Imperial Oil Limited (TSX:IMO):

- Net income of $424 million; cash generated from operations of

nearly $1.4 billion

- Highest third quarter production in 30 years at 407,000 gross

oil-equivalent barrels per day

- Returned $512 million to shareholders through share purchases

and dividends

Third quarter

Nine months

millions of Canadian dollars, unless

noted

2019

2018

∆

2019

2018

∆

Net income (loss) (U.S. GAAP)

424

749

-325

1,929

1,461

+468

Net income (loss) per common share,

assuming dilution (dollars)

0.56

0.94

-0.38

2.51

1.79

+0.72

Capital and exploration expenditures

442

376

+66

1,400

934

+466

Estimated net income in the third quarter of 2019 was $424

million, compared to net income of $749 million in the same period

of 2018. Cash generated from operating activities for the third

quarter totalled nearly $1.4 billion, up from $1.2 billion

generated in the third quarter of 2018.

Overall upstream gross oil-equivalent production averaged

407,000 barrels per day, up from 393,000 barrels per day in the

third quarter of 2018. Gross production at Kearl averaged 224,000

barrels per day in the third quarter, with production for the first

nine months of the year averaging 204,000 barrels per day.

“Imperial achieved its highest third quarter production in 30

years,” said Rich Kruger, chairman and chief executive officer.

“This performance demonstrates the results of the company’s focus

on upstream reliability.”

Refinery throughput averaged 363,000 barrels per day, compared

to 388,000 barrels per day in the third quarter of 2018. Petroleum

product sales averaged 488,000 barrels per day in the third

quarter, compared to 516,000 barrels per day in the same period of

2018. Downstream volumes were affected by the planned Nanticoke

refinery turnaround and ongoing impacts from the fractionation

tower incident at Sarnia earlier in the year.

“Imperial continued to deliver strong cash flow in the third

quarter, despite executing significant maintenance activities.

Year-to-date cash generated from operations totalled $3.4 billion,

supporting the company’s ability to fund its investment priorities

and also return surplus cash to shareholders. During the first nine

months of 2019, over $1.5 billion was returned to shareholders

through dividends and share purchases,” said Kruger.

As previously announced, chairman and chief executive officer

Rich Kruger declared his plans to retire at the end of December

2019 and Imperial’s board of directors announced the appointment of

Brad Corson as president and a director on September 17. Mr. Corson

will assume the additional roles of chairman and chief executive

officer on January 1, 2020. “Imperial’s people and assets provide a

solid foundation for continued growth and leadership within the

Canadian energy industry,” said Corson. “I look forward to building

on these strengths to deliver long-term shareholder value.”

Third quarter highlights

- Net income of $424 million or $0.56 per share on a diluted

basis, compared to net income of $749 million or $0.94 per

share in the third quarter of 2018.

- Cash generated from operating activities was $1,376

million, up from $1,207 million in the third quarter of

2018.

- Capital and exploration expenditures totalled $442

million, compared with $376 million in the third quarter of

2018. Total capital expenditures for the year continue to be

anticipated at between $1.8 billion and $1.9 billion.

- Dividends paid and share purchases totalled $512 million in

the third quarter of 2019. The company paid dividends of $169

million or $0.22 per share, and purchased about 9.8 million shares

for $343 million.

- Production averaged 407,000 gross oil-equivalent barrels per

day, up from 393,000 barrels per day in the same period of

2018.

- Gross production of Kearl bitumen averaged 224,000 barrels

per day (159,000 barrels Imperial’s share), compared to 244,000

barrels per day (173,000 barrels Imperial’s share) in the third

quarter of 2018. A planned turnaround on one of the asset’s two

plants began in early-September and was completed in mid-October,

impacting gross production in the quarter by an estimated 34,000

barrels per day (24,000 barrels Imperial’s share).

- Gross production of Cold Lake bitumen averaged 142,000

barrels per day, compared to 150,000 barrels per day in the

same period of 2018.

- The company’s share of gross production from Syncrude

averaged 69,000 barrels per day, up from 45,000 barrels per day

in the same period of 2018. The increase was mainly due to the

absence of impacts from the 2018 power disruption, partially offset

by an ongoing 75-day planned turnaround which began in late-August.

The turnaround impacted the company’s share of gross production in

the quarter by an estimated 15,000 barrels per day.

- Crude-by-rail shipments averaged 52,000 barrels per day in

the third quarter, compared to 64,000 barrels per day in the

second quarter of 2019.

- Refinery throughput averaged 363,000 barrels per

day,compared to 388,000 barrels per day in the third quarter of

2018. Capacity utilization was 86 percent, compared to 92 percent

in the third quarter of 2018. The results reflect a planned

turnaround at the Nanticoke refinery which began in September and

is anticipated to be complete in November, as well as ongoing

impacts from the fractionation tower incident at Sarnia which

occurred earlier this year.

- Petroleum product sales were 488,000 barrels per

day,compared to 516,000 barrels per day in the third quarter of

2018. Lower volumes were mainly due to reduced refining

throughput.

- Speedpass+TM mobile app enhancement and promotion a

success. During this promotion, the number of users enrolled

increased by 50 percent. Speedpass+ users can now earn Esso Extra

or PC Optimum points when using the app at participating Esso and

Mobil stations nationwide.

- Imperial to enhance artificial intelligence

capabilities. Imperial announced plans to collaborate with the

Alberta Machine Intelligence Institute for progressing in-house

machine learning capabilities, which will develop more effective

ways to recover oil and gas resources, lower operating costs and

reduce environmental impacts.

Third quarter 2019 vs. third quarter 2018

The company’s net income for the third quarter of 2019 was $424

million or $0.56 per share on a diluted basis, compared to net

income of $749 million or $0.94 per share in the same period of

2018.

Upstream net income was $209 million in the third quarter,

compared to net income of $222 million in the same period of 2018.

Earnings decreased mainly due to higher operating expenses of about

$70 million and higher royalties of about $50 million, partially

offset by higher volumes of about $110 million primarily at

Syncrude.

West Texas Intermediate (WTI) averaged US$56.44 per barrel in

the third quarter of 2019, down from US$69.43 per barrel in the

same quarter of 2018. Western Canada Select (WCS) averaged US$44.21

per barrel and US$47.49 per barrel for the same periods. The WTI /

WCS differential narrowed during the third quarter of 2019 to

average approximately US$12 per barrel for the quarter, compared to

around US$22 per barrel in the same period of 2018.

The Canadian dollar averaged US$0.76 in the third quarter of

2019, essentially unchanged from the third quarter of 2018.

Imperial’s average Canadian dollar realizations for bitumen

increased in the quarter supported primarily by lower diluent costs

partially offset by a decrease in WCS. Bitumen realizations

averaged $51.12 per barrel in the third quarter of 2019, up from

$50.42 per barrel in the third quarter of 2018. The company’s

average Canadian dollar realizations for synthetic crude declined

generally in line with WTI in the quarter, adjusted for changes in

exchange rates and transportation costs. Synthetic crude

realizations averaged $77.27 per barrel in the third quarter of

2019, compared to $89.70 per barrel in the same period of 2018.

Gross production of Cold Lake bitumen averaged 142,000 barrels

per day in the third quarter, compared to 150,000 barrels per day

in the same period of 2018.

Gross production of Kearl bitumen averaged 224,000 barrels per

day in the third quarter (159,000 barrels Imperial’s share),

compared to 244,000 barrels per day (173,000 barrels Imperial’s

share) in the third quarter of 2018. Lower production was mainly

due to timing of planned turnaround activity.

The company's share of gross production from Syncrude averaged

69,000 barrels per day, up from 45,000 barrels per day in the third

quarter of 2018. Higher production was mainly due to the absence of

production impacts from the 2018 power disruption, partially offset

by planned turnaround activity.

Downstream net income was $221 million in the third quarter,

compared to $502 million in the third quarter of 2018. Earnings

were negatively impacted by lower margins of about $230 million and

planned turnaround activity of about $70 million.

Refinery throughput averaged 363,000 barrels per day, compared

to 388,000 barrels per day in the third quarter of 2018. Capacity

utilization was 86 percent, compared to 92 percent in the third

quarter of 2018. Reduced throughput was mainly due to planned

turnaround activity at Nanticoke and ongoing impacts from the

fractionation tower incident at Sarnia which occurred earlier in

2019.

Petroleum product sales were 488,000 barrels per day, compared

to 516,000 barrels per day in the third quarter of 2018. Lower

petroleum product sales were mainly due to lower refinery

throughput.

Chemical net income was $38 million in the third quarter,

compared to $69 million from the same quarter of 2018, primarily

reflecting lower margins.

Corporate and other expenses were $44 million in the third

quarter, unchanged from the same period of 2018.

Cash flow generated from operating activities was $1,376 million

in the third quarter, up from $1,207 million in the corresponding

period in 2018, primarily reflecting favourable working capital

effects, partially offset by lower earnings.

Investing activities used net cash of $413 million in the third

quarter, compared with $352 million used in the same period of

2018.

Cash used in financing activities was $519 million in the third

quarter, compared with $580 million used in the third quarter of

2018. Dividends paid in the third quarter of 2019 were $169

million. The per share dividend paid in the third quarter was

$0.22, up from $0.19 in the same period of 2018. During the third

quarter, the company, under its share purchase program, purchased

about 9.8 million shares for $343 million, including shares

purchased from Exxon Mobil Corporation. In the third quarter of

2018, the company purchased about 10 million shares for $418

million.

The company’s cash balance was $1,531 million at September 30,

2019, versus $1,148 million at the end of third quarter 2018.

The company currently anticipates exercising its share purchases

uniformly over the duration of the program. Purchase plans may be

modified at any time without prior notice.

Nine months highlights

- Net income of $1,929 million, up from net income of $1,461

million in 2018.

- Net income per share on a diluted basis was $2.51, up from net

income per share of $1.79 in 2018.

- Cash flow generated from operating activities was $3,405

million, up from $3,051 million in 2018.

- Gross oil-equivalent production averaged 398,000 barrels per

day, up from 367,000 barrels per day in 2018.

- Refinery throughput averaged 363,000 barrels per day, compared

to 386,000 barrels per day in 2018.

- Petroleum product sales were 481,000 barrels per day, compared

to 503,000 barrels per day in 2018.

- Per share dividends declared during the year totalled $0.63, up

from $0.54 per share in 2018.

- Returned over $1.5 billion to shareholders through share

purchases and dividends.

Nine months 2019 vs. nine months 2018

Net income in the first nine months of 2019 was $1,929 million,

or $2.51 per share on a diluted basis, up from net income of $1,461

million or $1.79 per share in the first nine months of 2018. 2019

results include a favourable impact, largely non-cash, of $662

million associated with the Alberta corporate income tax rate

decrease. On June 28, 2019, the Alberta government enacted a 4

percent decrease in the provincial tax rate, from 12 percent to 8

percent by 2022.

Upstream net income was $1,252 million for the first nine months

of the year, reflecting the favourable impact associated with the

decreased Alberta corporate income tax rate of $689 million.

Excluding this impact, 2019 net income was $563 million, up from

net income of $172 million in the same period of 2018. Improved

results reflect higher volumes of about $530 million at Syncrude,

Kearl and Norman Wells, as well as the impact of higher crude oil

realizations of about $220 million and favourable foreign exchange

impacts of about $90 million. Results were negatively impacted by

higher operating expenses of about $270 million, higher royalties

of about $130 million, and lower Cold Lake volumes of about $70

million.

West Texas Intermediate averaged US$57.10 per barrel in the

first nine months of 2019, down from US$66.77 per barrel in the

same period of 2018. Western Canada Select averaged US$45.32 per

barrel and US$44.98 per barrel for the same periods. The WTI / WCS

differential narrowed to average approximately US$12 per barrel in

the first nine months of 2019, from around US$22 per barrel in the

same period of 2018.

The Canadian dollar averaged US$0.75 in the first nine months of

2019, a decrease of $0.03 from the same period in 2018.

Imperial's average Canadian dollar realizations for bitumen

increased in the first nine months of 2019, supported primarily by

lower diluent costs. Bitumen realizations averaged $52.44 per

barrel, up from $45.04 per barrel from the same period in 2018. The

company's average Canadian dollar realizations for synthetic crude

declined generally in line with WTI, adjusted for changes in

exchange rates and transportation costs. Synthetic crude

realizations averaged $74.59 per barrel, compared to $83.66 per

barrel from the same period in 2018.

Gross production of Cold Lake bitumen averaged 141,000 barrels

per day in the first nine months of 2019, compared to 145,000

barrels per day in the same period of 2018.

Gross production of Kearl bitumen averaged 204,000 barrels per

day in the first nine months of 2019 (145,000 barrels Imperial's

share), up from 202,000 barrels per day (144,000 barrels Imperial's

share) in the same period of 2018.

During the first nine months of 2019, the company's share of

gross production from Syncrude averaged 76,000 barrels per day, up

from 53,000 barrels per day in the same period of 2018. Higher

production was mainly due to the absence of production impacts from

the 2018 power disruption.

Downstream net income was $736 million for the first nine months

of 2019, compared to $1,224 million for the same period of 2018.

Earnings were negatively impacted by lower margins of about $430

million, reliability events of about $140 million, including the

fractionation tower incident at Sarnia, and lower sales volumes of

about $100 million. These factors were partially offset by lower

net turnaround impacts of about $80 million, and favourable foreign

exchange effects of about $60 million.

Refinery throughput averaged 363,000 barrels per day in the

first nine months of 2019, compared to 386,000 barrels per day in

the same period of 2018. Capacity utilization was 86 percent,

compared to 91 percent in the same period of 2018. Reduced

throughput was mainly due to higher planned turnaround activities

and impacts from the Sarnia fractionation tower incident.

Petroleum product sales were 481,000 barrels per day in the

first nine months of 2019, compared to 503,000 barrels per day in

the same period of 2018. Lower petroleum product sales were mainly

due to lower refinery throughput.

Chemical net income was $110 million in the first nine months of

2019, compared to $220 million in the same period of 2018,

primarily reflecting lower margins.

Corporate and other expenses were $169 million in the first nine

months of 2019, compared to $155 million in the same period of

2018.

Cash flow generated from operating activities was $3,405 million

in the first nine months of 2019, up from $3,051 million in the

same period of 2018, primarily reflecting favourable working

capital effects.

Investing activities used net cash of $1,305 million in the

first nine months of 2019, compared with $1,096 million used in

2018, primarily reflecting higher additions to property, plant and

equipment.

Cash used in financing activities was $1,557 million in the

first nine months of 2019, compared with $2,002 million used in the

same period of 2018. Dividends paid in the first nine months of

2019 were $465 million. The per share dividend paid in the first

nine months of 2019 was $0.60, up from $0.51 in the same period of

2018. During the first nine months of 2019, the company, under its

share purchase program, purchased about 29.6 million shares for

$1,072 million, including shares purchased from Exxon Mobil

Corporation. In the first nine months of 2018, the company

purchased about 38.5 million shares for $1,561 million.

Key financial and operating data follow.

Forward-looking statements

Statements of future events or conditions in this release,

including projections, targets, expectations, estimates, and

business plans are forward-looking statements. Forward-looking

statements can be identified by words such as believe, anticipate,

propose, plan, goal, target, estimate, expect, future, continue,

likely, may, should, will and similar references to future periods.

Disclosure related to capital expenditures for 2019; timing of

Nanticoke turnaround activities; the development, application and

impact of artificial intelligence technology; and the anticipated

purchases under the share purchase program constitute

forward-looking statements.

Forward-looking statements are based on the company's current

expectations, estimates, projections and assumptions at the time

the statements are made. Actual future financial and operating

results, including expectations and assumptions concerning demand

growth and energy source, supply and mix; commodity prices and

foreign exchange rates; production rates, growth and mix; project

plans, dates, costs, capacities and execution; production life and

resource recoveries; cost savings; applicable laws and government

policies; and capital and environmental expenditures could differ

materially depending on a number of factors. These factors include

changes in the supply of and demand for crude oil, natural gas, and

petroleum and petrochemical products and resulting price and margin

impacts; transportation for accessing markets; political or

regulatory events, including changes in law or government policy,

applicable royalty rates and tax laws; third party opposition to

operations and projects; environmental risks inherent in oil and

gas exploration and production activities; environmental

regulation, including climate change and greenhouse gas regulation

and changes to such regulation; currency exchange rates;

availability and allocation of capital; availability and

performance of third party service providers; unanticipated

operational disruptions; management effectiveness; project

management and schedules; response to technological developments;

operational hazards and risks; cybersecurity incidents; disaster

response preparedness; the ability to develop or acquire additional

reserves; and other factors discussed in Item 1A risk factors and

Item 7 management’s discussion and analysis of financial condition

and results of operations of Imperial Oil Limited’s most recent

annual report on Form 10-K.

Forward-looking statements are not guarantees of future

performance and involve a number of risks and uncertainties, some

that are similar to other oil and gas companies and some that are

unique to Imperial. Imperial’s actual results may differ materially

from those expressed or implied by its forward-looking statements

and readers are cautioned not to place undue reliance on them.

Imperial undertakes no obligation to update any forward-looking

statements contained herein, except as required by applicable

law.

In this release all dollar amounts are expressed in Canadian

dollars unless otherwise stated. This release should be read in

conjunction with Imperial’s most recent Form 10-K. Note that

numbers may not add due to rounding.

The term “project” as used in this release can refer to a

variety of different activities and does not necessarily have the

same meaning as in any government payment transparency reports.

Attachment I

Third Quarter

Nine Months

millions of Canadian dollars, unless

noted

2019

2018

2019

2018

Net Income (loss) (U.S. GAAP)

Total revenues and other income

8,736

9,732

25,979

27,209

Total expenses

8,182

8,706

24,298

25,222

Income (loss) before income taxes

554

1,026

1,681

1,987

Income taxes

130

277

(248

)

526

Net income (loss)

424

749

1,929

1,461

Net income (loss) per common share

(dollars)

0.56

0.94

2.51

1.79

Net income (loss) per common share -

assuming dilution (dollars)

0.56

0.94

2.51

1.79

Other Financial Data

Gain (loss) on asset sales, after tax

25

6

31

21

Total assets at September 30

41,907

41,819

Total debt at September 30

5,161

5,188

Shareholders' equity at September 30

24,965

23,979

Capital employed at September 30

30,150

29,186

Dividends declared on common stock

Total

166

151

482

438

Per common share (dollars)

0.22

0.19

0.63

0.54

Millions of common shares outstanding

At September 30

752.9

792.7

Average - assuming dilution

760.3

800.5

770.0

816.9

Attachment II

Third Quarter

Nine Months

millions of Canadian dollars

2019

2018

2019

2018

Total cash and cash equivalents at

period end

1,531

1,148

1,531

1,148

Net income (loss)

424

749

1,929

1,461

Adjustments for non-cash items:

Depreciation and depletion

419

364

1,201

1,099

Impairment of intangible assets

-

46

-

46

(Gain) loss on asset sales

(28

)

(10

)

(34

)

(29

)

Deferred income taxes and other

116

276

(359

)

485

Changes in operating assets and

liabilities

445

(218

)

668

(11

)

Cash flows from (used in) operating

activities

1,376

1,207

3,405

3,051

Cash flows from (used in) investing

activities

(413

)

(352

)

(1,305

)

(1,096

)

Proceeds associated with asset sales

30

13

66

34

Cash flows from (used in) financing

activities

(519

)

(580

)

(1,557

)

(2,002

)

Attachment III

Third Quarter

Nine Months

millions of Canadian dollars

2019

2018

2019

2018

Net income (loss) (U.S. GAAP)

Upstream

209

222

1,252

172

Downstream

221

502

736

1,224

Chemical

38

69

110

220

Corporate and other

(44

)

(44

)

(169

)

(155

)

Net income (loss)

424

749

1,929

1,461

Revenues and other income

Upstream

3,105

3,262

10,000

8,880

Downstream

6,612

7,330

19,425

20,542

Chemical

298

408

935

1,187

Eliminations / Corporate and other

(1,279

)

(1,268

)

(4,381

)

(3,400

)

Revenues and other income

8,736

9,732

25,979

27,209

Purchases of crude oil and

products

Upstream

1,376

1,566

4,764

4,513

Downstream

5,142

5,567

15,062

15,664

Chemical

167

239

531

657

Eliminations

(1,286

)

(1,273

)

(4,401

)

(3,418

)

Purchases of crude oil and products

5,399

6,099

15,956

17,416

Production and manufacturing

expenses

Upstream

1,087

1,073

3,414

3,191

Downstream

460

356

1,315

1,212

Chemical

54

51

182

154

Eliminations

-

-

-

-

Production and manufacturing expenses

1,601

1,480

4,911

4,557

Capital and exploration

expenditures

Upstream

302

257

975

646

Downstream

124

105

364

250

Chemical

4

8

27

19

Corporate and other

12

6

34

19

Capital and exploration expenditures

442

376

1,400

934

Exploration expenses charged to income

included above

4

4

42

13

Attachment IV

Operating statistics

Third Quarter

Nine Months

2019

2018

2019

2018

Gross crude oil and natural gas liquids

(NGL) production

(thousands of barrels per day)

Cold Lake

142

150

141

145

Kearl

159

173

145

144

Syncrude

69

45

76

53

Conventional

13

3

12

3

Total crude oil production

383

371

374

345

NGLs available for sale

2

1

1

1

Total crude oil and NGL production

385

372

375

346

Gross natural gas production

(millions of cubic feet per day)

132

127

138

124

Gross oil-equivalent production

(a)

407

393

398

367

(thousands of oil-equivalent barrels per

day)

Net crude oil and NGL production

(thousands of barrels per day)

Cold Lake

110

119

113

117

Kearl

154

163

139

137

Syncrude

60

45

66

51

Conventional

13

3

13

2

Total crude oil production

337

330

331

307

NGLs available for sale

1

2

2

2

Total crude oil and NGL production

338

332

333

309

Net natural gas production

(millions of cubic feet per day)

131

127

137

122

Net oil-equivalent production

(a)

360

353

356

329

(thousands of oil-equivalent barrels per

day)

Cold Lake blend sales (thousands of

barrels per day)

181

194

186

198

Kearl blend sales (thousands of

barrels per day)

226

234

200

200

NGL sales (thousands of barrels per

day)

5

5

6

5

Average realizations (Canadian

dollars)

Bitumen (per barrel)

51.12

50.42

52.44

45.04

Synthetic oil (per barrel)

77.27

89.70

74.59

83.66

Conventional crude oil (per barrel)

53.90

74.02

54.79

70.69

NGL (per barrel)

14.96

36.92

23.72

38.93

Natural gas (per thousand cubic feet)

1.36

2.19

2.06

2.37

Refinery throughput (thousands of

barrels per day)

363

388

363

386

Refinery capacity utilization

(percent)

86

92

86

91

Petroleum product sales (thousands

of barrels per day)

Gasolines

259

264

250

254

Heating, diesel and jet fuels

164

179

169

182

Heavy fuel oils

25

29

24

25

Lube oils and other products

40

44

38

42

Net petroleum products sales

488

516

481

503

Petrochemical sales (thousands of

tonnes)

194

208

579

626

(a) Gas converted to oil-equivalent at six

million cubic feet per one thousand barrels.

Attachment V

Net income (loss) per

Net income (loss) (U.S. GAAP)

common share - diluted (a)

millions of Canadian dollars

Canadian dollars

2015

First Quarter

421

0.50

Second Quarter

120

0.14

Third Quarter

479

0.56

Fourth Quarter

102

0.12

Year

1,122

1.32

2016

First Quarter

(101

)

(0.12

)

Second Quarter

(181

)

(0.21

)

Third Quarter

1,003

1.18

Fourth Quarter

1,444

1.70

Year

2,165

2.55

2017

First Quarter

333

0.39

Second Quarter

(77

)

(0.09

)

Third Quarter

371

0.44

Fourth Quarter

(137

)

(0.16

)

Year

490

0.58

2018

First Quarter

516

0.62

Second Quarter

196

0.24

Third Quarter

749

0.94

Fourth Quarter

853

1.08

Year

2,314

2.86

2019

First Quarter

293

0.38

Second Quarter

1,212

1.57

Third Quarter

424

0.56

Year

1,929

2.51

(a) Computed using the average number of

shares outstanding during each period. The sum of the quarters

presented may not add to the year total.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191101005166/en/

Investor relations (587) 476-4743

Media relations (587) 476-7010

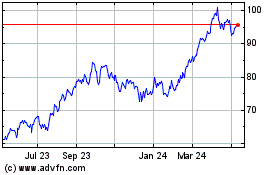

Imperial Oil (TSX:IMO)

Historical Stock Chart

From Jan 2025 to Feb 2025

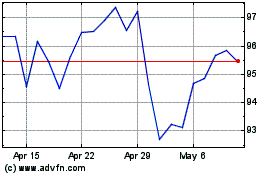

Imperial Oil (TSX:IMO)

Historical Stock Chart

From Feb 2024 to Feb 2025