Prairie Provident Resources Inc. ("Prairie Provident" or the

"Company") is pleased to announce that it has entered into a Debt

Restructuring Agreement (the "Debt Restructuring Agreement") with

PCEP Canadian Holdco, LLC (the "Noteholder"), which holds all of

the Company's outstanding subordinated notes (the "Subordinated

Notes") and share purchase warrants, and certain affiliates of the

Noteholder, and agreements with certain other parties, for various

recapitalization transactions (collectively, the

"Recapitalization") to, among other things, raise additional equity

and debt capital, significantly reduce the Company's total debt

through a repayment of all outstanding Subordinated Notes with

equity, waive certain defaults under existing credit agreements,

and extend the maturity date of its senior secured credit facility

(the "First Lien Loan"). In connection with the Recapitalization,

Prairie Provident has applied to the Toronto Stock Exchange ("TSX")

for an exemption from shareholder approval requirements under TSX

rules, pursuant to the 'financial hardship' provisions of the TSX

Company Manual, as prompt action is required to relieve the

Company's current financial difficulties and enable it to normalize

operations and resume the development of its assets.

The Recapitalization includes the following

principal transactions, all of which are subject to certain

conditions as provided in the Debt Restructuring Agreement and

other applicable transaction agreements:

- an immediate

new investment of US$3.64 million (approximately C$5 million at

current exchange rates) by certain affiliates of the Noteholder

through an issue of second lien notes due December 31, 2024 (the

"Second Lien Notes"), which the Company expects to complete on or

about March 30, 2023, and will provide the Company with the

liquidity needed to meet immediate and pressing working capital

requirements (the "Second Lien Financing");

- amendments and

waivers (the "First Lien Loan Amendments") to the First Lien Loan,

under which total advances of US$19.1 million and C$41.1 million

are currently drawn and outstanding, to extend the maturity date

from December 31, 2023 to July 1, 2024, defer any borrowing base

redetermination until 2024, provide additional covenant

flexibility, and waive certain financial covenant and other

defaults as more particularly described below, which amendments

will become effective on completion of the Second Lien Financing

and the concurrent effectiveness of the Subordinated Note

Amendments described below;

- amendments and

waivers (the "Subordinated Note Amendments") to the Subordinated

Notes to provide additional covenant flexibility, extend the

maturity date of the Subordinated Notes currently due June 30, 2024

to December 31, 2024, and waive certain financial covenant and

other defaults as more particularly described below, which

amendments are required now in order to address current defaults

and ongoing compliance pending completion of the Subordinated Notes

Conversion (defined below), and will become effective on completion

of the Second Lien Financing and the concurrent effectiveness of

the First Lien Loan Amendments;

- settlement of

all outstanding indebtedness under the Subordinated Notes, in the

aggregate amount of US$52.8 million, through an issue of common

shares of the Company ("Common Shares"), conditional upon Prairie

Provident completion of an offering of new equity for gross

proceeds of at least C$4,000,000 (the "New Equity Condition"), at

an agreed repayment price equal to 105% of the price at which

equity is in fact sold in such offering (the "Subordinated Notes

Conversion");

- concurrently

with the Subordinated Notes Conversion, exercise by the Noteholder,

on a cashless basis, of the 34,292,360 warrants of the Company

previously issued in December 2020 in connection with the

Subordinated Note financing completed at that time, which warrants

have an exercise price of C$0.0192 per share (the "Warrant

Exercise"); and

- a brokered

'best efforts' equity offering by the Company for minimum aggregate

gross proceeds of C$4,000,000 of common shares and warrants (the

"Equity Financing"), in reliance upon the 'listed issuer financing

exemption' (LIFE) under applicable Canadian securities laws,

successful completion of which will satisfy the New Equity

Condition.

The First Lien Loan Amendments, the Subordinated

Note Amendments and the Second Lien Financing are not conditional

on completion of any other transactions forming part of the

Recapitalization, but are conditional on one another and on the

Company's agreement to immediately proceed with and pursue the

remainder of the Recapitalization transactions on the terms

summarized herein.

The Subordinated Notes Conversion is conditional

on, among other things, satisfaction of the New Equity Condition

not later than May 31, 2023 and all requisite TSX approvals,

including acceptance of the Company's reliance on the financial

hardship exemption described below for the completion of certain of

the Recapitalization transactions.

The Recapitalization is necessary for the

Company to relieve its current condition of financial hardship,

resulting from an unsustainable total debt level and pressing

liquidity deficit. It will achieve a significant deleveraging of

Prairie Provident, reducing total debt by approximately 49% from

approximately C$139 million1 to C$71 million2 after giving effect

to the Second Lien Financing and Subordinated Notes Conversion. New

capital from the Second Lien Financing (approximately C$5 million

at current exchange rates) will bring immediate liquidity relief,

with net proceeds directed towards outstanding payables of which

approximately C$5 million are over 60 days past due. Payment delays

have strained relationships with vendors and service providers, and

the timely remedy of those delays is crucially important to

normalize operations and resume development activity. Immediate

capital through the Second Lien Financing, promptly followed by

incremental near-term capital through the Equity Financing (minimum

C$4 million in gross proceeds), will be used to retire overdue

payables and regularize the Company's working capital position,

which in turn provides Prairie Provident with the funds needed to

meet its business objectives and liquidity requirements for the

next 12 months.

Given the large number of Common Shares to be

issued pursuant to the Recapitalization, the Company anticipates

that it will seek approval at its next annual meeting of

shareholders for a consolidation of its Common Shares. Whether the

Company proceeds with a consolidation, and the consolidation ratio,

will be determined in advance of the annual meeting.

Further details regarding the Recapitalization

and constituent transactions, the terms of which have been

negotiated at arm's length between the Company and the applicable

counterparties, are provided below.

______________________1 Comprised of

C$41.1 in CAD advances under the First Lien Loan, US$19.1 million

in USD advances under the First Lien Loan, and US$52.8 million in

Subordinated Notes (including deferred interest amounts paid in

kind), with USD amounts converted to CAD at an exchange rate of USD

1.00 to CAD 1.3626.

2 Comprised of C$41.1 in CAD advances

under the First Lien Loan, US$19.1 million in USD advances under

the First Lien Loan, and US$3.64 million in Second Lien Notes, with

USD amounts converted to CAD at an exchange rate of USD 1.00 to CAD

1.3626.

Benefits to Prairie

Provident

The Recapitalization will, if completed,

significantly reduce the Company's total indebtedness, stop the

accrual of additional indebtedness that has been accumulating since

April 2020 as deferred interest amounts paid in kind on the

Subordinated Notes (which amounts totaled US$3.3 million in 2022

alone), materially reduce the Company's foreign exchange exposure

on USD denominated debt, provide comfort and stability with respect

to the borrowing base and term of the First Lien Loan and covenant

compliance thereunder, and better position the Company to execute

on future opportunities. In the immediate term, the Second Lien

Financing will provide the Company with the liquidity needed to

meet immediate working capital requirements for ongoing field

operations by significantly reducing overdue trade payables. Prompt

completion of the Equity Financing will further improve the

Company’s liquidity profile to a sustainable level, including to

remain compliant with a C$500,000 minimum liquidity requirement

under the First Lien Loan.

Going forward, completion of the

Recapitalization is expected to provide Prairie Provident with a

sustainable capital structure and the capital resources necessary

to optimize its current producing assets as well as develop its

currently undeveloped land base, for the benefit of all

stakeholders. Significant improvements to the Company's overall

leverage and non-cash interest burden is expected to allow Prairie

Provident to direct more of its operating cash flow towards

additional low-risk well reactivations, optimization and

development drilling, and improve its ability to execute on future

refinancing, acquisition and divestiture, and other transaction

opportunities. Management believes that the rates of return offered

by the Company's assets, with a 20.4-year reserve life index (based

on proved plus probable reserves and current production levels) and

significant tax pools in excess of C$800 million, support continued

investment to create shareholder value.

Strategic Rationale for the

Recapitalization

In recent years, Prairie Provident has faced an

increasingly challenging lack of liquidity and deteriorating

capital resource position. The Company is currently fully drawn on

the First Lien Loan, with no further draws permitted. Absent the

Recapitalization, its only source of capital is from internally

generated funds from operations, and the First Lien Loan would

mature on December 31, 2023.

The Company has over the past several months

actively sought out and evaluated strategic alternatives intended

to address its liquidity and capital resource constraints. The

Recapitalization is the culmination of these efforts. In the

meantime, Prairie Provident's debt levels have continued to grow as

it is required to make all interest payments on its Subordinated

Notes in kind. From an original principal amount of US$39.9

million, outstanding indebtedness under the Subordinated Notes has

grown to approximately US$52.8 million as a result of deferred

interest amounts that have been paid in kind.

The Company's leverage position has also driven

lender requirements, pursuant to the terms of the First Lien Loan

and Subordinated Notes, to hedge a significant portion of forecast

production. Commodity price movements resulted in total realized

hedging losses of approximately C$21.2 million in the first nine

months of 2022, which impaired the Company's ability to benefit

from improved commodity pricing during this period. This adverse

cash flow impact, combined with higher royalty payments based on

prevailing commodity prices and inflation in operating and capital

costs, drove a significant deterioration in Prairie Provident's

working capital position through 2022 and into 2023.

The Company's rising debt burden and working

capital deficit has left it with an increasingly limited ability to

invest in capital programs, stifling growth and the creation of

shareholder value. Completion of the Recapitalization will enable

the Company to reverse this trend by materially improving its

balance sheet and providing financial flexibility to invest in

future growth.

Equity Financing through LIFE

Offering

In connection with the Equity Financing, the

Company has entered into an agreement with Research Capital Corp.,

as sole agent and sole bookrunner (the "Agent"), for a best-efforts

basis, private placement of equity units ("Units") at a price of

C$0.10 per Unit for minimum aggregate gross proceeds of

C$4,000,000. Each Unit will be comprised of (i) one Common Share,

and (ii) one-half of one Common Share purchase warrant (each whole

warrant, a "Warrant").

Each whole Warrant will entitle the holder

thereof to subscribe for and purchase one Common Share at an

exercise price of C$0.1265 for a period of 60 months from closing

of the Equity Financing.

Matthew Shyba, currently one of Prairie

Provident's largest shareholders and a director of the Company

since July 2022, has provided an indication of interest for a lead

order in the amount of $500,000 (12.5% of the minimum offering

size). The Company welcomes Mr. Shyba’s continued support and his

input into refocusing the business to enhance shareholder value, a

key step of which is completing the Recapitalization.

The closing of the Equity Financing, which may

occur in multiple tranches, is expected to occur on or about the

week of April 13, 2023, or such later or earlier dates as the Agent

and the Company may determine. Prairie Provident intends to close

the Equity Financing as soon as possible in order to address its

near-term working capital needs.

Completion of the Equity Financing is subject to

completion of the Second Lien Financing (which is conditional on

the First Lien Loan Amendments and Subordinated Note Amendments

having become effective), and the concurrent completion of the

Subordinated Notes Conversion and Warrant Exercise, and to Prairie

Provident receiving all necessary TSX approvals.

The Equity Financing will be conducted on a

prospectus-exempt basis pursuant to the 'listed issuer financing

exemption' in Part 5A of National Instrument 45-106 – Prospectus

Exemptions ("NI 45-106") (the "Listed Issuer Financing Exemption")

to purchasers resident in Canada, except Québec, and/or other

qualifying jurisdictions. Any Units issued and sold pursuant to the

Listed Issuer Financing Exemption, and any Common Shares issued on

a future exercise of Warrants, will not be subject to any

restricted hold period pursuant to applicable Canadian securities

laws. In addition, the Company will use commercially reasonable

efforts to obtain the necessary approvals to list the Warrants on

the TSX upon closing of the Equity Financing. Listing

will be subject to the approval of the TSX in accordance with its

original listing requirements.

In consideration for its services, the Agent

will receive a cash commission equal to 8% of the gross proceeds of

the Equity Financing plus broker warrants equal to 8% of the total

number of Units sold (subject to a reduced 4% rate for sales to

certain 'president's list' investors). Each broker warrant will

entitle the holder to subscribe for and purchase one Unit at a

price of $0.1265 for a period of 60 months after closing of the

Equity Financing.

There is an offering document related to the

Equity Financing that can be accessed under the Company's issuer

profile at www.sedar.com and on the Company's website at

www.ppr.ca. Prospective investors should read this offering

document before making an investment decision.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy, nor shall there be

any sale of, any securities in the United States or in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities have not been and will not be registered

under the United States Securities Act of 1933, as amended (the

"1933 Act") or any U.S. state securities laws, and may not be

offered or sold within the United States or to, or for account or

benefit of, U.S. Persons (as defined in Regulation S under the 1933

Act) except in compliance with, or pursuant to an available

exemption from, the registration requirements of the 1933 Act and

applicable U.S. state securities laws.

First Lien Loan Amendments

The Company has entered into an amending

agreement and waiver with the lenders under the First Lien Loan to

extend the maturity date from December 31, 2023 to July 1, 2024, to

defer any borrowing base redetermination until 2024, to reset

financial covenants to thresholds that align with the Company's

current expectations for the remaining term, and to waive certain

defaults relating to non-compliance with specified hedging

requirements, not having repaid amounts in excess of the maximum

permitted amount of CAD denominated advances previously available

under the First Lien Loan, and anticipated non-compliance with

certain financial covenants as at December 31, 2022, as well as

corresponding cross-defaults under the agreements governing the

Subordinated Notes. Going forward, the Company will be required to

maintain available cash and cash equivalents of at least C$500,000

at all times. The First Lien Loan Amendments also provide for

additional reporting obligations in favour of the lenders, and

remove certain procedural requirements pertaining to any future

exercise of lender remedies.

The First Lien Loan Amendments will become

effective on completion of the Second Lien Financing and the

concurrent effectiveness of the Subordinated Note Amendments, and

are not otherwise conditional upon completion of any other

transaction forming part of the Recapitalization.

Prairie Provident currently has approximately

US$19.1 million and C$41.1 million drawn on the First Lien Loan. No

further draws are permitted. The interest margin on the First Lien

Loan is unchanged at 950 bps per annum above benchmark rates.

Failure to complete the Equity Financing and the

Subordinated Debt Conversion by May 31, 2023 will constitute an

event of default under the First Lien Loan, in which case the

lenders under the First Lien Loan would be entitled to demand

repayment of the full amounts owing under the First Lien Loan and

exercise creditors' remedies against the Company. Prairie

Provident's liquidity requirements are, however, such that

completion of the Recapitalization cannot be delayed until May.

Subordinated Note

Amendments

The Company has concurrently entered into

amending agreements and waivers with the Noteholder to extend the

maturity date of the Subordinated Notes maturing on June 30, 2024

to December 31, 2024, to change the maturity date of the

Subordinated Notes maturing on December 21, 2026 to December 31,

2024, to reset financial covenants to thresholds that align with

the Company's current expectations for the remaining term, and to

waive non-compliance with specified hedging requirements and

anticipated non-compliance with certain financial covenants as at

December 31, 2022, as well as corresponding cross-defaults under

the agreement governing the First Lien Loan.

The Subordinated Note Amendments will become

effective on completion of the Second Lien Financing and the

concurrent effectiveness of the First Lien Loan Amendments, and are

not otherwise conditional upon completion of any other transaction

forming part of the Recapitalization.

Prairie Provident currently has approximately

US$52.8 million in outstanding indebtedness under the Subordinated

Notes, including US$12.9 million of Subordinated Notes representing

deferred interest amounts that have been paid in kind. The interest

margin on the Subordinated Notes is unchanged at 8.0% for the

Subordinated Notes issued on each of October 31, 2017 and November

21, 2018, and 12.0% for the Subordinated Notes issued on December

31, 2020.

Failure to complete the Equity Financing and the

Subordinated Notes Conversion by May 31, 2023 will constitute an

event of default under the Subordinated Notes and a termination of

the waivers described herein. Prairie Provident's liquidity

requirements are, however, such that completion of the

Recapitalization cannot be delayed until May.

Second Lien Financing and Subordinated

Notes Conversion

Prairie Provident has entered into the Debt

Restructuring Agreement with the Noteholder and certain of its

affiliates providing for both the Second Lien Financing and the

Subordinated Notes Conversion and Warrant Exercise.

Second Lien Financing

In accordance with terms and conditions of the

Debt Restructuring Agreement, Prairie Provident and certain

affiliates of the Noteholder have agreed to enter into a note

purchase agreement for the Second Lien Financing, pursuant to which

such affiliates will purchase US$3.64 million (approximately C$5

million at current exchange rates) principal amount of new Second

Lien Notes.

The Second Lien Notes will have a maturity date

of December 31, 2024 and bear interest at a margin equal to 1150

bps per annum above the Secured Overnight Financing Rate (SOFR).

Interest due on the Second Lien Notes must be paid in kind while

the First Lien Loan is outstanding.

The note purchase agreement for the Second Lien

Notes also provides for payment by the Company of a deferred

compensation fee on the later of (i) maturity or earlier prepayment

or acceleration of the Second Lien Notes, and (ii) the date on

which the First Lien Loan is fully repaid, in an amount equal to

US$2.91 million less actual interest and breakage cost obligations

paid on the Second Lien Notes from the issue date through such

later date, provided that such fee shall not result in an internal

rate of return on the Second Lien Notes that exceeds 45% per annum.

Assuming (i) an issue date of March 30, 2023, (ii) repayment at

maturity on December 31, 2024, and (iii) that SOFR remains at 4.81%

through the term, total accrued interest on the Second Lien Notes

will be approximately US$1.04 million and the deferred compensation

fee payable on maturity will therefore be US$1.87 million.

The Company expects to complete the Second Lien

Financing on or about March 30, 2023.

Completion of the Second Lien Financing will

happen concurrently with the First Lien Loan Amendments and

Subordinated Note Amendments becoming effective, and is not

otherwise conditional upon completion of any other transaction

forming part of the Recapitalization.

Failure to complete the Equity Financing and the

Subordinated Notes Conversion by May 31, 2023 will constitute an

event of default under the Second Lien Notes.

Subordinated Notes Conversion

Pursuant to the Debt Restructuring Agreement,

Prairie Provident and the Noteholder have also agreed, upon and

subject to the terms and conditions thereof, including the New

Equity Condition, TSX approval (including acceptance of the

Company's reliance on the financial hardship exemption described

below) and other customary conditions, to effect the Subordinated

Notes Conversion.

The Subordinated Notes Conversion will settle

all outstanding indebtedness under the Subordinated Notes, in the

aggregate original principal amount of US$39.9 million plus

approximately US$12.9 million in deferred interest amounts

previously paid in kind, through an issue of Common Shares at an

agreed repayment price equal to 105% of the price at which Common

Shares (or units comprised of Common Shares and warrants) are

issued under the financing transaction that meets the New Equity

Condition.

Assuming satisfaction of the New Equity

Condition through the Equity Financing, and based on the Unit

offering price thereunder, the repayment price applicable to the

Subordinated Notes Conversion will be C$0.105 per share. At that

conversion price, and applying a current USD-to-CAD exchange rate

of 1.3626 to the approximately US$52.8 million total balance

currently outstanding under the Subordinated Notes, approximately

686 million Common Shares will be issuable pursuant to the

Subordinated Notes Conversion. The actual exchange rate that will

be applied on the Subordinated Notes Conversion will be the rate

quoted by the Bank of Canada on the day before the date on which

Subordinated Notes Conversion is completed. The number of Common

Shares ultimately issuable on completion of the Subordinated Notes

Conversion will therefore depend on the exchange rate at the time

of completion as well as the actual outstanding balance owed under

the Subordinated Notes at that time, which based on interest rates

currently applicable to the Subordinated Notes increases by

approximately US$13,000 per day.

The Warrant Exercise will be effected

concurrently with the Subordinated Notes Conversion, whereby the

approximately 34.3 million outstanding warrants originally issued

by Prairie Provident in connection with Subordinated Note

transactions previously completed in December 2020 will be

exercised on a cashless basis. Based on an assumed market price per

Common Share of C$0.1265 and the exercise price of C$0.0192 per

share under the warrants, approximately 29.1 million additional

Common Shares will be issued on the Warrant Exercise.

The Common Shares issued pursuant to the

Subordinated Notes Conversion will be subject to a 4-month

restricted hold period under applicable Canadian securities laws.

The Common Shares issued pursuant to the Warrant Exercise will not

be subject to a 4-month restricted hold period under applicable

Canadian securities laws. All such Common Shares will, however, be

subject to selling restrictions applicable to 'control persons'

under the applicable Canadian securities laws, as the Noteholder

will be a 'control person' of Prairie Provident within the meaning

of such laws.

In addition, the Noteholder has agreed with the

Company to certain 'lock-up' restrictions pursuant to which the

Noteholder will not, without Prairie Provident's consent, dispose

of Common Shares acquired by it pursuant to the Subordinated Notes

Conversion, otherwise than in connection with a business

combination, a reorganization or restructuring, or an acquisition

of all or substantially all of the Common Shares, or pursuant to a

private sale, or to an affiliate or other related party. The

lock-up restrictions will cease to apply as to 33⅓% all such Common

Shares on each of the 6-month, 12-month and 18-month anniversaries,

respectively, of the Subordinated Notes Conversion.

The total pro forma holding of Common Shares

(undiluted) of the Noteholder following completion of the Equity

Financing for minimum gross proceeds of C$4,000,000 and following

the Subordinated Notes Conversion and related Warrant Exercise is

expected to be approximately 715 million Common Shares,

representing approximately 81% of the total outstanding Common

Shares.

As the Noteholder will, after giving effect to

the Subordinated Notes Conversion, Warrant Exercise and Equity

Financing, hold more than 80% of the outstanding Common Shares

after the Recapitalization, the Noteholder will be a 'control

person' of Prairie Provident under applicable Canadian securities

laws, and the Recapitalization will materially affect control of

Prairie Provident within the meaning of TSX rules. See "Pro Forma

Shareholding Information" below.

Investor Rights Agreement

The Debt Restructuring Agreement also provides

that in connection with completion of the Subordinated Notes

Conversion the Company will enter into an Investor Rights Agreement

and a Registration Rights Agreement with the Noteholder and certain

of its affiliates (the "Holders" for the purposes of the

following).

Pursuant to the Investor Rights Agreement:

- the size of the

Company's board of directors will be fixed at five (5), with the

Holders having the right to nominate three directors for so long as

they hold more than 50% of the outstanding voting securities of the

Company, two directors for so long as they hold at least 25% of the

outstanding voting securities but less than 50%, and one director

for so long as they hold at least 10% of the outstanding voting

securities but less than 25%;

- the Holders

will have pre-emptive rights to participate in any future public or

private offering by the Company of equity securities, or of

securities that are convertible or exercisable into equity

securities, to such extent as maintains their proportionate

interest in voting securities of the Company; and

- the Holders

will, with respect to the Common Shares issued on the Subordinated

Notes Conversion, receive an anti-dilution adjustment right (the

"Adjustment Right") entitling the Holders to receive, for no

additional consideration and subject to certain exceptions, in the

event of Prairie Provident issuing, within 6 months after

completion of the Subordinated Notes Conversion, Common Shares a

price (or securities convertible or exercisable into Common Shares

at a conversion or exercise price) that is less than the repayment

price per share at which the Subordinated Notes Conversion is

completed, such number of additional Common Shares as (i) reduces

the effective price per share of the Common Shares issued on the

Subordinated Notes Conversion, when taken together with such

additional Common Shares issued for no additional consideration, to

such lower price, or (ii) maintains the Holders' voting interest,

whichever number is the lesser. As an illustrative example,

assuming an issue to the Noteholder of 686 million Common Shares

pursuant to the Subordinated Note Conversion (as set out under "Pro

Forma Shareholding Information" below) at a repayment price of

C$0.105, and a subsequent issue of 50 million Common Shares at a

price of C$0.08 per share one month thereafter, the Adjustment

Right could result in a maximum of up to 210 million additional

Common Shares being issued to the Holders for no additional

consideration, such that the average price per share of the 896

million Common Shares issued pursuant to the Subordinated Note

Conversion plus the additional Common Shares issued pursuant to the

Adjustment Right becomes C$0.08 – except that the number of such

additional Common Shares cannot exceed the number that would simply

maintain the Holders' voting interest. This latter cap operates to

prevent a small issuance of Common Shares at a price below the

repayment price from resulting in a disproportionately large number

of additional Common Shares being issued pursuant to the Adjustment

Right.

Registration Rights Agreement

The Registration Rights Agreement will give the

Holders customary rights to require that Prairie Provident file a

prospectus and otherwise take steps to qualify for public

distribution a future sale of Common Shares by the Holders (i.e.,

demand registration rights), and include in a future public

offering of equity securities that might be undertaken by the

Company, in addition to the new securities offered by the Company,

shares of the Holders (i.e., piggy-back registration rights), all

upon and subject to the terms and conditions of the Registration

Rights Agreement.

Pro Forma Shareholding

Information

The following table sets forth information

regarding the total pro forma holdings of Common Shares (undiluted)

of the Noteholder, of subscribers under the Equity Financing, and

of current Prairie Provident shareholders, after completion of the

Subordinated Notes Conversion, the Warrant Exercise and the Equity

Financing, based on the assumptions identified therein and in the

notes to the table.

|

|

Assuming Minimum Gross Proceeds of C$4,000,000 under Equity

Financing (1) |

Assuming Maximum Gross Proceeds of C$4,075,000 under Equity

Financing (2) |

|

Noteholder per Subordinated Notes Conversion (3) |

77.5%(686 million Common Shares) |

77.4%(686 million Common Shares) |

|

Noteholder per Warrant Exercise (4) |

3.3%(29 million Common Shares) |

3.3%(29 million Common Shares) |

|

Noteholder Subtotal |

80.8%(715 million Common Shares) |

80.7%(715 million Common Shares) |

|

Subscribers under Equity Financing |

4.5% (1)(40 million Common Shares) |

4.6% (2)(41 million Common Shares) |

|

TOTAL NEW SHARES(Subordinated Notes Conversion plusWarrant Exercise

plus Equity Financing) |

85.3% (5)(755 million Common Shares) |

85.3% (6)(755 million Common Shares) |

|

EXISTING SHAREHOLDERS |

14.7%(130 million Common Shares) |

14.7%(130 million Common Shares) |

Figures may not add due to rounding.

Notes:

|

(1) |

Assumes the issuance of 40.0 million Units at a price of C$0.10 per

Unit (being a 20.9% discount to the market price of the Common

Shares on the TSX on March 28, 2023 of C$0.1265 per share) for

total gross proceeds of C$4.0 million. |

|

|

|

|

(2) |

Assumes the issuance of 40.75 million Units at a price of C$0.10

per Unit for total gross proceeds of C$4.1 million. |

|

|

|

|

(3) |

Assumes (i) a repayment price of C$0.105 per share, (ii) a

completion date of April 1, 2023, at which time the outstanding

balance owed under the Subordinated Notes will be US$52.8 million

and (iii) a USD-to-CAD exchange rate of 1.3626. |

|

|

|

|

(4) |

Assumes a market price of the Common Shares on the TSX of C$0.1265

per share at the date of completion, which would result in an

'in-the-money' amount of C$0.1073 per warrant held by the

Noteholder based on the exercise price of C$0.0192 per share, with

the total number of Common Shares issuable pursuant to the Warrant

Exercise being such number of Common Shares as have a value, based

on such market price, equal to the aggregate in-the-money value of

all such warrants. |

|

|

|

|

(5) |

Represents an increase of 755 million or approximately 680% in the

number of Common Shares outstanding, from 130 million Common Shares

outstanding today to 885 million outstanding after completion of

the Subordinated Notes Conversion, Warrant Exercise and Equity

Financing based on the assumptions described above. |

|

|

|

|

(6) |

Represents an increase of 755 million or approximately 681% in the

number of Common Shares outstanding, from 130 million Common Shares

outstanding today to 885 million outstanding after completion of

the Subordinated Notes Conversion, Warrant Exercise and Equity

Financing based on the assumptions described above. |

| |

|

Background to and Consideration of the

Recapitalization Transactions

Prairie Provident has limited liquidity and

capital resources from which to meet its obligations and execute on

its business plan. Available borrowing capacity under the First

Lien Loan of US$6.4 million at year-end 2021 decreased to nil at

year-end 2022, partly due to a year-over-year reduction in the

borrowing base from US$53.8 million to US$50 million. Deferred

interest amounts on the Subordinated Notes have, in accordance with

commitments to the lenders under the First Lien Loan, continued to

be paid-in-kind and increase total indebtedness under the

Subordinated Notes.

The Company's liquidity has been further

compromised by the adverse cash flow impact of low commodity price

hedges throughout 2022, which when combined with increasing royalty

payments and inflation in operating and capital costs resulted in

Prairie Provident benefiting much less from higher commodity prices

in 2022 than many of its peers and contributed to a current working

capital deficit that is unsustainable. Without access to further

draws under the First Lien Loan, the Company has an immediate need

for new capital from which to satisfy payables and continue to fund

operations.

The combination of high debt and low liquidity

has limited the Company's ability to execute on its business plan

and access new capital (equity, debt or other), or to generate

additional funds through assets sales, joint ventures or other

industry transactions on reasonable terms.

Given the December 31, 2023 maturity of the

First Lien Loan and its over-levered balance sheet, the Company

engaged independent financial advisors in mid-2022 to assist in

identifying and developing potential refinancing and/or disposition

opportunities, while also pursuing discussions with the First Lien

Loan lenders and the holders of the Subordinated Notes, to explore

potential solutions to its liquidity and capital resources position

and avoid an event of default or similarly adverse consequences

under its existing credit arrangements. Following a broad canvass

to surface potential alternatives, the Company's efforts have

culminated in the Recapitalization.

In considering the Recapitalization and the

terms and conditions of each of its transactions, the Prairie

Provident board of directors (the "Board of Directors") undertook a

review of the Company's reasonable alternatives, prospects and the

Company's borrowing arrangements, including the consideration of

the factors and matters set forth below:

- the absence of

other alternatives reasonably available to Prairie Provident to

refinance (by way of debt, equity or otherwise) its current

borrowing arrangements;

- the immediacy

and magnitude of the Company's working capital requirements for

ongoing field operations and to settle outstanding payables, with a

significant portion of the Company’s trade payables substantially

overdue;

- the certainty

of a substantial reduction of debt and related servicing costs

through the Subordinated Debt Conversion, and the overall reduction

of total debt upon completion of the Recapitalization from

approximately C$139 million to approximately C$71 million, a

decrease of approximately 49%;

- the mitigation

of solvency risk associated with the Company's status quo position,

including the risk of near immediate debt maturities, and potential

creditor or similar proceedings in connection to the same, which

may have the effect of reducing or eliminating any value associated

with Prairie Provident's equity;

- the anticipated

ability to apply a portion of cash flow in 2023 to repay some

portion of outstanding amounts under the First Lien Loan, further

de-leveraging the Company's balance sheet and providing potential

liquidity to resume drilling and development opportunities;

- the repayment

price per share under the Subordinated Notes Conversion;

- that the

Subordinated Notes Conversion preserves the Company's cash

resources, which may be used for other expenditures, including

development of the Company's asset base and repayment of

outstanding amounts under the First Lien Loan;

- that since

April 2020, all interest under the Subordinated Notes, which

currently bear interest at 8% to 12% per annum, has been paid in

kind and as such capitalized as additional principal amount of

Subordinated Notes, which has a compounding effect to increase the

principal amount payable thereunder from time to time;

- the advantages

of having potential funding available to resume development of the

Company's asset base, with a view to increasing production,

reserves and revenue generating activities for the benefit of all

stakeholders; and

- the risks

associated with trying to secure funding from other third parties,

including the risk that such funding may not be available, on any

reasonable terms, measured against the relative certainty of the

Recapitalization.

No director has any interest in any

Recapitalization transaction apart from Matthew Shyba, who as noted

above has provided an indication of interest for a lead order in

the amount of $400,000 under the Equity Financing. That potential

interest was recognized and considered by the Independent Committee

referred to below.

Post-Recapitalization

Outlook

The Company believes that the Recapitalization

will allow it to begin to reinvest cash flows in its core

operations. Production averaged 4,072 boe/d in 2022, with a decline

in the fourth quarter due to the Company’s lack of capital. If the

Recapitalization is completed, Prairie Provident believes that it

will be able to flatten out its production declines with a limited

capital budget in 2023, while returning to growth in 2024. Based on

the Sproule December 31, 2022 price deck, the Company's guidance

for key financial figures would be as follows:

|

|

2023 |

2024 |

|

Avg. Production (boe/d) |

4,000 - 4,200 |

4,300 - 4,500 |

|

Capital Budget (1) |

$14 - 16MM |

$22 - 25MM |

|

EBITDA (2) |

$35 - 42MM |

$40 - 45MM |

|

Free Funds Flow (2) |

$17 - 22MM |

$20 - 25MM |

|

Exit Debt |

$55 - 65MM |

$45 - 55MM |

|

Exit Debt/EBITDA |

1.5 - 2.0x |

1.2 - 1.7x |

Notes:

|

(1) |

Including expenditures on Asset Retirement Obligations. |

|

|

|

|

(2) |

EBITDA is a non-GAAP measure. See "Non-GAAP and Other Financial

Measures, and Oil and Gas Metrics" below in this news release. |

|

|

|

|

(3) |

Free Funds Flow is a non-GAAP measure. See "Non-GAAP and Other

Financial Measures, and Oil and Gas Metrics" below in this news

release. |

|

|

|

TSX Approval and Financial Hardship

Exemptions

Completion of the Recapitalization, and in

particular the Subordinated Notes Conversion, the Equity Financing

(including insider participation in such financing) and the

Adjustment Right under the proposed Investor Rights Agreement, is

conditional on receipt by Prairie Provident of TSX approvals.

Pursuant to TSX rules, the Recapitalization

would ordinarily require approval of the Company's disinterested

shareholders:

- under section

604(a)(i) of the TSX Company Manual, on the basis that the

Noteholder will, after giving effect to the Subordinated Notes

Conversion and related Warrant Exercise as well as the Equity

Financing, hold more than 20% of the outstanding Common Shares and

the Recapitalization will therefore be considered by TSX to

materially affect control of Prairie Provident;

- under section

604(a)(ii) of the TSX Company Manual, on the basis that (i) the

Noteholder is, by reason of holding warrants pursuant to which it

has the right to acquire more than 10% of the outstanding Common

Shares, an insider of Prairie Provident, and (ii) the Common Shares

issuable to the Noteholder on the Subordinated Notes Conversion and

Warrant Exercise, and the total interest plus deferred compensation

fee payable over the term of the Second Lien Notes payable to

certain affiliates of the Noteholder, will provide the Noteholder

and such affiliates with more than 10% of the Company's market

capitalization;

- under section

607(g)(i) of the TSX Company Manual, on the basis that (i) the

repayment price under the Subordinated Notes Conversion

(anticipated to be C$0.105 per Common Share based on the offering

price of C$0.10 per Unit under the Equity Financing) will be less

than the 5-day volume weighted average trading price of the Common

Shares prior to the date of this news release (C$0.1265 per share),

and (ii) the number of new Common Shares issuable pursuant to the

Subordinated Notes Conversion (estimated to be approximately 686

million Common Shares based on the assumptions described above

under "Pro Forma Shareholding Information") will be greater than

25% of the number of Common Shares currently issued and outstanding

on an undiluted basis (130 million);

- under section

607(g)(i) of the TSX Company Manual, on the basis that (i) the

offering price under the Equity Financing (C$0.10 per Unit) is less

than the 5-day volume weighted average trading price of the Common

Shares prior to the date of this news release (C$0.1265 per share),

and (ii) the number of new Common Shares issuable pursuant to the

Equity Financing (being at least 40 million Common Shares forming

part of the minimum number of Units issuable to raise gross

proceeds of not less than C$4,000,000 plus a further 20 million

Common Shares issuable on exercise of the warrants forming part of

such Units) will be greater than 25% of the number of Common Shares

currently issued and outstanding on an undiluted basis

(130,116,666);

- under section

607(g)(ii) of the TSX Company Manual, on the basis that (i) the

Noteholder is, by reason of holding warrants pursuant to which it

has the right to acquire more than 10% of the outstanding Common

Shares, an insider of Prairie Provident, and (ii) the total number

of Common Shares issuable to the Noteholder on the Subordinated

Notes Conversion and Warrant Exercise, whether alone or taken

together with any number of Common Shares (including Common Shares

issuable under the warrants) that any director or officer of the

Company may acquire under the Equity Financing, is greater than 10%

of the outstanding Common Shares (it being noted, however, that no

director or officer that acquires Common Shares, including Common

Shares issuable under the warrants, will individually acquire more

than 10% of the outstanding Common Shares);

- under section

607(g)(ii) of the TSX Company Manual, on the basis that Matthew

Shyba, a current director of Prairie Provident who has provided an

indication of interest for a lead order of $500,000 under the

Equity Financing might, and any other director or officer of the

Company that participates in the Equity Financing might, depending

on overall market demand, acquire under the Equity Financing such

number of Common Shares (including Common Shares issuable under the

warrants) as exceeds 10% of the number of Common Shares currently

outstanding;

- under section

607(e) of the TSX Company Manual, on the basis that the Adjustment

Right constitutes an adjustment for which not all shareholders are

compensated, and may result in securities being issued at a price

lower than market price less the permissible discount under TSX

rules;

- on the basis

that the price at which Common Shares are issuable pursuant to the

Subordinated Notes Conversion, and the price at which Units are

offered pursuant to the Equity Financing, was determined prior to

the pending release of Prairie Provident's financial and operating

results for the year-ended December 31, 2022, which release is

expected to be made on March 31, 2023;

- on the basis

that the compensation payable to the Agent for their services in

respect of the Equity Financing is higher than general TSX

guidelines; and

- on the basis

that (i) the repayment price for the Subordinated Note Conversion

and offering price under the Equity Financing were determined prior

to public disclosure of the Recapitalization, (ii) TSX would

ordinarily in such circumstances restrict insider participation to

maintenance of their pro rata holding, unless otherwise approved by

shareholders, and (iii) participation by the Noteholder (who is, as

a result of holding warrants, an insider of the Company) in the

Recapitalization will, and participation by any director or officer

in the Equity Financing may, result in such parties increasing

their pro rata holdings of Common Shares.

The Company has applied to the TSX pursuant to

the "financial hardship" provisions of section 604(e) of the TSX

Company Manual for an exemption from any such shareholder approval

requirement, on the basis that Prairie Provident is in serious

financial difficulty and the immediacy of its need to reduce

indebtedness and raise additional capital does not afford it

sufficient time to seek that approval. This is reflected in the

Debt Restructuring Agreement entered into between the Noteholder

and Prairie Provident in respect of the Recapitalization, which (i)

provides for both the Second Lien Financing and Subordinated Notes

Conversion, (ii) contemplates immediate action on the

Recapitalization, and (iii) includes as a condition precedent to

the Noteholder's obligation to complete the Subordinated Notes

Conversion that the TSX accept the Company's application to rely on

the financial hardship exemption. This aligns with the Company's

pressing need for debt reduction and liquidity relief.

As the offering price under the Equity Financing

(and therefore the repayment price under the Subordinated Notes

Conversion) was determined before the Recapitalization was

disclosed, the Company has also certified to the TSX that the

Company would not have entered into the Recapitalization without

having also priced the Equity Financing.

The TSX is considering the application in

connection with its review of the Company's request for TSX

approval of the applicable Recapitalization

transactions. There is no certainty that the TSX will

approve the Subordinated Notes Conversion, the Equity Financing (or

the insider participation thereunder) or the Adjustment Right under

the proposed Investor Rights Agreement, or accept the Company's

application to rely on the financial hardship exemption.

A special committee of independent and

disinterested directors (the "Independent Committee") has

considered the terms of the Recapitalization transactions and, in

the circumstances, recommended that the "financial hardship"

application be made to the TSX. The Independent Committee has

determined, and the Board of Directors has unanimously agreed, that

Prairie Provident is in serious financial difficulty, and that the

Recapitalization (including, in particular, the Subordinated Notes

Conversion and Equity Financing) is reasonable in the circumstances

and designed to improve the Company's financial situation. In doing

so, the Independent Committee specifically considered the need for

a timely completion of the Recapitalization in light of the

Company's pressing financial obligations and the requirements of

its lenders.

Prairie Provident expects that, as a consequence

of its "financial hardship" exemption application, the TSX will

place the Company under a remedial delisting review, which is

normal practice when a listed issuer seeks to rely on this

exemption. Although the Company believes that it will be in

compliance with all continued listing requirements of the TSX upon

conclusion of a delisting review, no assurance can be provided as

to the outcome of that review and, therefore, on Prairie

Provident's continued qualification for listing on the TSX.

The Company has determined that the Subordinated

Notes Conversion (in the event that the Noteholder might be

considered a 'related party' of Prairie Provident despite being a

bona fide lender), and any participation by directors or officers

in the Equity Financing, insofar as such transactions might be

considered 'related party transactions' within the meaning of

Multilateral Instrument 61-101 - Protection of Minority Security

Holders in Special Transactions ("MI 61-101"), are also exempt from

any formal valuation and minority approval requirements that might

otherwise be applicable under MI 61-101 pursuant to the 'financial

hardship' exemptions set forth in Sections 5.5(g) and 5.7(1)(e) of

MI 61-101. In connection with the same, and as noted above, the

Board of Directors (including all independent directors) has in

good faith determined that: (i) the Company is in serious financial

difficulty; (ii) the Subordinated Notes Conversion and the Equity

Financing are designed to improve the financial position of the

Company; and (iii) the terms of the Subordinated Notes Conversion

and the Equity Financing are reasonable in the circumstances of the

Company. Further information required by MI 61-101 in connection

with the Subordinated Notes Conversion and the Equity Financing

will be set forth in the Company's material change report to be

filed under the Company's issuer profile on SEDAR at www.sedar.com

if and as required by MI 61-101. The material change report will

likely be filed less than 21 days before the closing of the

Subordinated Notes Conversion and the Equity Financing, as Prairie

Provident and other parties involved aim to complete the

Recapitalization as soon as possible in order to address the

Company's liquidity needs and debt burden.

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company's strategy is to optimize our

existing assets to provide stable low decline cash flow, and use

those funds to improve the balance sheet and manage

liabilities.

For further information, please contact:

Prairie Provident Resources Inc.

Patrick R. McDonaldAdam SmithTel: (403) 292-8150Email:

investor@ppr.ca

CAUTIONARY STATEMENTS:

Forward-Looking Statements

This news release contains certain statements

(“forward-looking statements”) that constitute forward-looking

information within the meaning of applicable Canadian securities

laws. Forward-looking statements relate to future performance,

events or circumstances, are based upon internal assumptions,

plans, intentions, expectations and beliefs, and are subject to

risks and uncertainties that may cause actual results or events to

differ materially from those indicated or suggested therein. All

statements other than statements of current or historical fact

constitute forward-looking statements. Forward-looking statements

are typically, but not always, identified by words such as

“anticipate”, “believe”, “expect”, “intend”, “plan”, “budget”,

“forecast”, “target”, “estimate”, “propose”, “potential”,

“project”, “continue”, “may”, “will”, “should” or similar words

suggesting future outcomes or events or statements regarding an

outlook.

Without limiting the foregoing, this news

release contains forward-looking statements pertaining to:

completion of the Recapitalization and its expected effect on the

Company's financial position; the sustainability of the Company's

capital structure after giving effect to the Recapitalization; a

prospective share consolidation for consideration by shareholders

at the next shareholders' meeting; and future transaction

opportunities; the Company's ability to flatten out its production

declines; and projections as to average production, capital

expenditure levels, EBITDA and free funds flow for 2023 and 2024,

and exit debt and debt-to-EBITDA ratio for year-end 2023 and

2024.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Prairie

Provident which have been used to develop such statements but which

may prove to be incorrect. Although the Company believes that the

expectations and assumptions reflected in such forward-looking

statements are reasonable, undue reliance should not be placed on

forward-looking statements, which are inherently uncertain and

depend upon the accuracy of such expectations and assumptions.

Prairie Provident can give no assurance that the forward-looking

statements contained herein will prove to be correct or that the

expectations and assumptions upon which they are based will occur

or be realized. In particular, the Company can give no assurance

that requisite TSX approvals for the Recapitalization will be

received, or that the Recapitalization will be successfully

completed. Actual results or events will differ, and the

differences may be material and adverse to the Company. In addition

to other factors and assumptions which may be identified herein,

assumptions have been made regarding, among other things: the

likelihood of the Company being able to raise the new equity

capital necessary to satisfy the New Equity Condition, whether

through the Equity Financing or another transaction; that the

Second Lien Financing will be completed on March 30, 2023 as

scheduled; the results from reactivation projects, that Prairie

Provident will continue to conduct its operations in a manner

consistent with past operations; results from drilling and

development activities, and their consistency with past operations;

the quality of the reservoirs in which Prairie Provident operates

and continued performance from existing wells (including with

respect to production profile, decline rate and product type mix);

the continued and timely development of infrastructure in areas of

new production; the accuracy of the estimates of Prairie

Provident’s reserves volumes; future commodity prices; future

operating and other costs; future USD/CAD exchange rates; future

interest rates; continued availability of external financing

(including borrowing capacity under available credit facilities)

and cash flow to fund Prairie Provident’s current and future plans

and expenditures, with external financing on acceptable terms; the

impact of competition; the general stability of the economic and

political environment in which Prairie Provident operates; the

general continuance of current industry conditions; the timely

receipt of any required regulatory approvals; the ability of

Prairie Provident to obtain qualified staff, equipment and services

in a timely and cost efficient manner; drilling results; the

ability of the operator of the projects in which Prairie Provident

has an interest in to operate the field in a safe, efficient and

effective manner; field production rates and decline rates; the

ability to replace and expand oil and natural gas reserves through

acquisition, development and exploration; the timing and cost of

pipeline, storage and facility construction and expansion and the

ability of Prairie Provident to secure adequate product

transportation; the regulatory framework regarding royalties, taxes

and environmental matters in the jurisdictions in which Prairie

Provident operates; and the ability of Prairie Provident to

successfully market its oil and natural gas products.

The forward-looking statements included in this

news release are not guarantees of future performance or promises

of future outcomes, and should not be relied upon. Such statements,

including the assumptions made in respect thereof, involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements including, without

limitation: reduced access to financing; higher interest costs or

other restrictive terms of financing; changes in realized commodity

prices; changes in the demand for or supply of Prairie Provident’s

products; the early stage of development of some of the evaluated

areas and zones; the potential for variation in the quality of the

geologic formations targeted by Prairie Provident’s operations;

unanticipated operating results or production declines; changes in

tax or environmental laws, royalty rates or other regulatory

matters; changes in development plans of Prairie Provident or by

third party operators; increased debt levels or debt service costs;

inaccurate estimation of Prairie Provident’s oil and gas reserves

volumes; limited, unfavourable or a lack of access to capital

markets; increased costs; a lack of adequate insurance coverage;

the impact of competitors; and such other risks as may be detailed

from time-to-time in Prairie Provident’s public disclosure

documents (including, without limitation, those risks identified in

this news release and Prairie Provident’s current Annual

Information Form as filed with Canadian securities regulators and

available from the SEDAR website (www.sedar.com) under Prairie

Provident’s issuer profile).

The forward-looking statements contained in this

news release speak only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Barrels of Oil Equivalent

The oil and gas industry commonly expresses

production volumes and reserves on a “barrel of oil equivalent”

basis (“boe”) whereby natural gas volumes are converted at the

ratio of six thousand cubic feet to one barrel of oil. The

intention is to sum oil and natural gas measurement units into one

basis for improved analysis of results and comparisons with other

industry participants. A boe conversion ratio of six thousand cubic

feet to one barrel of oil is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead nor at the plant

gate, which is where Prairie Provident sells its production

volumes. Boes may therefore be a misleading measure, particularly

if used in isolation. Given that the value ratio based on the

current price of crude oil as compared to natural gas is

significantly different from the energy equivalency ratio of 6:1,

utilizing a 6:1 conversion ratio may be misleading as an indication

of value.

Non-GAAP and Other Financial Measures,

and Oil and Gas Metrics

This news release discloses certain financial

measures that are 'non-GAAP financial measures' or 'supplementary

financial measures' within the meaning of applicable Canadian

securities laws. Such measures do not have a standardized or

prescribed meaning under International Financial Reporting

Standards (IFRS) and, accordingly, may not be comparable to similar

financial measures disclosed by other issuers. Non-GAAP and other

financial measures are provided as supplementary information by

which readers may wish to consider the Company's performance but

should not be relied upon for comparative or investment purposes.

Readers must not consider non-GAAP and other financial measures in

isolation or as a substitute for analysis of the Company’s

financial results as reported under IFRS.

This news release also includes reference to

certain metrics commonly used in the oil and gas industry but which

do not have a standardized or prescribed meanings under the

Canadian Oil and Gas Evaluation (COGE) Handbook or applicable law.

Such metrics are similarly provided as supplementary information by

which readers may wish to consider the Company's performance but

should not be relied upon for comparative or investment

purposes.

Following is additional information on non-GAAP

and other financial measures and oil and gas metrics used in this

news release.

EBITDA – EBITDA is a non-GAAP financial measure

calculated as net income (loss) before interest and financing

expenses, income taxes, depletion, depreciation and amortization.

Management uses the EBITDA as a measure of operational performance

and cash flow generating capability.

Free Funds Flow – Free funds flow is derived

from adjusted funds flow, both of which are non-GAAP financial

measures. Prairie Provident defines “adjusted funds flow” as cash

flow from operating activities before the effects of

decommissioning expenditures and changes in non-cash operating

working capital, and excluding transaction costs, restructuring

costs and other non-recurring items. The Company eliminates

settlements of decommissioning expenditures from cash flow from

operating activities as the amounts can be discretionary and may

vary from period to period depending on its capital programs and

the maturity of its operating areas. The settlement of

decommissioning expenditures is managed within the capital

budgeting process, which considers available adjusted funds flow.

Changes in non-cash operating working capital are eliminated in the

determination of adjusted funds flow as the timing of collection

and payment are variable and by excluding them from the

calculation, the Company believes that it is able to provide a more

meaningful measure of its operations and ability to generate cash

on a continuing basis. Management uses this measure to assess the

Company's ability to finance capital expenditures, settle

decommissioning obligations and repay debt. Prairie Provident

defines “free funds flow” as adjusted funds flow less capital

expenditures. Management believes that free funds flow provides a

useful measure of the Company's ability to generate shareholder

value.

Reserve Life Index – Reserve life index (RLI) is

an oil and gas metric calculated by dividing total company share

reserves by annualized production. RLI provides a summary measure

of the relative magnitude of the Company's reserves through an

indication as to how long they would last based on a current,

annualized production rate and assuming no additions to

reserves.

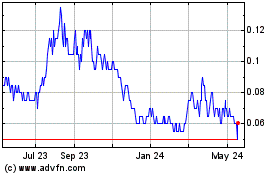

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

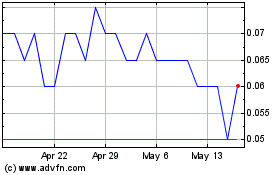

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2023 to Dec 2024