Alaska Energy Metals Corporation (TSX-V: AEMC, OTCQB: AKEMF)

(“

Alaska Energy Metals”, the

“

Company”, or “

AEMC”) today

announced that it plans to raise $3,000,000 gross proceeds through

a non-brokered private placement (the “

Offering”)

of special warrants (the “

Special Warrants”) to

purchase units (the “

Units”) at a price of $0.15

per Unit. The Special Warrants will convert to Units upon obtaining

a receipt from the TSX Venture Exchange for a Base Shelf Prospectus

supplement document to be filed by the Company. Each Unit will

consist of one common AEMC share (the

“Shares”)

and one share purchase warrant (the “

Warrants”) to

purchase another Alaska Energy Metals share at a price of $0.20 for

a three-year term.

The Company intends to use the net proceeds for drilling to test

geological, geophysical and geochemical targets at the Canwell

block of claims that form part of its Nikolai Nickel Project in

Alaska. Three holes totaling 1,200 meters are planned for drilling.

Proceeds will also be used for metallurgical testing of Eureka

deposit drill core, marketing, and general working capital. The

Canwell prospects are located near the Company’s Nikolai project

Eureka deposit which represents a large accumulation of nickel with

copper, cobalt, chrome, iron, platinum, palladium and gold.

Corporate Changes

The Company’s Annual General Meeting (“AGM”) of

shareholders, scheduled for June 10, 2024, will be adjourned

following the receipt of the annual consolidated financial

statements and appointment of the auditor in order to facilitate

changes to the Board of Directors. A notice of the date and time of

the adjourned AGM, together with an addendum to the Information

Circular and proxy, will be distributed to shareholders. Upon

approval by shareholders, the Board will be set at six directors.

The management nominees for election at the adjourned AGM will be

Mario Vetro, Tyron Breytenbach, and Ian Stalker, along with

incumbent directors Gregory Beischer, Mark Begich and, Corri Feige.

Stepping off the board will be Peter Chilibeck and Larry Cooper.

The Company thanks these two directors for more than a decade of

service each. Mr. Chilibeck and Mr. Cooper have been invited to

remain as advisors to the Company.

Mario Vetro: Mr. Vetro is an Investor / Financier and Partner at

Commodity Partners of Vancouver, BC. Mr. Vetro has extensive

experience in structuring and advising resource companies. He has

successfully raised hundreds of millions of dollars for resource

development projects and has participated in transactions ranging

from $100 million to $1.5 billion.

Tyron Breytenbach: Mr. Breytenbach presently serves on the

Company’s Advisory Board and has provided excellent advice. He is a

strong technical geologist with experience in magmatic nickel

deposits and extensive experience in international capital markets,

having worked with Cormark and Stifel Canada.

Ian Stalker: Mr. Stalker is Executive Chairman of Bradda Head

Lithium and has held numerous executive and board positions with

resource-oriented companies. He has been involved in raising more

than US$750 million from capital markets for a range of successful

mining projects.

Paul Matysek: Joining the Company’s advisory board, Mr. Matysek

is a well-known mineral resources developer and deal maker. He is

the Executive Chairman for a number of companies including Nano One

Materials Corp (TSE: NANO) and LithiumBank Resources

Corp. (TSX-V: LBNK).

Greg Beischer, the Company CEO, commented: “The current team and

board did a great job of identifying and defining the maiden

mineral resource estimate at the Nikolai Nickel Project. The

resource established to date is on track to be one of the largest

nickel deposits in the United States. As companies grow, it becomes

important to have depth in capital markets and operations. Seasoned

mining veterans having key attributes for this stage of corporate

development are needed. Tyron Breytenbach and Ian Stalker have

great track records. If elected, I am confident they will maximize

the Company’s chances of developing a world-class battery metals

project at Nikolai in Alaska.”

About Alaska Energy MetalsAlaska Energy Metals

Corporation is an Alaska-based corporation with offices in

Anchorage and Vancouver working to sustainably deliver the critical

materials needed for national security and a bright energy future,

while generating superior returns for shareholders.

AEMC is focused on delineating and developing the large-scale,

bulk tonnage, polymetallic Eureka deposit containing nickel,

copper, cobalt, chromium, iron, platinum, palladium, and gold.

Located in Interior Alaska near existing transportation and power

infrastructure, its flagship project, Nikolai, is well-situated to

become a significant domestic source of strategic energy-related

metals for North America. AEMC also holds a secondary project,

‘Angliers-Belleterre,’ in western Quebec. Today, material sourcing

demands excellence in environmental performance, carbon mitigation,

and the responsible management of human and financial capital. AEMC

works every day to earn and maintain the respect and confidence of

the public and believes that ESG performance is measured by action

and led from the top.

ON BEHALF OF THE BOARD“Gregory Beischer”Gregory

Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:Sarah

Mawji, Public RelationsVenture

StrategiesEmail: sarah@venturestrategies.com

Forward-Looking StatementsSome statements in

this news release may contain forward-looking information (within

the meaning of Canadian securities legislation), including, without

limitation, the statements as to the Company’s intention to raise

C$3 million, to drill exploratory drill holes at the Canwell

prospects, and to perform metallurgical studies. These statements

address future events and conditions and, as such, involve known

and unknown risks, uncertainties, and other factors which may cause

the actual results, performance, or achievements to be materially

different from any future results, performance, or achievements

expressed or implied by the statements. Forward-looking statements

speak only as of the date those statements are made. Although the

Company believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guaranteeing of future performance and actual results may

differ materially from those in the forward-looking statements.

Factors that could cause the actual results to differ materially

from those in forward-looking statements include regulatory

actions, market prices, and continued availability of capital and

financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees

of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements.

Forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are

made. Except as required by applicable law, the Company assumes no

obligation to update or to publicly announce the results of any

change to any forward-looking statement contained or incorporated

by reference herein to reflect actual results, future events or

developments, changes in assumptions, or changes in other factors

affecting the forward-looking statements. If the Company updates

any forward-looking statement(s), no inference should be drawn that

it will make additional updates with respect to those or other

forward-looking statements.

This news release does not constitute an offer for sale, or a

solicitation of an offer to buy, in the United States or to any

“U.S Person” (as such term is defined in Regulation S under the

U.S. Securities Act of 1933, as amended (the “1933 Act”)) of any

equity or other securities of the Company. The securities of the

Company have not been, and will not be, registered under the 1933

Act or under any state securities laws and may not be offered or

sold in the United States or to a U.S. Person absent registration

under the 1933 Act and applicable state securities laws or an

applicable exemption therefrom.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

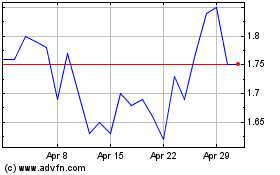

Nano One Materials (TSX:NANO)

Historical Stock Chart

From Nov 2024 to Dec 2024

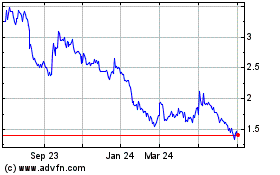

Nano One Materials (TSX:NANO)

Historical Stock Chart

From Dec 2023 to Dec 2024