Sprott Announces Renewal of Normal Course Issuer Bid

March 06 2025 - 5:00PM

Sprott Inc. (NYSE/TSX: SII) (“Sprott” or the “Company”) announced

today that the Toronto Stock Exchange (“TSX”) has approved the

Company’s notice of intention to make a normal course issuer bid

("NCIB"). Pursuant to the terms of the NCIB, Sprott may purchase

its own common shares for cancellation through the facilities of

the TSX, alternative Canadian trading systems and/or the New York

Stock Exchange, in each case in accordance with the applicable

requirements, through open market purchases at market price and as

otherwise permitted under applicable securities laws. The maximum

number of common shares which may be purchased by Sprott during the

NCIB will not exceed 645,333 common shares being approximately 2.5%

of 25,813,335 (representing the number of issued and outstanding

common shares as of February 28, 2025). The average daily trading

volume (the “ADTV”) of the common shares on the TSX for the

six-month period ended February 28, 2025 was 26,765. Under the

rules of the TSX, Sprott is entitled to repurchase during the same

trading day on the TSX up to 25% of the ADTV of the common shares,

being 6,691 common shares, except where such purchases are made in

accordance with the “block purchase” exemption under applicable TSX

policy. Sprott will effect purchases at varying times commencing on

March 11, 2025 and ending on March 10, 2026.

In addition to providing shareholders liquidity,

Sprott believes that the common shares have been trading in a price

range which does not adequately reflect the value of such shares in

relation to Sprott’s business and its future prospects.

Under its prior NCIB that commenced on March 4,

2024 and ended on March 3, 2025, Sprott sought and received

approval from the TSX to repurchase up to 646,576 common shares.

Pursuant to its prior NCIB, Sprott purchased an aggregate of 49,706

common shares through the facilities of the TSX, alternative

Canadian trading systems and the NYSE. 34,048 common shares were

purchased on the TSX or alternative Canadian trading systems at a

weighted-average price of C$59.08 per common share, for total cash

consideration of C$2,011,575.97, and 15,658 common shares were

purchased on the NYSE at a weighted-average price of US$41.43 per

common share, for total cash consideration of US$648,672.10. Sprott

did not repurchase the maximum allowance under the current NCIB due

to a combination of factors.

About Sprott

Sprott is a global asset manager focused on

precious metals and critical materials investments. We are

specialists. We believe our in-depth knowledge, experience and

relationships separate us from the generalists. Our investment

strategies include Exchange Listed Products, Managed Equities and

Private Strategies. Sprott has offices in Toronto, New York,

Connecticut and California and the company’s common shares are

listed on the New York Stock Exchange and the Toronto Stock

Exchange under the symbol (SII). For more information, please visit

www.sprott.com.

Forward Looking Statements

Certain statements in this press release contain

forward-looking information and forward-looking statements

(collectively referred to herein as the “Forward-Looking

Statements”) within the meaning of applicable Canadian and U.S.

securities laws. The use of any of the words “expect”,

“anticipate”, “continue”, “estimate”, “may”, “will”, “project”,

“should”, “believe”, “plans”, “intends” and similar expressions are

intended to identify Forward-Looking Statements. In particular, but

without limiting the forgoing, this press release contains

Forward-Looking Statements pertaining to methods and quantity of

any purchases by the Company of its common shares under the

NCIB.

Although the Company believes that the

Forward-Looking Statements are reasonable, they are not guarantees

of future results, performance or achievements. A number of factors

or assumptions have been used to develop the Forward-Looking

Statements, including: (i) the impact of increasing competition in

each business in which the Company operates will not be material;

(ii) quality management will be available; (iii) the effects of

regulation and tax laws of governmental agencies will be consistent

with the current environment; (iv) the impact of public health

outbreaks; and (v) those assumptions disclosed under the heading

“Critical Accounting Estimates, Judgments and Changes in Accounting

Policies” in the Company’s MD&A for the period ended December

31, 2024. Actual results, performance or achievements could vary

materially from those expressed or implied by the Forward-Looking

Statements should assumptions underlying the Forward-Looking

Statements prove incorrect or should one or more risks or other

factors materialize, including: (i) difficult market conditions;

(ii) poor investment performance; (iii) failure to continue to

retain and attract quality staff; (iv) employee errors or

misconduct resulting in regulatory sanctions or reputational harm;

(v) performance fee fluctuations; (vi) a business segment or

another counterparty failing to pay its financial obligation; (vii)

failure of the Company to meet its demand for cash or fund

obligations as they come due; (viii) changes in the investment

management industry; (ix) failure to implement effective

information security policies, procedures and capabilities; (x)

lack of investment opportunities; (xi) risks related to regulatory

compliance; (xii) failure to manage risks appropriately; (xiii)

failure to deal appropriately with conflicts of interest; (xiv)

competitive pressures; (xv) corporate growth which may be difficult

to sustain and may place significant demands on existing

administrative, operational and financial resources; (xvi) failure

to comply with privacy laws; (xvii) failure to successfully

implement succession planning; (xviii) foreign exchange risk

relating to the relative value of the U.S. dollar; (xix) litigation

risk; (xx) failure to develop effective business resiliency plans;

(xxi) failure to obtain or maintain sufficient insurance coverage

on favorable economic terms; (xxii) historical financial

information being not necessarily indicative of future performance;

(xxiii) the market price of common shares of the Company may

fluctuate widely and rapidly; (xxiv) risks relating to the

Company’s investment products; (xxv) risks relating to the

Company's proprietary investments; (xxvi) risks relating to the

Company's private strategies business; (xxvii) those risks

described under the heading “Risk Factors” in the Company’s annual

information form dated February 25, 2025; and (xxviii) those risks

described under the headings “Managing Financial Risks” and

“Managing Non-Financial Risks” in the Company’s MD&A for the

period ended December 31, 2024. The Forward-Looking Statements

speak only as of the date hereof, unless otherwise specifically

noted, and the Company does not assume any obligation to publicly

update any Forward-Looking Statements, whether as a result of new

information, future events or otherwise, except as may be expressly

required by applicable securities laws.

Investor contact

information:

Glen WilliamsManaging PartnerInvestor and

Institutional Client Relations(416)

943-4394gwilliams@sprott.com

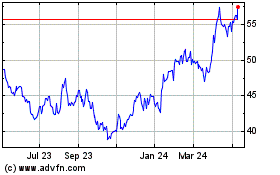

Sprott (TSX:SII)

Historical Stock Chart

From Feb 2025 to Mar 2025

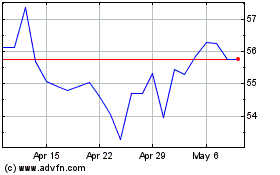

Sprott (TSX:SII)

Historical Stock Chart

From Mar 2024 to Mar 2025