MAG Silver Corp. (TSX / NYSE American: MAG) (“MAG,” “MAG

Silver” or the

“Company”) announces the

Company’s unaudited financial results for the three months ended

March 31, 2022. For details of the unaudited condensed interim

consolidated financial statements and Management's Discussion and

Analysis for the three months ended March 31, 2022, please see the

Company’s filings on SEDAR (www.sedar.com) or on EDGAR

(www.sec.gov).

All amounts herein are reported in $000s

of United States dollars (“US$”) unless otherwise

specified.

HIGHLIGHTS – MARCH 31, 2022 &

SUBSEQUENT TO THE QUARTER END

OPERATIONAL –

Juanicipio owned 44% by MAG Silver

-

During the first quarter of 2022 (“Q1 2022”), the 4,000 tonnes per

day (“tpd”) Juanicipio processing plant was being readied for

commissioning. Water commissioning commenced during the quarter and

commissioning of the grinding mills will start upon connection to

the national electrical power grid.

-

As reported by the operator Fresnillo, the regulatory approval to

tie into the national power grid remains on track for mid-2022,

with the expectation to ramp up the Juanicipio processing plant to

85-90% of nameplate capacity by year end.

-

Fresnillo is making available unused processing plant capacity at

its Fresnillo and Saucito operations. Campaign processing of

mineralized material from development headings and stopes continues

through these nearby facilities and is expected to continue until

the Juanicipio plant is commissioned.

-

For the three months ended March 31, 2022, on a 100% basis:

- 145,484 tonnes, or an average of 48,495 tonnes per month of

mineralized development and stope material were campaign processed

through the Fresnillo and Saucito plants, with 2,238,810 payable

silver ounces, 5,345 payable gold ounces, 1,066 tonnes of lead and

1,448 tonnes of zinc produced and sold;

- Average silver head grade for the quarter was 597 grams per

tonne (“g/t”) or 17.4 silver ounces/ton; and

- Pre-commercial production sales (net of treatment and

processing costs) totaled $64,916 for the quarter, less $18,695 in

mining and transportation costs and depreciation and amortization,

netting $46,221 in gross profit by Juanicipio in the quarter.

-

Campaign processing benefits include the cashflow being used to

offset some of the initial and sustaining capital, and the

de-risking of Juanicipio’s metallurgical performance which is

expected to significantly speed up project ramp-up.

-

54% of the tonnes in Q1 2022 were processed at Fresnillo’s Saucito

plant, where the flowsheet more closely resembles that of the

Juanicipio plant. It is expected these results will provide further

valuable metallurgical benefits when production commences at

Juanicipio.

-

Metal recoveries and concentrate grades are in line with

expectations from the initial metallurgical test work conducted on

Valdecañas.

-

A further 49,096 tonnes of mineralized development and stope

material with a silver head grade of 668 g/t were campaign

processed in April 2022 through the Fresnillo and Saucito

plants.

EXPLORATION

- The Juanicipio 2021 exploration

program was completed in the fourth quarter of 2021 (“Q4 2021”)

with $6,296 spent on a 100% basis and was focused on continued

step-out and infill drilling of the Valdecañas Vein System

(including independent targeting of the Venadas Vein family and the

Anticipada Vein).

-

Results of the Juanicipio 2021 exploration program (23

surface-based drill holes totaling 29,421 metres (“m”)) are

referenced herein, and highlights include:

- 21 holes cut the Valdecañas Vein System, with most directed at

the Valdecañas Vein Deep Zone plus coincidental intercepts of the

Anticipada (13), Pre-Anticipada (8) and various other hangingwall

and footwall veins;

- Most intercepts are comparable to previously drilled

neighboring holes and confirm both grade and thickness

expectations; and,

- Channel sampling of the advancing development headings and test

stopes in the Valdecañas Vein Bonanza Zone shows that the grade

distribution in the vein is very close to that shown by both

surface and underground drilling, which adds substantial confidence

in the width and grade continuity indicated by the surface drilling

for the balance of the vein.

-

With the completion of the 2021 exploration drill program, the

intercept density on the Valdecañas Vein Deep Zone is now

approaching that on the Bonanza Zone and confirms the continuity of

mineralization in the Valdecañas Vein to depth.

- The Juanicipio 2022 exploration

program is currently in progress ($1,589 expended on a 100% basis

in Q1 2022) with five drill rigs on surface running concurrently

with continued underground definition and geotechnical drilling,

and one rig testing the new Cesantoni target in the northwest part

of the Juanicipio concession.

-

Deer Trail Project in Utah:

-

A 5 hole/5,000 metre Phase II drill program commenced in the third

quarter of 2021 and is in progress with all assays pending.

-

During the quarter, the Company entered into a Definitive

Arrangement Agreement with Gatling Exploration Inc. (“Gatling”)

pursuant to which the Company is expected to acquire all of the

issued and outstanding common shares of Gatling by the issuance of

common shares of the Company and the advancement of a Canadian

dollar (“C$”) $3 million convertible loan (the “Transaction”).

- The Transaction was approved by the shareholders of Gatling on

May 13, 2022. Upon closing of the Transaction later in May 2022, it

is expected that Gatling shareholders will hold approximately 0.79%

of the Company’s shares on an outstanding basis.

- Gatling’s Larder Lake Project lies in the highly prolific

Abitibi Gold Province of northern Ontario, and with good

surrounding infrastructure and already permitted drill pads to test

initial targets.

-

During Q1 2022, the Company recorded a write down of $10,471 on its

option earn-in project on a prospective claim package in the Black

Hills of South Dakota, as a growing negative sentiment towards

resource extraction in the area, combined with a slow consultation

process have resulted in significant challenges being encountered

in permitting the property for exploration drilling.

LIQUIDITY AND CAPITAL

RESOURCES

-

As at March 31, 2022, MAG held cash of $52,248 while on a 100%

basis Juanicipio had working capital of $36,011 which included cash

on hand of $18,261.

- According to the operator

Fresnillo, the Juanicipio Project construction is expected to be

delivered on budget at $440,000.

- With the current ramp up of

underground mine production and given hiring restrictions on

contractors arising from the 2021 labour reform legislation, the

timing of various sustaining capital expenditures has been brought

forward:

- These sustaining capital costs are included in current

Juanicipio development costs but are not considered by the operator

as part of the $440,000 initial project capital; and

- The costs incurred are expected to reduce future sustaining

capital costs and totaled approximately $4,712 on a 100% basis in

the quarter ended March 31, 2022.

- The expected cash flow from the

ongoing campaign processing until the Juanicipio plant is

commissioned, along with the working capital held by Juanicipio at

March 31, 2022 are projected to substantially fund the remaining

capital expenditures in the $440,000 initial capex (a cash call has

not been needed since mid-December 2021 which was $21,000 on a 100%

basis).

- Should there be additional funding

requirements related to further commissioning delays or to

additional sustaining capital that is being brought forward in

excess of the cashflow generated prior to attaining commercial

production, there may still be further cash calls required from

Fresnillo and MAG.

CORPORATE

- On March 28, 2022, MAG announced

the appointment of Fausto Di-Trapani as Chief Financial Officer

(“CFO”) effective May 20, 2022. Mr. Di-Trapani is a finance

executive with experience in the natural resources sector spanning

two decades, most recently having served as the CFO at Galiano Gold

Inc. Mr. Di-Trapani replaces Mr. Larry Taddei, who, after 12 years

of service with the Company, will step down from the CFO role to

pursue other opportunities. Mr. Taddei will assist in the orderly

transition of his duties following Mr. Di-Trapani’s

appointment.

JUANICIPIO PROJECT UPDATE

Underground Mine Production

In Q1 2022, a total of 145,484 tonnes of

mineralized development and stope material were processed through

the Fresnillo plants, realizing commercial and operational

de-risking opportunities for the Juanicipio Project. The resulting

payable metals sold and processing details on a 100% basis for Q1

2022 are summarized in Table 1 below. The sales

and treatment charges for tonnes processed in the quarter were

recorded on a provisional basis and will be adjusted in the second

quarter of 2022 based on final assay and pricing adjustments in

accordance with the offtake contracts.

Table 1: Q1 2022 Mineralized Material

Processed at Fresnillo’s Processing Plants (100%

basis)

|

Three Months Ended March 31, 2022 (145,484 tonnes

processed) |

Q1 2021$Amount |

|

Payable Metals |

Quantity |

Average Per Unit (1) |

$Amount |

|

Silver |

2,238,810 ounces |

$24.97 per oz |

$55,899 |

$11,157 |

|

|

Gold |

5,345 ounces |

$1,925.44 per oz |

10,291 |

1,090 |

|

|

Lead |

1,066 tonnes |

$1.06 per lb |

2,483 |

267 |

|

|

Zinc |

1,448 tonnes |

$1.79 per lb |

5,712 |

555 |

|

|

Treatment and refining charges (“TCRCs”) and other processing

costs |

(9,469) |

(1,838) |

|

|

Provisional sales adjustment related to 2020 sales (2) |

- |

(1,146) |

|

|

Net Sales |

|

|

64,916 |

10,085 |

|

|

Mining and transportation costs |

|

|

(15,264) |

(1,886) |

|

|

Depreciation and amortization |

|

|

(3,431) (3) |

- |

|

|

Gross Profit |

|

|

$46,221 |

$8,199 |

|

(1) Ounces (“oz”) for silver and gold

and, pounds (“lb”) for lead and zinc.(2) Provisional sales for 2020

were finalized in Q1 2021 resulting in negative adjustment to net

sales revenue of $1,146.(3) The underground mine is now in stopes

with mineralized material being processed through Fresnillo’s

plants and refined and sold, and effectively readied for its

intended use.

The average silver head grade for the

mineralized development and initial stope material processed in Q1

2022 was 597 g/t (Q1 2021 458 g/t). This increased grade reflects

more stoped vein material being processed. Additionally, metal

recoveries and concentrate grades are in line with expectations

from the initial metallurgical test work conducted on

Valdecañas. Originally planned at a targeted rate

through Q3 2021 of 16,000 tonnes per month, the processing rate

increased to an average of 37,983 tonnes per month in Q4 2021 and

an average of 48,495 tonnes per month in Q1 2022. During the

quarter ended March 31, 2022, 54% of the total tonnage processed

was through the Saucito plant. The Saucito plant flowsheet better

resembles that of the Juanicipio plant and will provide further

valuable metallurgical benefits as production commences at

Juanicipio.

Processing Plant Construction & Outlook

The Juanicipio project team delivered the 4,000

tpd processing plant for commissioning in the fourth quarter of

2021. However, according to the operator Fresnillo and as

previously reported, the state-owned electrical company (Comision

Federal de Electricidad “CFE”), notified Fresnillo late in December

2021 that the regulatory approval to complete the tie-in to the

national power grid could not yet be granted and that the

Juanicipio plant commissioning timeline was therefore extended by

approximately six months. During Q1 2022, Fresnillo has indicated

that they were focused on complying with requirements from the CFE

and the energy regulator and expect the tie-in to the power grid in

mid-2022. With commissioning of the Juanicipio processing plant

expected to commence concurrently, it is expected that the plant

will ramp up to 85-90% of the nameplate 4,000 tpd capacity by the

end of 2022.

In the interim, stoping and mine development at

Juanicipio continues. In order to minimize any potential adverse

economic effect of the revised commissioning timeline, Fresnillo

has indicated it will make available unused plant capacity at its

Minera Fresnillo and Minera Saucito operations to process

mineralized material produced at Juanicipio until the Juanicipio

processing plant is commissioned. The effect on cashflow generation

from Juanicipio therefore will also be mitigated while power

connection approvals are pending. With the plant ready to commence

commissioning, final construction costs are expected to wind down

until commissioning and testing commence. The expected cash flow

from the ongoing campaign processing, along with the working

capital held by Juanicipio at March 31, 2022 of $36,011 on a 100%

basis (which includes cash of $18,261) are likely to fund the

remaining capital expenditures (a cash call has not been needed

since mid-December 2021 which was $21,000 on a 100% basis). Should

there be additional funding requirements related to further

commissioning delays or for additional sustaining capital prior to

attaining commercial production, in excess of the cashflow

generated, there may still be further cash calls required from

Fresnillo and MAG.

Juanicipio Exploration Update

The 2021 Juanicipio exploration program was

completed with a spend of $6,296 on a 100% basis and was focused on

continued step-out and infill drilling of the Valdecañas Vein

System (including independent targeting of the Venadas Vein family

and the Anticipada Vein). The Company’s interpretation of the 2021

Valdecañas drill results is below, with a complete set of assay

tables by vein of the 2021 drilling results available at:

https://magsilver.com/site/assets/files/6439/mda_mj_exploration-supplemental-assay-tables.pdf

along with various long sections detailing the results, available

at: https://magsilver.com/geological-long-sections/.

Most of the holes in the 2021 exploration

program were directed at the Valdecañas Vein Deep Zone, with 13

coincidental intercepts of the Anticipada and 8 more for

Pre-Anticipada, and various other hangingwall and footwall veins

(see above noted links). Four holes cut the Venadas Vein Family and

two holes were directed at a postulated vein lying to the northwest

of the Valdecañas Vein System in the northeast corner of the

concession. Most intercepts are comparable to previously drilled

neighbouring holes with no major deviations either towards higher

or lower grades or thicknesses. With the completion of the 2021

drilling program, the intercept density on the Valdecañas Vein Deep

Zone is approaching that on the Bonanza Zone and confirms the

continuity of mineralization in the Valdecañas Vein to depth.

The driving of development headings and test

stopes in the Valdecañas Vein Bonanza Zone has been accompanied by

channel sampling across the vein every 3 to 10 m. Samples are

mostly 1 m in length and honour geology as much as possible.

Importantly, the results of this detailed sampling show that the

grade distribution in the vein is very close to that shown by the

both the initial 50 m – 70 m spaced surface-based drilling and the

25m spaced underground drilling, which adds substantial confidence

in the width and grade continuity indicated by the surface drilling

for the balance of the vein.

The planned expenditures for the 2022

exploration program total $7,000 on a 100% basis, for drilling

programs designed to expand and convert the Inferred Mineral

Resources included in the Deep Zone into Indicated Mineral

Resources, and to explore other parts of the Juanicipio concession.

In mid-January 2022, drilling began on the first hole on the

“Cesantoni Kaolinite Pits” (“Cesantoni”) target. Cesantoni lies in

the northwestern corner of the Juanicipio concession, roughly 6 km

west of the Valdecañas Vein and related underground infrastructure.

Thousands of tonnes of mixed kaolinite-illite clays have been mined

over the last 25 years by the Cesantoni Ceramics Company from a

series of pits developed along the strong northeast-trending

Cesantoni structure. This orientation is almost orthogonal to the

northwest-trending veins that dominate the district, but is roughly

parallel to the high-grade Venadas Vein family that cuts the

NW-trending Valdecañas Vein. The extent of kaolinite-illite

alteration at Cesantoni is much greater than that seen elsewhere in

the district and may indicate passage of very large volumes of

hydrothermal fluids. The top of anticipated mineralization at

Cesantoni is expected to occur at depths similar to those elsewhere

in the Juanicipio concession (350 to 500 m below the surface).

Initial planning as laid out by project

operator, Fresnillo, is to drill 5 core holes totaling 6,000 m.

Depending on ground conditions in this new area, the drilling

program should take between five and seven months to complete after

which time assays will be released.

Qualified Person: All

scientific or technical information in this press release including

assay results referred to, and Mineral Resource estimates, if

applicable, is based upon information prepared by or under the

supervision of, or has been approved by Dr. Peter Megaw, Ph.D.,

C.P.G., a Certified Professional Geologist who is a “Qualified

Person” for purposes of National Instrument 43-101, Standards of

Disclosure for Mineral Projects (“National Instrument 43-101” or

“NI 43-101”). Dr. Megaw is not independent as he is an officer and

a paid consultant of MAG Silver.

Quality Assurance and Control:

The samples (half core) are shipped directly in security-sealed

bags to ALS-Chemex Laboratories preparation facility in

Guadalajara, Jalisco, Mexico (Certification ISO 9001). Samples

shipped also include intermittent standards and blanks. Pulp

samples are subsequently shipped to ALS-Chemex Laboratories in

North Vancouver, British Columbia, Canada for analysis. Two extra

pulp samples are also prepared and are analyzed by SGS Laboratories

(Certification ISO 9001) and Inspectorate Laboratories

(Certification ISO 9001) (or another recognized lab). The remaining

half core is placed back into the core boxes and is stored on site

with the rest of the drill hole core in a secured core storage

facility. The bulk reject is subsequently sent to the Center for

Investigation and Technical Development (“CIDT”) of Peñoles in

Torreon, Coahuila State, Mexico for metallurgical testing where a

fourth assay for each sample is analyzed and a calculated head

grade is received on the basis of a concentrate balance. The CIDT

also does a full microscopic, XRF and XRD mineralogical

analysis.

DEER TRAIL PROJECT UPDATE

Phase II drilling commenced at the Deer Trail

Project in Q3 2021 and is planned for 5,000 m of drilling over 5

holes and is in progress. Deviation/directional drilling is being

used in Phase II to make the drilling more efficient and accurate.

In part to facilitate the directional drilling, drilling

contractors were changed in Q1 2022, with the new contractor having

resumed drilling subsequent to the quarter ended March 31, 2022. To

date, two holes of Phase II have been successfully completed, with

assays pending.

GATLING ACQUISITION / LARDER LAKE

PROJECT

On March 11, 2022, the Company entered into a

Definitive Arrangement Agreement with Gatling pursuant to which the

Company is expected to acquire all of the issued and outstanding

common shares of Gatling by the issuance of common shares of the

Company and the advancement of a C$3 million convertible loan. The

Transaction was approved by the shareholders of Gatling on May 13,

2022 and is expected to close later in May 2022.

Gatling is a Canadian gold exploration company

focused on advancing the Larder Lake Project, located in the

prolific Abitibi greenstone belt in Northern Ontario, Canada. The

property includes several known shear-hosted (“orogenic”) gold

mineralization centres located along approximately 7 km of strike

length of the greater than 250 km long Larder Lake–Cadillac Break

(the “Break”), a highly-productive regional first-order shear

structure.

Once the Transaction closes, MAG intends to

apply an integrated district-scale exploration model and new

technology to the search for large-volume, high-grade gold

mineralization of the style known to occur throughout the Abitibi

region. MAG’s technical team believe that a combination of

systematic surface-based exploration combined with geophysics will

likely uncover numerous targets in this highly gold mineralized

region. This will focus efforts along not just the Break but also

along the many known, and geophysically indicated 2nd and 3rd order

structures throughout the balance of the sparsely tested mineral

claim package.

FINANCIAL RESULTS – THREE MONTHS ENDED

MARCH 31, 2022

As at March 31, 2022, the Company had working

capital of $53,278 (December 31, 2021: $57,761) including cash of

$52,248 (December 31, 2021: $56,748) and no long-term debt. As

well, as at March 31, 2022, Juanicipio had working capital of

$36,011 including cash of $18,261 (MAG’s attributable share is

44%).

The Company’s net income for three months ended

March 31, 2022 amounted to $2,680 (March 31, 2021: $3,662 net loss)

or $0.03/share (March 31, 2021: $(0.04)/share). MAG recorded a 44%

income from equity accounted investment in Juanicipio of $13,762

(March 31, 2021: $632) which included MAG’s 44% share of net income

from the sale of pre-production development and stope material (see

Table 2 below).

Table 2: MAG’s share of income from its

equity accounted Investment in Juanicipio

|

|

March 31, 2022 |

March 31, 2021 |

|

Gross profit from processing mineralized

material(see Underground Mine Production – Juanicipio

Project above) |

$46,221 |

$8,199 |

|

Administrative expenses |

(1,532) |

(321) |

|

Extraordinary mining duty |

(103) |

(47) |

|

Foreign exchange and other |

(821) |

(1,075) |

|

Income before tax |

43,765 |

6,756 |

|

Income tax expense (including deferred income tax) |

(12,487) |

(5,320) |

|

Income for the period (100% basis) |

$31,278 |

$1,436 |

|

MAG’s 44% share of income from equity accounted investment

in Juanicipio |

$13,762 |

$632 |

In 2017, the Company entered into an option

earn-in agreement with a private group whereby the Company can earn

up to a 100% interest in a prospective land claim package in the

Black Hills of South Dakota. Although the geological prospect of

the property remains encouraging, growing negative sentiment

towards resource extraction in the area, combined with a slow

consultation process have resulted in significant challenges being

encountered in permitting the property for exploration drilling.

Concurrent efforts by the Company to find a partner or buyer for

the project have been unsuccessful and the Company provided formal

notice that it will not be making the final $150 option payment

when due in May 2022 and consequently has recorded a write-down of

$10,471 as at March 31, 2022.

About MAG Silver Corp.

(www.magsilver.com )

MAG Silver Corp. is a Canadian development and

exploration company focused on becoming a top-tier primary

silver mining company by exploring and advancing high-grade,

district scale, silver-dominant projects in the Americas. Its

principal focus and asset is the Juanicipio Project (44%), being

developed with Fresnillo Plc (56%), the operator. The project

is located in the Fresnillo Silver Trend in Mexico, the world's

premier silver mining camp, where the operator is currently

developing an underground mine and constructing a 4,000 tonnes

per day processing plant. Underground mine production of

mineralized development material commenced in Q3 2020, and an

expanded exploration program is in place targeting multiple highly

prospective targets at Juanicipio. MAG is also executing a

multi-phase exploration program at the Deer Trail 100% earn-in

project in Utah, and is in the process of acquiring the Larder Lake

project located in the historically prolific Abitibi region of

Canada.

Neither the Toronto Stock Exchange nor the NYSE

American has reviewed or accepted responsibility for the accuracy

or adequacy of this press release, which has been prepared by

management.

This release includes certain statements that

may be deemed to be “forward-looking statements” within the meaning

of the US Private Securities Litigation Reform Act of 1995. All

statements in this release, other than statements of historical

facts are forward looking statements, including statements

regarding the anticipated time and capital schedule to production;

anticipated electrical hook-up of the processing plant and impact

on commissioning; statements that address our expectations with

respect to the timing and success of plant commissioning

activities; processing rates of mineralized materials, estimated

project economics, including but not limited to, plant or mill

recoveries, payable metals produced, underground mining rates;

production rates, expected upside from additional exploration;

expected capital requirements and adequacy of current working

capital for the next year; and other future events or developments.

Forward-looking statements are often, but not always, identified by

the use of words such as "seek", "anticipate", "plan", "continue",

"estimate", "expect", "may", "will", "project", "predict",

"potential", "targeting", "intend", "could", "might", "should",

"believe" and similar expressions. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Although MAG

believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance and actual results or

developments may differ materially from those in the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include, but are not limited to, impacts (both direct and indirect)

of COVID-19, supply chain constraints and general costs escalation

in the current inflationary environment heightened by the invasion

of Ukraine by Russia, timing of receipt of required permits,

changes in applicable laws, changes in

commodities prices, changes in mineral

production performance, exploitation and exploration

successes, continued availability of capital and financing, and

general economic, market or business conditions, political risk,

currency risk and capital cost inflation. In addition,

forward-looking statements are subject to various risks, including

that data is incomplete and considerable additional work will be

required to complete further evaluation, including but not limited

to drilling, engineering and socio-economic studies and

investment. The reader is referred to the MAG Silver’s filings

with the SEC and Canadian securities regulators for disclosure

regarding these and other risk factors. There is no certainty that

any forward-looking statement will come to pass, and investors

should not place undue reliance upon forward-looking

statements.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and

quarterly reports and other public filings, accessible through

the Internet at www.sedar.com and

www.sec.gov.

LEI: 254900LGL904N7F3EL14

For further information on behalf of MAG Silver Corp.

Contact Michael J. Curlook, VP Investor Relations and Communications

Phone: (604) 630-1399

Toll Free: (866) 630-1399

Website: www.magsilver.com

Email: info@magsilver.com

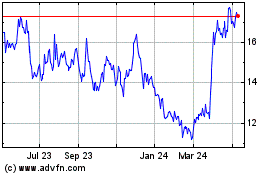

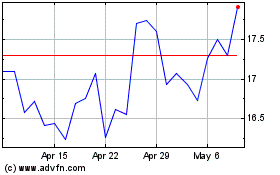

MAG Silver (TSX:MAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

MAG Silver (TSX:MAG)

Historical Stock Chart

From Dec 2023 to Dec 2024