NuVista Receives TSX Approval for Normal Course Issuer Bid and Announces Credit Facility Renewal with Sustainability Linked Performance Features

June 09 2022 - 5:00PM

NuVista Energy Ltd. (TSX:NVA, "NVA" or the "Corporation") announces

that the Toronto Stock Exchange (the "TSX") has approved the

commencement of a normal course issuer bid (the “NCIB”) and the

renewal and extension of the Corporation’s $440 million credit

facility; which has been amended to include the incorporation of

sustainability linked performance targets and hence converted into

a sustainability linked loan (the “SLL Credit Facility”).

Normal Course Issuer Bid

Pursuant to the NCIB, NuVista will purchase for

cancellation, from time to time, as it considers advisable, up to a

maximum of 18,190,261 common shares of the Corporation. The NCIB

will become effective on June 14, 2022 and will terminate on June

13, 2023 or such earlier time as the NCIB is completed or

terminated at the option of NuVista.

NuVista's intention to launch a share buyback

program is consistent with its strategy to continue its disciplined

growth concurrently with continuing with net debt reduction and the

commencement of capital return to shareholders. The Corporation

currently believes that the best method for return of capital to

shareholders is through share repurchases under the NCIB.

The maximum number of common shares to be

purchased pursuant to the NCIB represents 10% of the public float,

as of May 31, 2022. Purchases pursuant to the NCIB will be made on

the open market through the facilities of the TSX and/or

alternative trading systems. The number of common shares that can

be purchased pursuant to the NCIB is subject to a daily maximum of

335,363 common shares (which is equal to 25% of the average daily

trading volume of 1,341,453 from December 1, 2021 to May 31, 2022)

with the exception that one block purchase in excess of the daily

maximum is permitted per calendar week. The price that NuVista will

pay for any common shares under the NCIB will be the prevailing

market price on the TSX at the time of such purchase. A copy of the

Form 12 Notice of Intention to Make a Normal Course Issuer Bid

filed by the Corporation with the TSX can be obtained from the

Corporation upon request without charge. In addition, under the SLL

Credit Facility, NuVista may not purchase common shares under the

NCIB if: (i) the Corporation's proforma Senior Debt to EBITDA (each

as defined in the SLL Credit Facility) for the next twelve months

exceeds a specified ratio; or (ii) NuVista's proforma drawings

under the SLL Credit Facility exceed a threshold dollar amount.

Under the Corporation's current forecasts, NuVista expects to

satisfy both conditions in the SLL Credit Facility for the purchase

of common shares under the NCIB.

NuVista has entered into an automatic share

purchase plan ("ASPP") with Peters & Co. Limited ("Peters &

Co.") in order to facilitate repurchases of its common shares.

Under the Corporation's ASPP, Peters & Co. may repurchase

shares under the normal course issuer bid during the Corporation's

self-imposed blackout periods. Purchases will be made by Peters

& Co. based upon the parameters prescribed by the TSX and

applicable securities laws and the terms of the plan and the

parties' written agreement. Outside of these blackout periods,

common shares may be purchased under the NCIB in accordance with

management's discretion.

As of the close of business on May 31, 2022, the

Corporation had 230,748,703 common shares issued and outstanding

and a public float of 181,902,614 common shares. All common shares

acquired under the NCIB will be cancelled.

This news release does not constitute an

offer to sell, or a solicitation of an offer to buy, any security

and shall not constitute an offer, solicitation or sale in any

jurisdiction in which such an offer, solicitation, or sale would be

unlawful.

Credit Facility Incorporates

Sustainability Linked Performance Features

The conversion of the Corporation's credit

facility to a sustainability-linked loan (“SLL”) allows us to link

our performance on key sustainability themes to our borrowing

costs, whereby rates increase or decrease depending on whether we

meet or miss the established annual sustainability performance

targets ("SPTs") related to:

- A reduction of Scope 1 & 2 GHG Intensity;

- Increased spending on Asset Retirement Obligations, over and

above the minimum Alberta Energy Regulator established regulations

as well as the number of well sites moved through the assessment

and remediation process; and

- Gender diversity at the Board of Directors level.

Successfully achieving these SPTs will result in

a decrease to the ongoing costs of the SLL Facility, and

conversely, NuVista will incur an increase to the ongoing costs if

it fails to meet the SPTs. The SPTs are important to our business

plan and corporate values while demonstrating our continuing

commitment to the environment.

The SLL Credit Facility was structured in

collaboration with CIBC and RBC as Co-Sustainability Structuring

Agents. CIBC acted as Sole Bookrunner, Administrative Agent and

Co-Sustainability Structuring Agent; while RBC acted as

Co-Syndicate Agent and Co-Sustainability Structuring Agent for the

transaction.

About NuVista

NuVista is an oil and natural gas company

actively engaged in the exploration for, and the development and

production of, oil and natural gas reserves in the province of

Alberta. NuVista’s primary focus is on the scalable and repeatable

condensate-rich Montney formation in the Pipestone and Wapiti areas

of the Alberta Deep Basin. This play has the potential to create

significant shareholder value due to the high-value condensate

volumes associated with the natural gas production and the large

scope of this resource play. The common shares of NuVista trade on

the TSX under the symbol NVA. Learn more at

www.nuvistaenergy.com

Forward-Looking Information

This news release contains certain

forward-looking information and statements within the meaning of

applicable securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "may", "will", "project",

"should", "believe", "plans", "intends" “forecast” and similar

expressions are intended to identify forward-looking information or

statements. In particular, and without limiting the foregoing, this

news release contains forward-looking statements with respect to

NuVista's intentions with respect to the NCIB, including the return

of capital to shareholders, the timing for beginning purchases of

common shares under the NCIB, the effects of repurchases of common

shares under the NCIB, the anticipated effects of the SLL, and

NuVista's ability to achieve the SPTs and anticipated outcomes

thereof. Forward-looking statements or information are based on a

number of material factors, expectations or assumptions of NuVista

which have been used to develop such statements and information but

which may prove to be incorrect. Although NuVista believes that the

expectations reflected in such forward-looking statements or

information are reasonable, undue reliance should not be placed on

forward-looking statements because NuVista can give no assurance

that such expectations will prove to be correct. The

forward-looking information and statements contained in this news

release speak only as of the date of this news release, and NuVista

does not assume any obligation to publicly update or revise any of

the included forward-looking statements or information, whether as

a result of new information, future events or otherwise, except as

may be required by applicable securities laws.

FOR FURTHER INFORMATION

CONTACT:

|

|

Jonathan A. Wright |

Ross L. Andreachuk |

Mike J. Lawford |

|

|

President and CEO |

VP, Finance and CFO |

Chief Operating Officer |

|

|

(403) 538-8501 |

(403) 538-8539 |

(403) 538-1936 |

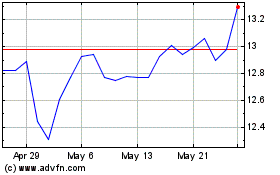

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Nov 2023 to Nov 2024