MedBright AI Investments Inc. (the “

Company” or

“

MedBright AI”) (CSE:MBAI, OTCQB:MBAIF, FSE:Y30)

announces execution of a letter of intent (the “LOI”) to be

acquired by Numinus Wellness Inc. (“

Numinus” )

(TSX: NUMI, OTCQX: NUMIF), a mental healthcare company advancing

traditional and innovative behavioral health treatments including

safe, evidence-based psychedelic-assisted therapies, by way of a

statutory plan of arrangement (the

“Proposed

Transaction”).

MedBright AI deploys artificial intelligence and

machine learning (“AI”) to empower medical

professionals to deliver increased access to healthcare, reduce

healthcare costs, and improve patient outcomes. With the Proposed

Transaction, Numinus plans to leverage its significant expertise in

traditional therapy, clinic management, patient care, insurance

reimbursement, and psychedelic-assisted therapy into a unique

AI-enabled offering (the “AI Offering”) available

to the growing number of U.S. mental health care providers.

Specifically, the AI Offering will leverage Numinus’

industry-leading experience and data as it relates to providing

reimbursed care for drug-assisted therapy, to allow therapists to

address a key challenge in building out the infrastructure

necessary to generate re-imbursed revenue.

To signify its new strategic direction and

focus, Numinus intends to rebrand as Numinus

Intelligence upon closing, a name that reflects the

commitment to leveraging AI and data science to expand mental

health service and solutions across the US. The Numinus ticker

symbol on the Toronto Stock Exchange will remain NUMI.

In preparation for the transaction, a transition

team has been formed to reduce costs, preserve cash and work to

increase revenues through the period before the Proposed

Transaction is complete.

Details of the Proposed

Transaction

Pursuant to the terms of the LOI, as

consideration for the acquisition of all of the issued and

outstanding common shares in the capital of MedBright AI

(“MedBright AI Shares”), Numinus will issue 1.86

common shares of Numinus (“Numinus

Shares”) for each MedBright AI Share such that it

is anticipated that Numinus will issue an aggregate of

approximately 204,729,372 Numinus Shares, which will represent

ownership of approximately 39% of the pro forma company on an

undiluted basis, based on the current capitalization of Numinus and

MedBright AI.

The Proposed Transaction is subject to a number

of conditions precedent, including, among other things, the

negotiation and execution of a definitive arrangement agreement,

completion of satisfactory due diligence by each party, receipt of

certain regulatory approvals and the approval of the Proposed

Transaction by shareholders of each of Numinus and MedBright AI.

The LOI is binding with respect to exclusivity and non-binding in

all other aspects and serves as an important step in advance of a

definitive arrangement agreement.

“This acquisition is the culmination of our

efforts over the past year to align Numinus with the revenue growth

opportunities we see in the US mental health care sector with the

delivery of high-quality care to a large population of patients in

need of drug-assisted therapy and mental health services,” said

Payton Nyquvest, CEO of Numinus. “This is also a testament to the

entire Numinus team who, over the past four years, has built an

optimized clinic network that delivers great patient care at high

levels of efficiency. We believe that harnessing our expertise and

intellectual property to complement MedBright’s AI technology will

amplify our ability to help those in need of care while driving

revenue growth and, importantly, profitability.”

“I am pleased with the prospect of joining the

Numinus Intelligence board and advancing this crucial strategic

transaction,” added Dr. Jaime Gerber, Chairman of the Board of

MedBright AI and Associate Professor of Clinical Medicine at Yale

School of Medicine. “MedBright is dedicated to empowering

healthcare providers with AI, and we believe this mission is vital

for addressing the global mental health crisis. We look forward to

generating value that will benefit both MedBright and Numinus

shareholders."

“I believe this merger will accelerate the

mission of and opportunity for both companies,” stated Mr. Michael

Dalsin. “I look forward to having an increasingly substantial role

in Numinus Intelligence upon completion of the transaction. I see a

pathway to revenue growth and profitability with this merger and I

am enthusiastic about its potential.”

Mr. Dalsin is an advisor and the largest

shareholder of MedBright AI, a guest lecturer at Yale School of

Medicine, and former Chairman of Patient Home Monitoring (“PHM”)

(now Quipt and VieMed on the Nasdaq) and Convalo Health (a mental

health company formerly listed on the TSXV). Mr. Dalsin has

extensive experience in right-sizing clinic operations to bring

them to profitability, and has demonstrated this on the public

level with both Convalo Health and PHM. Mr. Dalsin has been a

banker and buy-out fund manager specializing in US clinical

operations.

Eight Capital is acting as Numinus’ financial

advisor in connection with the Proposed Transaction.

Change in Management

In preparation for the transaction, Dr. Jaime

Gerber will become transition CEO of MedBright AI and Trevor Vieweg

will assume a new role as a technology consultant.

MedBright AI Investments Inc. Dr. Jaime Gerber, Chief Executive

OfficerEmail: investors@medbright.ai Phone: (604)

602-0001www.medbright.ai

Cautionary Statement Regarding Forward

Looking Statements

This release includes certain statements and

information that may constitute forward-looking information within

the meaning of applicable Canadian securities laws. All statements

in this news release, other than statements of historical facts,

including statements regarding future estimates, plans, objectives,

timing, assumptions or expectations of future performance,

including without limitation, Numinus’ plans with respect to the

near-term generation of positive EBITDA; Numnius’ expectation that

leveraging its expertise in psychedelic-assisted therapy, clinic

management, patient care, and insurance reimbursement will create a

unique AI-enabled offering; Numinus’ intentions regarding

rebranding as “Numinus Intelligence”; the expectation that

leveraging AI and data science will expand mental health service

and solutions across the U.S.; the expectation that Numinus’

transition team will be able to reduce costs, preserve cash and

increase revenues; the expectation that the parties will be able to

satisfy the conditions precedent to closing the Proposed

Transaction, including execution of a definitive arrangement

agreement, completion of satisfactory due diligence by each party,

receipt of certain regulatory approvals and the approval of the

Proposed Transaction by shareholders of each of Numinus and

MedBright AI; the belief that Numnius’ expertise and intellectual

property will complement MedBright’s AI technology and amplify the

combined entity’s ability to help those in need of care while

driving revenue growth and profitability; the belief that the

merger will generate value for MedBright AI and Numinus

shareholders; the belief that the merger will accelerate the

mission and opportunities for the combined entity; and the belief

that the merger will create a pathway for revenue growth and

profitability, are forward-looking statements and contain

forward-looking information. Generally, forward-looking statements

and information can be identified by the use of forward-looking

terminology such as “intends” or “anticipates”, or variations of

such words and phrases or statements that certain actions, events

or results “may”, “could”, “should” or “would” or occur.

Forward-looking statements are based on certain

material assumptions and analysis made by the Company and the

opinions and estimates of management as of the date of this press

release, including that the combined entity can generate near-term

positive EBITDA; that leveraging Numinus’ expertise in

psychedelic-assisted therapy, clinic management, patient care, and

insurance reimbursement will create a unique AI-enabled offering;

that the combined entity will successfully rebrand as “Numinus

Intelligence”; that leveraging AI and data science will expand

mental health service and solutions across the U.S.; that Numinus’

transition team will be able to reduce costs, preserve cash and

increase revenues; that the parties will be able to satisfy the

conditions precedent to closing the Proposed Transaction, including

execution of a definitive arrangement agreement, completion of

satisfactory due diligence by each party, receipt of certain

regulatory approvals and the approval of the Proposed Transaction

by shareholders of each of Numinus and MedBright AI; that Numinus’

expertise and intellectual property will complement MedBright’s AI

technology and that this will amplify the combined entity’s ability

to help those in need of care while driving revenue growth and

profitability; that the merger will generate value for MedBright AI

and Numinus shareholders; that the merger will accelerate the

mission and opportunities for the combined entity; and that the

merger will create a pathway for revenue growth and

profitability.

These forward-looking statements are subject to

known and unknown risks, uncertainties and other factors that may

cause the actual results, level of activity, performance or

achievements of the Company to be materially different from those

expressed or implied by such forward-looking statements or

forward-looking information. Important risks that may cause actual

results to vary, include, without limitation, the risk that the

combined entity will be unable to generate near-term positive

EBITDA; that the combined entity will be unable to create a unique

AI-enabled offering; that the combined entity will not be able to

succesfully rebrand as “Numinus Intelligence”; that leveraging AI

and data science will not expand mental health service and

solutions across the U.S.; that Numinus’ transition team will be

unable able to reduce costs, preserve cash or increase revenues;

that the parties will be unable able to satisfy the conditions

precedent to closing the Proposed Transaction; that Numnius’

expertise and intellectual property will not complement MedBright’s

AI technology or that this will not amplify the combined entity’s

ability to help those in need of care an will not drive revenue

growth or profitability; that the merger will be unable to generate

value for MedBright AI and Numinus shareholders; that the merger

will be unable to accelerate the mission and opportunities for the

combined entity; and that the merger will be unable to create a

pathway for revenue growth and profitability.

Although management of the Company has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements or forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements and forward-looking information. Readers are cautioned

that reliance on such information may not be appropriate for other

purposes. The Company does not undertake to update any

forward-looking statement, forward-looking information or financial

outlook that are incorporated by reference herein, except in

accordance with applicable securities laws.

A PDF accompanying this announcement is available

at: http://ml.globenewswire.com/Resource/Download/78369a0f-5c76-40cb-9f62-c72848c5df1e

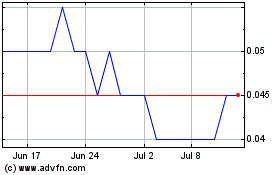

Numinus Wellness (TSX:NUMI)

Historical Stock Chart

From Oct 2024 to Nov 2024

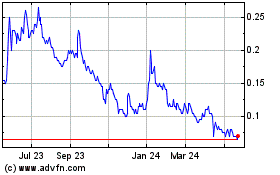

Numinus Wellness (TSX:NUMI)

Historical Stock Chart

From Nov 2023 to Nov 2024