ERES REIT Completes €116 Million in Strategic Portfolio Sales

July 15 2024 - 10:05AM

European Residential Real Estate Investment Trust

(“

ERES” or “

the REIT”)

(TSX:ERE.UN) announced today that it has closed on two dispositions

of an aggregate 530 residential suites in the Netherlands for

approximately €114.9 million in combined gross proceeds. ERES also

announced that it has closed on the sale of one office building in

the Netherlands for approximately €1.1 million. All amounts

disclosed herein exclude transaction costs.

In June 2024, ERES completed the sale of 66

residential suites for approximately €14.2 million, with proceeds

used in part to repay approximately €7.0 million in associated

mortgage principal outstanding. On July 15, 2024, ERES closed on

another sale of 464 residential suites for approximately €100.7

million, with partial proceeds used to repay approximately €62.8

million in associated mortgage principal outstanding. Also in July

2024, ERES completed the disposition of one office property in the

Netherlands for approximately €1.1 million, with net proceeds used

in full to pay down its associated portfolio of mortgage principal

outstanding. As at March 31, 2024, the associated mortgages

together had a weighted average term to maturity of approximately

3.9 years, and a weighted average interest rate of approximately

3.2%. Net proceeds from the transactions are intended to be used

for the repayment of amounts outstanding on the revolving credit

facility.

“We’ve been exploring various

liquidity-generating opportunities in order to sturdy the REIT’s

financial position and reduce its exposure to interest rate risk,

and these three strategic dispositions accomplish just that,”

commented Mark Kenney, Chief Executive Officer. “These transactions

have freed up capital that we can reallocate into the repayment of

our higher interest credit facility debt, which will reduce our

leverage, enhance our cash flows, and strengthen our balance

sheet.”

“Furthermore, we were able to complete these

sales at prices at or above IFRS fair values, reinforcing the high

quality of our property portfolio,” said Jenny Chou, Chief

Financial Officer. “We’ve also been surfacing capital through our

suite-by-suite privatization program, as we’ve completed the sale

of an additional 53 individual suites during the second quarter of

2024, which generated €14.2 million in incremental gross proceeds.

We’re pleased to be executing on our commitment to maximize

unitholder value through all possible means, and we remain focused

on this mission going forward.”

ABOUT ERESERES is an

unincorporated, open-ended real estate investment trust. ERES’s

units are listed on the TSX under the symbol ERE.UN. ERES is

Canada’s only European-focused multi-residential REIT, with a

current portfolio of high-quality, multi-residential real estate

properties in the Netherlands. As at March 31, 2024, ERES owned 158

multi-residential properties, comprised of approximately 6,900

residential suites and ancillary retail space located in the

Netherlands, and owned one commercial property in Germany and one

commercial property in Belgium. For more information about ERES,

its business and its investment highlights, please visit our

website at www.eresreit.com and our public disclosure which can be

found under our profile on SEDAR+ at www.sedarplus.ca.

CAUTIONARY STATEMENTS REGARDING

FORWARD-LOOKING INFORMATIONCertain statements contained in

this press release constitute forward-looking information within

the meaning of applicable Canadian securities laws which reflect

ERES’s current expectations and projections about future results.

Forward-looking information generally can be identified by the use

of forward-looking terminology such as “outlook”, “objective”,

“may”, “will”, “expect”, “intent”, “estimate”, “anticipate”,

“believe”, “consider”, “should”, “plans”, “predict”, “estimate”,

“forward”, “potential”, “could”, “likely”, “approximately”,

“scheduled”, “forecast”, “variation” or “continue”, or similar

expressions suggesting future outcomes or events. The

forward-looking information in this press release relates only to

events or information as of the date on which the statements are

made in this press release. Actual results and developments are

likely to differ, and may differ materially, from those expressed

or implied by the forward-looking information contained in this

press release. Any number of factors could cause actual results to

differ materially from this forward-looking information. Although

ERES believes that the expectations reflected in forward-looking

information are reasonable, it can give no assurances that the

expectations of any forward-looking information will prove to be

correct. Such forward-looking information is based on a number of

assumptions that may prove to be incorrect, including regarding the

intended use of proceeds from the transactions, the impact of the

transactions on ERES’s financial performance and metrics, and the

impact of higher interest rates and general economic conditions on

ERES. Accordingly, readers should not place undue reliance on

forward-looking information.

Forward looking information in this press

release are subject to certain risks and uncertainties that could

result in actual results differing materially from this

forward-looking information. Risks and uncertainties pertaining to

ERES are more fully described in regulatory filings that can be

obtained on SEDAR+ at www.sedarplus.ca.

Except as specifically required by applicable

Canadian securities law, ERES does not undertake any obligation to

update or revise publicly any forward-looking information, whether

as a result of new information, future events or otherwise, after

the date on which the information is provided or to reflect the

occurrence of unanticipated events. This forward-looking

information should not be relied upon as representing ERES’s views

as of any date subsequent to the date of this press release.

For more information, please

contact:

| ERESDr. Gina

Parvaneh CodyChair of the Board(437) 219-1765 |

ERESMr. Mark

KenneyChief Executive Officer(416) 861-9404 |

ERESMs. Jenny

ChouChief Financial Officer(416) 354-0188 |

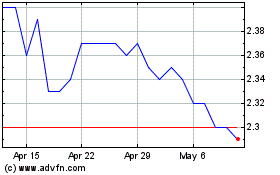

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

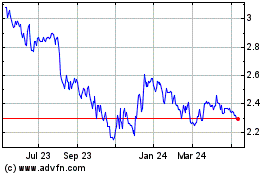

European Residetial Real... (TSX:ERE.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024