Synex International Inc first quarter of fiscal 2012

November 05 2011 - 3:57PM

PR Newswire (Canada)

TSX : SXI VANCOUVER, Nov. 8, 2011 /CNW/ - For the three months

ended September 30, 2011 ("Q1 2012"), revenue from energy sales and

consulting increased to $828,377 as compared to $424,526 in the

corresponding period in fiscal 2011 ("Q1 2011"). This

increase in revenue is due to increases in electricity sales from

each of the Mears Plant, the Cypress Plant and the Kyuquot Utility

and an increase in consulting revenue. The net loss for Q1 2012 was

$89,790 as compared to a net loss of $73,866 in Q1 2011. A

net loss in the first quarter is expected as the generation from

hydro plants in the first quarter normally represents less than 10%

of annual forecast generation. In Q1 2011, the Company had

income of $300,000 from the proceeds of an option to a third party

for the purchase of some water licences and related rights of the

Engineering Division of the Company (the "Option

Payment"). Excluding the Option Payment, Q1 2012 is improved

from Q1 2011 by about $283,882 with the higher revenues from

operations being only partly offset by higher interest on long term

debt and higher salaries, general and administrative

expenses. The loss per share in Q1 2012 was $0.00 as compared

to a loss per share of $0.00 in Q1 2011. On August 19, 2010, the

Company announced that the Engineering Division had entered into an

Option Agreement dated July 23, 2010 with an unrelated third

party. The Option Agreement provides the third party with the

right to purchase a number of applications for water licences and

land tenures held by the Engineering Division as well as other

related rights. The Option Agreement has a latest exercise

date of December 2011. In a partly related transaction to the

Option Agreement, during the spring of Fiscal 2010, the Company

participated as a bidder in the purchase of the assets from the

Receiver for Hawkeye Energy Corporation ("HEC"). During the

Court process to approve the sale of the HEC assets to the Company,

Hawkeye Power Corporation ("HPC") opposed the sale on the basis of

an unregistered prior right to the assets. During Q2012, the

Company and HPC completed the trial procedure and a decision of the

Court is now pending. During Q1 2012, the Barr Creek Limited

Partnership ("BCLP") and its general partner Barr Creek Hydro Ltd.

("BCHL") continued to advance the Barr Creek Hydro Project (the

"Barr Project"). The Company holds an 80% interest in BCLP

and BCHL with the Ehattesaht Tribe holding the remaining 20% of

BCLP and BCHL. As of September 30, 2011, construction of the

Barr Project was about 70% complete. The current schedule is

for substantial completion of the Barr Project before the end of

calendar 2011. In late December 2004, the Company invested $500,000

for a 12.5% share of the Upnit Power Limited Partnership, which

included a 12.5% share of the General Partner of the Limited

Partnership ("Upnit"). During July 2011, Upnit executed an

amendment to its loan agreement which included for the term of the

loan to be extended for five years beyond July 15, 2011. At

September 30, 2011, the Company had a cash balance of

$359,225. Loans payable at September 30, 2011 included a

current portion of $9,198,979 and a non-current portion of

$6,456,699. The Company is continuing to utilize much of its

free cash flow to support development of the Barr Project. The

Company has commenced reporting financial results under IFRS as of

the first quarter of 2012. The financial results under IFRS

are not significantly different than the financial results would

have been under GAAP, although there has been a reduction in assets

due primarily to differences in amortization treatment

between IFRS and GAAP. The Company has applications for water

licences and land tenure on over 70 potential hydroelectric sites

and is currently advancing the development of two proposed new

hydroelectric plants on Vancouver Island. Synex International Inc.

is a public company, trading on the TSX since 1987, with business

interests that cover the development, ownership and operation of

electrical generation facilities and the provision of consulting

engineering services in water resources, particularly hydroelectric

facilities. "signed" ______________________________________ Greg

Sunell, President This press release contains forward-looking

statements that involve risks and uncertainties. These statements

reflect our current expectations and are subject to change. They

are subject to a number of risks and uncertainties including, but

not limited to, changes in economic conditions, risks associated

with the construction and operation of hydroelectric facilities and

changes in government policies. Synex International Inc. CONTACT:

400 - 1444 Alberni Street, Vancouver BC V6G 2Z4Phone (604) 688 8271

Ext. 309 Fax (604) 688 1286E-mail: gsunell@synex.com Web Site:

www.synex.com/

Copyright

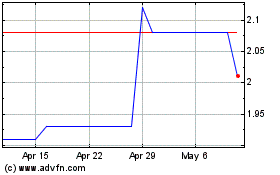

Synex Renewable Energy (TSX:SXI)

Historical Stock Chart

From Jul 2024 to Aug 2024

Synex Renewable Energy (TSX:SXI)

Historical Stock Chart

From Aug 2023 to Aug 2024