Newmont Goldcorp Announces Pricing of 2.800% Senior Notes Offering

September 05 2019 - 5:06PM

Business Wire

Newmont Goldcorp Corporation (NYSE: NEM, TSX: NGT) (formerly

known as Newmont Mining Corporation) (“Newmont Goldcorp” or the

“Company”) announced today the pricing of its public offering of

$700 million aggregate principal amount of 2.800% senior notes due

2029 (the “Notes”). Subject to customary conditions, the offering

is expected to close on September 16, 2019. The offering is being

made pursuant to the Company’s shelf registration statement filed

with the Securities and Exchange Commission.

The Notes will be senior unsecured obligations of the Company

and will rank equally with the Company’s existing and future

unsecured senior debt and senior to the Company’s future

subordinated debt. The Notes will be guaranteed on a senior

unsecured basis by the Company’s subsidiary Newmont USA

Limited.

The Company estimates that the net proceeds to us from the

offering will be approximately $690 million, after deducting

estimated discounts (before expenses). The Company intends to use

the net proceeds of this offering for repayment of the Company’s

outstanding 5.125% senior notes due October 1, 2019 and any

remaining portion for general corporate purposes.

Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC are

acting as joint book-running managers for the offering. Copies of

the preliminary prospectus supplement and accompanying prospectus

meeting the requirements of Section 10 of the Securities Act of

1933, as amended, may be obtained from Goldman Sachs & Co. LLC

by calling toll-free at (866) 471-2526, or J.P. Morgan Securities

LLC by calling collect at (212) 834-4533. An electronic copy may

also be obtained at www.sec.gov.

This news release does not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of any

of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

The securities being offered have not been approved or disapproved

by any regulatory authority, nor has any such authority passed upon

the accuracy or adequacy of the prospectus supplement or the shelf

registration statement or prospectus.

About Newmont Goldcorp

Newmont Goldcorp is the world’s leading gold company and a

producer of copper, silver, zinc and lead. Newmont Goldcorp’s

world-class portfolio of assets, prospects and talent is anchored

in favorable mining jurisdictions in North America, South America,

Australia and Africa. Newmont Goldcorp is the only gold producer

listed in the S&P 500 Index and is widely recognized for its

principled environmental, social and governance practices. Newmont

Goldcorp is an industry leader in value creation, supported by

robust safety standards, superior execution and technical

proficiency. Newmont Goldcorp was founded in 1921 and has been

publicly traded since 1925.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws. Where a

forward-looking statement expresses or implies an expectation or

belief as to future events or results, such expectation or belief

is expressed in good faith and believed to have a reasonable basis.

However, such statements are subject to risks, uncertainties and

other factors, which could cause actual events or results to differ

materially from future events or results expressed, projected or

implied by the forward-looking statements. Forward-looking

statements often address our expected future business, financial

performance and financial condition and often contain words such as

“anticipate,” “intend,” “plan,” “will,” “would,” “estimate,”

“expect,” “believe,” “target,” “indicative,” “preliminary,” or

“potential.” Such forward-looking statements may include, without

limitation, statements regarding expected closing date for the

offering and the use of proceeds from the offering. Estimates or

expectations of future events or results are based upon certain

assumptions, which may prove to be incorrect. Such assumptions

include, without limitation: (i) there being no significant change

to current geotechnical, metallurgical, hydrological and other

physical conditions; (ii) permitting, development, operations and

expansion of operations and projects being consistent with current

expectations and mine plans, including, without limitation, receipt

of export approvals; (iii) political developments in any

jurisdiction in which Newmont Goldcorp operates being consistent

with its current expectations; (iv) certain exchange rate

assumptions for the Australian dollar or the Canadian dollar to the

U.S. dollar, as well as other exchange rates being approximately

consistent with current levels; (v) certain price assumptions for

gold, copper, silver, zinc, lead and oil; (vi) prices for key

supplies being approximately consistent with current levels; (vii)

the accuracy of current mineral reserve and mineralized material

estimates; and (viii) other planning assumptions. In addition,

material risks that could cause actual results to differ from

forward-looking statements include: (A) the inherent uncertainty

associated with financial or other projections; (B) the prompt and

effective integration in connection with the recent business

combination by which Newmont acquired Goldcorp Inc. (the

“integration”) and the ability to achieve the anticipated synergies

and value-creation contemplated by the integration; (C) the outcome

of any legal proceedings that may be instituted against the parties

and others related to the integration or the Nevada joint venture;

(D) the ability to achieve the anticipated synergies and

value-creation contemplated by the Nevada joint venture; (E)

unanticipated difficulties or expenditures relating to the

integration and Nevada joint venture; (F) potential volatility in

the price of Newmont Goldcorp’s common stock due to the integration

and the Nevada joint venture; and (G) the diversion of management

time on integration and transaction-related issues. For a more

detailed discussion of risks and other factors that might impact

future looking statements, see Newmont Goldcorp’s Annual Report on

Form 10-K for the year ended December 31, 2018 as well as Newmont

Goldcorp’s Quarterly Report on Form 10-Q for the quarter ended June

30, 2019 under the heading “Risk Factors” available on the SEC

website or www.newmontgoldcorp.com. Newmont Goldcorp does not

undertake any obligation to release publicly revisions to any

“forward-looking statement,” including, without limitation,

outlook, to reflect events or circumstances after the date of this

press release or to reflect the occurrence of unanticipated events,

except as may be required under applicable securities laws.

Investors should not assume that any lack of update to a previously

issued “forward-looking statement” constitutes a reaffirmation of

that statement. Continued reliance on “forward-looking statements”

is at investors’ own risk.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190905005999/en/

Media Contact Omar Jabara

303.837.5114 omar.jabara@newmont.com Investor

Contact Jessica Largent 303.837.5484

jessica.largent@newmont.com

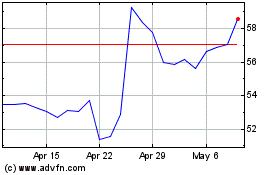

Newmont (TSX:NGT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Newmont (TSX:NGT)

Historical Stock Chart

From Nov 2023 to Nov 2024