GVIC Communications Corp. (“GVIC” or the "Company"), the associated

company of Glacier Media Inc. ("Glacier") announced today that it

has sold a 45% interest in its ERIS and STP businesses (the

“Businesses”) to Madison Venture Corporation (“Madison”), through

the acquisition by Madison of units ("Units") in ERI Environmental

Risk Limited Partnership, the limited partnership established to

hold the Businesses (the “Limited Partnership”).

GVIC received $11 million in cash and retained

100% of the cash flow of the Businesses attributed to Madison’s 45%

interest for two years in exchange for the 45% interest. The

transaction pricing reflects a value of $28 million (the

“Enterprise Value”) for the Businesses. Pursuant to the

Limited Partnership agreement (the "Agreement"), Madison has the

right, for a period of 3 years following closing, to acquire from

GVIC an additional 4% of the outstanding Units at the pro rata

Enterprise Value per Unit and an additional 2% of the outstanding

Units at the greater of the pro rata fair market value per Unit and

the pro rata Enterprise Value. The Agreement contains a

buy/sell provision that is exercisable after 3 years and a mutual

right of first refusal.

The transaction was completed to alleviate the

financial distress caused by the impact of the COVID pandemic on

the Company’s revenues and cash flow, and to allow the Company to

maintain access to its banking facility and have sufficient

liquidity.

Glacier’s consolidated revenues (including its

proportionate share in the Company's joint ventures) declined

approximately 36% in April and May. In order to maintain

operating cash flow and liquidity, the Company has been

implementing a comprehensive program including a) significant

operating cost reductions including wage rollbacks, reduced work

weeks, temporary layoffs and a variety of other cost reduction

measures, b) government assistance including the wage subsidy and

work share programs, c) capital raising through the ERIS and STP

transaction and d) amendment of its bank facility. The

Company acted quickly to implement the cost reductions and is

monitoring costs on an ongoing basis to remain in line with

revenues.

Due to the financial impact of the pandemic, the

Company requested and received temporary covenant relief and worked

with its banking syndicate to implement the financial restructuring

and capital raising plan in order to reach agreement on the bank

facility amendment terms in a timely basis. As a result of

the transaction, the banking facility has been amended,

concurrently, to provide additional ongoing borrowing

capacity.

Under applicable securities legislation and as a

result of Madison's 42% shareholding in Glacier, which owns 38% of

GVIC’s voting shares and 98% of GVIC’s non-voting shares, Madison

is considered “a related party” of GVIC for the purpose of this

transaction. A Special Committee of the board of directors of

GVIC, comprised of the director independent from Madison and

Glacier, was formed to review the transaction and determine whether

the terms of the transaction are reasonable in the

circumstances. The Special Committee retained Blake, Cassels

and Graydon LLP as independent legal counsel and engaged Marckenz

Group Capital Partners ("Marckenz") as financial advisor to

evaluate and advise on the financial position of GVIC and to

provide fairness advice with respect to the transaction. The

Special Committee received a fairness opinion from Marckenz

advising that the consideration to be received by GVIC pursuant to

the transaction is fair from a financial point of view to both GVIC

and GVIC's shareholders.

As a part of oversight of the transaction, a

special committee of independent directors of Glacier was formed

and Glacier's special committee and its board confirmed the

financial difficulty faced by GVIC and were supportive of the

transaction.

The Company and its Special Committee considered

a variety of financial restructuring options but deemed the sale of

the partial interest of ERIS and STP to be the most favourable in

the market conditions caused by the pandemic. GVIC’s Special

Committee concluded that there were no viable alternatives

available on commercially reasonable terms in the time required

that would be more likely to improve the financial situation of the

Company as compared to the transaction. The Special Committee

determined that the transaction was reasonable for the Company in

the circumstances and recommended that GVIC proceed with the

transaction.

Selling the 45% interest in the Businesses and

retaining the related cash flow for two years allows GVIC to retain

value in the Businesses and maintain a higher level of cash flow

and greater overall operating scale. The transaction

structure also allows GVIC to potentially buy back the interest

sold in the Businesses after three years. Given Madison's

relationship with GVIC and Glacier and its familiarity with the

Businesses, Madison was able to move quickly and was motivated to

support GVIC.

The transaction is a “related party transaction”

for GVIC under Multilateral Instrument 61-101 – Protection of

Minority Security Holders in Special Transactions (“MI

61-101”). As such, the transaction would ordinarily be

subject to valuation and minority approval requirements under MI

61-101. However, GVIC relied on the “financial hardship”

exemptions in sections 5.5(g) and 5.7(e) of MI 61-101 from the

valuation and minority approval requirements, respectively.

The Special Committee and the Board of Directors of GVIC,

acting in good faith, determined that GVIC was in serious financial

difficulty, that the transaction was designed to improve the

financial condition of the Company, and that the terms of the

transaction were reasonable in the circumstances.

The $11,000,000 proceeds from the transaction

will alleviate the Company's current financial distress and help

maintain debt at acceptable levels.

While the pandemic has impacted the Company’s

revenues and operations, and it is unclear how long the pandemic

will last and the extent of its financial impact, the Company is

starting to see increased activity in its core businesses.

Revenues recovered to some degree in May and June from April

levels. While print advertising revenues have declined the

most, the Company’s data, information and digital media businesses

have held up better, and the Company believes that the underlying

fundamentals and value of these products have not changed and

performance is expected to improve further as the pandemic abates

and market conditions improve. As a result of the

transaction, the Company is now in a stronger financial position

with which to operate during the pandemic and continue to develop

its core businesses.

Shares in Glacier are traded on the Toronto

Stock Exchange under the symbol GVC.

For further information please contact Mr. Orest

Smysnuik, Chief Financial Officer, at 604-708-3264.

About Glacier: Glacier is an information

& marketing solutions company pursuing growth in sectors where

the provision of essential information and related services

provides high customer utility and value. Glacier’s products and

services are focused in two areas: 1) data, analytics and

intelligence; and 2) content & marketing solutions.

Cautionary Note Concerning Forward Looking

Statements

This news release contains forward-looking

statements that relate to, among other things, Glacier’s

objectives, goals, strategies, intentions, plans, beliefs,

expectations and estimates. These forward-looking statements

include, among other things, statements relating to our

expectations regarding revenues, expenses, cash flows, future

profitability, recovery of businesses, the fundamentals of the

businesses, availability of credit, the effect of the sale of an

interest in the Businesses, our strategic initiatives and

restructuring, including our expectations to grow certain

operations, invest in key strategic areas, and to realize cost

efficiencies and actions taken to alleviate the impact on the

pandemic. These forward-looking statements are based on certain

assumptions, including continued economic growth and recovery and

the realization of cost savings in a timely manner and in the

expected amounts, which are subject to risks, uncertainties and

other factors which may cause results, performance or achievements

of Glacier to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking statements, and undue reliance should not be placed

on such statements.

Important factors that could cause actual

results to differ materially from these expectations include

failure to implement or achieve the intended results from our

strategic initiatives, the failure to reduce debt and the other

risk factors listed in our Annual Information Form under the

heading “Risk Factors” and in our MD&A under the heading

“Business Environment and Risks”, many of which are out of our

control. These other risk factors include, but are not limited to,

the impact of Coronavirus, that future cash flow from operations,

including the Businesses, and the availability under existing

banking arrangements are believed to be adequate to support

financial liabilities and that GVIC expects to be successful in its

objection with CRA, the ability of GVIC to sell advertising and

subscriptions related to its publications, foreign exchange rate

fluctuations, the seasonal and cyclical nature of the agricultural

and energy sectors, discontinuation of government grants, general

market conditions in both Canada and the United States, changes in

the prices of purchased supplies including newsprint, the effects

of competition in GVIC’s markets, dependence on key personnel,

integration of newly acquired businesses, technological changes,

tax risk, financing risk, debt service risk and cybersecurity

risk.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, Glacier

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

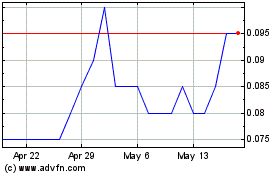

Glacier Media (TSX:GVC)

Historical Stock Chart

From Nov 2024 to Dec 2024

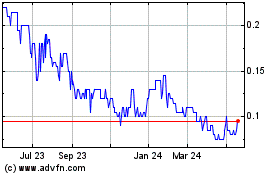

Glacier Media (TSX:GVC)

Historical Stock Chart

From Dec 2023 to Dec 2024