Fortis Inc. Announces $150 Million Bought Deal Offering of Series J First Preference Shares

November 01 2012 - 9:24AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES

Fortis Inc. ("Fortis" or the "Corporation") (TSX:FTS) has today entered into an

agreement with a syndicate of underwriters led by BMO Capital Markets and RBC

Capital Markets under which the underwriters have agreed to purchase, on a

bought deal basis, 6,000,000 Cumulative Redeemable First Preference Shares,

Series J (the "Preference Shares") for sale to the public at a price of $25.00

per Preference Share, representing aggregate gross proceeds of $150 million.

Fortis has granted the underwriters an underwriters' option to purchase an

additional 2,000,000 Preference Shares at the same offering price. Should the

underwriters' option be fully exercised, the total gross proceeds of the

Preference Share offering will be $200 million.

Holders of Preference Shares will be entitled to receive a cumulative quarterly

fixed dividend of 4.75% per annum, if, as and when declared by the Board of

Directors of the Corporation payable (other than the first dividend payment) in

equal quarterly installments on the first day of March, June, September and

December of each year. Assuming a closing date of November 13, 2012, the first

dividend will be payable on March 1, 2013 in the amount of $0.35137 per

Preference Share.

The Preference Shares are not redeemable prior to December 1, 2017. On or after

December 1, 2017, the Corporation may, on not less than 30 nor more than 60

days' notice, redeem the Preference Shares in whole or in part, at the

Corporation's option, by the payment in cash of $26.00 per Preference Share if

redeemed prior to December 1, 2018, at $25.75 per Preference Share if redeemed

on or after December 1, 2018 but prior to December 1, 2019, at $25.50 if

redeemed on or after December 1, 2019 but prior to December 1, 2020, at $25.25

if redeemed on or after December 1, 2020 but prior to December 1, 2021 and at

$25.00 per Preference Share if redeemed on or after December 1, 2021, in each

case together with all declared and unpaid dividends up to but excluding the

date fixed for redemption.

The Preference Share offering is expected to close on November 13, 2012. The

Offering is subject to the receipt of all necessary regulatory and stock

exchange approvals. The net proceeds from the issue will be used towards

repaying borrowings under the Corporation's $1 billion committed corporate

credit facility, which borrowings were primarily incurred to support the

construction of the non-regulated Waneta-Expansion hydroelectric generating

facility and for other general corporate purposes.

The securities offered have not been and will not be registered under the U.S.

Securities Act of 1933, as amended, and may not be offered or sold in the United

States absent registration or an applicable exemption from the registration

requirements. This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any offer, solicitation or

sale of the securities in any state in which such offer, solicitation or sale

would be unlawful.

About Fortis

Fortis is the largest investor-owned distribution utility in Canada, with total

assets of more than $14 billion and fiscal 2011 revenue totaling approximately

$3.7 billion. The Corporation serves more than 2,000,000 gas and electricity

customers. Its regulated holdings include electric distribution utilities in

five Canadian provinces and two Caribbean countries and a natural gas utility in

British Columbia, Canada. Fortis owns and operates non-regulated generation

assets across Canada and in Belize and Upstate New York. It also owns hotels

across Canada and commercial office and retail space primarily in Atlantic

Canada. The Corporation's common shares are listed on the Toronto Stock Exchange

and trade under the symbol FTS. Additional information can be accessed at

www.fortisinc.com or www.sedar.com.

Fortis includes forward-looking information in this material within the meaning

of applicable securities laws in Canada ("forward-looking information"). The

purpose of the forward-looking information is to provide management's

expectations regarding the Corporation's future growth, results of operations,

performance, business prospects and opportunities, and it may not be appropriate

for other purposes. All forward-looking information is given pursuant to the

safe harbour provisions of applicable Canadian securities legislation. The words

"anticipates", "believes", "budgets", "could", "estimates", "expects",

"forecasts", "intends", "may", "might", "plans", "projects", "schedule",

"should", "will", "would" and similar expressions are often intended to identify

forward-looking information, although not all forward-looking information

contains these identifying words. The forward-looking information, including the

expectation that the offering will close on November 13, 2012 and the

expectation that the net proceeds of the offering will be used to repay

borrowings as described, reflects management's current beliefs and is based on

assumptions developed using information currently available to the Corporation's

management. Although Fortis believes that the forward-looking statements are

based on information and assumptions which are current, reasonable and complete,

these statements are necessarily subject to a variety of risks and

uncertainties. For additional information on risk factors that have the

potential to affect the Corporation, reference should be made to the

Corporation's continuous disclosure materials filed from time to time with

Canadian securities regulatory authorities and to the heading "Business Risk

Management" in the Corporation's annual and quarterly Management Discussion and

Analysis and the "Risk Factors" section of the Annual Information Form. Except

as required by law, the Corporation undertakes no obligation to revise or update

any forward-looking information as a result of new information, future events or

otherwise after the date hereof.

FOR FURTHER INFORMATION PLEASE CONTACT:

Fortis Inc.

Mr. Barry V. Perry

Vice President, Finance and Chief Financial Officer

(709) 737.2800

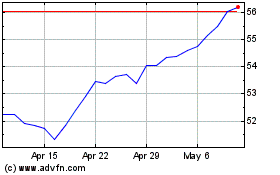

Fortis (TSX:FTS)

Historical Stock Chart

From Oct 2024 to Nov 2024

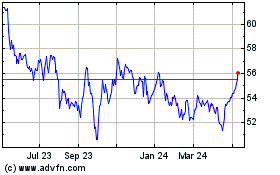

Fortis (TSX:FTS)

Historical Stock Chart

From Nov 2023 to Nov 2024