Osisko Mining Obtains Interim Order for Plan of Arrangement; Update on Special Meeting for Gold Fields Transaction

September 03 2024 - 4:30PM

Osisko Mining Inc. ("

Osisko") (TSX:OSK) is pleased

to announce that it has obtained an interim order ("

Interim

Order") from the Ontario Superior Court of Justice

(Commercial List) (the "

Court") in respect of the

acquisition by Gold Fields Limited, through a 100% owned Canadian

subsidiary (the "

Purchaser"), of Osisko by way of

plan of arrangement under the Business Corporations Act (Ontario)

(the "

Arrangement").

The Interim Order, among other things,

authorizes Osisko to call and hold a special meeting of

shareholders of Osisko (the "Special Meeting") to

approve the Arrangement. In accordance with the Interim Order, the

Special Meeting is schedule to be held at 10:00 a.m. (Toronto time)

on Thursday, October 17, 2024, at the offices of Bennett Jones LLP,

Suite 3400, One First Canadian Place, Toronto, Ontario, Canada.

Under the terms of the Arrangement, the

Purchaser has agreed to acquire all of the issued and outstanding

common shares of Osisko (the "Shares") at a price

of C$4.90 per Share (the "Consideration"). The

Consideration represents a premium of approximately 55% to the

20-day volume weighted average trading price per Share on the

Toronto Stock Exchange for the period ending August 9, 2024, being

the last trading day prior to the announcement of the

Arrangement.

Shareholders of Osisko as of August 30, 2024,

being the record date of the Special Meeting, will receive notice

of, and be entitled to vote at, the Special Meeting. A management

information circular of Osisko (the "Circular"),

which will provide further information about the Arrangement, will

be mailed to shareholders of Osisko in due course.

The Circular will include the unanimous

recommendation of the Board of Directors of Osisko for Osisko's

shareholders to vote FOR the Arrangement. The

Circular will be available in due course on SEDAR+

(www.sedarplus.ca) under Osisko's issuer profile.

The hearing date for the application for the

Final Order of the Court is scheduled for October 22, 2024. The

Arrangement is anticipated to become effective on or about October

25, 2024, subject to obtaining the required approvals from the

shareholders of Osisko, the final order from the Court, the receipt

of all approvals under the Competition Act (Canada) and the

satisfaction or waiver of all other closing conditions.

Shareholder Questions

For shareholder inquiries regarding the

Arrangement, please contact Laurel Hill Advisory Group:

North America Toll Free: 1-877-452-7184 Calls

Outside North America: 416-304-0211Email:

assistance@laurelhill.com

About

Osisko

Osisko is a mineral exploration company focused

on the acquisition, exploration, and development of precious metal

resource properties in Canada. Osisko holds a 50% interest in the

high-grade Windfall gold deposit located between Val-d'Or and

Chibougamau in Québec and holds a 50% interest in a large area of

claims in the surrounding Urban Barry area and nearby Quévillon

area (over 2,300 square kilometers).

Cautionary

Statement Regarding

Forward-Looking Statements

This news release may contain forward-looking

statements (within the meaning of applicable securities laws) which

reflect Osisko's current expectations regarding future events.

Forward-looking statements are identified by words such as

"believe", "anticipate", "project", "expect", "intend", "plan",

"will", "may", "estimate" and other similar expressions. The

forward-looking statements in this news release include statements

regarding the proposed acquisition by the Purchaser of all of the

Shares of Osisko and the terms thereof, the anticipated date of the

Special Meeting, the anticipated filing of materials on SEDAR+, the

expected date of completion of the Arrangement, the receipt of all

required regulatory approvals and other statements that are not

historical fact.

The forward-looking statements in this news

release are based on a number of key expectations and assumptions

made by Osisko including, without limitation: the Arrangement will

be completed on the terms currently contemplated; the Arrangement

will be completed in accordance with the timing currently expected;

and all conditions to the completion of the Arrangement will be

satisfied or waived. Although the forward-looking statements

contained in this news release are based on what Osisko's

management believes to be reasonable assumptions, Osisko cannot

assure investors that actual results will be consistent with such

statements.

The forward-looking statements in this news

release are not guarantees of future performance and involve risks

and uncertainties that are difficult to control or predict. Several

factors could cause actual results to differ materially from the

results discussed in the forward-looking statements. Such factors

include, among others: the Arrangement not being completed in

accordance with the terms currently contemplated or the timing

currently expected, or at all; expenses incurred by Osisko in

connection with the Arrangement that must be paid by Osisko in

whole or in part regardless of whether or not the Arrangement is

completed; the conditions to the Arrangement not being satisfied by

Osisko and the Purchaser; currency fluctuations; disruptions or

changes in the credit or security markets; results of operations;

and general developments, market and industry conditions.

Additional factors are identified in Osisko's annual information

form for the year ended December 31, 2023 and most recent

Management's Discussion and Analysis, each of which is available on

SEDAR+ (www.sedarplus.ca) under Osisko's issuer profile.

Readers, therefore, should not place undue

reliance on any such forward-looking statements. There can be no

assurance that the Arrangement will be completed or that it will be

completed on the terms and conditions contemplated in this news

release. The proposed Arrangement could be modified or terminated

in accordance with its terms. Further, these forward-looking

statements are made as of the date of this news release and, except

as expressly required by applicable law, Osisko assumes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Contact

Information:

John BurzynskiChairman & Chief Executive

Officer(416) 363-8563

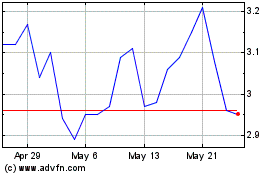

Osisko Mining (TSX:OSK)

Historical Stock Chart

From Feb 2025 to Mar 2025

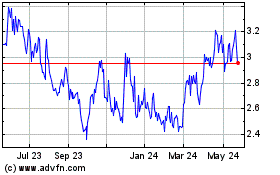

Osisko Mining (TSX:OSK)

Historical Stock Chart

From Mar 2024 to Mar 2025