MAG Silver Corp. (TSX / NYSE American: MAG) (“MAG”

or the

“Company”) announces the Company’s audited

consolidated financial results for the year ended December 31,

2021. For details of the audited consolidated financial

statements, Management's Discussion and Analysis, Annual

Information Form and Annual Report on Form 40-F for the year ended

December 31, 2021, please see the Company’s filings on SEDAR

(www.sedar.com) or on EDGAR (www.sec.gov).

All amounts herein are reported in $000s

of United States dollars (“US$”) unless otherwise

specified.

HIGHLIGHTS – DECEMBER 31, 2021 AND

SUBSEQUENT TO YEAR END

OPERATIONAL

- Significant progress was achieved during the year ended

December 31, 2021 on the construction of the 4,000 tonnes per day

(“tpd”) Juanicipio processing plant as the Juanicipio project team

delivered the project for plant commissioning late in the fourth

quarter of 2021.

- The plant commissioning timeline was extended, however, by

approximately six months until the regulatory approval to tie into

the national power grid is obtained. The plant commissioning

timeline is now expected to commence in Q2 2022.

- As reported by the operator Fresnillo, the Juanicipio Project

is expected to come in on budget with the processing plant expected

to be ramped up to 85% to 90% of plant capacity by the end of

2022.

- A regularly updated photo gallery of construction progress at

Juanicipio is available at

https://magsilver.com/projects/photo-gallery/#photo-gallery.

- Campaign processing of mineralized material from development

headings continues through the nearby Fresnillo plant and starting

in Q4 2021 mineralized material also began to be campaign processed

at Fresnillo’s Saucito plant. Saucito’s flowsheet better resembles

that of the Juanicipio plant and will provide further valuable

metallurgical benefits as production commences at

Juanicipio.

- The campaign processing rate originally targeted at 16,000

tonnes per month increased significantly to an average of 37,983

tonnes per month in Q4 2021 and to an average of 44,963 tonnes per

month for the first two months of 2022.

- Processing at the Fresnillo plants is expected to continue

until the Juanicipio plant is commissioned, with Fresnillo making

available any unused plant capacity at its Minera Fresnillo and

Minera Saucito operations, and if possible matching commissioning

and ramp up tonnages that were previously expected at

Juanicipio.

- For the three months ended December 31, 2021, on a 100% basis:

- 113,950 tonnes of mineralized material were campaign processed

through the Fresnillo and Saucito plants, with 1,519,027 payable

silver ounces, 3,641 payable gold ounces, 563 tonnes of lead and

800 tonnes of zinc produced and sold;

- Average silver head grade was 542 grams per tonne (“g/t”);

and

- Pre-commercial production sales totaled $39,368 for the quarter

(net of treatment and processing costs), less $7,593 in mining and

transportation costs, netting $31,775 in gross profit by Minera

Juanicipio in the quarter.

- For the year ended December 31, 2021, on a 100% basis:

- 251,907 tonnes of mineralized material were campaign processed

through Fresnillo’s plants, with 2,974,524 payable silver ounces,

5,975 payable gold ounces, 1,065 tonnes of lead and 1,519 tonnes of

zinc produced and sold;

- Average silver head grade was 470 g/t; and

- Pre-commercial production sales of $75,393 (net of treatment

and processing costs) less $15,329 in mining and transportation

costs, netting $60,064 gross profit in Minera Juanicipio for the

year.

- Since commencing campaign processing of Juanicipio mineralized

material from development headings in August of 2020 through

February 2022, a total of 413,691 tonnes of mineralized development

material have been processed through the nearby Fresnillo plant and

starting in December 2021 in the Saucito plant:

- contributing cash-flow to offset some of the initial project

capital; and

- de-risking Juanicipio’s metallurgical performance, which is

expected to significantly speed up project ramp-up.

- A further 89,925 tonnes of mineralized development material

with a silver head grade of 529 g/t were processed in January and

February 2022 through the Fresnillo and Saucito plants.

EXPLORATION

- Results of the Juanicipio 2020 exploration program were

reported in the third quarter (see Press Release dated August 5,

2021), and the program successfully:

- Confirms, and allows modeling with greater detail and

confidence of the high-grade silver resource within the upper parts

of the Valdecañas Bonanza Zone (as defined in the 2017 PEA) where

the first several years of mining is expected to occur;

- Confirms, expands, and allows improved modeling of the

continuous wide mineralization of the Valdecañas Deep Zone (as

defined in the 2017 PEA); and

- Confirms, expands, and allows improved modeling of the

ever-growing Anticipada Vein.

- The Juanicipio 2021 exploration program was completed in Q4

2021 with $6,296 spent on a 100% basis and was focused on continued

step-out and infill drilling of the Valdecañas Vein System

(including independent targeting of the Venadas Vein family and the

Anticipada Vein).

- The Juanicipio 2022 exploration program is currently in

process, with five drill rigs presently on surface running

concurrently with continued underground definition and geotechnical

drilling, and one rig testing the new Cesantoni target in the

northwest part of the Juanicipio concession.

- Deer Trail Project in Utah:

- Assays were released in Q3 2021 for the Phase I drill program

(see Press Release dated September 7, 2021), which successfully

fulfilled all three of its planned objectives by:

- Confirming the presence of a thick section of more favorable

carbonate host rocks (the predicted “Redwall Limestone” or

“Redwall”) below the Deer Trail mine;

- Confirming and projecting two suspected mineralization feeder

structures to depth; and

- Intercepting high-grade mineralization related to those

structures in host rocks below what was historically known.

- A follow up 5 hole/5,000 metre Phase II drill program commenced

in Q3 2021 and is in process with all assays pending.

- Subsequent to the year end, the Company entered into a

Definitive Arrangement Agreement with Gatling Exploration Inc.

(TSXV:GTR, OTCOB:GATGF) (“Gatling”) pursuant to which the Company

will acquire all of the issued and outstanding common shares of

Gatling in an all-share transaction. The Company and Gatling have

also entered into a loan agreement pursuant to which the Company

has agreed to provide Gatling with a C$3 million secured

convertible bridge loan to finance Gatling’s accounts payable and

operating expenses.

LIQUIDITY AND CAPITAL

RESOURCES

- As at December 31, 2021, MAG held cash of $56,748 while Minera

Juanicipio had cash on hand of $18,972 on a 100% basis.

- According to the operator Fresnillo, the Juanicipio Project

construction is expected to be delivered on budget at $440,000.

- With the current ramp up of underground mine production and

given hiring restrictions on contractors arising from new 2021

labour reform legislation, the timing of various sustaining capital

expenditures has been brought forward:

- These sustaining capital costs are included in current

Juanicipio development costs but are not considered by the operator

as part of the $440,000 initial project capital; and

- The costs incurred are expected to reduce future sustaining

capital costs and totaled approximately $41,388 on a 100% basis in

the second half of 2021 in preparation for the legislation to come

into effect.

- The expected cash flow from the ongoing campaign processing

until the Juanicipio plant is commissioned, along with the cash

held by Minera Juanicipio at December 31, 2021 of $18,972, are

projected to substantially fund the remaining capital expenditures

in the $440,000 initial capex (a cash call has not been needed

since mid-December 2021 which was $21,000 on a 100% basis).

- Should there be additional funding requirements in excess of

the cashflow generated, related to further commissioning delays or

to additional sustaining capital that is being brought forward

prior to attaining commercial production, there may still be

further cash calls required from Fresnillo and MAG.

- In Q4 2021, MAG closed a bought deal share offering and issued

2,691,000 common shares, including 15,700 common shares issued to

an officer and two directors of MAG and 351,000 common shares

issued upon the full exercise of the over-allotment option, at

$17.15 per share for gross proceeds of $46,151. The Company paid

commission of $2,301 to the underwriters and legal and filing costs

totaled an additional $608 resulting in net proceeds of

$43,242.

COVID-19

- Fresnillo, the Juanicipio operator implemented a range of

safety measures and monitoring procedures, consistent with World

Health Organization and Mexican Government COVID-19

directives.

- COVID-19 had an impact on the Juanicipio plant commissioning

timeline however during the course of the year:

- In Q1 2021, Fresnillo, as operator, reported that commissioning

was pushed out a few months to Q4 2021 as some infrastructure

contracts were delayed related to COVID-19; and,

- In Q4 2021, approval to complete the tie-in to the national

power grid was extended as noted above related to knock-on effects

of the pandemic.

CORPORATE

- MAG continued to refresh its board during the year with three

new appointments:

- Ms. Susan Mathieu was appointed to the board on January 13,

2021 increasing the size of the board to eight members;

- Mr. Tim Baker was appointed to the board on March 31, 2021

replacing Mr. Richard Clark who resigned from the board to focus on

other professional responsibilities; and,

- Mr. Dale Peniuk was appointed to the board on August 3, 2021

replacing Mr. Derek White who did not stand for re-election at the

Company’s Annual General and Special Meeting on June 21,

2021.

- On October 16, 2021 MAG announced that Mr. W.J. (Jim) Mallory

joined the Company as its Chief Sustainability Officer (“CSO”)

highlighting the Company’s commitment to environmental, social,

governance (“ESG”) betterment.

- On March 28, 2022, MAG announced the appointment of Fausto Di

Trapani as Chief Financial Officer (“CFO”) effective May 20, 2022.

Mr. Di Trapani is a finance executive with experience in the

natural resources sector spanning two decades, most recently having

served as the Chief Financial Officer at Galiano Gold Inc. Mr. Di

Trapani replaces Mr. Larry Taddei, who, after 12 years of service

with the Company, will step down from the CFO role to pursue other

opportunities. Mr. Taddei will assist in the orderly transition of

his duties following Mr. Di Trapani’s appointment.

JUANICIPIO PROJECT UPDATE

Underground Mine Production

As of August 2020, mineralized development

material from the Juanicipio Project is being campaign processed,

refined and sold on commercial terms at a targeted rate through Q3

2021 of 16,000 tonnes per month at the nearby Fresnillo plant 12

kilometres away. The processing rate increased to an average of

37,983 tonnes per month in Q4 2021 and subsequent to the year end

to an average of 44,963 tonnes per month for the first two months

of 2022. In December 2021, for the first time, 8,725 tonnes were

processed at Fresnillo’s Saucito beneficiation plant (also 100%

owned by Fresnillo). The Saucito plant flowsheet better resembles

that of the Juanicipio plant and will provide further valuable

metallurgical information as processing commences at Juanicipio.

This preproduction toll processing of Juanicipio mineralized

development material plus some initial stope production is expected

to continue until the Juanicipio plant is commissioned

In the three months and year ended December 31,

2021, 113,950 and 251,907 tonnes of mineralized development

material respectively, were processed through the Fresnillo plants,

realizing commercial and operational de-risking opportunities for

the Juanicipio Project. The resulting payable metals sold and

processing details on a 100% basis are summarized in Table

1 (three months ended December 31, 2021) and in

Table 2 (year ended December 31, 2021) below.

Table 1: Q4 2021 Development Material

Processed at Fresnillo’s Processing Plants (100%

basis)

|

Three Months Ended December 31, 2021 (113,950 tonnes

processed) |

|

|

Payable Metals |

Quantity |

Average Per Unit (1) |

$Amount |

Q4 2020$Amount |

|

Silver |

1,519,027 ounces |

$22.96 per oz |

$ 34,877 |

$ 5,866 |

|

Gold |

3,641 ounces |

$1,793.67 per oz |

6,531 |

876 |

|

Lead |

563 tonnes |

$1.05 per lb |

1,300 |

80 |

|

Zinc |

800 tonnes |

$1.55 per lb |

2,729 |

220 |

|

Treatment and refining charges (“TCRCs”) and other processing

costs |

(6,069) |

(1,232) |

|

Net Sales |

39,368 |

5,810 |

|

Mining and transportation costs |

(7,593) |

(2,342) |

|

Gross Profit |

$ 31,775 |

$ 3,468 |

(1) Ounces (“oz”) for silver and gold and, pounds (“lb”)

for lead and zinc.

Table 2: Year 2021 Development Material

Processed at Fresnillo’s Processing Plants (100%

basis)

|

Year Ended December 31, 2021 (251,907 tonnes

processed) |

|

|

Payable Metals |

Quantity |

Average Per Unit (1) |

$Amount |

2020$Amount (2) |

|

Silver |

2,974,524 ounces |

$23.99 per oz |

$ 71,369 |

$ 15,403 |

|

Gold |

5,975 ounces |

$1,791.22 per oz |

10,702 |

1,941 |

|

Lead |

1,065 tonnes |

$1.02 per lb |

2,387 |

301 |

|

Zinc |

1,519 tonnes |

$1.45 per lb |

4,849 |

575 |

|

TCRCs and other processing costs |

(12,768) |

(2,885) |

|

Provisional sales adjustment related to 2020 sales (3) |

(1,146) |

- |

|

Net Sales |

75,393 |

15,335 |

|

Mining and transportation costs |

(15,329) |

(3,873) |

|

Gross Profit |

$ 60,064 |

$ 11,462 |

(1) Ounces (“oz”) for silver and gold and, pounds (“lb”)

for lead and zinc.(2) Processing of Juanicipio mineralized

development material at the Fresnillo plant commenced in August of

2020, with no prior processing.(3) Provisional sales for 2020

were finalized in Q1 2021 resulting in negative adjustment to net

sales revenue of $1,146.

The average silver head grade for the

mineralized development material and initial stope material

processed in the three months and year ended December 31, 2021 was

542 g/t and 470 g/t (three months and year ended December 31, 2020

was 300 g/t and 328 g/t) respectively. This increased grade in the

last quarter of 2021 reflects less diluted development material and

more stoped vein material being processed.

Processing Plant Construction & Outlook

The Juanicipio project team delivered the

Juanicipio plant for commissioning in the fourth quarter of 2021.

However, according to the operator Fresnillo, the state-owned

electrical company (Comision Federal de Electricidad “CFE”),

notified Fresnillo late in December 2021 that the regulatory

approval to complete the tie-in to the national power grid could

not yet be granted, and the projected commissioning timeline has

therefore been extended by approximately six months, with

commissioning of the Juanicipio processing plant now expected to

commence in Q2-2022 with ramp up to 85 to 90% of the nameplate

4,000 tpd capacity by the end of 2022, according to Fresnillo.

In order to minimize any potential adverse

economic effect of the revised commissioning timeline, Fresnillo

has indicated it will make available any unused plant capacity at

its Minera Fresnillo and Minera Saucito operations to process

mineralized material produced at Juanicipio during this period, and

if possible match commissioning and ramp up tonnages that were

previously expected. The effect on cashflow generation from

Juanicipio therefore will also be mitigated while power connection

approvals are pending.

With the plant ready to commence commissioning

once connected to the power grid, final construction costs are

expected to wind down until final commissioning and testing

commence. Meanwhile, as noted above, the amount of mineralized

development material being processed at the two Fresnillo plats

since Q4 2021 has been significantly higher than the original

targeted rate of 16,000 tonnes per month. The cash flow from this

processing, along with the cash held by Minera Juanicipio at

December 31, 2021 of $18,972 and the expected cash flows from

continued processing until the Juanicipio plant is commissioned are

projected to substantially fund the remaining capital expenditures

in the $440,000 initial project capital (a cash call has not been

needed since mid-December 2021 which was $21,000 on a 100%

basis).

With the current ramp up of underground mine

production and given hiring restrictions on contractors arising

from new 2021 labour reform legislation, the timing of various

sustaining capital expenditures has been brought forward. Labour

reform on subcontracting and outsourcing in Mexico was published on

April 23, 2021 and came into effect on September 1, 2021. With

various restrictions on hiring contractors, Fresnillo, as operator,

has indicated a need to internalize a significant portion of its

contractor workforce and perform much of the development work

directly rather than outsourcing it to contractors. This requires

investment in equipment to be utilized in underground operations,

either not previously in the project scope or not envisaged to be

required until later in the mine life. As well, certain underground

development expenditures related to processing development material

and some small items brought forward from project investments

planned in the future are considered sustaining capital by

Fresnillo. The costs incurred are expected to reduce future

sustaining capital costs and totaled approximately $41,388 on a

100% basis in the second half of 2021 in preparation for the

legislation to come into effect. These costs are included in the

current Juanicipio development costs but are not considered by the

operator as part of the $440,000 initial project capital. Should

there be additional funding requirements in excess of the cashflow

generated related to further commissioning delays or to additional

sustaining capital that is being brought forward, there may still

be further cash calls required from Fresnillo and MAG.

Juanicipio Exploration Update

The planned expenditures for the 2022

Exploration Program total $7,000 with the programs designed to

expand and convert the Inferred Mineral Resources included in the

Deep Zone into Indicated Mineral Resources, and to explore other

parts of the Juanicipio concession. All aspects of the exploration

work continue to be done under strict COVID-19 protocols.

Subsequent to the year-end in mid-January, 2022, drilling began on

the first hole on the “Cesantoni Kaolinite Pits”(Cesantoni) target

(assay pending). Cesantoni lies in the northwestern corner of the

Juanicipio concession, roughly 6 km west of the Valdecañas Vein and

related underground and surface infrastructure.

The 2021 Juanicipio exploration program was

completed in late 2021, with an actual spend of $6,296 on a 100%

basis and was focused on continued step-out and infill drilling of

the Valdecañas Vein System (including independent targeting of the

Venadas Vein family and the Anticipada Vein). In total, 23 targets

(holes) were successfully tested with 21 being deep infill holes

and two exploration holes on other parts of the Juanicipio

concession, resulting in 29,421 metres drilled. The program results

will be released in Q2 2022 pending receipt of all

assays.

Assays for the Juanicipio 2020 drill program

were released in the Q3 2021 (see Press Release dated August 5,

2021). The 2020 drill program successfully:

- Confirmed, and allowed modeling with greater detail and

confidence of the high-grade silver resource within the upper parts

of the Valdecañas Bonanza Zone where the first several years of

mining will occur;

- Confirmed, expanded, and allowed improved modeling of the

continuous wide mineralization of the Valdecañas Deep Zone;

and,

- Confirmed, expanded, and allowed improved modeling of the

ever-growing Anticipada Vein.

DEER TRAIL PROJECT UPDATE

Phase I drilling commenced in November 2020 and

was completed in Q2 2021 with assays and interpretations released

in the third quarter of 2021 (see Press Release September 7, 2021).

Phase I saw the completion of three holes and 3,927 metres drilled

from surface and successfully fulfilled all three of its planned

objectives by:

- Confirming the presence of a thick section of more favorable

carbonate host rocks (the predicted “Redwall Limestone” or

“Redwall”) below the Deer Trail mine;

- Confirming and projecting two suspected mineralization feeder

structures to depth; and

- Intercepting high-grade mineralization related to those

structures in host rocks below what was historically known.

Phase II drilling commenced at the Deer Trail

Project on August 20, 2021 and is in process, planned for 5,000

metres of drilling over 5 holes. Deviation/directional drilling is

being used in Phase II to make the drilling more efficient and

accurate. In part to facilitate the directional drilling, drilling

contractors were changed in Q1 2022, with the new contractor on

site and preparing to resume drilling.

GATLING ACQUISITION

Subsequent to the year end, the Company entered

into a Definitive Arrangement Agreement with Gatling pursuant to

which the Company will acquire all of the issued and outstanding

common shares of Gatling in an all-share transaction. The Company

and Gatling have also entered into a loan agreement pursuant to

which the Company has agreed to provide Gatling with a C$3 million

secured convertible bridge loan to finance Gatling’s accounts

payable and operating expenses.

Gatling is a Canadian gold exploration company

focused on advancing the Larder Gold Project, located in the

prolific Abitibi greenstone belt in Northern Ontario, Canada. The

3,370 ha Larder Project hosts three high-grade gold deposits along

the Cadillac-Larder Lake Break, 35 km east of Kirkland Lake and 7

kilometers west of the Kerr Addison Mine. The project is 100% owned

by Gatling and is comprised of patented and unpatented claims,

leases and mining licenses of occupation within the McVittie and

McGarry Townships. All parts of the Larder property are readily

accessible and MAG expects to engage the existing exploration team

going forward.

Qualified Person: Dr. Peter

Megaw, Ph.D., C.P.G., has acted as the Qualified Person as defined

in National Instrument 43-101 for this disclosure and supervised

the preparation of the technical information in this release. Dr.

Megaw has a Ph.D. in geology and more than 40 years of relevant

experience focused on ore deposit exploration worldwide. He is a

Certified Professional Geologist (CPG 10227) by the American

Institute of Professional Geologists and an Arizona Registered

Geologist (ARG 21613). Dr. Megaw is not independent as he is Chief

Exploration Officer and a Shareholder of MAG.

FINANCIAL RESULTS – YEAR ENDED DECEMBER

31, 2021

As at December 31, 2021, the Company had working

capital of $57,761 (December 31, 2020: $94,513) including cash of

$56,748 (December 31, 2020: $94,008) and no long-term debt. As at

December 31, 2021, Minera Juanicipio had cash of $18,972 (MAG’s

attributable 44% share $8,348). The Company makes cash advances to

Minera Juanicipio as ‘cash called’ by the operator Fresnillo, based

on approved joint venture budgets. In the year ended December 31,

2021, the Company funded advances to Minera Juanicipio, which

combined with MAG’s Juanicipio expenditures on its own account,

totaled $74,136 (December 31, 2020: $64,270).

The Company’s net income for year the ended

December 31, 2021 amounted to $6,025 (December 31, 2020: $7,097 net

loss) or $0.06/share (December 31, 2020: loss of $(0.08)/share).

MAG recorded its 44% income from its equity accounted Investment in

Juanicipio of $15,686 (December 31, 2020: $2,214) which included

MAG’s 44% share of net income from the sale of pre-production

development material (see Table 3 below). Share

based payment expense, a non-cash item, recorded in the year ended

December 31, 2021 amounted to $4,256 (December 31, 2020: $3,122),

and is determined based on the fair value of equity incentives

granted and vesting in the year.

Table 3: MAG’s income from its equity

accounted Investment in Juanicipio

|

|

December 31,2021 |

December 31,2020 |

|

Gross Profit from processing development material

(see Table 2 above) |

$ 60,064 |

$ 11,462 |

|

Administrative expenses |

(1,929) |

(239) |

|

Extraordinary mining duty |

(337) |

(76) |

|

Foreign exchange and other |

(1,363) |

(623) |

|

Net Income before tax |

56,435 |

10,524 |

|

Income tax expense (including deferred income tax) |

(20,784) |

(5,492) |

|

Net Income for the year (100% basis) |

$ 35,651 |

$ 5,032 |

|

MAG’s 44% share of income from equity accounted Investment

in Juanicipio |

$ 15,686 |

$ 2,214 |

Shareholders may receive, upon request and free

of charge, a hard copy of the Company’s Audited Financial

Statements. The Company’s 40-F has also been filed with the United

States Securities and Exchange Commission.

About MAG Silver Corp.

(www.magsilver.com )

MAG Silver Corp. is a Canadian development and

exploration company focused on becoming a top-tier primary silver

mining company by exploring and advancing high-grade, district

scale, silver-dominant projects in the Americas. Its principal

focus and asset is the Juanicipio Project (44%), being developed

with Fresnillo Plc (56%), the operator. The Project is located in

the Fresnillo Silver Trend in Mexico, the world's premier silver

mining camp, where the operator is currently developing an

underground mine and constructing a 4,000 tonnes per day processing

plant. Underground mine production of mineralized development

material commenced in Q3 2020, and an expanded exploration program

is in place targeting multiple highly prospective targets at

Juanicipio. MAG is also executing a multi-phase exploration program

at the Deer Trail 100% earn-in project in Utah.

This release includes certain statements that

may be deemed to be “forward-looking statements” within the meaning

of the US Private Securities Litigation Reform Act of 1995. All

statements in this release, other than statements of historical

facts are forward looking statements, including statements that

address our expectations with respect to the timing and success of

plant pre-commissioning and commissioning activities, processing

rates of development materials, future mineral production, and

events or developments. Forward-looking statements are often, but

not always, identified by the use of words such as "seek",

"anticipate", "plan", "continue", "estimate", "expect", "may",

"will", "project", "predict", "potential", "targeting", "intend",

"could", "might", "should", "believe" and similar expressions.

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. Although MAG believes the expectations expressed

in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future

performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors

that could cause actual results to differ materially from those in

forward-looking statements include, but are not limited to, impacts

(both direct and indirect) of COVID-19, timing of receipt of

required permits, changes in applicable laws, changes in

commodities prices, changes in mineral

production performance, exploitation and exploration

successes, continued availability of capital and financing, and

general economic, market or business conditions, political risk,

currency risk and capital cost inflation. In addition,

forward-looking statements are subject to various risks, including

that data is incomplete and considerable additional work will be

required to complete further evaluation, including but not limited

to drilling, engineering and socio-economic studies and

investment. The reader is referred to the MAG Silver’s filings

with the SEC and Canadian securities regulators for disclosure

regarding these and other risk factors. There is no certainty that

any forward-looking statement will come to pass, and investors

should not place undue reliance upon forward-looking

statements.Neither the Toronto Stock Exchange nor the NYSE American

has reviewed or accepted responsibility for the accuracy or

adequacy of this press release, which has been prepared by

management.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and

quarterly reports and other public filings, accessible through

the Internet at www.sedar.com and www.sec.gov LEI:

254900LGL904N7F3EL14

For further information on behalf of MAG Silver Corp.

Contact Michael J. Curlook, VP Investor Relations and Communications

Phone: (604) 630-1399

Toll Free:(866) 630-1399

Email: info@magsilver.com

Website: www.magsilver.com

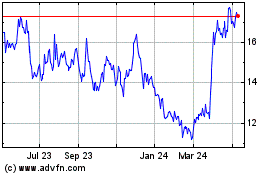

MAG Silver (TSX:MAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

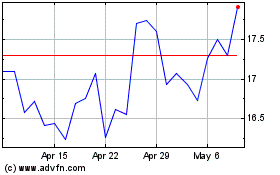

MAG Silver (TSX:MAG)

Historical Stock Chart

From Dec 2023 to Dec 2024