Osisko Gold Royalties Ltd (the “

Corporation” or

“

Osisko”) (OR: TSX & NYSE) is pleased to

provide an update on its second quarter 2023 deliveries, revenues,

cash margin and recent asset advancements. All monetary amounts

included in this report are expressed in Canadian dollars, unless

otherwise noted.

PRELIMINARY Q2 2023 RESULTS

Osisko earned approximately 24,645 attributable

gold equivalent ounces1 (“GEOs”) in the second quarter of 2023,

including 1,527 GEOs earned from the recently acquired CSA silver

stream, for which revenues are expected to be recognized in the

third quarter of 2023.

Osisko recorded preliminary revenues from

royalties and streams of $60.5 million during the second quarter

and preliminary cost of sales (excluding depletion) of $4.3

million, resulting in a quarterly cash margin2 of approximately

$56.2 million (or 93%).

Paul Martin, Interim CEO of Osisko, commented:

“It is a privilege to be granted the opportunity to become Interim

CEO of Osisko, a leading royalty company with an exceptional

portfolio of assets. I look forward to overseeing management’s

continued execution of its successful strategy of originating and

delivering high quality royalty and streaming transactions while

the board continues its search for the next leader of the

company.”

Osisko will provide full production and

financial details with the release of its second quarter 2023

results after market close on Wednesday, August 9th, 2023 followed

by a conference call on Thursday, August 10th at 10am ET. More

details are provided at the end of this release.

PORTFOLIO UPDATE

Canadian Malartic Mine Life Extension

and Update (5% NSR royalty on open pit and 3-5% NSR royalty on

underground)

On June 30th, Agnico Eagle Mines Limited

(“Agnico Eagle”) provided results from an internal study on the

Odyssey underground mine (the “2023 Study”) and exploration results

from the Canadian Malartic Complex. The 2023 Study highlighted a

23% increase in life-of-mine payable gold production from the

Odyssey mine compared to the internal study from 2020. The 2023

Study also outlined an extension of the mine life to 2042 with a

mine plan that includes approximately 9.0 million ounces of gold,

including 0.2 million ounces of gold in Mineral Reserves (2.8

million tonnes grading 2.22 grams per tonne "g/t" gold), 4.8

million ounces of gold in Indicated Resources (45.5 million tonnes

grading 3.31 g/t gold) and Inferred Resources of 4.0 million ounces

of gold (53.5 million tonnes grading 2.32 g/t gold).

Agnico Eagle noted that the potential for

further conversion of Inferred Resources is significant and

expected to further add to mine life. With additional exploration,

Agnico Eagle believes that mineralization will continue to be added

into the overall mine plan in the coming years, with good potential

to grow annual gold production and further extend the mine

life.

Figure 1: Canadian Malartic Production

Profile

Source: Agnico Eagle Press Release, June 20,

2023

In 2023, Agnico Eagle expects to spend

approximately $21.8 million for 164,000 meters of drilling at

Canadian Malartic and its adjoining properties. Approximately

95,030 meters were drilled during the first five months of 2023. Up

to fifteen drills were active on Canadian Malartic and its

surrounding properties during the same period, with five

underground drills currently completing infill drilling on the

Odyssey South deposit, four surface drills focused on completing

infill drilling and transitioning to expand East Gouldie

mineralization, and up to six drills active in regional

exploration.

Drilling from underground in the Odyssey South

deposit gradually increased during the first half of 2023 as ramp

development provided access to new drill bays to test Odyssey South

and Odyssey internal zones. As at May 31st, the ramp was 3,645

meters in length, reaching the bottom of the Odyssey South deposit

at a depth of 578 meters. Shaft sinking activities started in

March, with 55 meters completed as of June 20th. Underground infill

drilling into Odyssey South continued to confirm the widths and

grades of mineralization. With continued infill drilling success,

Agnico Eagle’s expectation is that Probable Mineral Reserves will

continue to grow and replace 2023 production from that zone.

Exploration drilling from the Odyssey ramp is also increasing

confidence in the adjacent Odyssey internal zones and demonstrating

good continuity of gold mineralization within these internal

structures. The gold mineralization encountered to date in the

Odyssey internal zones has not been included in the current mine

plan and could represent an attractive near-term exploration

opportunity considering the zone’s proximity to existing and

planned underground mine infrastructure around the Odyssey South

and Odyssey North deposits. Agnico Eagle indicated that positive

drill results at Odyssey internal zones show the potential to

further increase production during the operation’s 2023-2028

transition period.

Exploration at the Odyssey mine in 2023 is

expected to include $11.8 million for 102,000 meters of drilling

focused on the following four objectives:

- Continued drilling into East

Gouldie to convert additional Inferred Resources to Indicated

Resources towards the outer portions of the deposit

- Testing the immediate extensions of

East Gouldie to the west and at shallower depths

- Continued conversion drilling into

extensions of Odyssey South; and

- Further investigate Odyssey

internal zones

Select intercepts from recent drilling at

Odyssey are shown in Figure 2.

Figure 2: Canadian Malartic Long

Section

Source: Agnico Eagle Press Release, June 20,

2023

Agnico Eagle continues to expect to have 40,000

tonnes per day (“tpd”) of excess mill capacity starting in 2028 as

processing of open pit ore and low-grade stockpiles gradually

decreases and transitions to the higher-grade Odyssey underground

mine. This additional mill capacity provides significant

optionality for organic growth at Canadian Malartic and the greater

land package. Agnico Eagle now controls 16.5 kilometers of

continuous ground along the Cadillac-Larder Lake break at its

Canadian Malartic and adjoining properties. Agnico Eagle has

budgeted approximately $10 million in 2023 for 62,000 meters of

regional exploration drilling on the Canadian Malartic, Rand

Malartic, Camflo, Midway and East Amphi properties which offer

potential opportunities to supplement the existing mine life with

additional ore sources. Osisko holds 5% NSR royalties on East Amphi

and Midway.

In addition to near-mill exploration, Agnico

continues to explore the possibility of utilizing the excess mill

and tailings storage capacity at Canadian Malartic to support other

regional projects. Current internal studies include potential

sources of ore from the Macassa near surface deposits and the AK

deposit (2% NSR Royalty), the Upper Beaver project (2% NSR

Royalty), other Kirkland Lake satellite deposits including Upper

Canada and Anoki-McBean (2% NSR Royalties), as well as the Wasamac

project. Osisko holds a $0.40 per tonne mill royalty on any ore

processed at the Canadian Malartic mill that was not part of the

initial Malartic property at the time of the sale to Yamana and

Agnico Eagle in 2014.

Figure 3: Regional Pipeline – Cadillac-Larder Lake

Break

Source: Agnico Eagle Presentation “Canadian

Malartic Complex Mine Tour”, June 21, 2023

CSA Initial Deliveries and Update (100%

Silver Stream and 3.0% Copper Stream)

On June 16th, Osisko Bermuda Limited (“OBL”)

closed the previously announced silver purchase agreement (the

“Silver Stream”) and copper purchase agreement (the “Copper

Stream”) referenced to production from the CSA mine (“CSA”) with

Metals Acquisition Limited (“MAC”). Deliveries of refined silver to

OBL under the Silver Stream will include approximately 1,527 GEOs

in respect of silver produced at CSA between February 1st and June

15th. Deliveries of refined copper to OBL under the Copper Stream

will commence in June 2024. Production in the first half of 2023

was impacted by planned downtime of the process plant to complete

upgrades to the grinding circuit.

On June 27th, MAC announced that it had shipped

its first shipment of concentrate to customers in Asia containing

approximately 2,300 tonnes of copper and 28,000 ounces of silver.

MAC has identified multiple opportunities to improve productivity,

optimize costs, lower cut-off grade, increase the resource and

extend the mine life at CSA.

Costa Fuego Royalty Acquisition (1.0%

Copper NSR Royalty and 3.0% Gold NSR Royalty)

On June 28th, Osisko announced a binding

agreement to acquire a 1.0% copper NSR royalty and a 3.0% gold NSR

royalty covering Hot Chili Limited’s Costa Fuego Copper-Gold

Project (“Costa Fuego”) in Chile.

Costa Fuego is one of the world’s largest

undeveloped copper projects, not currently controlled by a major

mining company. It hosts an NI 43-101 Indicated Resource including

both the open pit and underground portions of the Cortadera and

Productora deposits, of 725 million tonnes grading 0.47% Copper

Equivalent (“CuEq”), grading 0.38% Copper, 0.11 g/t gold, 0.45 g/t

silver and 93 ppm Molybdenum and an Inferred Resource of 202

million tonnes grading 0.30% copper and 0.06 g/t gold. The June

2023 PEA projects at 16 year mine life with average annual

production of 95 thousand tonnes of copper and 49,000 ounces of

gold in the first 14 years.

Costa Fuego is situated at low altitude and is

in close proximity to all key infrastructure requirements. An

updated resource is scheduled for late 2023 and will serve as the

basis for a PFS, scheduled for completion in the second half of

2024.

Gibraltar Stream Increase (87.5% Silver

Stream)

On June 29th, Osisko announced an amendment to

its silver stream on the Gibraltar copper mine (“Gibraltar”).

Osisko and Taseko Mines Limited (“Taseko”) have amended the silver

stream to increase Osisko’s effective stream percentage by 12.5% to

87.5%. Further, the step-down silver delivery threshold has been

extended to coincide with Taseko’s recently updated mineral reserve

estimate for Gibraltar.

Mantos Blancos Ramp Up (100% Silver

Stream)

On May 3rd, Capstone Copper (“Capstone”)

discussed its progress on the ramp up at Mantos Blancos, including

continued focus on preventative maintenance to increase reliability

and reduce downtime. Average throughput during the first quarter

was 16,023 tpd (compared to 15,246 tpd in the fourth quarter of

2022). The quarter included eighteen days operating at 20,000 tpd

and an average throughput rate of 19,000 tpd in February. On their

first quarter conference call, Capstone indicated that higher

throughput at Mantos Blancos is anticipated over the balance of the

year. OBL expects to see stronger deliveries under the stream in

the second half of 2023.

Capstone is currently evaluating the potential

to further increase throughput of the Mantos Blancos sulphide

concentrator plant from 20,000 tpd to 27,000 tpd using idled mill

capacity with the potential for additional production through 2032.

The Mantos Blancos Phase II feasibility study is expected to be

released in the second half of 2023.

Eagle Ramp Up (5.0% NSR

Royalty)

On July 5th, Victoria Gold Corp. (“Victoria”)

reported second quarter production of 45,568 ounces of gold

resulting in production of 83,188 ounces of gold during the first

half of 2023. This represents a 47% improvement over the 56,413

ounces of gold produced in the first half of 2022. Both gold grade

and metallurgical recovery continue to reconcile well against the

Eagle reserve model. Island Exploration Success (1.38% to

3.0% NSR Royalty)

On June 15th, Alamos Gold Inc. (“Alamos”)

reported new results from underground drilling at the Island Gold

mine, further extending high-grade gold across the deposit,

including several recently defined hanging wall and footwall

structures in close proximity to existing underground

infrastructure. Continued exploration success within recently

defined sub-parallel structures demonstrates the significant

opportunities to add high-grade ounces near existing mining

horizons. This includes the newly defined NS1-Zone in the hanging

wall which is currently being developed and mined; the zone is

beyond existing Mineral Reserves and Resources and outside of the

2023 mine plan.

A total of $14 million is budgeted for

exploration at Island Gold in 2023. For the past several years, the

exploration focus has been on adding high-grade Mineral Resources

at depth in advance of the Phase 3+ Expansion study, primarily

through surface directional drilling. This exploration strategy has

been successful in tripling the Mineral Reserve and Resource base

since 2017. With a 17-year mine life, and with work on the

expansion ramping up, the focus has shifted to an expanded

underground exploration drilling program that will leverage

existing underground infrastructure. The underground exploration

drilling program has been expanded from 27,500 meters in 2022 to

45,000 meters in 2023 and is focused on defining new Mineral

Reserves and Resources in proximity to existing production horizons

and infrastructure including along strike, and in the hanging-wall

and footwall. These potential high-grade Mineral Reserve and

Resource additions would be low-cost to develop and could be

incorporated into the mine plan and mined within the next several

years.

Seabee Update (3% NSR

Royalty)

During SSR Mining Inc.’s (“SSR Mining”) first

quarter conference call, it was mentioned that production during

the quarter reflected an issue with underground equipment

availability that negatively impacted the mine sequencing at

Seabee. The issue was resolved, but grades processed were below

expectations.

SSR Mining continues to advance near mine

exploration at Seabee with a focus on prioritizing mineral resource

conversion activities to ensure mineral reserve growth and mine

life extensions in the future. They continue to evaluate

early-stage exploration targets at depth below the existing Santoy

mineralization as well as regional targets like Porky and Porky

West that could contribute meaningfully to Seabee's longer-term

production platform.

Lamaque Update (1% and 2.5% NSR

Royalty)

During Eldorado Gold Corporation’s (“Eldorado”)

first quarter conference call, management indicated that second

quarter processing rates will increase slightly coupled with

consistent grade and production for the second half of the year is

expected to be stronger than the first half. Additionally, Eldorado

is anticipating the delivery of the first electric haul truck in

the second quarter and a second in the fourth quarter, which are

expected to enhance haulage capabilities and reduce diesel

consumption per tonne, lowering GHG emissions.

Eldorado also highlighted that exploration

results at Ormaque continue to demonstrate the potential to

increase resources. Partial results from resource conversion

drilling will be incorporated in a resource update later in 2023

and a maiden reserve on Ormaque in 2024.

Renard Update (9.6% Diamond

Stream)

On June 23rd, Stornoway made the decision to

evacuate the Renard mine, located in central Québec, due to forest

fires located 50km to the northwest of the operation. Smoke

from the fires as well as the closure of an important access road

necessitated the interruption in site activities. Mining

operations resumed on July 1st and the diamond recovery plant

restarted on July 4th following the reopening of the access road

allowing for the resumption of transportation of natural gas and

diesel necessary for operations. As a result of the temporary

evacuation, we anticipate a moderate impact on deliveries from

Renard in the third quarter of 2023; we also note a general

softening in the diamond market over the second quarter due to high

polished inventory levels and a slower economic rebound in

China.

Pan Mine (4.0% NSR Royalty)

On June 21st, Calibre Mining Corp. (“Calibre”)

announced assay results from the 2023 drill program at the Pan Mine

in Nevada. Results at the Palomino target, located immediately

south of the current open pit, indicate higher grades than the

current average reserve grade of 0.4g/t gold. Currently a small

amount of material at Palomino exists in Inferred Resources. The

potential now exists to materially increase resource ounces, grade

and confidence south of the Pan mine and the Palomino deposit

remains open to the southeast and at shallow depths. Some highlight

intercepts include 3.84 g/t gold over 15.2 meters, 2.08 g/t gold

over 27.4 meters and 2.02 g/t gold over 27.4 meters. All drill

targets are located near-surface in oxidized limestone. Given the

proximity to the current open pit, and the fact that Palomino is

within the permitted area, Calibre has indicated they could start

mining at Palomino as early as 2024.

Windfall Joint Venture (2-3% NSR

Royalty)

On June 5th, Osisko Mining Inc. (“Osisko

Mining”) announced the suspension of all activities at the Windfall

project due to the wildfire situation in Northern Québec.

Facilities were monitored in accordance with local directives.

On May 2nd, Osisko Mining and Gold Fields Ltd.

(“Gold Fields”) announced a joint venture partnership (collectively

“the Partnership”) to develop and mine the Windfall Project in

Québec, Canada. Gold Fields acquired a 50% interest in the

feasibility stage Windfall Project (including exploration

potential) on the following key terms:

- cash payment of C$300 million paid

on signing;

- cash payment of C$300 million

payable on issuance of key permits and,

- 50/50 co-share of interim and

construction capital expenditures.

Gold Fields believes the Windfall Project is on

track to become a high-quality, low-cost underground gold mine with

a relatively small surface footprint and considerable growth

prospects along strike and down plunge, well beyond delineated

Mineral Reserves and the current 10 year projected mine life set

out in Osisko Mining’s December 2022 Windfall feasibility study.

Drawing on more than 20 years of successful brownfields exploration

and reserve growth at its Western Australian operations, Gold

Fields sees the potential for a similar path to emerge at the

Windfall, Urban Barry and Quévillon belts.

Property-wide regional and near-deposit

exploration is already in progress, with six drills exploring

targets developed by Osisko over the past seven years, including

the Golden Bear, Fox and Shellian prospects. An initial exploration

program developed by the Partnership includes $20 million dedicated

to these and other targets.

Tintic Ramp Progress and Exploration

Success (2.5% Metals Stream)

On May 17th, Osisko Development Corp. (“Osisko

Development”) announced the remaining diamond drilling (“DD”) and

reverse circulation (“RC”) drill results from its 2022 exploration

program, announced new 2023 underground diamond drilling results

and provided an overview of the ongoing 2023 exploration program at

its 100%-owned Trixie test mine (“Trixie”) within the greater

Tintic Project (“Tintic”). Highlights included 23.49 g/t gold and

58.79 g/t silver over 1.37 meters, 62.82 g/t gold and 231.46 g/t

silver over 6.86 meters including 191 g/t gold and 707 g/t silver

over 1.07 meters. Currently there are two underground diamond drill

rigs in operation at Trixie conducting exploration activities.

Additionally, as of May 17th, approximately 75%

of the Trixie portal and underground decline ramp had been

completed and completion of the decline ramp to the main 625 level

is anticipated by the third quarter of 2023, which is expected to

significantly improve underground access for exploration

drilling.

During 2022, Osisko Development completed an

extensive review and compilation of historical data on the Tintic

Project. As a result, a number of high-sulphidation epithermal

gold-silver targets were identified at North Lily and Eureka

Standard. Additionally, copper-molybdenum-gold porphyry targets

were identified at Big Hill – a lithocap approximately 2 kilometers

in strike length and 1 kilometer wide indicative of an underlying

porphyry system. A strong geophysical and geochemical target was

also identified to the West and at depth below Trixie. An initial

program of surface drilling is planned to test Big Hill, commencing

in the third quarter of 2023.

Cariboo Permitting Update (5.0% NSR

Royalty)

On May 8th, Osisko Development announced the

signing of two permitting agreements, the Process Charter and the

Joint Information Requirements Table, reaffirming the multilateral

support of and commitment by the various levels of the Government

of British Columbia to advance the approval process of the Cariboo

Gold Project (“Cariboo”). The target timelines established by the

Process Charter, which are contingent on the issuance of the

Environmental Assessment Certificate anticipated in the third

quarter of 2023, contemplate a final application referral date that

is aligned with the anticipated receipt of environmental permits in

Q1 2024.

Taylor Update (1% NSR Royalty on

Sulphide Ores)

On May 8th, South32 Limited (“South32”)

announced that the Taylor project had been confirmed by the United

States Federal Permitting Improvement Steering Council (FPISC), as

the first mining project added to the FAST-41 process, enabling a

more efficient and transparent process for federal permitting. The

Taylor project, located in Southern Arizona, is currently the only

advanced mine development project in the US that could produce two

federally designated critical minerals: zinc and manganese. To

qualify for the FAST-41 process, complex critical infrastructure

projects must meet rigorous criteria to demonstrate benefit to the

United States.

In a recent presentation, South32 indicated that

the Taylor feasibility study and a final investment decision is on

track for the second half of 2023 incorporating the revised mine

development schedule, which is being optimized for the FAST-41

permitting process.

On April 23rd, along with quarterly results,

South32 indicated that US$173 million had been invested at the

project in the nine months ended March 2023. Construction of the

second water treatment plant progressed and remained on track to be

completed in the fourth quarter of 2023.

Casino (2.75% NSR Royalty)

On April 14th, Western Copper and Gold

Corporation (“Western Copper”) announced the closing of the $21.3

million strategic equity investment by Mitsubishi Materials

Corporation representing approximately 5.0% interest in Western

Copper, to further advance the Casino Project. And subsequently,

Western Copper also announced the closing of the $2.3 million

subscription by Rio Tinto Canada Inc. to maintain its pro-rata

interest of approximately 7.84%.

Corvette Property (2% NSR Royalty on

Lithium covering the majority of drilled area)

On June 14th, Patriot Battery Metals Inc.

(“Patriot”) announced further drill results from the 2023 winter

drill program at the Corvette Property (“Corvette”), located in the

Eeyou Istchee James Bay region of Québec. Core assays, for the

drill holes reported cover the CV5 Pegmatite’s recently defined

eastward extension, the high-grade Nova Zone and the recently

defined westward extension. Drill hole CV23-148 targeted the Nova

Zone and returned a wide and high-grade intercept of 95.3 meters at

1.62% Li2O, including 47.6 meters at 2.09% Li2O.

The high-grade result affirms the interpretation

that the Nova Zone extends continuously over a strike length of at

least 1.1 kilometers. Strong grades and widths were returned in

drilling over the recently defined westward extension, highlighted

by drill hole CV23-160A, which returned 127.7 meters at 1.78% Li2O,

including 50.1 meters at 2.43% Li2O. Through the 2023 winter drill

program, the CV5 Pegmatite has been traced continuously by drilling

(at approximately 50 to 150 meters spacing) as a principally

continuous spodumene-mineralized body over a lateral distance of at

least 3.7 kilometer and remains open along strike at both ends and

to depth along most of its length. Patriot expects to announce an

initial mineral resource estimate at CV5 in the near term.

On June 4th, Patriot provided an update on its

work programs and the impact of the current forest fire situation

in Québec. Patriot temporarily ceased drilling and surface

exploration field activities until the situation improves. Core

continues to be processed from holes completed at Corvette in May

2023.

Tocantinzinho Gold Project (0.75% NSR

Royalty)

On June 13th, G Mining Ventures Corp. (“G

Mining”) provided an update on site activities for its

Tocantinzinho Gold Project (“TZ”) in the State of Pará, Brazil. As

at June 13th, the project was 30% complete and remained on track

and on budget for commercial production in the second half of 2024.

To date, 1.74 million tonnes of waste material had been excavated

from the starter pit. Approximately 2.4 million tonnes of ore will

be stockpiled during the pre-production period prior to mill

commissioning, providing roughly 6 months of mill feed. Powerline

progress has reached 41%.

On June 1st, G Mining announced it entered into

a power purchase that grants Renewable Energy Certificates as

assurance of the supply of renewably generated power. This will

enable G Mining to produce gold ounces with Scope 1 emissions in

the lowest quartile of the CO2 emissions curve when compared to

similar operations in the Americas.

Marimaca Copper (1% NSR

Royalty)

On June 20th, Marimaca Copper Corp. (“Marimaca”)

announced a $20 million equity investment by Mitsubishi

Corporation, representing a strong endorsement of the quality of

the Marimaca Project. Proceeds from the investment will be used to

advance and accelerate development and progress towards the

feasibility study, as well as on project permitting

initiatives.

On May 18th, Marimaca announced an updated

Mineral Resource Estimate (“MRE”) for the Marimaca Oxide Deposit

(the “MOD”). Measured and Indicated Resources for the MOD are now

200 million tonnes at 0.45% total copper (“CuT”) for 900 thousand

tonnes of contained copper, in addition to Inferred Resources of

37.3 million tonnes at 0.38% CuT for 141kt of contained copper. 86%

of the MOD’s total resource tonnes are now contained in the

Measured and Indicated categories. The 2023 MRE incorporates 28,374

meters of new drilling data completed since the 2022 MRE released

in October 2022. The MOD’s unique characteristics were maintained

in the 2023 MRE, including a low strip ratio within a single

constraining pit shell. Marimaca has completed 5 phases of

extensive metallurgical test work and a 6th phase of metallurgical

testing is underway, which is expected to define the optimized

process design flowsheet ahead of the planned feasibility study,

which is now expected to be released in the first quarter of

2024.

Akasaba West (2.5% NSR

Royalty)

On April 27th, Agnico Eagle announced that work

at the Akasaba West project commenced in September 2022 and

remained on schedule for overburden removal in the first quarter of

2023, with over 670,000 tonnes of material removed to date.

Construction of surface infrastructure is also progressing on

schedule, including offices, a garage and water treatment

facilities.

Altar Exploration Success (1.0% NSR

Royalty)

On June 14th, Aldebaran Resources (“Aldebaran”)

announced the completion of the previously announced top-up

financing with a subsidiary of South32. South32 elected to exercise

its anti-dilution rights to maintain a 9.9% equity interest in

Aldebaran following the exercise of warrants announced on May 5th,

2023.

On June 7th, Aldebaran reported results from its

ongoing drill campaign at Altar. ALD-23-228 hit the favourable host

rock formation at approximately 750 meters depth and thereafter

returned some of the highest-grade copper mineralization

encountered on the project to date, demonstrating continuity with

previously intersected high-grade mineralization. Highlights

include 565.6 meters of 0.60% Copper Equivalent (“CuEq”) from 676

meters depth in hole ALD-23-228, including 329.6 meters of 0.80

CuEq and 198.5 meters of 0.50% CuEq from 1,040 meters depth in hole

ALD-23-227, notably the hole ended in 31.5 meters of 0.69% CuEq. As

at June 7th Aldebaran had re-started drilling on hole 228 to see if

the higher-grade mineralization continues to depth. Aldebaran

indicated that four rigs are actively drilling with assays

pending.

On May 31st, Aldebaran announced results from

hole ALD-23-225B, drilled to test the continuity between

mineralization encountered in previously released holes and to

provide another pierce point into the promising geophysical anomaly

that sits below and lateral to the current resources at Altar.

Results included 1,056.2 meters of 0.56% CuEq from 291 meters

depth, including 951.20 meters of 0.60% CuEq from 396 meters. This

drilling fills a 400 meter gap between previous holes 223 and 224.

The results are higher grade than the current average grade of the

mineral resource and provide additional confirmation that the

mineralized footprint of the Altar system is larger than previously

understood. Figure 4 shows a across section looking towards the

northeast displaying significant drill results that correspond with

a large geophysical anomaly spanning the Altar East and Altar

Central deposits.

Figure 4: Cross Section Looking Towards

the NorthEast

Source: Aldebaran Resources, May 2023

West Kenya (2.0% NSR

Royalty)

On May 22nd, Shanta Gold Limited (“Shanta Gold”)

announced a company-wide exploration update, including drill plans

from the West Kenya Project (“West Kenya”) for 2023. Up to 26,000

meters are planned across 80 holes focused around the Isulu and

Ramula deposits targeting both conversion to Indicated Resources

plus resource extensions. Third party consultants have been engaged

to accelerate technical studies and a workstream toward mining

license application and permitting for West Kenya is underway. The

2023 exploration budget for West Kenya is up to US$10 million,

consistent with previous years. Initial assay results are expected

in July, with an updated Mineral Resource Estimate anticipated for

the second half of 2023.

WKP (2.0% NSR Royalty)

On June 19th, OceanaGold Corporation

(“OceanaGold”) announced results from the 2023 resource conversion

drill program at Wharekirauponga (“WKP”) in New Zealand.

WKP is a low-sulphidation epithermal gold-silver

vein system located approximately 10 kilometers to the north of

OceanaGold’s Waihi Gold Mine. WKP hosts an Indicated Resource of

1.7 million tonnes grading 12.3 g/t for 0.66 million ounces of

gold. Inferred Resources total 2.6 million tonnes at a grade of 7.8

g/t for 0.64 million ounces of gold, with approximately 90% of the

Resources contained within the EG Vein, a hanging wall splay and

three footwall veins (collectively, the "EG Vein Zone"). Resource

conversion drilling remains a priority in 2023 as OceanaGold works

towards growing Indicated Resources to support a pre-feasibility

study in 2024.

Opportunities for both up- and down-plunge and

along-strike extensions of the EG Vein remain, with high-grade

intercepts remaining open. Step-out drilling in hole WKP100, the

most southerly hole on the EG Vein also confirmed mineralization

continues for at least a further 200 meters along strike of the

currently defined southern shoot. Highlight intercepts

from drilling on the EG Vein Zone include 60.5 g/t gold over 11.1

meters, 51.3 g/t gold over 5.9 meters, 36.9 g/t gold over 8.0

meters and 53.3 g/t gold over 5.0 meters.

ADDITIONAL HIGHLIGHTS

1) Group 6 Metals announced commercial

production at the Dolphin Tungsten Mine in Tanzania and first

concentrate shipment is expected in July (1.5% GRR Royalty)

2) Westhaven Resources announced results from

its drill campaign at the Shovelnose gold property, including 24.95

meters of 14.66 g/t Gold And 35.52 g/t Silver at the Franz target

(2.0% NSR royalty)

3) Brunswick Exploration announced its first

set of results from its recently completed drilling campaign at the

Anatacau West project, located in the Eeyou Istchee-James Bay

region of Québec. Results from the first 12 holes included hole

26.5 meters at 1.51% Li2O, and 10.1 meters at 1.06% Li2O, including

4.9 m at 1.63% Li2O. (3.0% NSR royalty)

4) Roscan Gold announced additional drill

results at Kabaya in Mali including 1.62 g/t gold over 24 meters

and 2.27 g/t gold over 7 meters (1.0% NSR royalty)

5) First Majestic Silver announced that Santa

Elena transitioned full mine production to the Ermitaño underground

mine during the quarter (2.0% NSR royalty)

6) Talisker Resources announced US$31.5 million

financing package for Bralorne Gold Project (1.7% NSR Royalty)

7) Eagle Mountain Mining announced that assay

results from detailed maiden sampling and mapping at Oracle Ridge

have identified multiple high-grade copper zones enhancing the

optionality of Oracle Ridge, supporting either bulk mining or

selective high-grade mining scenarios (3.0% NSR royalty)

8) Benz Mining announced an updated MRE on the

Eastmain deposit in Québec including Indicated Resources of 1.3

million tonnes of 9.0 g/t for 384koz gold and Inferred Resources of

3.8 million tonnes of 5.1g/t for 621koz gold (1.15% NSR

royalty)

Q2 2023 RESULTS CONFERENCE CALL DETAILS

Osisko provides notice of second quarter 2023

results and webcast and conference call details.

|

Results Release: |

Wednesday, August 9th, 2023 after market close |

|

Conference Call: |

Thursday, August 10th, 2023 at 10:00 am ET |

|

Dial-in Numbers: |

North American Toll-Free: 1 (888) 886 7786Local and International:

1 (416) 764 8658Conference ID: 63806714 |

| Replay (available until Sunday,

September 10th at 11:59 PM ET): |

North American Toll-Free: 1 (877) 674 7070Local and International:

1 (416) 764 8692Playback Passcode: 806714# |

|

|

Replay also available on our website at www.osiskogr.com |

The figures presented in this press release,

including revenues and costs of sales, have not been audited and

are subject to change. As the Corporation has not yet finished its

quarter-end procedures, the anticipated financial information

presented in this press release is preliminary, subject to

quarter-end adjustments, and may change materially.

(1) Gold Equivalent OuncesGEOs

are calculated on a quarterly basis and include royalties, streams

and offtakes. Silver earned from royalty and stream agreements are

converted to gold equivalent ounces by multiplying the silver

ounces earned by the average silver price for the period and

dividing by the average gold price for the period. Diamonds, other

metals and cash royalties are converted into gold equivalent ounces

by dividing the associated revenue earned by the average gold price

for the period. Offtake agreements are converted using the

financial settlement equivalent divided by the average gold price

for the period.

Average Metal Prices and Exchange Rate

|

|

Three months ended June 30 |

|

|

|

|

2023 |

|

2022 |

|

| |

|

|

| Gold(i) |

$1,976 |

$1,871 |

| Silver(ii) |

$24.13 |

$22.60 |

| |

|

|

| Exchange rate

(US$/Can$)(iii) |

|

1.3428 |

|

1.2768 |

(i) The

London Bullion Market Association’s pm price in U.S.

dollars. (ii) The

London Bullion Market Association’s price in U.S.

dollars. (iii) Bank

of Canada daily rate.

(2) Non-IFRS MeasuresThe

Corporation has included certain performance measures in this press

release that do not have any standardized meaning prescribed by

International Financial Reporting Standards (IFRS) including cash

margin in dollars and in percentage. The presentation of these

non-IFRS measures is intended to provide additional information and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS. These

measures are not necessarily indicative of operating profit or cash

flow from operations as determined under IFRS. As Osisko’s

operations are primarily focused on precious metals, the

Corporation presents cash margins as it believes that certain

investors use this information, together with measures determined

in accordance with IFRS, to evaluate the Corporation’s performance

in comparison to other companies in the precious metals mining

industry who present results on a similar basis. However, other

companies may calculate these non-IFRS measures differently.

Cash margin (in dollars) represents revenues less cost of sales

(excluding depletion). Cash margin (in percentage) represents the

cash margin (in dollars) divided by revenues.

| |

Three months endedJune 30, 2023 |

|

|

|

|

|

|

|

|

| Revenues |

$60,500 |

|

|

|

|

Less: Cost of sales (excluding depletion) |

|

($4,260 |

) |

|

|

| Cash margin (in dollars) |

$56,240 |

|

|

|

| Cash margin (in percentage of

revenues) |

|

93 |

% |

|

|

Qualified Person

The scientific and technical content of this

news release has been reviewed and approved by Guy Desharnais,

Ph.D., P.Geo., Vice President, Project Evaluation at Osisko Gold

Royalties Ltd, who is a “qualified person” as defined by National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”).

In this press release, Osisko relies on

information publicly disclosed by other issuers and third parties

pertaining to its assets and, therefore, assumes no liability for

such third-party public disclosure.

About Osisko Gold Royalties

Ltd

Osisko is an intermediate precious metal royalty

company focused on the Americas that commenced activities in June

2014. Osisko holds a North American focused portfolio of over 180

royalties, streams and precious metal offtakes. Osisko’s portfolio

is anchored by its cornerstone asset, a 5% net smelter return

royalty on the Canadian Malartic mine, which is the largest gold

mine in Canada.

Osisko’s head office is located at 1100 Avenue

des Canadiens-de-Montréal, Suite 300, Montréal, Québec,

H3B 2S2.

For further information, please contact Osisko Gold

Royalties Ltd:

| Grant MoentingVice President,

Capital MarketsTel: (514) 940-0670 #116Email:

gmoenting@osiskogr.com |

Heather TaylorVice President,

Sustainability and CommunicationsTel: (514) 940-0670 #105Email:

htaylor@osiskogr.com |

CAUTIONARY

NOTE REGARDING

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press

release may be deemed “forward-looking statements” within the

meaning of the United States Private Securities Litigation Reform

Act of 1995 and “forward-looking information” within the meaning of

applicable Canadian securities legislation. Forward-looking

statements are statements other than statements of historical fact,

that address, without limitation, future events, that

one-and-a-half million additional ounces of silver will be

delivered to Osisko due to the extended threshold, production

estimates of Osisko’s assets (including increase of production),

timely developments of mining properties over which Osisko has

royalties, streams, offtakes and investments, management’s

expectations regarding Osisko’s growth, results of operations,

estimated future revenues, production costs, carrying value of

assets, ability to continue to pay dividend, requirements for

additional capital, business prospects and opportunities future

demand for and fluctuation of prices of commodities (including

outlook on gold, silver, diamonds, other commodities) currency,

markets and general market conditions. In addition, statements and

estimates (including data in tables) relating to mineral reserves

and resources and gold equivalent ounces are forward-looking

statements, as they involve implied assessment, based on certain

estimates and assumptions, and no assurance can be given that the

estimates will be realized. Forward-looking statements are

statements that are not historical facts and are generally, but not

always, identified by the words “expects”, “plans”, “anticipates”,

“believes”, “intends”, “estimates”, “projects”, “potential”,

“scheduled” and similar expressions or variations (including

negative variations), or that events or conditions “will”, “would”,

“may”, “could” or “should” occur. Forward-looking statements are

subject to known and unknown risks, uncertainties and other

factors, most of which are beyond the control of Osisko, and actual

results may accordingly differ materially from those in

forward-looking statements. Such risk factors include, without

limitation, (i) with respect to properties in which Osisko holds a

royalty, stream or other interest; risks related to: (a) the

operators of the properties, (b) timely development, permitting,

construction, commencement of production, ramp-up (including

operating and technical challenges), (c) differences in rate and

timing of production from resource estimates or production

forecasts by operators, (d) differences in conversion rate from

resources to reserves and ability to replace resources, (e) the

unfavorable outcome of any challenges or litigation relating title,

permit or license, (f) hazards and uncertainty associated with the

business of exploring, development and mining including, but not

limited to unusual or unexpected geological and metallurgical

conditions, slope failures or cave-ins, flooding and other natural

disasters or civil unrest or other uninsured risks, (ii) with

respect to other external factors: (a) fluctuations in the prices

of the commodities that drive royalties, streams, offtakes and

investments held by Osisko, (b) fluctuations in the value of the

Canadian dollar relative to the U.S. dollar, (c) regulatory changes

by national and local governments, including permitting and

licensing regimes and taxation policies, regulations and political

or economic developments in any of the countries where properties

in which Osisko holds a royalty, stream or other interest are

located or through which they are held, (d) continued availability

of capital and financing and general economic, market or business

conditions, and (e) responses of relevant governments to infectious

diseases outbreaks and the effectiveness of such response and the

potential impact of such outbreaks on Osisko’s business, operations

and financial condition; (iii) with respect to internal factors:

(a) business opportunities that may or not become available to, or

are pursued by Osisko, (b) the integration of acquired assets or

(c) the determination of Osisko’s PFIC status. The forward-looking

statements contained in this press release are based upon

assumptions management believes to be reasonable, including,

without limitation: the absence of significant change in Osisko’s

ongoing income and assets relating to determination of its PFIC

status, and the absence of any other factors that could cause

actions, events or results to differ from those anticipated,

estimated or intended and, with respect to properties in which

Osisko holds a royalty, stream or other interest, (i) the ongoing

operation of the properties by the owners or operators of such

properties in a manner consistent with past practice and with

public disclosure (including forecast of production), (ii) the

accuracy of public statements and disclosures made by the owners or

operators of such underlying properties (including expectations for

the development of underlying properties that are not yet in

production), (iii) no adverse development in respect of any

significant property, (iv) that statements and estimates relating

to mineral reserves and resources by owners and operators are

accurate and (v) the implementation of an adequate plan for

integration of acquired assets.

For additional information on risks,

uncertainties and assumptions, please refer to the most recent

Annual Information Form of Osisko filed on SEDAR at www.sedar.com

and EDGAR at www.sec.gov which also provides additional general

assumptions in connection with these statements. Osisko cautions

that the foregoing list of risk and uncertainties is not

exhaustive. Investors and others should carefully consider the

above factors as well as the uncertainties they represent and the

risk they entail. Osisko believes that the assumptions reflected in

those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be accurate as

actual results and prospective events could materially differ from

those anticipated such the forward-looking statements and such

forward-looking statements included in this press release are not

guarantee of future performance and should not be unduly relied

upon In this press release, Osisko relies on information

publicly disclosed by other issuers and third parties pertaining to

its assets and, therefore, assumes no liability for such

third-party public disclosure. These statements speak only

as of the date of this press release. Osisko undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, other than as required by applicable law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/ec939231-873d-437f-9bde-920be1018eb6

https://www.globenewswire.com/NewsRoom/AttachmentNg/c95c4a65-6fef-445e-a6be-a009269ef080

https://www.globenewswire.com/NewsRoom/AttachmentNg/e17186b7-18e6-42b3-a44b-c4293c807da6

https://www.globenewswire.com/NewsRoom/AttachmentNg/c975a14e-f360-472f-8e62-5895ea450d96

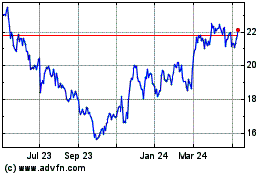

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

From Jan 2025 to Feb 2025

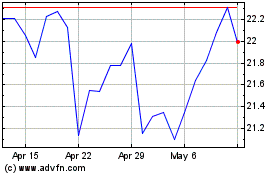

Osisko Gold Royalties (TSX:OR)

Historical Stock Chart

From Feb 2024 to Feb 2025