Glacier Media Inc. ("Glacier" or the "Company") (TSX:GVC) reported cash flow,

earnings and revenue for the quarter ended March 31, 2014.

Summary Results

Results are reported below on an adjusted basis to include the Company's share

of the results of its joint ventures. Management bases its operating decisions

and performance evaluation utilizing these results.

----------------------------------------------------------------------------

For the three months ended

(thousands of dollars) March 31,

except share and per share amounts 2014 (1)(5) 2013 (1)(5)

----------------------------------------------------------------------------

Revenue $76,895 $76,840

EBITDA (1) $8,927 $7,889

EBITDA margin (1) 11.6% 10.3%

EBITDA per share (1) $0.10 $0.09

Net income attributable to common shareholders

before non-recurring items (1)(2)(3) $1,941 $540

Net income attributable to common shareholders

per share before non-recurring items

(1)(2)(3) $0.02 $0.01

Cash flow from operations (1)(2)(3) $9,184 $8,261

Cash flow from operations per share (1)(2)(3) $0.10 $0.09

Debt net of cash outstanding before deferred

financing charges $101,739 $120,907

Dividends paid (4) $1,838 -

Dividends paid per share (4) $0.02 -

Weighted average shares outstanding, net 89,083,105 89,243,102

----------------------------------------------------------------------------

Notes:

(1) Refer to "Non-IFRS Measures" section of the financial statements.

(2) 2014 excludes $0.8 million of restructuring expense, $0.1 million of

transaction and transition costs and $0.5 million of other income.

(3) For non-recurring items excluded in the prior period, refer to

previously reported financial statements.

(4) Dividends in 2014 and 2013 total $0.08 per share, paid quarterly.

Dividends in 2013 were declared in March and paid in April.

(5) These results are presented on an adjusted basis to include the

Company's share of the results of its joint ventures, as management bases

its operating decisions and performance evaluation on the adjusted results.

Key Financial Highlights (1)

-- For the quarter ended March 31, 2014, Glacier's adjusted consolidated

revenues increased $0.1 million to $76.9 million from $76.8 million for

the same quarter in the prior year;

-- For the period ended March 31, 2014, adjusted consolidated earnings

before interest taxes, depreciation and amortization (EBITDA) increased

13.2% to $8.9 million from $7.9 million for the same period in the prior

year;

-- Adjusted cash flow from operations (before changes in non-cash operating

accounts and non-recurring items) increased 11.2% over the same period

in the prior year to $9.2 million;

-- Adjusted net income attributable to common shareholders before non-

recurring items was $1.9 million for the quarter, compared to $0.5

million for the same quarter in the prior year;

-- Adjusted EBITDA per share increased 11.1% to $0.10 per share from $0.09

per share for the quarter compared to the same quarter in the prior year

and net income attributable to common shareholders before non-recurring

items per share increased to $0.02 per share from $0.01 per share for

the same quarter in the prior year;

-- Adjusted cash flow from operations (before changes in non-cash operating

accounts and non-recurring items) increased to $0.10 per share from

$0.09 per for the same quarter in the prior year; and

-- Continued progress was made in reducing leverage, with consolidated debt

net of cash outstanding before deferred financing charges and other

expenses being lowered to 2.3x trailing 12 months EBITDA as at March 31,

2014.

Note:

(1) These results include non-IFRS measures such as EBITDA, cash flow from

operations and net income attributable to common shareholders before

non-recurring items, and are presented on a basis that includes the Company's

share of revenue, expenses, assets and liabilities from its joint venture

operations, which reflects the basis on which management makes its operating

decisions and performance evaluation. Prior to January 1, 2013 the Company

consolidated the financial results of its joint ventures on a proportionate

basis in accordance with then applicable accounting standards. Since January 1,

2013, the Company has been required to report the financial results of its joint

ventures using equity accounting under the new IFRS accounting standards.

The adjusted results are not generally accepted measures of financial

performance under IFRS. The Company's method of calculating these financial

performance measures may differ from other companies and accordingly, they may

not be comparable to measures used by other companies. Please refer to the MD&A

for a reconciliation of these non-IFRS measures and adjusted results.

Review of Operations and Value Enhancement Initiatives

Glacier Media Inc. ("Glacier" or the "Company") completed the first quarter of

2014 with continued improvement. Consolidated EBITDA was up 13.2% for the

quarter compared to the same quarter in the prior year on an adjusted basis(1).

Consistent with Glacier's fourth quarter 2013 performance, revenues returned to

prior year levels as a number of the Company's operations experienced improved

market opportunities and revenue growth. The profit performance was also the

result of a variety of initiatives that are being undertaken to affect the

transformation of the Company and enhance value for shareholders. These

initiatives are discussed below.

For the quarter ended March 31, 2014, adjusted consolidated revenue increased

0.1% to $76.9 million and adjusted consolidated EBITDA increased to $8.9

million, from $7.9 million the prior year. Revenue remained consistent despite

the closure of the Kamloops Daily News and other small publications. Revenues

were also affected by weaker community media revenues, which were impacted by

overall economic conditions first experienced in 2013 that continue in 2014, as

well as digital competition. The community media revenue shortfalls were offset

by stronger business information revenues and increased printing revenues in one

of Glacier's joint venture operations.

Improved operating performance resulted as well from a series of value

enhancement initiatives first launched in 2013 and continued in 2014. They

include:

-- Evolve, Enrich and Extend initiatives. The Company is pursuing a

comprehensive initiative to grow its business information operations

through an Evolve, Enrich and Extend strategy. This strategy focuses on

the provision of richer content, data and information, related analytics

and business and market intelligence, and the achievement of greater

customer utility and decision dependence. Management is currently

reviewing the spectrum of verticals in which it operates with a view of

focusing resources and efforts on those verticals and opportunities

deemed to have the greatest growth potential that can be realized

through this Evolve, Enrich and Extend strategy. Management and staff

are using the strategy to develop the Company's community media

operations as well.

-- Cost reduction initiatives. A variety of significant cost reduction

measures have and are being implemented to reduce overall operating

costs. The initiatives have been targeted to reduce costs by more than

$10.0 million on an annualized basis. Savings from these initiatives

began to be realized in both the third and fourth quarters of 2013 - and

continue in the first quarter of 2014. In implementing these

initiatives, management has been diligent to maintain the operating

integrity of the businesses, and maintain development spending in areas

where growth opportunities exist.

-- Sale of real estate assets. The Company has been selling real estate

properties to strengthen its financial position. In 2013, more than

$12.0 million was raised through the sale of property. In early 2014,

the Company entered into an agreement to sell its vacant real estate

property in Kamloops for $4.8 million. The sale is expected to close in

the summer of 2014. Other property dispositions are currently being

pursued. Given current capitalization and interest rates, monetizing

real estate value to reduce leverage has been deemed prudent.

Real estate and other asset sales have been targeted to a) cover any

required deposit relating to the previously reported notice of possible

re-assessment from Canada Revenue Agency (CRA) for the 2008-2011 income

tax years, should a deposit become payable and b) result in a net

reduction of leverage from current levels. Any potential CRA re-

assessment timing is not currently determinable.

-- Sale of non-core assets. The Company continues to assess assets that may

be considered non-core.

Business Information

Many of the Company's business information operations (which include business

and professional and trade information) continue to grow and provide attractive

opportunities for future growth in both existing and new verticals through

multi-platform offerings. In particular, energy, agriculture, environmental

risk, environmental compliance, manufacturing and financial services performed

well.

Business information operations now represent more than half of Glacier's

EBITDA, of which 45% comes from rich information digital data products. These

products provide essential information that generate highly profitable recurring

revenues, and are particularly well positioned for scalable growth. The product

lines offer resiliency in challenging economic times as they provide critical

insight and analysis to Glacier's customers. Much of 2014's strategic

initiatives will focus on enhancing and expanding existing product lines, with a

view to increasing the level of customer decision dependence, as a key aspect of

the Evolve, Enrich and Extend strategy.

The Company is continuing to develop its business information content and

marketing offerings with multi-platform solutions - with a key focus on mobile

offerings - digitally designed to integrate more seamlessly with customer

decision-making processes. Digital revenues now represent more than one quarter

of Glacier's business information revenues. Efforts continue to be refined with

respect to developing different types of digital revenues, including content,

advertising and subscriptions. A consistent focus on various ways of enriching

content is resulting in improved rates for advertising positioned alongside rich

information.

In 2014, Glacier's business information divisions continued their focus on

integrated solutions selling. Among the activities:

-- A new National Network team was created, drawing together top sales and

sales management personnel, with a view to offering national clients

solutions that span the depth and breadth of all divisions;

-- In February 2014, the business information division launched a new

conference - the Next-Gen Forum - which focuses on the importance of

corporate social responsibility in the extractive industries sectors.

This forum represents a new practice area for Glacier and will include

new publications and related events and conferences;

-- The British Columbia, Alberta and Ontario Export Awards were added to

the Company's growing stable of events and conferences. The events

solidify important relationships with the Canadian Manufacturers and

Exporters association, as well as respective provincial governments and

the federal government, along with key marketing clients;

-- Several divisions launched formal partnerships with key industry

associations that represent lead business segments. These partnerships

create new revenue opportunities via events, branded content and new

supplements.

Community Media

Glacier's community media operations offer broad coverage across Western Canada

in local markets, and continue to offer a strong value proposition through local

information and marketing channel utility.

Generally weak economic conditions, as well as structural changes in the

community newspaper industry, continued to affect revenue levels. National

revenues have been generally lower as a result of these factors, although

national revenues recovered in April to higher levels than the previous year.

Many of the Company's smaller rural community media markets - largely spread

across the Prairies - have enjoyed more steady local performance due to their

strong local positions and local advertising revenues, although they are still

affected by cyclical downturns in key economies such as energy and agriculture,

and the factors driving national revenues.

While print advertising revenues continue to be weak in some markets, digital

revenues continue to grow steadily in Glacier's community media operations with

new product offerings including extended market coverage and specialty digital

products. Operating expense investments are being made to improve the digital

community media products in order to exploit new revenue opportunities,

particularly of the larger markets, focusing on content delivery and advertising

effectiveness. The investments are being made prudently with a view to

generating profitable revenue. As a result, Glacier's community media digital

operations are contributing attractive net profit margins to the Company.

Significant efforts are also being made to develop new community media features

and products. The scale of these efforts continues to build, with the segment

generating strong print revenue growth over prior year, augmented with digital

revenues and events.

While economic and market challenges have affected the community media

operations, management believes that these businesses have unrealized

opportunities available and will continue to generate solid cash flow given the

nature of the markets in which Glacier operates - particularly within the more

robust micro-economies of Western Canada. This cash flow can be used to fund

growth and reduce leverage through both internal investment and acquisition of

digital business information and community media assets, as well as debt

repayments.

Financial Position

On an adjusted basis, to include the Company's share of its joint ventures,

Glacier's consolidated debt net of cash outstanding before deferred financing

charges and other expenses was reduced to 2.3x trailing 12 months EBITDA as at

March 31, 2014.

The Company (excluding its joint ventures) reduced debt by $1.7 million during

the period. Glacier's consolidated debt net of cash outstanding before deferred

financing charges was $94.0 million as at March 31, 2014.

Capital expenditures (excluding the Company's joint ventures) were $0.8 million

for the quarter ended March 31, 2014 compared to $1.1 million for the same

period in the prior year.

Declaration of Dividend

The Board of Directors declared a quarterly dividend of $0.02 per share to

shareholders of record on June 13, 2014 and payable on July 4, 2014. The

dividend is consistent with the Company's dividend policy of paying $0.08 per

share per annum, payable quarterly.

Outlook

The Company continues to grow its business operations through its Evolve, Enrich

and Extend strategy and is making good progress in this transformation. While

media maturation factors are having an impact as described, the softer economy

has continued to play a significant role in dampening revenues, and economic

strengthening should result in improved revenues at the margin.

As indicated, management has undertaken a number of Value Enhancement

Initiatives to strengthen the Company's financial position and operating

performance in the near term, including a) a wide variety of revenue development

initiatives, b) sale of real estate assets to reduce leverage and cover a

potential tax re-assessment deposit, c) sale of non-core assets, d) significant

cost reduction measures targeted to reduce costs by more than $10.0 million, and

e) review of the spectrum of verticals in which the Company operates to focus

operating and financial resources on those verticals deemed to have the greatest

growth potential. Profitability enhancements and asset sale initiatives are

intended to significantly improve Glacier's financial position and place the

Company in a better position from which to take advantage of organic growth and

acquisition opportunities, particularly within the digital business information

space.

Management will focus in the short-term on a balance of paying down debt,

reducing costs and improving profitability, enhancing existing operations,

targeting select acquisition opportunities and returning value to shareholders

through growth in cash flow per share and payment of dividends.

Shares in Glacier are traded on the Toronto Stock Exchange under the symbol GVC.

About the Company: Glacier Media Inc. is an information communications company

focused on the provision of primary and essential information and related

services through print, electronic and online media. Glacier is pursuing this

strategy through its core businesses: the community media, trade information and

business and professional information markets.

Financial Measures

To supplement the consolidated financial statements presented in accordance with

International Financial Reporting Standards (IFRS), Glacier uses certain

non-IFRS measures that may be different from the performance measures used by

other companies. These non-IFRS measures include cash flow from operations

(before changes in non-cash operating accounts and non-recurring items), net

income attributable to common shareholders before non-recurring items, earnings

before interest, taxes, depreciation and amortization (EBITDA) and all

'adjusted' measures, which are not alternatives to IFRS financial measures.

Management focuses on operating cash flow per share as the primary measure of

operating profitability, free cash flow and value. EBITDA per share is also an

important measure as the Company has low ongoing capital expenditures and

depreciation and amortization largely relates to acquisition goodwill and

copyrights and does not represent a corresponding sustaining capital expense.

These non-IFRS measures do not have any standardized meanings prescribed by IFRS

and accordingly they are unlikely to be comparable to similar measures presented

by other issuers.

Forward-Looking Statements

This news release contains forward-looking statements that relate to, among

other things, the Company's objectives, goals, strategies, intentions, plans,

beliefs, expectations and estimates. These forward-looking statements include,

among other things, statements relating to the Company's expectations regarding

revenues, expenses, cash flows and future profitability and the effect of

Glacier's strategic initiatives, including its expectations to grow its business

information operations, to implement cost reduction measures, to sell real

estate properties and utilize proceeds of such sales to cover required CRA

re-assessment deposits, to produce products and services that provide growth

opportunities, to organic development and new business acquisitions, to improve

profitability, to grow cash flow per share, to pay dividends, to repurchase

shares and to reduce debt levels and as to its expectations as to the level of

investment in capital expenditures. These forward looking statements are based

on certain assumptions, including continued economic growth and recovery and the

realization of cost savings in a timely manner and in the expected amounts, and

are subject to risks, uncertainties and other factors which may cause results,

performance or achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by such

forward-looking statements, and undue reliance should not be placed on such

statements.

Important factors that could cause actual results to differ materially from

these expectations include failure to implement or achieve the intended results

from Glacier's strategic initiatives, the failure to implement or realize cost

savings in a timely manner or in the expected amounts, the failure to negotiate

or complete the sale of real estate assets, the failure to identify, negotiate

and complete the acquisition of new businesses, the failure to develop new

products, and the other risk factors listed in the Company's Annual Information

Form under the heading "Risk Factors" and in the Company's MD&A under the

heading "Business Environment and Risks", many of which are out of the Company's

control. These other risk factors include, but are not limited to, the ability

of the Company to sell advertising and subscriptions related to its

publications, foreign exchange rate fluctuations, the seasonal and cyclical

nature of the agricultural industry, discontinuation of the Department of

Canadian Heritage's Canada Periodical Fund's Aid to Publishers, general market

conditions in both Canada and the United States, changes in the prices of

purchased supplies including newsprint, the effects of competition in the

Company's markets, dependence on key personnel, integration of newly acquired

businesses, technological changes, tax risk and financing and debt service risk.

The forward-looking statements made in this news release relate only to events

or information as of the date on which the statements are made. Except as

required by law, the Company undertakes no obligation to update or revise

publicly any forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements are made or

to reflect the occurrence of unanticipated events.

FOR FURTHER INFORMATION PLEASE CONTACT:

Glacier Media Inc.

Mr. Orest Smysnuik

Chief Financial Officer

604-708-3264

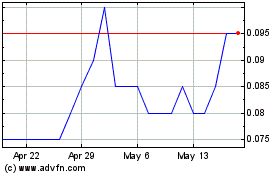

Glacier Media (TSX:GVC)

Historical Stock Chart

From May 2024 to Jun 2024

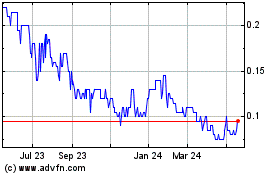

Glacier Media (TSX:GVC)

Historical Stock Chart

From Jun 2023 to Jun 2024