Aura Announces Forward Split of Brazilian Depositary Receipts

July 05 2024 - 7:50PM

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX:

ORAAF) (“

Aura” or the

“

Company”) is pleased to announce that its board

of directors and Comissão de Valores Mobiliários (CVM) have

approved a forward split of the Company's Brazilian Depositary

Receipts (the "

BDRs") on the basis of three (3)

BDRs for each one (1) BDR currently outstanding (the "

BDR

Split").

Each holder of record of old BDRs will receive

three (3) new BDRs for every old BDR held on such date. No action

is required by the holders of BDRs in connection with the BDR

Split. There will be no changes to the common shares of the

Company. Prior to the BDR Split, each BDR represented one (1)

common share of the Company and following the BDR Split, three (3)

BDRs will represent one (1) common share of the Company. The BDRs

will continue to be listed on the B3 - Brasil, Bolsa Balcão under

the symbol “AURA33”.

Currently, there are 19,256,720 BDRs with no par

value issued and outstanding. Upon completion of the BDR split,

there will be 57,770,160 BDRs with no par value issued and

outstanding.

Details of the BDR Split:

Record Date: 07/10/2024.

Trading: BDRs will be traded

ex-rights to the split from 07/11/2024, with the new BDRs being

included in the holders' positions on 07/15/2024.

The Company will keep its shareholders and the

market in general informed regarding the developments of this Press

Release. In case of any questions, the Investor Relations

Department is available for further clarification.

About Aura 360° Mining

Aura is focused on mining in complete terms –

thinking holistically about how its business impacts and benefits

every one of our stakeholders: our company, our shareholders, our

employees, and the countries and communities we serve. We call this

360° Mining.

Aura is a mid-tier gold and copper production

company focused on operating and developing gold and base metal

projects in the Americas. The Company has 4 operating mines

including the Aranzazu copper-gold-silver mine in Mexico, Apoena

and Almas gold mines in Brazil, and the San Andres gold mine in

Honduras. The Company’s development projects include Borborema and

Matupá both in Brazil. Aura has unmatched exploration potential

owning over 650,000 hectares of mineral rights and is currently

advancing multiple near-mine and regional targets along with the

Serra da Estrela copper project in the prolific Carajás region of

Brazil.

For more information, please contact:

Investor Relations

ir@auraminerals.comwww.auraminerals.com

Forward-Looking Information

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

laws and “forward-looking statements” within the meaning of

applicable Unites States securities laws (collectively,

“forward-looking statements”) which include, without limitation,

the intention to complete the BDR Split and the effective date

thereof.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements if such risks,

uncertainties or factors materialize. The Company has made numerous

assumptions with respect to forward-looking statements contain

herein and actual results to differ materially from those contained

in the forward-looking statements if such assumptions prove wrong.

Specific reference is made to the Company’s most recent AIF on file

with certain Canadian provincial securities regulatory authorities

and the Technical Reports for a discussion of some of the risk

factors underlying forward-looking statements, which include,

without limitation, the receipt of regulatory approvals to complete

the BDR Split. Readers are cautioned that the foregoing list of

factors is not exhaustive of the factors that may affect the

forward-looking statements.

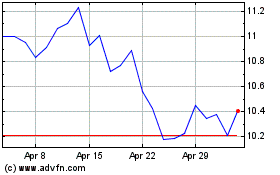

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Oct 2024 to Nov 2024

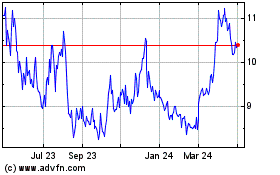

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Nov 2023 to Nov 2024