Maxim Power Corp. Announces Confirmation of 2011 Guidance, M2 Development Update and $14 million Expansion of Credit Facility

September 21 2011 - 6:55PM

Marketwired Canada

Maxim Power Corp. (TSX:MXG) ("MAXIM" or the "Corporation") is confirming that

its guidance for 2011 remains unchanged from the guidance provided in MAXIM's

Management Discussion and Analysis dated March 25, 2011, as shown in the

following table:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

For the year ending December 31,

(000's, except per share amounts) 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Adjusted EBITDA (1) $ 37,972

Funds from operations (1) $ 34,853

Funds from operations per share - basic

and diluted (1) (2) $ 0.65

Net income (loss) $ 6,436

Net income per share - basic and

diluted (2) $ 0.12

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) The following measures are not measures under Canadian Generally

Accepted Accounting Principles ("GAAP") and may not be comparable to

similar measures presented by other companies. Refer to MAXIM's MD&A

dated March 25, 2011 for a reconciliation of these non-GAAP measures.

- Adjusted EBITDA is a measure of earnings before interest, taxes,

depreciation and amortization, and certain other expenses

- Funds from operations is a measure of cash flow from operations before

working capital requirements

(2) Per share amounts are calculated using average weighted shares

outstanding. Refer to MAXIM's MD&A dated March 25, 2011 for assumptions

related to shares outstanding

MAXIM anticipates that Adjusted EBITDA will be $38 million in 2011. Results to

date in Q3 and forecast for Q4 show significant improvement over Q2 2011 due to

improving Alberta wholesale electricity prices and the Corporation having

reduced the average cost of coal per megawatt hour at HR Milner for the balance

of 2011.

Milner Expansion

On August 10, 2011, the Alberta Utilities Commission ("AUC") issued its final

decision to approve MAXIM's application to construct and operate the 500

megawatt ("MW") Milner Expansion Project ("M2").

M2 has been under development by MAXIM since May 2005. A lengthy public

consultation and regulatory approval process has culminated in the project's

approval by the AUC. M2 will utilize supercritical, pulverized coal technology,

making it one of the cleanest and most fuel-efficient coal-fired power plants in

Canada that can meet Alberta's growing electric energy needs and allow for the

orderly retirement of a less efficient, less reliable and aging conventional

coal-fired fleet.

The M2 design incorporates emission control equipment capable of achieving 60 to

80 percent reductions in sulphur dioxide, nitrogen oxides and mercury compared

to the conventional coal-fired power plants still operating in Alberta. The

highly efficient M2 design will also reduce carbon dioxide emissions by 20%

compared to these plants. M2 is a reliable and low-cost generation supply

solution for Albertans that is entirely consistent with federal and provincial

goals for emissions reductions.

Expansion of Credit Facility

MAXIM has expanded its credit facility with the Bank of Montreal ("BMO"). The

BMO credit facility has been amended by the addition of Facility E, which is a

$14 million revolving credit facility. Facility E may be used for the

construction of MAXIM's Mine 14 Project and is available to MAXIM until December

31, 2011.

About MAXIM

Based in Calgary, Alberta, MAXIM is an independent power producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM currently owns and operates 44 power plants in

western Canada, the United States and France, having 809 MW of electric and 117

MW of thermal net generating capacity. MAXIM trades on the TSX under the symbol

"MXG". For more information about MAXIM, visit our website at

www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward looking statements as required pursuant

to applicable securities laws.

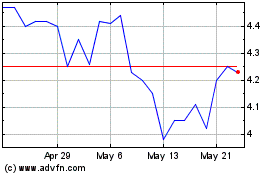

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

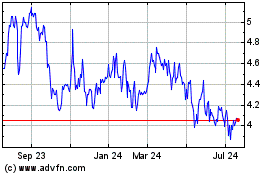

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024