Prairie Provident Resources Inc. ("Prairie Provident", "PPR" or the

"Company") (TSX:PPR) is pleased to announce its operating and

financial results for the three months and year ended December 31,

2017, and to provide an operational update. PPR’s audited

consolidated financial statements ("Annual Financial Statements")

and related Management's Discussion and Analysis ("MD&A") for

the three months and year ended December 31, 2017 and annual

information form dated March 28, 2018 (“AIF”) are available on its

website at www.ppr.ca and filed on SEDAR.

Prairie Provident’s Annual Financial Statements

present the results for the properties owned by Lone Pine Resources

Canada Ltd. (“Lone Pine”) for the period up to September 12, 2016

and for the combination of Lone Pine and Arsenal Energy Inc. after

September 12, 2016. This is a significant factor in understanding

the year-over-year and quarter-over-quarter financial results of

Prairie Provident. This news release contains forward-looking

information and statements and non-IFRS measures. Readers are

cautioned that the news release should be read in conjunction with

the Company’s disclosures under the headings "Forward-Looking

Statements" and "Non-IFRS Measures" included at the end of this

news release.

FOURTH QUARTER 2017

HIGHLIGHTS

- Average production in the fourth quarter was 4,872 boe/d,

compared to 4,845 during the same period in 2016. Excluding

the impact from divesting approximately 400 boe/d non-core

natural-gas weighted producing assets, average production increased

by approximately 9% over the same period in 2016. Continued

weak benchmark natural gas prices in Alberta drove the Company’s

conscious decision to allocate capital resources away from natural

gas opportunities in favour of oil and liquids targets. As a

result of this shift, the Company’s oil and liquids production

weighting increased to 69% for the quarter, compared to 58% for the

same period in 2016.

- Adjusted funds from operations totaled $5.5 million in the

fourth quarter of 2017, a $1.6 million decrease compared to the

same period of 2016, primarily due to higher interest expenses and

lower realized hedging gains.

- Operating netbacks after realized hedging gains were $22.04/boe

in the fourth quarter of 2017, which reflected higher realized

prices, an increased oil and liquids weighting but lower realized

gains on derivative instruments and higher operating costs compared

to $22.32/boe for the same period in 2016.

- Capital expenditures prior to acquisitions or dispositions in

the quarter were $7.2 million, with approximately $4.0 million

directed to drilling, completion and tie-in activities, primarily

in Wheatland, Princess and Evi; $2.1 million was directed to land

and seismic in the Princess area and the remaining to

capitalized G&A. The land and seismic purchase at

Princess is complementary to our existing landholdings and provides

additional step out locations to our core

play.

2017 ANNUAL HIGHLIGHTS

- Full-year 2017 production averaged 5,470 boe/d (62% liquids),

an increase of 49% over 2016 due to production additions from the

Arsenal (September 2016) and Red Earth (March 2017) Acquisitions

and the impact of volumes being brought on-stream from the 2016 and

2017 development programs. An uncertain oil pricing

environment during the first half of 2017 led PPR to postpone its

2017 capital program to preserve liquidity and protect project

economics. This deferral, coupled with the disposition of

certain non-core natural gas weighted properties, resulted in

annual average production that was below guidance.

- Capital expenditures and acquisitions during 2017 totaled $64.2

million (net of $1.4 million in proceeds for dispositions),

including $40.9 million for the Red Earth Acquisition.

Excluding acquisitions and dispositions, capital expenditures of

$23.7 million were focused on exploration efforts to delineate

PPR’s prospects at Wheatland and to meet its flow-through share

commitments. An unbudgeted strategic land and seismic

acquisition of $2.1 million in the fourth quarter and the

acceleration of some 2018 capital into 2017 in response to improved

oil prices increased spending by $3.8 million over PPR’s $25

million capital guidance (including ARO expenditures).

- Operating netbacks after realized hedging gains of $17.48/boe

decreased $0.47/boe from 2016. Higher realized prices were

offset by lower realized gains on derivative instruments, higher

royalty expenses and higher operating expenses per boe related to

lower production volumes.

- Adjusted funds from operations totaled $23.1 million, a $9.8

million increase compared to 2016, primarily due to higher

production volumes, partially offset by reduced gains on derivative

instruments.

- As a result of prolonged weakness in the current and forecast

price environment for natural gas and to a lesser extent, crude

oil, PPR recorded total impairment losses of $34.2 million in 2017,

primarily against the production and development assets in the

Wheatland and Princess cash generating units. The impairment

losses were the primary contributors to the net loss of $47.8

million recognized for 2017.

- As at December 31, 2017, PPR had US$31.3 million drawn against

its US$40 million revolving facility and had US$16.0 of Senior

Notes outstanding, plus a working capital deficit of $2.2

million.

- PPR has extended its lease acquisition commitment to March 31,

2019 and provided the Company spends $37.5 million towards the $45

million commitment by March 31, 2019, its remaining commitments

will be further extended until September 30, 2019. As of

December 31, 2017, the Company had incurred a total of $21.3

million towards the total capital commitment. In the first quarter

of 2018, PPR has further incurred approximately $6 million on its

Wheatland development. PPR expects to fulfill the remaining capital

commitment through its planned capital program.

FINANCIAL AND OPERATING

HIGHLIGHTS

|

|

Three Months

Ended |

|

Year Ended |

|

|

|

December

31, |

|

December 31, |

|

($000s except per unit amounts) |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

|

Financial |

|

|

|

|

|

|

|

|

| Oil and natural gas

revenue |

20,510 |

|

17,060 |

|

79,011 |

|

42,748 |

|

| Net

loss |

(44,145 |

) |

(8,782 |

) |

(47,802 |

) |

(60,396 |

) |

| Per share

– basic & diluted1 |

(0.38 |

) |

(0.09 |

) |

(0.42 |

) |

(0.62 |

) |

| Adjusted Funds from

operations2 |

5,545 |

|

7,107 |

|

23,075 |

|

13,259 |

|

| Per share

– basic & diluted3 |

0.05 |

|

0.07 |

|

0.2 |

|

0.14 |

|

| Net

capital expenditures |

6,251 |

|

11,918 |

|

64,198 |

|

34,875 |

|

|

Production Volumes |

|

|

|

|

|

|

|

|

| Crude oil (bbls/d) |

3,233 |

|

2,653 |

|

3,178 |

|

2,012 |

|

| Natural gas

(Mcf/d) |

9,200 |

|

12,300 |

|

12,537 |

|

9,253 |

|

| Natural

gas liquids (bbls/d) |

106 |

|

142 |

|

202 |

|

126 |

|

| Total

(boe/d) |

4,872 |

|

4,845 |

|

5,470 |

|

3,680 |

|

| %

Liquids |

69 |

% |

58 |

% |

62 |

% |

58 |

% |

| |

|

|

|

|

|

|

|

|

|

Average Realized Prices |

|

|

|

|

|

|

|

|

| Crude oil ($/bbl) |

62.01 |

|

54.28 |

|

56.01 |

|

46.75 |

|

| Natural gas

($/Mcf) |

1.81 |

|

3.09 |

|

2.47 |

|

2.21 |

|

| Natural

gas liquids ($/bbl) |

54.86 |

|

24.49 |

|

37.08 |

|

17.91 |

|

| Total

($/boe) |

45.76 |

|

38.27 |

|

39.57 |

|

31.74 |

|

| Operating

Netback ($/boe)4 |

|

|

|

|

|

|

|

|

| Realized price |

45.76 |

|

38.27 |

|

39.57 |

|

31.74 |

|

| Royalties |

(4.84 |

) |

(5.09 |

) |

(5.20 |

) |

(3.63 |

) |

| Operating

costs |

(20.78 |

) |

(13.92 |

) |

(19.36 |

) |

(17.39 |

) |

| Operating netback |

20.14 |

|

19.26 |

|

15.01 |

|

10.72 |

|

| Realized

gains on derivative instruments |

1.9 |

|

3.06 |

|

2.47 |

|

7.23 |

|

| Operating netback,

after realized gains on |

|

|

|

|

|

|

|

|

|

derivative instruments |

22.04 |

|

22.32 |

|

17.48 |

|

17.95 |

|

| |

|

|

|

|

|

|

|

|

Notes:(1)(3) As the historical financial

statements were prepared on a combined and consolidated basis, it

is not possible to measure per share amounts until after the

closing of the Arrangement on September 12, 2016 when Lone Pine and

Arsenal were brought under a common parent entity. The

Company calculated per share information for the current and

historical periods by assuming that the common shares issued upon

the closing of the Arrangement at September 12, 2016 were

outstanding since the beginning of the period (2)(4)

Adjusted funds from operations and Operating Netback are non-IFRS

measures and are defined below under “Other Advisories

|

Capital Structure($000s) |

|

|

As at December 31, 2017 |

|

As at December 31, 2016 |

|

| Working capital

(deficit)(1) |

|

|

(2,201 |

) |

(4,380 |

) |

| Long-term debt |

|

|

(55,760 |

) |

(15,047 |

) |

| Total net debt(2) |

|

|

(57,961 |

) |

(19,427 |

) |

| Current debt

capacity(3) |

|

|

11,291 |

|

34,117 |

|

| Common

shares outstanding (in millions) (4) |

|

|

115.9 |

|

104.2 |

|

Notes:

(1)

Working capital (deficit) is a non-IFRS measure (see Other

Advisories below) calculated as current assets less current

liabilities excluding the current portion of derivative

instruments, the current portion of decommissioning liabilities and

flow-through share premium.(2)

Net debt is a non-IFRS measure (see Other Advisories below),

calculated by adding working capital (deficit) and long-term

debt. (3) Current debt

capacity reflects the undrawn capacity of the USD$40 million

Revolving Facility at December 31, 2017 and of $55 million

previously outstanding credit facility at December 31, 2016.

Revolving Facility debt capacity was translated using the year end

exchange rate of $1.0000 USD to $1.2545

CAD.(4) As historical financial

statements were prepared on a combined and consolidated basis (see

note 3(a) to the Annual Financial Statements), common shares

outstanding is not a relevant measure until subsequent to the

closing of the Arsenal Acquisition on September 12, 2016 when Lone

Pine and Arsenal were brought under a common parent entity.

|

|

|

|

|

|

Three months ended December 31 |

Year ended December 31 |

|

|

2017 |

2016 |

2017 |

2016 |

| Drilling Activity |

|

|

|

|

| Gross wells |

- |

3 |

6 |

14 |

| Working interest

wells |

- |

2.95 |

5.7 |

12.65 |

|

Success rate, net wells (%) |

N/A |

100 |

82 |

100 |

| |

|

|

|

|

OPERATIONS UPDATE

Wheatland, AB

For the year ended December 31, 2017, PPR’s

Wheatland properties averaged 2,083 boe/d (27% liquids) and

represented 38% of PPR’s total production. During the fourth

quarter, area production averaged 1,619 boe/d (27% liquids),

contributing 33% to the Company’s total volumes.

PPR’s 2017 capital program at Wheatland totaled

$13.6 million and included equipping and tying-in two wells that

were drilled in late 2016; and drilling five gross (4.7 net) wells

to further delineate the Company’s Ellerslie play in the Wayne

area, where wells average 60% oil compared to 23% across the

broader Wheatland area. While the delineation provided

valuable data in helping PPR to further map its land base, which

led to the acquisition in 2017 an additional 17 gross (11 net)

sections of land and 10 square miles of 3D seismic at Wayne, they

did not add significant production for the three months and year

ended December 31, 2017.

The Company has identified an additional 15

potential Ellerslie horizontal drilling locations in the Wayne play

and plans to drill and complete up to six wells in 2018.

Subsequent to year end, three wells were drilled and completed,

with results released on March 20, 2018.

Princess, AB

Production at Princess averaged 388 boe/d (85%

liquids) during 2017 and 408 boe/d (83% liquids) during the fourth

quarter. Area capital expenditures during 2017 of $6.2

million were directed to tying-in three wells, acquiring 14.5 net

sections prospective for Glauconite and Basal Mannville oil, and

roughly 30 sections of additional 3D seismic, which is expected to

facilitate the identification of attractive future potential oil

drilling locations.

The Company has identified 15 potential oil

drilling locations in the Detrital, Basal Mannville and Glauconite

formations and commenced drilling activities in the first quarter

of 2018. Prairie Provident plans to spend approximately $10 million

on the drilling and completion of up to six Glauconite horizontal

oil wells at Princess during 2018.

Evi, AB

The Evi properties produced average sales

volumes of approximately 2,108 boe/d (98% liquids) during 2017,

contributing 39% to PPR’s overall production, and 2,225 boe/d (97%

liquids) during the fourth quarter of 2017. On March 22,

2017, PPR closed the acquisition of oil and natural gas assets in

the Greater Red Earth area of Northern Alberta for cash

consideration of $40.9 million. The acquired assets include

high-quality and low-decline oil production complementary to its

existing operations in the Peace River Arch area. The

acquisition further enhances the Company’s size and competitive

position through an increased liquids ratio, lower corporate

decline and the potential to improve operating netbacks.

Excluding acquisitions, PPR’s 2017 capital

expenditures in Evi totaled $1.1 million, which were primarily

directed to expansion of the area waterflood by converting

low-productivity wells to water injection wells and the

recompletion of three wells designed to access additional uphole

zones in the wellbores.

The Company anticipates spending approximately

$7 million at Evi in 2018 to convert up to eight additional wells

to injectors and the drilling of 3 vertical directional Granite

Wash wells.

2018 OUTLOOK AND GUIDANCE

Prairie Provident’s business strategy has been

built on a balanced approach, utilizing predictable funds flows

from our low decline oil assets to fuel growth developments.

Our priorities continue to focus on maintaining a strong balance

sheet while delivering accretive asset value growth for our

shareholders. PPR’s capital allocation process takes into

account a number of factors including rate-of-return, project

payout period and reserves addition cost. In response to the

broader commodity price environment, the Company will continue to

focus on improving corporate netbacks by targeting higher value

production streams while striving to lower costs through various

operational initiatives such as pad drilling and evaluating

opportunities to acquire underutilized infrastructure in our

operating areas.

On January 29, 2018 PPR’s Board of Directors

approved a $26 million capital program for 2018 (excluding land

purchases and property acquisitions or dispositions) designed to

support long-term profitability and balance sheet strength through

the continued development of oil-weighted opportunities within its

low-risk asset base. The capital program anticipates continued

development of PPR’s Wayne property at Wheatland, ongoing drilling

and completions at Princess, and further expansion of the

attractive waterflood at Evi and oil development at Red

Earth.

Prairie Provident will continue to actively

manage expected commodity price volatility over the near-term,

while taking steps to mitigate price risk, including executing an

active risk management program. PPR intends to continue

adding positions to its hedge book which currently provides

protection to approximately 65% of its 2018 forecast base volumes

(net of royalties) and is expected to support adjusted funds from

operations through 2019 and beyond. Operationally, the

Company will remain focused on capturing capital and operating

efficiencies and protecting its financial position.

Prairie Provident's full-year 2018 guidance

estimates remain unchanged from those presented in the Company’s

release dated February 6, 2016 and are outlined in the following

table. Additional details on Prairie Provident's 2018 capital

program and guidance can be found on the Company’s website at

www.ppr.ca.

2018 BUDGET AND GUIDANCE SUMMARY

|

Production guidance |

5,200 - 5,600 boe/d |

| Liquids weighting |

68 -

71% |

| Capital expenditures

(excluding abandonment and reclamation expenditures and capitalized

G&A) |

$26

million |

| Operating expense |

$17.00

- 18.50/boe |

| Operating netback1 |

$20.50

– 22.00/boe |

| 2018 year-end long-term

debt (net of cash collateralized for letters of credit) |

$58

million |

|

|

|

| Financial

Assumptions |

|

| Oil (WTI) |

US$63.00/bbl |

| Oil (WCS) |

C$51.50/bbl |

| Natural gas (AECO) |

C$1.40/mcf |

| Edmonton Light/WTI

differential |

C$6.00 |

| USD/CAD exchange

rate |

0.81 |

- Operating netback is a non-IFRS measure (see "Other Advisories"

below).

Within a challenging market for Canadian energy

producers, PPR remains focused on increasing exposure of the

Company to the broader investment community and enhancing the

trading liquidity of its shares. Further, the Company firmly

believes that continued operational execution, growth on a per

share basis, and prudent management of the balance sheet will

ultimately be the key drivers towards increasing shareholder

value.

ABOUT PRAIRIE PROVIDENT:

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company’s strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident’s operations are primarily focused at Wheatland

and Princess in Southern Alberta targeting the Ellerslie and the

Lithic Glauc formations, along with an early stage waterflood

project at Evi in the Peace River Arch. Prairie Provident protects

its balance sheet through an active hedging program and manages

risk by allocating capital to opportunities offering maximum

shareholder returns.

For further information, please contact:

Prairie Provident Resources Inc. Tim Granger President and Chief

Executive Officer Tel: (403) 292-8110 Email: tgranger@ppr.ca

website: www.ppr.ca

FORWARD-LOOKING STATEMENTS

This news release contains certain

forward-looking information and statements within the meaning of

applicable Canadian securities laws. Statements involving

forward-looking information relate to future performance, events or

circumstances, and are based upon internal assumptions, plans,

intentions, expectations and beliefs. All statements other

than statements of current or historical fact constitute

forward-looking information. Forward-looking information is

typically, but not always, identified by words such as

"anticipate", "believe", "expect", "intend", "plan", "budget",

"forecast", "target", "estimate", "propose", "potential",

"project", "continue", "may", "will", "should" or similar words

suggesting future outcomes or events or statements regarding an

outlook. In particular, but without limiting the foregoing,

this news release contains forward-looking information and

statements pertaining to the following: projected capital

expenditure plans, production and product mix, production growth

expectations, development and exploration plans at Wheatland,

Princess and Evi (including with respect to numbers of wells at

Wheatland and Princess and Evi waterflood activities and

expectations), opportunities for operating cost reductions in the

Greater Red Earth area, continued focus on corporate netbacks and

capital efficiency and anticipated activities in furtherance

thereof, future hedging arrangements, projected annual and exit

production, operating costs, operating netback, royalties, G&A

expenses, capital expenditures and adjusted funds from operations

of Prairie Provident for 2018 and beyond, assumptions as to future

commodity prices, its risk management plans for 2018 and beyond,

use of excess funds from operations for debt repayment, per share

production growth, drilling inventory numbers, expected benefits of

waterflood initiatives, view on potential benefits from the Red

Earth Acquisition and future merger and acquisition activities.

The forward-looking information and statements

contained in this news release reflect material factors and

expectations and assumptions of Prairie Provident including,

without limitation: commodity prices and foreign exchange rates for

2018 and beyond; the timing and success of future drilling,

development and completion activities (and the extent to which the

results thereof meet Management's expectations); the continued

availability of financing (including borrowings under the Company's

credit facility) and cash flow to fund current and future

expenditures, with external financing on acceptable terms; future

capital expenditure requirements and the sufficiency thereof to

achieve the Company's objectives; the performance of both new and

existing wells; production from the Red Earth Acquisition and

capital and operating costs in respect thereof; the timely

availability and performance of facilities, pipelines and other

infrastructure in areas of operation; the geological

characteristics and quality of Prairie Provident's properties and

the reservoirs in which the Company conducts oil and gas activities

(including field production and decline rates); successful

integration of the Red Earth Acquisition assets into the Company's

operations; the successful application of drilling, completion and

seismic technology; future exploration, development, operating,

transportation, royalties and other costs; the Company's ability to

economically produce oil and gas from its properties and the timing

and cost to do so; the predictability of future results based on

past and current experience; prevailing weather conditions;

prevailing legislation and regulatory requirements affecting the

oil and gas industry (including royalty regimes); the timely

receipt of required regulatory approvals; the availability of

capital, labour and services on timely and cost-effective basis;

the creditworthiness of industry partners and the ability to source

and complete acquisitions; and the general economic, regulatory and

political environment in which the Company operates. Prairie

Provident believes the material factors, expectations and

assumptions reflected in the forward-looking information and

statements are reasonable but no assurance can be given that these

factors, expectations and assumptions will prove to be correct.

All information and statements that are in the

nature of a financial outlook are forward-looking statements as

they relate to prospective financial performance, financial

position or cash flows based on assumptions about future economic

conditions and courses of action. Financial outlook information in

this news release includes statements regarding future funds flow

from operations and operating netback, which are subject to the

assumptions, risk factors, limitations and qualifications set forth

above. All financial outlook information is made as of the date of

this news release and is provided for the sole purpose of

describing the Company's internal expectations on cash flows for

2018, and should not be used, and may be inappropriate for, any

other purpose.

Although Prairie Provident believes that the

expectations and assumptions upon which the forward-looking

information in this news release is based are reasonable based on

currently available information, undue reliance should not be

placed on such information, which is inherently uncertain, relies

on assumptions and expectations, and is subject to known and

unknown risks, uncertainties and other factors, both general and

specific, many of which are beyond the Company's control, that may

cause actual results or events to differ materially from those

indicated or suggested in the forward-looking information.

Prairie Provident can give no assurance that the forward-looking

information contained herein will prove to be correct or that the

expectations and assumptions upon which they are based will occur

or be realized. These include, but are not limited to: risks

inherent to oil and gas exploration, development, exploitation and

production operations and the oil and gas industry in general,

including geological, technical, engineering, drilling, completion,

processing and other operational problems and potential delays,

cost overruns, production or reserves loss or reduction in

production, and environmental, health and safety implications

arising therefrom; uncertainties associated with the estimation of

reserves, production rates, product type and costs; adverse changes

in commodity prices, foreign exchange rates or interest rates; the

ability to access capital when required and on acceptable terms;

the ability to secure required services on a timely basis and on

acceptable terms; increases in operating costs; environmental

risks; changes in laws and governmental regulation (including with

respect to royalties, taxes and environmental matters); adverse

weather or break-up conditions; competition for labour, services,

equipment and materials necessary to further the Company's oil and

gas activities; and changes in plans with respect to exploration or

development projects or capital expenditures in respect thereof.

These and other risks are discussed in more detail in the Company's

current annual information form and other documents filed by it

from time to time with securities regulatory authorities in Canada,

copies of which are available electronically under Prairie

Provident's issuer profile on the SEDAR website at www.sedar.com

and on the Company's website at www.ppr.ca. This list is not

exhaustive.

The forward-looking information and statements

contained in this news release speak only as of the date of this

news release, and Prairie Provident assumes no obligation to

publicly update or revise them to reflect new events or

circumstances, or otherwise, except as may be required pursuant to

applicable laws. All forward-looking information and statements

contained in this news release are expressly qualified by this

cautionary statement.

OTHER ADVISORIES

The oil and gas industry commonly expresses

production volumes and reserves on a “barrel of oil equivalent”

basis (“boe”) whereby natural gas volumes are converted at the

ratio of six thousand cubic feet to one barrel of oil. The

intention is to sum oil and natural gas measurement units into one

basis for improved analysis of results and comparisons with other

industry participants. A boe conversion ratio of six thousand

cubic feet to one barrel of oil is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead nor at the plant

gate, which is where Prairie Provident sells its production

volumes. Boes may therefore may be a misleading measure,

particularly if used in isolation. Given that the value ratio based

on the current price of crude oil as compared to natural gas is

significantly different from the energy equivalency ratio of 6:1,

utilizing a 6:1 conversion ratio may be misleading as an indication

of value.

Non-IFRS Measures

The Company uses certain terms in this news

release and within the MD&A that do not have a standardized or

prescribed meaning under International Financial Reporting

Standards (IFRS), and, accordingly these measurements may not be

comparable with the calculation of similar measurements used by

other companies. For a reconciliation of each non-IFRS measure to

its nearest IFRS measure, please refer to the “Non-IFRS Measures”

section in the MD&A. Non-IFRS measures are provided as

supplementary information by which readers may wish to consider the

Company's performance, but should not be relied upon for

comparative or investment purposes. The non-IFRS measures

used in this news release are summarized as follows:

Working Capital – Working capital (deficit) is

calculated as current assets less current liabilities excluding the

current portion of derivative instruments, the current portion of

decommissioning liabilities, the warrant liability and flow-through

share premium. This measure is used to assist management and

investors in understanding liquidity at a specific point in

time. The current portion of derivatives instruments is

excluded as management intends to hold derivative contracts through

to maturity rather than realizing the value at a point in time

through liquidation. The current portion of decommissioning

expenditures is excluded as these costs are discretionary and the

current portion of flow-through share premium liabilities are

excluded as it is a non-monetary liability.

Net Debt – Net debt is defined as long-term debt

plus working capital surplus or deficit. Net debt is commonly

used in the oil and gas industry for assessing the liquidity of a

company.

Operating Netback – Operating netback is a

non-IFRS measure commonly used in the oil and gas industry. This

measurement assists management and investors to evaluate the

specific operating performance at the oil and gas lease level.

Operating netbacks included in this news release were determined by

taking (oil and gas revenues less royalties less operating costs)

divided by gross working interest production. Operating netback,

including realized commodity (loss) and gain, adjusts the operating

netback for only realized gains and losses on derivative

instruments.

Adjusted Funds from Operations – Adjusted funds

from operations is calculated based on cash flow from operating

activities before changes in non-cash working capital, transaction

costs, restructuring costs, decommissioning expenditures and other

non-recurring items. Management believes that such a measure

provides an insightful assessment of Prairie Provident’s operation

performance on a continuing basis by eliminating certain non-cash

charges and charges that are non-recurring and utilizes the measure

to assess its ability to finance operating activities, capital

expenditures and debt repayments. Adjusted funds from operations as

presented is not intended to represent cash flow from operating

activities, net earnings or other measures of financial performance

calculated in accordance with IFRS.

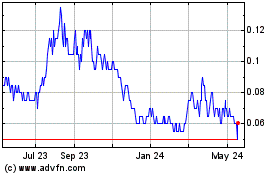

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

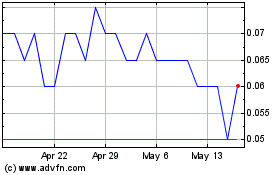

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2024 to Jan 2025