Prairie Provident Announces Significant Incremental Reserves Booking Attributable to Evi Waterflood

September 18 2019 - 4:30PM

Prairie Provident Resources Inc. (“Prairie Provident”, “PPR” or the

“Company”) is pleased to announce the results of an updated

independent reserves evaluation of the Company's interests in

respect to specific reserve entities within three future

undeveloped waterflood expansion areas in Evi (“Evi Waterflood

Areas”). The evaluation was conducted by Sproule Associates Limited

(“Sproule”), independent qualified reserves evaluators, with an

effective date of May 31, 2019 (the “Evi Waterflood Report”), and

supplements Sproule's year-end evaluation of the Company's total

corporate reserves as at December 31, 2018.

The results of the Evi Waterflood Report,

including changes relative to Sproule's year-end evaluation, are

summarized in more detail in a material change report filed by the

Company today which is available under the Company's profile on

SEDAR at www.sedar.com.

EVI WATERFLOOD RESERVES

HIGHLIGHTS

At Evi, our development strategy continues to

focus on expanding reserves, lowering decline rates and stabilizing

production through waterflood which has proven successful to date.

Based on the Evi Waterflood Report, an incremental 2.1 MMboe of

proved plus probable (“P+P”) undeveloped reserves (97% oil and

liquids) have been assigned to future waterflood expansions,

comprised of approximately 1.6 MMboe of proved undeveloped reserves

and approximately 0.5 MMboe of probable undeveloped reserves.

Relative to year-end reserves bookings for specific reserves

entities within the three Evi Waterflood areas, the undeveloped

reserves additions attributed to the future expansions represent an

increase of nearly 40% in original recoverable reserves estimates

on a proved (“1P”) basis for those areas. As a result of the

increased reserves assignments at Evi, PPR’s total estimated

corporate reserves volumes grow by 7.1% on a 1P basis and by 6.1%

on a P+P basis, relative to year-end estimates. The estimated net

present value of future net revenue before-tax discounted at 10%

(“NPV10 BT”) associated with the additional 2.1 MMboe of

incremental P+P undeveloped reserves is $30 million.

|

|

|

|

NPV10 BT ($000’s) |

|

Proved Undeveloped (Mboe) |

Probable Undeveloped (Mboe) |

Future Development Capital

($000’s) |

Proved Undeveloped |

Proved + Probable

Undeveloped |

|

1,589 |

471 |

$15,709 |

20,254 |

30,049 |

The Evi Waterflood Report was prepared in

accordance with National Instrument 51-101 Standards of Disclosure

for Oil and Gas Activities (“NI 51-101”) and the definitions,

standards, and procedures contained in the Canadian Oil and Gas

Evaluation Handbook (the “COGE Handbook”). Sproule evaluated the

P&NG reserves of the Company’s interests in three future

waterflood expansions in the Evi area of Alberta. The Evi

Waterflood Report is based on forecast prices and costs and applies

Sproule’s forecast escalated commodity price deck and foreign

exchange rate and inflation rate assumptions as at May 31, 2019.

Estimated future net revenue is stated without any provisions for

interest costs, other debt service charges or general and

administrative expenses, and after the deduction of royalties,

operating costs, estimated well abandonment and reclamation costs

and estimated future development costs.

See also the “Cautionary Statements” below for

further explanations and discussions.

ABOUT PRAIRIE PROVIDENT:

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company's strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident's operations are primarily focused at the

Michichi/Wayne and Princess areas in Southern Alberta targeting the

Banff, the Ellerslie and the Lithic Glauconite formations, along

with an early-stage waterflood project at our Evi area in the Peace

River Arch. Prairie Provident protects its balance sheet through an

active hedging program and manages risk by allocating capital to

opportunities offering maximum shareholder returns.

For further information, please contact:

Prairie Provident Resources Inc. Tim Granger President and Chief

Executive Officer Tel: (403) 292-8110 Email: tgranger@ppr.ca

Cautionary Statements

Disclosure of Oil and Gas

Reserves Data

The reserves data estimates contained herein are

estimates only and there is no guarantee that the estimated

reserves will be recovered or that the related estimates of future

net revenues will be realized. There can be no assurance that the

forecast prices and cost assumptions applied by Sproule in

evaluating the Company's reserves will be attained, and variances

between actual and forecast prices and costs could be material.

Actual reserves may be greater than or less than the estimated

volumes provided herein, and it should not be assumed that the

estimates of future net revenues presented herein represent the

fair market value of the reserves. Estimates in respect of

individual properties may not reflect the same confidence level as

estimates of reserves and future net revenue for all properties,

due to the effects of aggregation.

Barrels of oil

equivalent

The oil and gas industry commonly expresses

production volumes and reserves on a “barrel of oil equivalent”

basis (“boe”) whereby natural gas volumes are converted at the

ratio of six thousand cubic feet to one barrel of oil. The

intention is to sum oil and natural gas measurement units into one

basis for improved analysis of results and comparisons with other

industry participants. A boe conversion ratio of six thousand cubic

feet to one barrel of oil is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead nor at the plant

gate, which is where Prairie Provident sells its production

volumes. Boes may therefore be a misleading measure, particularly

if used in isolation. Given that the value ratio based on the

current price of crude oil as compared to natural gas is

significantly different from the energy equivalency ratio of 6:1,

utilizing a 6:1 conversion ratio may be misleading as an indication

of value.

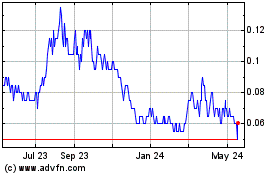

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

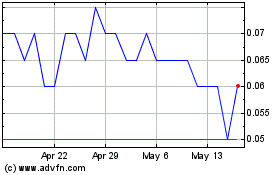

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2024 to Jan 2025