NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Sherritt International Corporation ("Sherritt" or the "Corporation") (TSX:S)

today announced third-quarter 2009 results.

-- Net earnings for third-quarter 2009 were $55.9 million ($0.19 per

share), compared to net earnings of $133.1 million ($0.45 per share) for

third-quarter 2008. Net earnings of $37.4 million ($0.13 per share) for

the first nine months of 2009 compared to $302.4 million ($1.11 per

share, fully diluted) in the prior-year period.

-- Consolidated cash, cash equivalents and short-term investments were $1.3

billion at September 30, 2009, an increase of $0.3 billion from June 30,

2009. Of the cash balance, $47.3 million (50% basis) was held by the Moa

Joint Venture and $646.9 million (100% basis) was held by the Ambatovy

Joint Venture. The cash increase was mainly due to the receipt of

Ambatovy Project funding at the end of the quarter. The Project cash is

expected to be substantially utilized to satisfy expenditure obligations

for the remainder of the year.

-- Cash flow from operations was $198.5 million for third-quarter 2009,

after a working capital decrease of $78.5 million. This compares to

operating cash flow of $42.5 million for third-quarter 2008, net of a

working capital increase of $112.5 million.

-- Capital expenditures were $397.0 million for third-quarter 2009, of

which 84% ($330.9 million) related to the Ambatovy Project (100% basis).

Sherritt's 40% share of capital expenditures ($132.4 million) was

primarily funded through loans from the Ambatovy Partners and senior

project financing.

-- Total long-term debt was $3.4 billion at September 30, 2009, of which

approximately 50% ($1.7 billion, 100% basis) was related to the

limited-recourse Ambatovy senior project finance and approximately 12%

($0.4 billion) to non-recourse partner loans to Sherritt.

Summary Financial and Sales Data (unaudited)

Nine months ended

September 30

Q3 2009 Q3 2008 2009 2008

----------------------------------------------------------------------------

Financial Data (millions of dollars,

except per share amounts

and ratios)

Revenue $ 389.6 $ 478.3 $ 1,097.7 $ 1,236.2

EBITDA(1) 136.5 214.1 344.4 579.5

Operating earnings 70.2 143.7 149.6 405.3

Net earnings 55.9 133.1 37.4 302.4

Basic earnings per share 0.19 0.45 0.13 1.12

Diluted earnings per share 0.19 0.45 0.13 1.11

Net working capital(2) 1,041.3 842.6 1,401.3 842.6

Capital expenditures 397.0 479.7 1,202.1 1,561.2

Total assets 10,171.5 8,821.2 10,171.5 8,821.2

Shareholders' equity 3,464.5 3,995.0 3,464.5 3,995.0

Long-term debt to capitalization(3) 36% 29%

Weighted average number of shares

(millions)

Basic 293.1 291.9 293.1 268.8

Diluted 296.2 295.8 296.0 273.2

Sales Volumes (units as noted)

Nickel (thousands of pounds, 50%

basis) 9,779 9,762 28,097 26,324

Cobalt (thousands of pounds, 50%

basis) 1,002 936 3,078 2,758

Thermal coal - Prairie Operations

(millions of tonnes)(4) 8.9 8.6 25.5 26.1

Thermal coal - Mountain Operations

(millions of tonnes, 50% basis) 0.6 0.5 1.4 1.3

Oil (boepd, net working-interest

production) 12,875 16,797 13,319 17,737

Electricity (GWh, 100% basis) 588 577 1,644 1,742

Average Realized Prices (units as

noted)

Nickel ($/lb) $ 8.78 $ 9.16 $ 7.16 $ 11.28

Cobalt ($/lb) 18.19 33.64 17.00 41.74

Thermal coal - Prairie Operations

($/tonne) 14.07 15.54 14.47 14.59

Thermal coal - Mountain Operations

($/tonne) 70.06 87.19 83.27 80.93

Oil ($/boe) 50.07 72.20 42.63 61.84

Electricity ($/MWh) 45.07 42.32 47.83 41.25

1. EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at the

end of this release.

2. Net working capital is calculated as total current assets less total

current liabilities.

3. Calculated as long-term debt divided by the sum of total long-term debt,

non-controlling interests and shareholders' equity. For purposes of this

calculation, total long-term debt does not include other long-term

liabilities.

4. Prairie Operations volumes presented on a 100% basis for each period.

Review of Operations

Metals

Nine months ended

September 30

----------------------------------------------------------------------------

Q3 2009 Q3 2008 2009 2008

----------------------------------------------------------------------------

Production (tonnes, 50% basis)

Mixed sulphides 4,647 4,350 13,971 12,997

Nickel 4,341 4,415 12,675 11,867

Cobalt 489 438 1,428 1,250

Sales (thousands of pounds, 50%

basis)

Nickel 9,779 9,762 28,097 26,324

Cobalt 1,002 936 3,078 2,758

Reference prices (US$/lb)

Nickel $ 7.99 $ 8.61 $ 6.23 $ 11.09

Cobalt (1) 17.30 32.54 15.10 41.49

Realized prices ($/lb)

Nickel $ 8.78 $ 9.16 $ 7.16 $ 11.28

Cobalt 18.19 33.64 17.00 41.74

Unit operating costs (US$/lb)

Mining, processing and

refining costs $ 4.47 $ 7.12 $ 4.59 $ 6.59

Third-party feed costs 0.11 0.54 0.19 0.94

Cobalt by-product credits (1.70) (3.10) (1.60) (4.30)

Other 0.01 (0.06) 0.05 (0.09)

----------------------------------------

Net direct cash costs of

nickel(2) $ 2.89 $ 4.50 $ 3.23 $ 3.14

----------------------------------------

Revenue ($ millions)

Nickel $ 85.9 $ 89.4 $ 201.3 $ 296.9

Cobalt 18.2 31.5 52.3 115.1

Fertilizer and other 10.2 16.6 51.5 65.5

----------------------------------------

$ 114.3 $ 137.5 $ 305.1 $ 477.5

EBITDA ($ millions)(3) $ 45.0 $ 39.1 $ 70.1 $ 199.6

Operating earnings ($ millions) $ 37.6 $ 32.3 $ 48.8 $ 182.1

Capital expenditures ($ millions)

Moa Joint Venture (50%

basis) $ 7.3 $ 66.3 $ 20.1 $ 181.2

Ambatovy Joint Venture

(100% basis) 330.9 366.5 1,034.6 1,251.1

----------------------------------------

$ 338.2 $ 432.8 $ 1,054.7 $ 1,432.3

1. Average Metal Bulletin: Low Grade cobalt published price.

2. Net direct cash cost of nickel after cobalt and by-product credits.

3. EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at the

end of this release. EBITDA excludes depreciation of $4.1 million and

$4.5 million in the three-month periods ended September 30, 2009 and

September 30, 2008 and $15.0 million and $11.0 million in the nine-month

periods ended September 30, 2009 and September 30, 2008.

Mixed sulphides production for third-quarter 2009 was 9,293 tonnes (100% basis),

up 7% (593 tonnes) from third-quarter 2008. The year-over-year increase reflects

the impact of Hurricane Ike on production in September 2008.

Finished nickel production of 8,681 tonnes (100% basis) was relatively unchanged

from the prior-year period, and finished cobalt production of 979 tonnes (100%

basis) was up 12% compared to the same period last year. Year-over-year

production level differences reflected the impact of the Phase 1 Expansion

contribution in 2009 and a lower nickel-to-cobalt ratio in feed in third-quarter

2009, which increased cobalt production relative to nickel production.

Nickel sales volumes of 9.8 million pounds (50% basis) for third-quarter 2009

were similar to the prior- year period. Cobalt sales volumes of 1.0 million

pounds (50% basis), were up 7% (0.1 million pounds) from third-quarter 2008,

reflecting increased cobalt production.

Average metal reference prices in third-quarter 2009 were down relative to the

prior year period, with the average nickel reference price down 7% (US$0.62/lb)

and the average cobalt reference price down 47% (US$15.24/lb). Price declines

were largely due to the impact of relatively weakened global industrial demand

on the base metals market. Realized metal prices reflected the impact of the

market price decline.

The net direct cash cost of nickel for the quarter was US$2.89/lb, similar to

second-quarter 2009 (US$2.85/lb) and 36% (US$1.61/lb) lower than the prior-year

period. The year-over-year decline was due to lower mining, processing and

refining costs that benefited from lower commodity input prices and the

favourable foreign exchange impact on refining costs, as well as lower

third-party feed costs that resulted from increased availability of mixed

sulphides and the impact of lower market reference prices.

Sustaining capital expenditures for third-quarter 2009 were 67% ($10.4 million,

50% basis) lower than the prior-year period, commensurate with lower metals

prices in 2009. Expansion capital expenditures in the Moa Joint Venture during

third-quarter 2009 were 96% ($48.6 million, 50% basis) lower than the prior-year

period due to the suspension of the Phase 2 Expansion and Moa Acid Plant in

fourth-quarter 2008. Current expansion expenditures in the Moa Joint Venture

mainly relate to the capitalization of interest associated with the financing of

the Phase 2 Expansion and the Moa Acid Plant.

The Ambatovy Project

Ambatovy Project capital expenditures for third-quarter 2009 were $330.9 million

(100% basis). Total project expenditures as at September 30, 2009 were US$3.1

billion. Construction activities during the quarter continued with the

installation of mechanical equipment and piping at both the minesite and

plantsite. All major foundation work has been completed and the hydrotest of the

first boiler in the Power Plant was completed successfully. Construction will

continue to ramp up through the next two quarters with the peak of activity

expected in second-quarter 2010. The Project, which is expected to produce

60,000 tonnes (100% basis) of nickel and 5,600 tonnes (100% basis) of cobalt

annually, is scheduled for mechanical completion in the latter part of 2010.

During third-quarter 2009, US$523.0 million (100% basis) was drawn against the

senior project financing and Sherritt borrowed US$98.8 million on partner loans,

pursuant to an agreement between Sherritt and its Ambatovy partners. As at

September 30, 2009, $1.7 billion had been drawn on the senior project financing

and $0.4 billion had been drawn on the partner loans.

Coal

Nine months ended

September 30

Q3 2009 Q3 2008 2009 2008

----------------------------------------------------------------------------

Production (millions of tonnes)

Prairie Operations(1) 9.0 8.8 25.8 26.4

Mountain Operations(2) (50%

basis) 0.5 0.5 1.5 1.3

Sales (millions of tonnes)

Prairie Operations(1) 8.9 8.6 25.5 26.1

Mountain Operations(2) (50%

basis) 0.6 0.5 1.4 1.3

Realized prices, excluding royalties

($/tonne)

Prairie Operations(1) $ 14.07 $ 15.54 $ 14.47 $ 14.59

Mountain Operations(2) 70.06 87.19 83.27 80.93

Nine months ended

September 30

Q3 2009 Q3 2008 2009 2008

----------------------------------------------------------------------------

Unit operating costs ($/tonne)

Prairie Operations(1) $ 11.28 $ 12.26 $ 11.37 $ 11.44

Mountain Operations(2) 68.99 64.51 64.34 63.82

Revenue ($ millions)

Prairie Operations(1)

Mining revenue $ 124.5 $ 133.1 $ 369.1 $ 380.4

Coal royalties 13.2 12.5 39.3 32.0

Potash royalties 1.8 5.0 8.4 13.1

Mountain Operations and

Other Assets(2),(3)

(50% basis) 41.7 39.3 119.0 104.4

----------------------------------------

$ 181.2 $ 189.9 $ 535.8 $ 529.9

EBITDA ($millions)(4)

Prairie Operations(1) $ 36.4 $ 46.8 $ 115.0 $ 117.8

Mountain Operations and

Other Assets(2), (3)

(50% basis) - 9.4 23.3 20.3

----------------------------------------

$ 36.4 $ 56.2 $ 138.3 $ 138.1

Operating earnings ($ millions) $ 9.1 $ 25.6 $ 61.8 $ 50.9

Capital expenditures ($ millions)

Prairie Operations(1) $ 13.4 $ 1.7 $ 38.4 $ 13.2

Mountain Operations(2)(5)

(50% basis) 1.6 1.3 8.3 2.4

Activated Carbon Project

(50% basis) 7.6 - 13.2 -

Obed Mountain mine(6) (50%

basis) 1.9 - 10.9 -

----------------------------------------

$ 24.5 $ 3.0 $ 70.8 $ 15.6

1. Prairie Operations are presented on a 100% basis. Sherritt

equity-accounted for these operations up to the date of the acquisition

of Royal Utilities Income Fund in May 2008.

2. Mountain Operations include the results of the Coal Valley and Obed

mines, which are primarily involved in the export of thermal coal, and

are presented on a 50% basis.

3. Other Assets include certain undeveloped reserves that produce coal-bed

methane and technologies under development, including the

Dodds-Roundhill Coal Gasification Project, and are presented on a 50%

basis.

4. EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at the

end of this release. EBITDA excludes depreciation of $16.4 million and

$12.6 million for the three-month periods ended September 30, 2009 and

September 30, 2008, and $46.2 million and $23.7 million for the

nine-month periods ended September 30, 2009 and September 30, 2008.

5. The nine-month period ended September 30, 2009 includes$3.6 million of

equipment financed through a bank credit facility that ordinarily would

have been acquired under a capital lease.

6. The nine-month period ended September 30, 2009 includes $2.9 million of

equipment financed through a bank credit facility that ordinarily would

have been acquired under a capital lease.

Production volumes at the Prairie and Mountain Operations were relatively

unchanged from the prior-year period. Sales volumes at both operations showed

increases over the prior-year period, with Prairie Operations up by 3% (0.3

million tonnes) and Mountain Operations up by over 30% (0.1 million tonnes 50%

basis). Production commenced at the Obed Mountain mine in July 2009. During

third-quarter 2009, Coal Valley Resources Inc. (CVRI), a subsidiary of the Coal

Valley Partnership (in which the Corporation has a 50% interest and owns the

Obed Mountain mine), issued a Demand to Arbitrate to its counterparty in an

off-take contract. The contract, signed in 2008 for 100% of the increase in

Mountain Operations production resulting from the re-opening of the Obed

Mountain mine, provides a guaranteed floor price for three years with a sharing

of the price upside. In September 2009, the counterparty refused to take

delivery of coal under this contract. CVRI will be seeking full compensation for

any and all costs or lost profits that result from having to sell the coal to

other customers. If arbitration on the contract proceeds, CVRI will seek to

mitigate its losses by selling the coal to other existing customers or on the

spot market.

Realized pricing was down in both the Prairie and Mountain Operations. Prairie

Operations average realized pricing (excluding royalties) was down 9%

($1.47/tonne) from the prior-year period, reflecting index-adjustments in

pricing at owned mines and lower cost and capital recoveries at the contract

mines. Mountain Operations average realized pricing was 20% ($17.13/tonne) lower

than third-quarter 2008, mainly the result of relative settlement price changes

in the export thermal coal markets between the periods.

Unit operating costs at the Prairie Operations were 8% ($0.98/tonne) lower than

third-quarter 2008 due to the decline in diesel and other commodity input

prices. Unit operating costs at Mountain Operations were up 7% ($4.48/tonne) due

to temporary fluctuations in the coal quality at the Coal Valley mine, which

impacted plant yield, as well as the start-up of operations at the Obed Mountain

mine.

Total royalties of $15.0 million for third-quarter 2009, were down 14% over the

prior-year period as the increase in coal royalty prices and volumes, resulting

from a change in mining sequence in royalty assessable areas, was more than

offset by declining potash demand and pricing.

Sustaining capital expenditures for Coal were $15.0 million for third-quarter

2009. The majority of the $12.0 million increase was not the result of a marked

increase in spending, but rather the result of reduced market capacity of lease

finance on acceptable terms. Sustaining capital expenditures in Mountain

Operations were directed at infrastructure development, as Coal Valley prepared

to enter new mining areas. During third-quarter 2009, $7.6 million in capital

spending was directed to the Activated Carbon Project and $1.9 million to the

Obed Mountain mine. The Obed Mountain mine re-opening is now complete and

production commenced in July 2009.

In April 2009, a subsidiary in Prairie Operations signed a letter of intent to

establish a new $17.2 million non-revolving, term credit facility to finance

certain equipment. The first draw on the facility of $4.6 million occurred in

October. A fixed interest rate of 9.85% applies to all borrowings under the

facility.

At September 30, 2009, CVRI was not in compliance with a financial covenant

applicable to the $38.0 million (100% basis) 3-year non-revolving term facility

used to finance the re-opening of the Obed Mountain mine. The covenant requires

CVRI to maintain a current ratio of not less than 1:1. CVRI's working capital

balance was reduced as it was unable to record expected levels of revenue

related to production from the re-opening of the Obed Mountain mine. CVRI was

granted a waiver of this covenant for third-quarter 2009.

Oil and Gas

Nine months ended

June 30

Q3 2009 Q3 2008 2009 2008

----------------------------------------------------------------------------

Production (boepd)(1), (2)

Gross working interest -

Cuba(3), (5) 22,031 28,952 21,296 31,248

Net working interest(4)

Cuba - cost recovery(5) 5,345 6,878 6,694 6,748

Cuba - profit oil(5) 6,807 9,082 5,939 10,125

----------------------------------------

Cuba - total 12,152 15,960 12,633 16,873

Spain(4) 373 447 318 473

Pakistan(4) 350 390 368 391

----------------------------------------

Total net working-interest

production 12,875 16,797 13,319 17,737

Reference prices (US$/bbl)

US Gulf Coast Fuel Oil

No. 6 $ 63.30 $ 95.25 $ 51.33 $ 83.48

Brent crude 68.46 114.41 57.44 112.98

Realized prices

Cuba ($/bbl) $ 50.54 $ 72.51 $ 43.01 $ 61.68

Spain ($/bbl) 74.14 117.26 67.36 112.84

Pakistan ($/boe) 8.07 7.61 8.30 7.35

Nine months ended

September 30

Q3 2009 Q3 2008 2009 2008

----------------------------------------------------------------------------

Unit operating costs

Cuba ($/bbl) $ 6.63 $ 5.97 $ 7.88 $ 5.86

Spain ($/bbl) 48.15 32.75 60.14 31.82

Pakistan ($/boe) 0.50 0.78 0.99 0.92

Revenue ($ millions) $ 59.9 $ 112.9 $ 156.7 $ 304.9

EBITDA ($ millions)(6) $ 42.8 $ 96.2 $ 103.6 $ 250.7

Operating earnings ($ millions) $ 20.3 $ 72.0 $ 33.6 $ 173.6

Capital expenditures ($ millions) $ 22.1 $ 32.6 $ 44.5 $ 87.7

1. Production figures exclude production from wells for which commerciality

has not been established.

2. Oil production is stated in barrels per day ("bpd"). Natural gas

production is stated in barrels of oil equivalent per day ("boepd"),

which is converted at 6,000 cubic feet per barrel.

3. In Cuba, Oil and Gas delivers all of its gross working-interest oil

production to CUPET at the time of production. Gross working-interest

oil production excludes (i) production from wells for which

commerciality has not been established in accordance with

production-sharing contracts; and (ii) working interests of other

participants in the production-sharing contracts.

4. Net production (equivalent to net sales volume) represents the

Corporation's share of gross working-interest production. In Spain and

Pakistan, net oil production volumes equal 100% of gross

working-interest production volumes.

5. Gross working-interest oil production is allocated between Oil and Gas

and CUPET in accordance with production-sharing contracts. The

Corporation's share, referred to as 'net oil production', includes (i)

cost recovery oil (based upon the recoverable capital and operating

costs incurred by Oil and Gas under each production-sharing contract)

and (ii) a percentage of profit oil (gross working-interest production

remaining after cost recovery oil is allocated to Oil and Gas). Cost

recovery pools for each production-sharing contract include cumulative

recoverable costs, subject to certification by CUPET, less cumulative

proceeds from cost recovery oil allocated to Oil and Gas. Cost recovery

revenue equals capital and operating costs eligible for recovery under

the production-sharing contracts. Therefore, cost recovery oil volumes

increase as a result of higher capital expenditures and decrease when

selling prices increase. When oil prices increase, the resulting

reduction in cost recovery oil volumes is partially offset by an

increase in profit oil barrels.

6. EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at the

end of this release.

Gross working-interest (GWI) production in 2009 reflects the loss of Block 7

production in Cuba resulting from the premature termination of the

production-sharing contract earlier in the year. Excluding Block 7,

third-quarter GWI production was 6% higher (1,180 bpd) than the prior-year

period, and reflected the success of drilling activity in 2009 and the impact of

two hurricanes in third-quarter 2008. Excluding Block 7, net working-interest

production in Cuba for the quarter of 12,152 bpd was relatively unchanged from

the prior-year period (12,115 bpd).

Average realized prices in third-quarter 2009 were lower than the prior-year

period, reflecting the impact of substantially lower reference pricing. While

reference prices declined by 34% (US$31.95) for Cuban production and 40%

(US$45.95/bbl) for Spanish production, the decline in realized prices was

slightly less dramatic, at 30% ($21.97/bbl) and 37% ($43.12/bbl) respectively,

as a result of the partially offsetting impact of foreign exchange.

Third-quarter 2009 unit operating costs in Cuba increased 11% ($0.66/bbl)

compared to the prior-year period, mainly due to fixed operating costs being

applied against a smaller production base, following the premature termination

of the Block 7 production-sharing contract and higher treatment and

transportation rates. Unit operating costs in Spain were 47% ($15.40/bbl) higher

than third-quarter 2008 due to increased workover activity during 2009.

Third-quarter 2009 capital expenditures were 32% ($10.5 million) lower than in

the prior-year period, as there was no Block 7 drilling activity in 2009.

Exploration activities during the quarter related mainly to a gas well completed

in Turkey, which did not yield commercial quantities of gas and was subsequently

shut-in. In third-quarter 2009, one development well was initiated and two

development wells were completed.

Power

Nine months ended

September 30

Q3 2009 Q3 2008 2009 2008

----------------------------------------------------------------------------

Electricity sold (GWh, 100% basis) 588 577 1,644 1,742

Realized price ($/MWh) $ 45.07 $ 42.32 $ 47.83 $ 41.25

Unit cash operating cost ($/MWh) $ 11.82 $ 11.89 $ 14.82 $ 10.71

Net capacity factor 79% 76% 74% 77%

Revenue ($ millions) $ 30.6 $ 30.9 $ 89.6 $ 91.0

EBITDA ($ millions)(1) $ 22.0 $ 23.7 $ 61.4 $ 70.4

Operating earnings ($ millions) $ 14.2 $ 16.4 $ 38.3 $ 48.4

Capital expenditures ($ millions)

Cuba $ 4.4 $ 4.9 $ 18.6 $ 16.2

Madagascar (0.3) - 4.5 -

----------------------------------------

$ 4.1 $ 4.9 $ 23.1 $ 16.2

(1) EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at the

end of this release.

Electricity production and the net capacity factor for third-quarter 2009 were

up slightly (11 GWh and 3%, 100% basis), due to higher gas availability relative

to the prior-year period. Unit cash operating costs remained relatively

unchanged from the prior-year quarter.

Sustaining capital expenditures in third-quarter 2009 of $1.6 million were 129%

($0.9 million) higher than the prior-year period due to infrastructure projects

initiated in the quarter. Expansion capital expenditures were $2.5 million for

third-quarter 2009, 40% ($1.7 million) lower than the prior-year period due to

reduced spending on the 150 MW Combined Cycle Project in Cuba as a result of the

ongoing review of the Project.

Cash, Debt and Financing

Cash, cash equivalents and short-term investments were $1.3 billion at September

30, 2009. Of that amount, 4% ($47.3 million, 50% basis) was held by the Moa

Joint Venture and 50% ($646.9 million, 100% basis) was held by the Ambatovy

Joint Venture. These funds are for the use of each joint venture, respectively.

No new drawings under the Ambatovy senior project financing are expected in

fourth- quarter 2009, as the majority of the Ambatovy Project cash balance is

expected to be utilized to meet expenditure obligations.

At June 30, 2009, the amount of credit available under various credit

facilities, inclusive of approximately US$0.5 billion (100% basis) under the

Ambatovy senior project financing, was $0.9 billion.

Outlook

Sherritt's production volumes, royalties and capital expenditures for the first

nine months of 2009 and projections for the year 2009 are shown below:

Actual for Projected

the nine for the

months year

ended ending

September December

30, 2009 31, 2009

----------------------------------------------------------------------------

Production

Mixed sulphides (tonnes, 100% basis) 27,942 37,000

Nickel (tonnes, 100% basis) 25,350 33,500

Cobalt (tonnes, 100% basis) 2,856 3,700

Coal - Prairie Operations (millions of tonnes) 25.8 35

Coal - Mountain Operations (millions of tonnes, 100%

basis) 2.9 4.3

Oil - Gross working interest (Cuba) (bpd) 21,296 21,000

Oil - Net working-interest production, all operations

(boepd)(1) 13,319 12,600

Power - Electricity (GWh) 1,644 2,100

Royalties

Coal ($ millions) 39 48

Potash ($ millions) 8 11

Capital Expenditures ($ millions, unless otherwise

noted)

Metals - Moa Joint Venture (50% basis) 20 39

Coal - Prairie Operations(2) 38 35

Coal - Mountain Operations (50% basis) 8 9

Coal - Activated Carbon Project (50% basis) 13 25

Coal - Obed Mountain mine (50% basis)(3) 8 9

Oil and Gas - Cuba 31 59

Oil and Gas - Other 13 14

Power - Cuba 19 28

Power - Madagascar 4 5

----------------------

154 223

Metals - Ambatovy (100% basis, US$ millions) 882 1,400

1. Net oil production is predicated on the WTI/Fuel Oil No.6 price

differential remaining consistent with historical levels.

2. For the nine months ended September 30, 2009, includes equipment that is

expected to be financed through new borrowings in fourth- quarter 2009.

These anticipated new borrowings have been reflected in the projected

annual amount.

3. Excludes equipment financed through a bank credit facility.

-- In Metals, the net direct cash cost of nickel for 2009 is expected to

remain near the average for the first nine months of 2009 if the current

level of commodity input prices and cobalt prices continues through the

fourth quarter. The staged maintenance approach has proven successful in

terms of minimizing the impact on production, and production levels are

expected to be at capacity for the year. The capital expenditure

guidance for Metals in 2009 remains unchanged from last quarter.

-- In the Ambatovy Project, the previous 2009 capital expenditure estimate

of US$1.8 billion has been revised to US$1.4 billion, reflecting the

impact of the Project review early in 2009 that slowed the rate of

expenditures.

-- In Coal, estimated annual production levels at Prairie Operations are

consistent with the estimate provided in the second quarter. In Mountain

Operations, production volumes for 2009 on a 100% basis are expected to

be down slightly from the previous estimate of 4.4 million tonnes to 4.3

million tonnes, due to lower-than-projected production volumes in the

third quarter. In Mountain Operations, with the exception of the

disputed guaranteed floor price contract, contract prices have been

established for the balance of the year, but realized prices will

fluctuate with foreign exchange rate changes as settlement pricing for

exports is denominated in U.S. dollars. In order to mitigate the impact

of the disputed guaranteed floor price contract, CVRI will use its best

efforts to sell the volumes committed under that contract to other

customers at prevailing contract or market prices, which are expected to

be lower than the guaranteed floor price. Royalties are expected to be

slightly lower than previously estimated, as the impact of lower potash

royalties, due to declining pricing and production is expected to be

largely offset by more robust coal royalties resulting from the mining

sequence in royalty assessable areas. The commissioning of the first

Activated Carbon plant is on schedule for early 2010.

-- In Oil and Gas, the capital expenditure estimate for 2009 has been

revised to reflect planned drilling activity for the remainder of 2009.

Cuban receivables continue to be received on a consistent basis. At

September 30, 2009 receivables of $26.1 million were overdue, a decrease

of $14 million since June 30, 2009.

-- In Power, the 25 MW facility in Madagascar is complete and, in

accordance with the relevant agreements, was turned over to the

state-run electricity company early in the fourth quarter of 2009. A

maintenance turnaround on the steam turbine at the Varadero facility is

scheduled for the fourth quarter and as a result approximately 70 MW of

capacity will not be available for an estimated 40 day period. As with

Oil and Gas, regular receivables payments in Cuba continue to be

received. The 150 MW Boca de Jaruco Combined Cycle Project continues to

be reviewed, and the Project option value will be maintained through the

continuation of progress payments.

Non-GAAP Measures

The Corporation discloses EBITDA in order to provide an indication of revenue

less cash operating expenses. Operating earnings is a measure used by Sherritt

to evaluate the operating performance of its businesses as it excludes interest

charges, which are a function of the particular financing structure for the

business, and certain other charges. EBITDA and operating earnings do not have

any standardized meaning prescribed by Canadian generally accepted accounting

principles and, therefore, they may or may not be comparable with similar

measures presented by other issuers.

About Sherritt

Sherritt is a diversified natural resource company that produces nickel, cobalt,

thermal coal, oil, gas and electricity. It also licenses its proprietary

technologies to other metals companies. Sherritt's common shares are listed on

the Toronto Stock Exchange under the symbol "S".

Forward-looking Statements

This press release contains certain forward-looking statements. Forward-looking

statements generally can be identified by the use of statements that include

words such as "believe", "expect", "anticipate", "intend", "plan", "forecast",

"likely", "may", "will", "could", "should", "suspect", "outlook", "projected",

"continue" or other similar words or phrases. Similarly, statements with respect

to expectations concerning assets, prices, costs, dividends, foreign-exchange

rates, earnings, production, market conditions, capital expenditures, commodity

demand, risks, availability of regulatory approvals, the impact of investments

in Master Asset Vehicles, corporate objectives and plans or goals, are or may be

forward-looking statements. These forward-looking statements are not based on

historic facts, but rather on current expectations, assumptions and projections

about future events. There is significant risk that predictions, forecasts,

conclusions or projections will not prove to be accurate, that those assumptions

may not be correct and that actual results may differ materially from such

predictions, forecasts, conclusions or projections. Sherritt cautions readers of

this press release not to place undue reliance on any forward-looking statements

as a number of factors could cause actual future results, conditions, actions or

events to differ materially from the targets, expectations, estimates or

intentions expressed in the forward-looking statements. By their nature,

forward-looking statements require Sherritt to make assumptions and are subject

to inherent risks and uncertainties. Key factors that may result in material

differences between actual results and developments and those contemplated by

this press release include global economic conditions, business, economic and

political conditions in Canada, Cuba, Madagascar, and the principal markets for

Sherritt's products.

Other such factors include, but are not limited to, uncertainties in the

development and construction of large mining projects; risks related to the

availability of capital to undertake capital initiatives; changes in capital

cost estimates in respect of the Corporation's capital initiatives; risks

associated with Sherritt's joint venture partners; future non-compliance with

financial covenants; potential interruptions in transportation; political,

economic and other risks of foreign operations; Sherritt's reliance on key

personnel and skilled workers; the possibility of equipment and other unexpected

failures; the potential for shortages of equipment and supplies; risks

associated with mining, processing and refining activities; uncertainties in oil

and gas exploration; risks related to foreign-exchange controls on Cuban

government enterprises to transact in foreign currency; risks associated with

the United States embargo on Cuba and the Helms-Burton legislation; risks

related to the Cuban government's ability to make certain payments to the

Corporation; development programs; uncertainties in reserve estimates;

uncertainties in asset retirement and reclamation cost estimates; Sherritt's

reliance on significant customers; foreign exchange and pricing risks;

uncertainties in commodity pricing; credit risks; competition in product

markets; Sherritt's ability to access markets; risks in obtaining insurance;

uncertainties in labour relations; uncertainties in pension liabilities; the

ability of Sherritt to enforce legal rights in foreign jurisdictions; the

ability of Sherritt to obtain government permits; risks associated with

government regulations and environmental health and safety matters; and other

factors listed from time to time in Sherritt's continuous disclosure documents.

Further, any forward-looking statement speaks only as of the date on which such

statement is made, and except as required by law, Sherritt undertakes no

obligation to update any forward-looking statements.

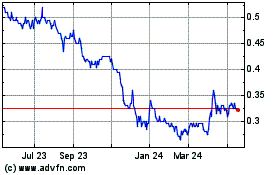

Sherritt (TSX:S)

Historical Stock Chart

From Oct 2024 to Nov 2024

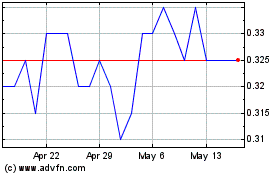

Sherritt (TSX:S)

Historical Stock Chart

From Nov 2023 to Nov 2024