Magna International Inc. (TSX: MG; NYSE: MGA) today announced that

it has entered into underwriting agreements in respect of the

offering of two series of U.S. dollar denominated senior notes

(“

U.S. dollar senior notes”) and one series

of Euro denominated senior notes (“

Euro senior

notes”), as follows:

|

|

Principal Amount |

Maturity |

Annual Interest Rate |

|

U.S. Dollar Senior Notes |

|

|

|

|

Series 1 U.S. dollar |

$300,000,000 |

March 21, 2026 |

5.980% |

|

Series 2 U.S. dollar |

$500,000,000 |

March 21, 2033 |

5.500% |

|

|

|

|

|

|

Euro Senior Notes |

€550,000,000 |

March 17, 2032 |

4.375% |

Magna intends to use the net proceeds from the

offering of U.S. dollar senior notes to finance a portion of the

cost of its proposed acquisition of the Veoneer Active Safety

business (the “Veoneer Acquisition”) and to pay

related fees and expenses, and for general corporate purposes,

which may include the repayment of its existing indebtedness.

However, the completion of this offering is not contingent upon the

completion of the Veoneer Acquisition. In the event that (x) the

Veoneer Acquisition is not consummated on or prior to December 19,

2023 or such later date as the parties to the agreement (the

“Equity Purchase Agreement”) governing the Veoneer

Acquisition may agree as the “End Date” thereunder (the “End Date”)

or (y) the Equity Purchase Agreement is terminated, Magna will be

required to redeem all of the notes then outstanding at a

redemption price equal to 101% of the principal amount of the notes

plus accrued and unpaid interest, if any, to, but excluding, the

redemption date.

Magna intends to use the net proceeds from the

Euro senior notes for general corporate purposes, which may include

the repayment of its existing indebtedness.

The offering of U.S. dollar senior notes is

expected to close on March 21, 2023 and the offering of Euro senior

notes is expected to close on March 17, 2023, in each case, subject

to customary closing conditions. The U.S. dollar senior notes and

Euro senior notes will be offered pursuant to an effective shelf

registration statement previously filed with the Securities and

Exchange Commission (the “SEC”) and a short form base shelf

prospectus and prospectus supplements filed with the Ontario

Securities Commission.

BofA Securities, Inc., Citigroup Global Markets

Inc., J.P. Morgan Securities LLC, BNP Paribas Securities Corp., RBC

Capital Markets, LLC, Scotia Capital (USA) Inc. and TD Securities

(USA) LLC are acting as joint book-running managers for the

offering of U.S. dollar senior notes and BNP Paribas, Citigroup

Global Markets Limited, Merrill Lynch International and ING Bank

N.V. are acting as joint book-running managers for the offering of

Euro senior notes.

This release shall not constitute an offer to

sell or a solicitation of an offer to buy any securities, nor shall

there be any sale of these securities, in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of

any such state or jurisdiction. The U.S. dollar senior notes and

Euro senior notes are not being qualified for distribution in

Canada but the U.S. dollar senior notes will be offered in Canada

on a private placement basis to certain accredited investors as

defined under Canadian securities laws.

The offering of each of these securities may be

made only by means of a prospectus supplement and accompanying

prospectus. Copies of the prospectus supplements and the

accompanying prospectus can be obtained for free by visiting EDGAR

on the SEC’s website at www.sec.gov or from:

In the case of the offering of U.S. dollar

senior notes:

|

BofA Securities, Inc.NC1-004-03-43200 North

College Street, 3rd FloorCharlotte, NC 28202Attention: Prospectus

DepartmentToll Free: +1 (800)

294-1322dg.prospectus_requests@baml.com |

Citigroup Global Markets Inc.c/o Broadridge

Financial Solutions1155 Long Island AvenueEdgewood, NY 11717Toll

Free: +1 (800) 831-9146prospectus@citi.com |

J.P. Morgan Securities LLCc/o Broadridge Financial

Solutions,Attn: Prospectus Department,1155 Long Island

Avenue,Edgewood, NY 11717,or by telephone: 1-866-803-9204 |

|

|

|

|

|

BNP Paribas Securities Corp.787 Seventh Avenue,

3rd FloorNew York, NY 10019Attention: Syndicate DeskToll Free:

1-800-854-5674DL.US.Syndicate.Support@us.bnpparibas.com |

RBC Capital Markets, LLCThree World Financial

Center200 Vesey StreetNew York, NY 10281Attn: Debt Capital

Markets1-866-375-6829usdebtcapitalmarkets@rbccm.com |

Scotia Capital (USA) Inc.250 Vesey Street, 24th

FloorNew York, NY 10281Toll Free: 1-800-372-3930 |

|

|

|

|

|

|

TD Securities (USA) LLC31 West 52nd Street,

2ndFloorNew York, NY 10019Attention: TransactionManagement

GroupToll Free: +1 (855) 495-9846USTMG@tdsecurities.com |

|

|

|

|

|

In the case of the offering of Euro senior

notes:

|

BNP Paribas10 Harewood AvenueLondon, NW1 6AAUnited

KingdomAttention: Fixed Income SyndicateTel: +44 (0)20 7595

8222Toll Free: +1 (800) 854-5674Fax: +44 (0)20 7595 2555 |

Merrill Lynch International222 BroadwayNew York,

NY 10038Attn: Prospectus

Departmentdg.prospectus_requests@baml.com |

Citigroup Global Markets Limitedc/o Broadridge

Financial Solutions1155 Long Island AvenueEdgewood, NY 11717Toll

Free +1 (800) 831-9146prospectus@citi.com |

|

|

|

|

|

|

ING Bank N.V.Foppingadreef 71102 BD AmsterdamThe

NetherlandsTel: +31 20 563 8035 |

|

|

|

|

|

INVESTOR CONTACT

Louis Tonelli, Vice-President, Investor

Relationslouis.tonelli@magna.com │ 905.726.7035

MEDIA CONTACT

Tracy Fuerst, Vice-President, Corporate

Communications & PRtracy.fuerst@magna.com │ 248.761.7004

OUR BUSINESS1

Magna is more than one of the world’s largest

suppliers in the automotive space. We are a mobility technology

company with a global, entrepreneurial-minded team of over 168,0002

employees and an organizational structure designed to innovate like

a startup. With 65+ years of expertise, and a systems approach to

design, engineering and manufacturing that touches nearly every

aspect of the vehicle, we are positioned to support advancing

mobility in a transforming industry. Our global network includes

343 manufacturing operations and 88 product development,

engineering and sales centres spanning 29 countries.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release

constitute “forward-looking information” or “forward-looking

statements” (collectively, “forward-looking statements").

Forward-looking statements in this press release include, but are

not limited to, the expected closing date of the offering for the

U.S. dollar senior notes and Euro senior notes, the intended use of

the net proceeds from the offering of U.S. dollar senior notes and

Euro senior notes, including the consummation of the Veoneer

Acquisition and any redemption of the U.S. dollar senior notes and

are subject to, and expressly qualified by, the cautionary

disclaimers that are set out in Magna’s regulatory filings. Please

refer to the prospectus supplement relating to the offering of the

notes, as well as Magna’s most current Management’s Discussion and

Analysis of Results of Operations and Financial Position, Annual

Information Form and Annual Report on Form 40-F, as replaced or

updated by any of Magna’s subsequent regulatory filings, which set

out the cautionary disclaimers, including the risk factors that

could cause actual events to differ materially from those indicated

by such forward-looking statements.

EUROPEAN ECONOMIC AREA NOTICE

This announcement, insofar as it relates to the

U.S. dollar senior notes, and the offering of the U.S. dollar

senior notes are only addressed to and directed at persons in

member states of the EEA who are “Qualified Investors” within the

meaning of Article 2(e) of the Prospectus Regulation. The U.S.

dollar senior notes are only available to, and any invitation,

offer or agreement to subscribe, purchase or otherwise acquire such

securities will be engaged in only with Qualified Investors. This

announcement, insofar as it relates to the U.S. dollar senior

notes, should not be acted upon or relied upon in any member state

of the EEA by persons who are not Qualified Investors.

The offering of the Euro senior notes will be

made pursuant to an exemption under the Prospectus Regulation from

the requirement to produce a prospectus for offers of

securities.

The expression “Prospectus Regulation” means

Regulation (EU) 2017/1129 (as amended or superseded).

MiFID II professionals/ECPs-only / No PRIIPs KID

– Manufacturer target market (MiFID II product governance) in

relation to the Euro senior notes is eligible counterparties and

professional clients only (all distribution channels). No PRIIPs

key information document (KID) has been prepared as neither the

U.S. dollar senior notes nor the Euro senior notes are

available to retail in EEA.

UK NOTICE

This release is for distribution only to persons

who (i) have professional experience in matters relating to

investments falling within Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 (as amended,

the “Financial Promotion Order”), (ii) are persons falling within

Article 49(2)(a) to (d) (“high net worth companies, unincorporated

associations etc.”) of the Financial Promotion Order, (iii) are

persons falling within Article 47 of the Financial Promotion Order,

(iv) are outside the United Kingdom, or (v) are persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of section 21 of the Financial Services and Markets Act

2000) in connection with the issue or sale of any securities may

otherwise lawfully be communicated or caused to be communicated

(all such persons together being referred to as “relevant

persons”). This release is directed only at relevant persons and

must not be acted on or relied on by persons who are not relevant

persons. Any investment or investment activity to which this

document relates is available only to relevant persons and will be

engaged in only with relevant persons.

This announcement, insofar as it relates to the

U.S. dollar senior notes, and the offering of the U.S. dollar

senior notes are only addressed to and directed at persons in the

United Kingdom who are “Qualified Investors” within the meaning of

Article 2(e) of the UK Prospectus Regulation. The U.S. dollar

senior notes are only available to, and any invitation, offer or

agreement to subscribe, purchase or otherwise acquire such

securities will be engaged in only with Qualified Investors. This

announcement, insofar as it relates to the U.S. dollar senior

notes, should not be acted upon or relied upon in the United

Kingdom by persons who are not Qualified Investors.

The offering of the Euro senior notes will be

made pursuant to an exemption under the Financial Services and

Markets Act 2000 and UK Prospectus Regulation from the requirement

to produce a prospectus for offers of securities.

The expression “UK Prospectus Regulation” means

Regulation (EU) 2017/1129 as it forms part of domestic law by

virtue of the European Union (Withdrawal) Act 2018.

UK MiFIR professionals/ECPs-only / No UK PRIIPs

KID – Manufacturer target market (UK MiFIR product governance) in

relation to the Euro senior notes is eligible counterparties and

professional clients only (all distribution channels). No UK PRIIPs

key information document (KID) has been prepared as neither the

U.S. dollar senior notes nor the Euro senior notes are available to

retail in UK.

________________________1 Manufacturing

operations, product development, engineering and sales centres

include certain operations accounted for under the equity method.2

Number of employees includes approximately 158,000 employees at our

wholly owned or controlled entities and over 10,000 employees at

certain operations accounted for under the equity method.

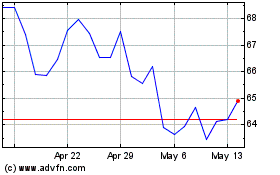

Magna (TSX:MG)

Historical Stock Chart

From Oct 2024 to Nov 2024

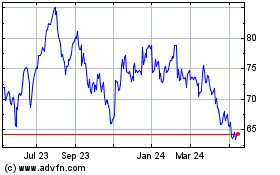

Magna (TSX:MG)

Historical Stock Chart

From Nov 2023 to Nov 2024