Fortis and Central Hudson File Settlement Agreement

January 28 2013 - 10:26AM

Marketwired Canada

(TSX:FTS) - Nearly $50 million to fund customer and community benefits, plus a

one-year electric and natural gas customer delivery rate freeze, and customer

protections, including the continuation of Central Hudson Gas & Electric

Corporation ("Central Hudson") as a stand-alone utility company, are

cornerstones of a settlement of all issues among the signatories (the

"Settlement Agreement") filed with the New York State Public Service Commission

(the "Commission") regarding the acquisition of Central Hudson, the utility

subsidiary of CH Energy Group, Inc. ("CH Energy Group") (NYSE:CHG), by Fortis

Inc. ("Fortis") (TSX:FTS). Other signatory parties to the Settlement Agreement

are the Staff of the New York State Department of Public Service, Multiple

Intervenors and the Utility Intervention Unit of the New York State Department

of State. The Settlement Agreement indicates that the acquisition is in the

public interest pursuant to New York State Public Service Law, Section 70 and,

therefore, the aforementioned parties recommend approval of the Settlement

Agreement by the Commission. Support was also received from several counties for

the portions of the Settlement Agreement of relevance to the respective

counties' interests. Closing of the acquisition is now expected to take place

during the second quarter of 2013, subject to receiving approval from the

Commission.

"This Settlement Agreement provides multiple and substantive benefits to our

customers and the communities we serve," said Steven V. Lant, Chairman of the

Board and President of CH Energy Group. "The proposed terms also retain

substantial autonomy for Central Hudson, allowing us to continue our mission of

serving our customers well, while providing opportunities to improve service

through a close association with the Fortis family of utility companies. We are

pleased and excited to have reached this step toward finalizing the transaction

with Fortis."

"Fortis worked closely with management of Central Hudson through this thorough

regulatory approval process and has gained increased knowledge about the

utility's operating philosophy and the regulatory oversight requirements in New

York State," said Stan Marshall, President and Chief Executive Officer, Fortis

Inc. "This Settlement Agreement will provide tangible benefits to Central

Hudson's customers and will strengthen the utility's ability to meet the energy

needs of its current and future customers."

The Settlement Agreement will moderate future customer rate increases by

providing $35 million to cover expenses that normally would be recovered in

customer rates, for example significant restoration expenses related to

Superstorm Sandy, the October 2011 snowstorm and Tropical Storm Irene, and other

similar expenses. Also, under the terms of the Settlement Agreement, Central

Hudson customers will save a guaranteed $9.25 million over five years resulting

from the elimination of costs the utility now incurs as a public company.

Additionally, the Settlement Agreement requires that customer delivery rates be

frozen until July 1, 2014 and requires the establishment of a $5 million

Customer Benefit Fund for economic development and low-income assistance

programs for communities and residents of the Mid-Hudson Valley.

Becoming part of the Fortis family of utilities, which currently serve more than

two million customers, will bring benefits to Central Hudson, explained Lant.

"Central Hudson will be in the position to benefit from shared experiences and

knowledge from other Fortis utility companies, as all of us seek to continuously

improve our operations," he said. "In addition, Fortis has greater access to

capital that will enhance Central Hudson's ability to make significant

investments in the electric and gas system to improve customer service and

system reliability, including those recommended in the Governor's Energy Highway

initiative."

Central Hudson will continue to maintain its name and Poughkeepsie headquarters,

as well as all of its employees and the utility's substantial civic and

community presence in the Mid-Hudson Valley. The Settlement Agreement also

provides financial protections for CH Energy Group, Central Hudson and its

customers as part of the larger Fortis organization, and Central Hudson will

continue to have annual independent financial audits. Within one year, the Board

of Directors of Central Hudson will transition to a majority of independent

directors, increase members from the Hudson Valley and New York State, and

include representatives from Fortis.

"Fortis remains focused on closing the acquisition and providing the benefits to

Central Hudson customers as quickly as possible," concluded Marshall.

The definitive merger agreement was announced between CH Energy Group and Fortis

in February 2012. CH Energy Group shareholders approved the transaction in June

2012, and several other required regulatory approvals by U.S. federal agencies

were subsequently received. For more information and to view the Settlement

Agreement, visit www.CentralHudson.com or www.FortisInc.com.

About CH Energy Group

CH Energy Group, Inc. is an energy delivery company headquartered in

Poughkeepsie, NY. Regulated transmission and distribution subsidiary Central

Hudson Gas & Electric Corporation serves approximately 300,000 electric and

about 75,000 natural gas customers in eight counties of New York State's

Mid-Hudson River Valley, delivering natural gas and electricity in a

2,600-square-mile service territory that extends north from the suburbs of

metropolitan New York City to the Capital District at Albany. CH Energy Group

also operates Central Hudson Enterprises Corporation (CHEC), a non-regulated

subsidiary composed primarily of Griffith Energy Services, which supplies

petroleum products and related services to approximately 56,000 customers in the

Mid Atlantic Region.

About Fortis

Fortis Inc. is the largest investor-owned distribution utility in Canada,

serving more than 2 million gas and electricity customers. Its regulated

holdings include electric utilities in five Canadian provinces and two Caribbean

countries and a natural gas utility in British Columbia. It owns non-regulated

hydroelectric generation assets across Canada and in Belize & Upstate New York.

It also owns hotels and commercial real estate in Canada.

Fortis includes forward-looking information in this material within the meaning

of applicable securities laws in Canada ("forward-looking information"). The

purpose of the forward-looking information is to provide management's

expectations regarding the acquisition of CH Energy Group by Fortis and the

expected timing and benefits thereof, the Corporation's future growth, results

of operations, performance, business prospects and opportunities, and it may not

be appropriate for other purposes. All forward-looking information is given

pursuant to the safe harbour provisions of applicable Canadian securities

legislation. The words "anticipates", "believes", "budgets", "could",

"estimates", "expects", "forecasts", "intends", "may", "might", "plans",

"projects", "schedule", "should", "will", "would" and similar expressions are

often intended to identify forward-looking information, although not all

forward-looking information contains these identifying words. The

forward-looking information reflects management's current beliefs and is based

on assumptions developed using information currently available to the

Corporation's management. Although Fortis believes that the forward-looking

statements are based on information and assumptions which are current,

reasonable and complete, these statements are necessarily subject to a variety

of risks and uncertainties, including the ability to obtain New York State

Public Service Commission regulatory approval and to satisfy conditions to

closing and the ability to realize the expected benefits of the acquisition of

CH Energy Group by Fortis. For additional information on risk factors that have

the potential to affect the Corporation, reference should be made to the

Corporation's continuous disclosure materials filed from time to time with

Canadian securities regulatory authorities and to the heading "Business Risk

Management" in the Corporation's annual and quarterly Management Discussion and

Analysis and the "Risk Factors" section of the Annual Information Form. Except

as required by law, the Corporation undertakes no obligation to revise or update

any forward-looking information as a result of new information, future events or

otherwise after the date hereof.

FOR FURTHER INFORMATION PLEASE CONTACT:

Mr. Barry Perry

Vice President Finance and Chief Financial Officer

Fortis Inc.

(709) 737-2822

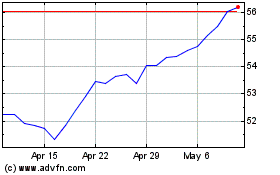

Fortis (TSX:FTS)

Historical Stock Chart

From Oct 2024 to Nov 2024

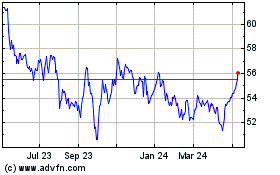

Fortis (TSX:FTS)

Historical Stock Chart

From Nov 2023 to Nov 2024