningful

(1)

Includes gross inter-segment volumes which

are eliminated in the consolidated totals.

Worldwide brand volume (or "brand volume" when discussed by

segment) reflects owned or actively managed brands sold to

unrelated external customers within our geographic markets (net of

returns and allowances), royalty volume and our proportionate share

of equity investment worldwide brand volume calculated consistently

with MCBC owned volume. Financial volume represents owned or

actively managed brands sold to unrelated external customers within

our geographical markets, net of returns and allowances as well as

contract brewing, wholesale non-owned brand volume and

company-owned distribution volume. Contract brewing and

wholesale/factored volume is included within financial volume, but

is removed from worldwide brand volume, as this is non-owned volume

for which we do not directly control performance. Factored volume

in our EMEA&APAC segment is the distribution of beer, wine,

spirits and other products owned and produced by other companies to

the on-premise channel, which is a common arrangement in the U.K.

Royalty volume consists of our brands produced and sold by third

parties under various license and contract brewing agreements and,

because this is owned volume, it is included in worldwide brand

volume. Our worldwide brand volume definition also includes an

adjustment from Sales-to-Wholesaler ("STW") volume to

Sales-to-Retailer ("STR") volume. We believe the brand volume

metric is important because, unlike financial volume and STWs, it

provides the closest indication of the performance of our brands in

relation to market and competitor sales trends.

We also utilize COGS per hectoliter, as well as the year over

year changes in this metric, as a key metric for analyzing our

results. This metric is calculated as COGS per our unaudited

condensed consolidated statements of operations divided by

financial volume for the respective period. We believe this metric

is important and useful for investors and management because it

provides an indication of the trends of sales mix and other cost

impacts on our COGS.

NON-GAAP MEASURES AND RECONCILIATIONS

Use of Non-GAAP Measures

In addition to financial measures presented on the basis of

accounting principles generally accepted in the U.S. (“U.S. GAAP”),

we also use non-GAAP financial measures, as listed and defined

below, for operational and financial decision making and to assess

Company and segment business performance. These non-GAAP measures

should be viewed as supplements to (not substitutes for) our

results of operations presented under U.S. GAAP. We have provided

reconciliations of all historical non-GAAP measures to their

nearest U.S. GAAP measure and have consistently applied the

adjustments within our reconciliations in arriving at each non-GAAP

measure.

Our management uses these metrics to assist in comparing

performance from period to period on a consistent basis; as a

measure for planning and forecasting overall expectations and for

evaluating actual results against such expectations; in

communications with the Board of Directors, stockholders, analysts

and investors concerning our financial performance; as useful

comparisons to the performance of our competitors; and as metrics

of certain management incentive compensation calculations. We

believe these measures are used by, and are useful to, investors

and other users of our financial statements in evaluating our

operating performance.

- Underlying Income (Loss) before Income Taxes (Closest GAAP

Metric: Income (Loss) Before Income Taxes) – Measure of the

Company’s or segment's income (loss) before income taxes excluding

the impact of certain non-GAAP adjustment items from our U.S. GAAP

financial statements. Non-GAAP adjustment items include goodwill

and other intangible and tangible asset impairments, restructuring

and integration related costs, unrealized mark-to-market gains and

losses, potential or incurred losses related to certain litigation

accruals and settlements and gains and losses on sales of

non-operating assets, among other items included in our U.S. GAAP

results that warrant adjustment to arrive at non-GAAP results. We

consider these items to be necessary adjustments for purposes of

evaluating our ongoing business performance and are often

considered non-recurring. Such adjustments are subjective, involve

significant management judgment and can vary substantially from

company to company.

- Underlying COGS (Closest GAAP Metric: COGS) – Measure of

the Company’s COGS adjusted to exclude non-GAAP adjustment items

(as defined above). Non-GAAP adjustment items include the impact of

unrealized mark-to-market gains and losses on our commodity

derivative instruments, which are economic hedges, and are recorded

through COGS within Unallocated. As the exposure we are managing is

realized, we reclassify the gain or loss to the segment in which

the underlying exposure resides, allowing our segments to realize

the economic effects of the derivatives without the resulting

unrealized mark-to-market volatility. We also use underlying COGS

per hectoliter, as well as the year over year change in such

metric, as a key metric for analyzing our results. This metric is

calculated as underlying COGS divided by financial volume for the

respective period.

- Underlying MG&A (Closest GAAP Metric:

MG&A) – Measure of the Company’s MG&A expense excluding

the impact of certain non-GAAP adjustment items (as defined

above).

- Underlying net income (loss) attributable to MCBC (Closest

GAAP Metric: Net income (loss) attributable to MCBC) – Measure

of net income (loss) attributable to MCBC excluding the impact of

non-GAAP adjustment items (as defined above), the related tax

effects of non-GAAP adjustment items and certain other discrete tax

items.

- Underlying net income (loss) attributable to MCBC per

diluted share (also referred to as Underlying Diluted Earnings per

Share) (Closest GAAP Metric: Net income (loss) attributable to MCBC

per diluted share) – Measure of underlying net income (loss)

attributable to MCBC (as defined above) per diluted share. If

applicable, a reported net loss attributable to MCBC per diluted

share is calculated using the basic share count due to dilutive

shares being antidilutive. If underlying net income (loss)

attributable to MCBC becomes income excluding the impact of our

non-GAAP adjustment items, we include the incremental dilutive

shares, using the treasury stock method, into the dilutive shares

outstanding.

- Underlying effective tax rate (Closest GAAP Metric:

Effective Tax Rate) – Measure of the Company’s effective tax

rate excluding the related tax impact of pre-tax non-GAAP

adjustment items (as defined above) and certain other discrete tax

items. Discrete tax items include certain significant tax audit and

prior year reserve adjustments, impact of significant tax

legislation and tax rate changes and significant non-recurring and

period specific tax items.

- Underlying free cash flow (Closest GAAP Metric: Net Cash

Provided by (Used in) Operating Activities) – Measure of the

Company’s operating cash flow calculated as Net Cash Provided by

(Used In) Operating Activities less Additions to property, plant

and equipment, net and excluding the pre-tax cash flow impact of

certain non-GAAP adjustment items (as defined above). We consider

underlying free cash flow an important measure of our ability to

generate cash, grow our business and enhance shareholder value,

driven by core operations and after adjusting for non-GAAP

adjustment items, which can vary substantially from company to

company depending upon accounting methods, book value of assets and

capital structure.

- Underlying depreciation and amortization (Closest GAAP

Metric: Depreciation & Amortization) – Measure of the

Company’s depreciation and amortization excluding the impact of

non-GAAP adjustment items (as defined above). These adjustments

primarily consist of accelerated depreciation or amortization taken

related to the Company’s strategic exit or restructuring

activities.

- Net debt and net debt to underlying earnings before

interest, taxes, depreciation, and amortization ("underlying

EBITDA") (Closest GAAP Metrics: Cash, Debt, & Net Income

(Loss)) – Measure of the Company’s leverage calculated as net

debt (defined as current portion of long-term debt and short-term

borrowings plus long-term debt less cash and cash equivalents)

divided by the trailing twelve month underlying EBITDA. Underlying

EBITDA is calculated as Net income (loss) excluding Interest

expense (income), net, Income tax expense (benefit), depreciation

and amortization, and the impact of non-GAAP adjustment items (as

defined above). This measure is not the same as the Company’s

maximum leverage ratio as defined under its revolving credit

facility, which allows for other adjustments in the calculation of

net debt to EBITDA.

- Constant currency - Constant currency is a non-GAAP

measure utilized to measure performance, excluding the impact of

translational and certain transactional foreign currency movements,

and is intended to be indicative of results in local currency. As

we operate in various foreign countries where the local currency

may strengthen or weaken significantly versus the U.S. dollar or

other currencies used in operations, we utilize a constant currency

measure as an additional metric to evaluate the underlying

performance of each business without consideration of foreign

currency movements. We present all percentage changes for net

sales, underlying COGS, underlying MG&A and underlying income

(loss) before income taxes in constant currency and calculate the

impact of foreign exchange by translating our current period local

currency results (that also include the impact of the comparable

prior period currency hedging activities) at the average exchange

rates during the respective period throughout the year used to

translate the financial statements in the comparable prior year

period. The result is the current period results in U.S. dollars,

as if foreign exchange rates had not changed from the prior year

period. Additionally, we exclude any transactional foreign currency

impacts, reported within the other non-operating income (expense),

net line item, from our current period results.

Our guidance for any of the measures noted above are also

non-GAAP financial measures that exclude or otherwise have been

adjusted for non-GAAP adjustment items from our U.S. GAAP financial

statements. When we provide guidance for any of the various

non-GAAP metrics described above, we do not provide reconciliations

of the U.S. GAAP measures as we are unable to predict with a

reasonable degree of certainty the actual impact of the non-GAAP

adjustment items. By their very nature, non-GAAP adjustment items

are difficult to anticipate with precision because they are

generally associated with unexpected and unplanned events that

impact our Company and its financial results. Therefore, we are

unable to provide a reconciliation of these measures without

unreasonable efforts.

RECONCILIATION TO NEAREST U.S. GAAP

MEASURES

Reconciliation by Line Item

(In millions, except per share data)

(Unaudited)

For the Three Months Ended

June 30, 2024

Cost of goods sold

Marketing, general and

administrative expenses

Income (loss) before income

taxes

Net income (loss) attributable

to MCBC

Diluted earnings per

share

Reported (U.S. GAAP)

$

(1,922.4

)

$

(728.5

)

$

559.9

$

427.0

$

2.03

Adjustments to arrive at underlying

Restructuring

—

—

(0.2

)

(0.2

)

—

(Gains) losses on other disposals

—

—

0.1

0.1

—

Unrealized mark-to-market (gains)

losses

(28.8

)

—

(28.8

)

(28.8

)

(0.14

)

Other items

—

0.4

0.2

0.2

—

Total

$

(28.8

)

$

0.4

$

(28.7

)

$

(28.7

)

$

(0.14

)

Tax effects on non-GAAP adjustments

—

—

—

6.6

0.03

Discrete tax items

—

—

—

(0.7

)

—

Underlying (Non-GAAP)

$

(1,951.2

)

$

(728.1

)

$

531.2

$

404.2

$

1.92

(In millions, except per share data)

(Unaudited)

For the Three Months Ended

June 30, 2023

Cost of goods sold

Marketing, general and

administrative expenses

Income (loss) before income

taxes

Net income (loss) attributable

to MCBC

Diluted earnings per

share

Reported (U.S. GAAP)

$

(2,047.7

)

$

(734.9

)

$

441.1

$

342.4

$

1.57

Adjustments to arrive at underlying

Restructuring

—

—

(0.2

)

(0.2

)

—

Unrealized mark-to-market (gains)

losses

62.7

—

60.8

60.8

0.28

Other items

—

0.7

0.5

0.5

—

Total

$

62.7

$

0.7

$

61.1

$

61.1

$

0.28

Tax effects on non-GAAP adjustments

—

—

—

(15.5

)

(0.07

)

Discrete tax items

—

—

—

(0.8

)

—

Underlying (Non-GAAP)

$

(1,985.0

)

$

(734.2

)

$

502.2

$

387.2

$

1.78

(In millions, except per share data)

(Unaudited)

For the Six Months Ended June

30, 2024

Cost of goods sold

Marketing, general and

administrative expenses

Income (loss) before income

taxes

Net income (loss) attributable

to MCBC

Diluted earnings per

share

Reported (U.S. GAAP)

$

(3,555.3

)

$

(1,383.1

)

$

825.3

$

634.8

$

2.99

Adjustments to arrive at underlying

Restructuring

—

—

(1.1

)

(1.1

)

(0.01

)

(Gains) losses on other disposals

—

—

(5.3

)

(5.3

)

(0.02

)

Unrealized mark-to-market (gains)

losses

(29.6

)

—

(29.6

)

(29.6

)

(0.14

)

Other items

—

0.9

0.7

0.7

—

Total

$

(29.6

)

$

0.9

$

(35.3

)

$

(35.3

)

$

(0.17

)

Tax effects on non-GAAP adjustments

—

—

—

8.2

0.04

Discrete tax items

—

—

—

(0.7

)

—

Underlying (Non-GAAP)

$

(3,584.9

)

$

(1,382.2

)

$

790.0

$

607.0

$

2.86

In millions, except per share data)

(Unaudited)

For the Six Months Ended June

30, 2023

Cost of goods sold

Marketing, general and

administrative expenses

Income (loss) before income

taxes

Net income (loss) attributable

to MCBC

Diluted earnings per

share

Reported (U.S. GAAP)

$

(3,623.3

)

$

(1,349.9

)

$

543.0

$

414.9

$

1.91

Adjustments to arrive at underlying

Restructuring

—

—

0.3

0.3

—

Unrealized mark-to-market (gains)

losses

114.5

—

112.6

112.6

0.52

Other items

—

4.3

4.1

4.1

0.02

Total

$

114.5

$

4.3

$

117.0

$

117.0

$

0.54

Tax effects on non-GAAP adjustments

—

—

—

(27.6

)

(0.13

)

Discrete tax Items

—

—

—

(0.8

)

—

Underlying (Non-GAAP)

$

(3,508.8

)

$

(1,345.6

)

$

660.0

$

503.5

$

2.31

Reconciliation to Underlying Income

(Loss) Before Income Taxes by Segment

(In millions) (Unaudited)

For the Three Months Ended

June 30, 2024

Americas

EMEA&APAC

Unallocated

Consolidated

Income (loss) before income

taxes

$

487.1

$

81.2

$

(8.4

)

$

559.9

Add/Less:

Cost of goods sold(1)

—

—

(28.8

)

(28.8

)

Marketing, general &

administrative

0.5

(0.1

)

—

0.4

Other non-GAAP adjustment items

(0.2

)

(0.1

)

—

(0.3

)

Total non-GAAP adjustment items

$

0.3

$

(0.2

)

$

(28.8

)

$

(28.7

)

Underlying income (loss) before income

taxes

$

487.4

$

81.0

$

(37.2

)

$

531.2

In millions) (Unaudited)

For the Three Months Ended

June 30, 2023

Americas

EMEA&APAC

Unallocated

Consolidated

Income (loss) before income

taxes

$

487.3

$

64.2

$

(110.4

)

$

441.1

Add/Less:

Cost of goods sold(1)

—

—

62.7

62.7

Marketing, general &

administrative

0.5

0.2

—

0.7

Other non-GAAP adjustment items

(0.2

)

(0.2

)

(1.9

)

(2.3

)

Total non-GAAP adjustment items

$

0.3

$

—

$

60.8

$

61.1

Underlying income (loss) before income

taxes

$

487.6

$

64.2

$

(49.6

)

$

502.2

(In millions) (Unaudited)

For the Six Months Ended June

30, 2024

Americas

EMEA&APAC

Unallocated

Consolidated

Income (loss) before income

taxes

$

807.7

$

70.2

$

(52.6

)

$

825.3

Add/Less:

Cost of goods sold(1)

—

—

(29.6

)

(29.6

)

Marketing, general &

administrative

1.0

(0.1

)

—

0.9

Other non-GAAP adjustment items

(0.2

)

(6.4

)

—

(6.6

)

Total non-GAAP adjustment items

$

0.8

$

(6.5

)

$

(29.6

)

$

(35.3

)

Underlying income (loss) before income

taxes

$

808.5

$

63.7

$

(82.2

)

$

790.0

(In millions) (Unaudited)

For the Six Months Ended June

30, 2023

Americas

EMEA&APAC

Unallocated

Consolidated

Income (loss) before income

taxes

$

720.7

$

38.8

$

(216.5

)

$

543.0

Add/Less:

Cost of goods sold(1)

—

—

114.5

114.5

Marketing, general &

administrative

1.0

3.3

—

4.3

Other non-GAAP adjustment items

(0.2

)

0.3

(1.9

)

(1.8

)

Total non-GAAP adjustment items

$

0.8

$

3.6

$

112.6

$

117.0

Underlying income (loss) before income

taxes

$

721.5

$

42.4

$

(103.9

)

$

660.0

(1)

Reflects changes in our mark-to-market

positions on our derivative hedges recorded as COGS within

Unallocated. As the exposure we are managing is realized, we

reclassify the gain or loss to the segment in which the underlying

exposure resides, allowing our segments to realize the economic

effects of the derivative without the resulting unrealized

mark-to-market volatility.

Underlying Free Cash Flow

(In millions) (Unaudited)

For the Six Months

Ended

June 30, 2024

June 30, 2023

U.S. GAAP Net Cash Provided by (Used

In) Operating Activities

$

894.6

$

894.4

Add/Less:

Additions to property, plant and

equipment, net(1)

(392.2

)

(335.1

)

Cash impact of non-GAAP adjustment

items(2)

2.6

10.4

Non-GAAP Underlying Free Cash

Flow

$

505.0

$

569.7

(1)

Included in net cash provided by (used in)

investing activities.

(2)

Included in net cash provided by (used in)

operating activities and primarily reflects costs paid for

restructuring activities for the six months ended June 30, 2024 and

June 30, 2023.

Net Debt and Net Debt to Underlying EBITDA Ratio

(In millions except net debt to underlying

EBITDA ratio) (Unaudited)

As of

June 30, 2024

June 30, 2023

U.S. GAAP Current portion of long-term

debt and short-term borrowings

$

894.2

$

423.2

Add/Less:

Long-term debt

6,161.5

6,191.9

Cash and cash equivalents

1,647.3

960.9

Net debt

5,408.4

$

5,654.2

Q2 Underlying EBITDA

750.1

725.2

Q1 Underlying EBITDA

476.2

388.4

Q4 Underlying EBITDA

566.1

555.5

Q3 Underlying EBITDA

742.9

593.5

Non-GAAP Underlying EBITDA(1)

$

2,535.3

$

2,262.6

Net debt to underlying EBITDA

ratio

2.13

2.50

(1)

Represents underlying EBITDA on a trailing

twelve month basis.

Underlying EBITDA Reconciliation

(In millions) (Unaudited)

For the Three Months

Ended

June 30, 2024

June 30, 2023

U.S. GAAP Net income (loss)

425.3

346.1

Add/Less:

Interest expense (income), net

51.2

54.6

Income tax expense (benefit)

134.6

95.0

Depreciation and amortization

167.7

168.4

Adjustments included in underlying

income(1)

(28.7

)

61.1

Non-GAAP Underlying EBITDA

$

750.1

$

725.2

(1)

Includes adjustments to income (loss)

before income taxes related to non-GAAP adjustment items. See

Reconciliations to Nearest U.S. GAAP Measures by Line Item table

for detailed adjustments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806604516/en/

Investor Relations Traci Mangini, (415) 308-0151

News Media Rachel Dickens, (314) 452-9673

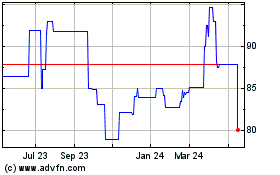

Molson Coors Canada (TSX:TPX.A)

Historical Stock Chart

From Nov 2024 to Dec 2024

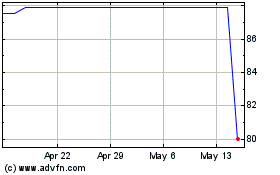

Molson Coors Canada (TSX:TPX.A)

Historical Stock Chart

From Dec 2023 to Dec 2024