Mr. Ian Rozier, President and CEO of Eastern Platinum Limited ("Eastplats")

(TSX:ELR)(AIM:ELR)(JSE:EPS) reports financial results for the three months ended

September 30, 2012.

Summary of results for the three months ended September 30, 2012:

-- Eastplats recorded a loss attributable to equity shareholders of the

Company of $5,029,000 ($0.01 loss per share) in the quarter ended

September 30, 2012 ("Q3 2012") compared to earnings of $1,364,000 ($0.00

per share) in the quarter ended September 30, 2011 ("Q3 2011").

-- Adjusted EBITDA was negative $2,873,000 in Q3 2012 compared to

$2,912,000 in Q3 2011.

-- PGM ounces sold decreased 21% to 21,273 ounces in Q3 2012 compared to

26,955 PGM ounces in Q3 2011.

-- The U.S. dollar average delivered price per PGM ounce decreased 18% to

$896 in Q3 2012 compared to $1,088 in Q3 2011.

-- The Rand average delivered price per PGM ounce decreased 5% to R7,401 in

Q3 2012 compared to R7,768 in Q3 2011.

-- Total Rand operating cash costs decreased 8% to R188 million in Q3 2012

compared to R204 million in Q3 2011.

-- Rand operating cash costs net of by-product credits increased 34% to

R8,197 per ounce in Q3 2012 compared to R6,097 per ounce in Q3 2011.

Rand operating cash costs increased 17% to R8,830 per ounce in Q3 2012

compared to R7,561 per ounce in Q3 2011.

-- U.S. dollar operating cash costs net of by-product credits increased 16%

to $992 per ounce in Q3 2012 compared to $854 per ounce achieved in Q3

2011. U.S. dollar operating cash costs increased 1% to $1,069 per ounce

in Q3 2012 compared to $1,059 per ounce in Q3 2011.

-- Head grade in Q3 2012 was 4.08 grams per tonne, consistent with the head

grade in Q3 2011.

-- Average concentrator recovery decreased to 76% in Q3 2012 compared to

78% in Q3 2011.

-- Development meters decreased by 48% to 2,066 meters and on-reef

development decreased by 57% to 966 meters compared to Q3 2011.

-- Stoping units decreased 29% to 28,943 square meters in Q3 2012 compared

to 40,594 square meters in Q3 2011.

-- Run-of-mine ore hoisted decreased 22% to 206,176 tonnes in Q3 2012

compared to 265,889 tonnes in Q3 2011.

-- Run-of-mine ore processed decreased by 22% to 203,279 tonnes in Q3 2012

compared to 261,280 tonnes in Q3 2011.

-- The Company's Lost Time Injury Frequency Rate (LTIFR) was 0.63 in Q3

2012 compared to 1.66 in Q3 2011.

-- At September 30, 2012, the Company had a cash position (including cash,

cash equivalents and short term investments) of $135,594,000 (December

31, 2011 - $250,801,000).

The qualified person having reviewed the operating disclosures presented in this

press release is Mr. Brian Montpellier, P. Eng, V.P. Project Development.

Financial Information

For complete details of financial results, please refer to the unaudited

condensed consolidated interim financial statements and accompanying

Management's Discussion and Analysis ("MD&A") for the three months ended

September 30, 2012. These financial statements and MD&A, and the comparative

financial statements for the three months ended September 30, 2011 are all

available on SEDAR at www.sedar.com and on the Company's website

www.eastplats.com.

Teleconference call details

Eastplats will host a telephone conference call on Wednesday, November 14, 2012

at 10:00 am Pacific (1:00 pm Eastern) to discuss these results. The conference

call may be accessed by dialing 1-800-319-4610 in Canada and the United States,

or 1-604-638-5340 internationally.

The conference call will be archived for later playback until Wednesday,

November 21, 2012 and can be accessed by dialing 1-604-638-9010 or

1-800-319-6413 and using the pass code 4219 followed by the number sign (#).

Total shares issued and outstanding - 928,187,807

Cautionary Statement on Forward-Looking Information

This press release, which contains certain forward-looking statements, is

intended to provide readers with a reasonable basis for assessing the financial

performance of the Company. All statements, other than statements of historical

fact, are forward-looking statements. The words "believe", "expect",

"anticipate", "contemplate", "target", "plan", "intends", "continue", "budget",

"estimate", "may", "will", "schedule" and similar expressions identify forward

looking statements. These forward-looking statements pertain to assumptions

regarding the price of PGMs, fluctuations in currency markets (specifically the

Rand and the U.S. dollar), the future funding of the Company's projects, the

future development of the Company's projects, the Company's plans for its

properties, the anticipated timing for the awarding of tenders, and the

accounting policies issued but not yet effective for the Company.

Forward-looking statements are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by the Company, are inherently

subject to significant business, economic and competitive uncertainties and

contingencies. Known and unknown factors could cause actual results to differ

materially from those projected in the forward-looking statements. Such factors

include, but are not limited to, the risk of fluctuations in the assumed

exchange rates of currencies that directly impact the Company, such as Canadian

dollar, South African Rand and U.S. dollar, the risk of fluctuations in the

assumed prices of PGM and other commodities, the risk of changes in government

legislation, taxation, controls, regulations and political or economic

developments in Canada, the United States, South Africa, or Barbados or other

countries in which the Company carries or may carry on business in the future,

risks associated with mining or development activities, the speculative nature

of exploration and development, including the risk of obtaining necessary

licenses and permits, and assumed quantities or grades of reserves. Many of

these uncertainties and contingencies can affect the Company's actual results

and could cause actual results to differ materially from those expressed or

implied in any forward-looking statements made by, or on behalf of, the Company.

Readers are cautioned that forward-looking statements are not guarantees of

future performance. There can be no assurance that such statements will prove to

be accurate and actual results and future events could differ materially from

those acknowledged in such statements. Specific reference is made to the

Company's most recent Annual Information Form on file with Canadian provincial

securities regulatory authorities for a discussion of some of the factors

underlying forward-looking statements.

The Company disclaims any intention or obligation to update or revise any

forward-looking statements whether as a result of new information, future events

or otherwise, except to the extent required by applicable laws.

Eastern Platinum Limited

Condensed consolidated interim statements of loss

(Expressed in thousands of U.S. dollars - unaudited)

Three months ended Nine months ended

Note September 30, September 30,

2012 2011 2012 2011

----------------------------------------------------------------------------

Revenue $ 19,861 $ 31,453 $ 68,534 $ 94,031

----------------------------------------------------------------------------

Cost of operations

Production costs 22,734 28,541 78,420 88,987

Depletion and

depreciation 6 3,192 5,502 11,325 15,880

Impairment 6 - - 88,278 -

(Gain) loss on

disposal of

property, plant

and equipment (167) - 1,402 -

----------------------------------------------------------------------------

25,759 34,043 179,425 104,867

----------------------------------------------------------------------------

Mine operating loss (5,898) (2,590) (110,891) (10,836)

----------------------------------------------------------------------------

Expenses

General and

administrative 6(d) 1,987 2,546 6,682 8,573

Share-based

payments 7(e)(f) (31) 22 2,309 8,291

----------------------------------------------------------------------------

1,956 2,568 8,991 16,864

----------------------------------------------------------------------------

Operating loss (7,854) (5,158) (119,882) (27,700)

Other income

(expense)

Interest income 791 1,376 2,720 4,298

Finance costs 8 (281) (322) (5,380) (1,197)

Foreign exchange

(loss) gain (138) 3,108 64 4,785

----------------------------------------------------------------------------

Loss before income

taxes (7,482) (996) (122,478) (19,814)

Income tax (expense)

recovery (98) 447 12,377 1,040

----------------------------------------------------------------------------

Net loss for the

period $ (7,580) $ (549) $ (110,101) $ (18,774)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Attributable to

Non-controlling

interest 9 $ (2,551) $ (1,913) $ (10,490) $ (6,554)

Equity shareholders

of the Company (5,029) 1,364 (99,611) (12,220)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net loss for the

period $ (7,580) $ (549) $ (110,101) $ (18,774)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Loss per share

Basic 10 $ (0.01) $ 0.00 $ (0.11) $ (0.01)

Diluted 10 $ (0.01) $ 0.00 $ (0.11) $ (0.01)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Weighted average number of common shares

outstanding in thousands

Basic 10 927,499 908,188 927,499 908,129

Diluted 10 927,499 916,706 927,499 908,129

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Approved and authorized for issue by the Board on November 13, 2012.

"David Cohen" "Robert Gayton"

--------------------------------- ---------------------------------

David Cohen, Director Robert Gayton, Director

Eastern Platinum Limited

Condensed consolidated interim statements of comprehensive loss

(Expressed in thousands of U.S. dollars - unaudited)

----------------------------------------------------------------------------

Three months ended Nine months ended

September 30, September 30,

2012 2011 2012 2011

----------------------------------------------------------------------------

Net loss for the period $ (7,580) $ (549) $ (110,101) $ (18,774)

Other comprehensive

income (loss)

Exchange differences on

translating foreign

operations (2,962) (133,229) (9,850) (133,701)

Exchange differences on

translating non-

controlling interest 218 (82) 509 (285)

----------------------------------------------------------------------------

Comprehensive loss for

the period $ (10,324) $ (133,860) $ (119,442) $ (152,760)

----------------------------------------------------------------------------

Attributable to

Non-controlling

interest (2,333) (1,995) (9,981) (6,839)

Equity shareholders of

the Company (7,991) (131,865) (109,461) (145,921)

----------------------------------------------------------------------------

Comprehensive loss for

the period $ (10,324) $ (133,860) $ (119,442) $ (152,760)

----------------------------------------------------------------------------

Eastern Platinum Limited

Condensed consolidated interim statements of financial position as at

September 30, 2012 and December 31, 2011

(Expressed in thousands of U.S. dollars - unaudited)

September 30, December 31,

Note 2012 2011

----------------------------------------------------------------------------

Assets

Current assets

Cash and cash equivalents 11 $ 68,662 $ 151,838

Short-term investments 66,932 98,963

Trade and other receivables 12 30,322 23,580

Inventories 13 6,862 7,989

----------------------------------------------------------------------------

172,778 282,370

Non-current assets

Property, plant and equipment 6 576,853 615,439

Refining contract 14 7,778 9,009

Other assets 15 8,905 7,995

----------------------------------------------------------------------------

$ 766,314 $ 914,813

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Liabilities

Current liabilities

Trade and other payables 16 $ 23,656 $ 40,459

Finance leases - 1,675

----------------------------------------------------------------------------

23,656 42,134

Non-current liabilities

Provision for environmental

rehabilitation 17 8,695 8,390

Deferred tax liabilities 20,331 33,520

----------------------------------------------------------------------------

52,682 84,044

----------------------------------------------------------------------------

Equity

Issued capital 7 1,230,358 1,230,358

Treasury shares 7(c) (334) (334)

Equity-settled employee

benefits reserve 43,868 41,563

Foreign currency translation

reserve (113,329) (103,479)

Deficit (433,467) (333,856)

----------------------------------------------------------------------------

Capital and reserves

attributable to equity

shareholders of the Company 727,096 834,252

Non-controlling interest 9 (13,464) (3,483)

----------------------------------------------------------------------------

713,632 830,769

----------------------------------------------------------------------------

$ 766,314 $ 914,813

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Eastern Platinum Limited

Condensed consolidated interim statements of cash flows

(Expressed in thousands of U.S. dollars - unaudited)

Three months ended Nine months ended

September 30, September 30,

Note 2012 2011 2012 2011

----------------------------------------------------------------------------

Operating activities

Loss before income

taxes $ (7,482) $ (996) $ (122,478) $ (19,814)

Adjustments to net

loss for

non-cash items

Depletion and

depreciation 6 3,259 5,568 11,525 16,540

Impairment 6 - - 88,278 -

Refining contract

amortization 14 335 387 1,032 1,189

Share-based

payments 7(e)(f) (31) 22 2,309 8,291

(Gain) loss on

disposal of

property, plant

and equipment (167) - 1,402

Interest income (791) (1,376) (2,720) (4,298)

Finance costs 8 281 322 5,380 1,197

Foreign exchange

loss (gain) 138 (3,108) (64) (4,785)

Net changes in non-

cash

working capital

items

Trade and other

receivables (3,039) (7,736) (6,231) (195)

Inventories (402) (1,408) 920 (654)

Trade and other

payables (5,936) (1,994) (6,675) (1,638)

----------------------------------------------------------------------------

Cash used in

operations (13,835) (10,319) (27,322) (4,167)

Adjustments to net

loss

for cash items

Interest income

received 979 573 3,035 2,246

Finance costs paid (165) (3) (4,631) (198)

Net taxes received - 90 543 57

----------------------------------------------------------------------------

Net operating cash

flows (13,021) (9,659) (28,375) (2,062)

----------------------------------------------------------------------------

Investing activities

Acquisition of Lion's

Head 5 - - (10,000) -

Net receipt of short-

term investments 46,919 14,752 34,897 13,257

Purchase of other

assets (435) (175) (1,147) (5,170)

Property, plant and

equipment

expenditures (23,886) (27,765) (80,540) (61,281)

Disposal of property,

plant and equipment 218 - 772 -

----------------------------------------------------------------------------

Net investing cash

flows 22,816 (13,188) (56,018) (53,194)

----------------------------------------------------------------------------

Financing activities

Common shares issued

for cash

- exercise of stock

options - - - -

Payment of finance

leases - - (1,553) (648)

----------------------------------------------------------------------------

Net financing cash

flows - - (1,553) (648)

----------------------------------------------------------------------------

Effect of exchange

rate changes

on cash and cash

equivalents 1,470 (3,876) 2,770 (2,506)

----------------------------------------------------------------------------

Increase (decrease)

in cash and cash

equivalents 11,265 (26,723) (83,176) (58,410)

Cash and cash

equivalents,

beginning of period 57,397 76,159 151,838 107,846

----------------------------------------------------------------------------

Cash and cash

equivalents, end of

period $ 68,662 $ 49,436 $ 68,662 $ 49,436

----------------------------------------------------------------------------

----------------------------------------------------------------------------

FOR FURTHER INFORMATION PLEASE CONTACT:

Eastern Platinum Limited

Ian Rozier

President & C.E.O.

+1-604-685-6851

+1-604-685-6493 (FAX)

info@eastplats.com

www.eastplats.com

NOMAD:

Canaccord Genuity Securities Limited, London

Rob Collins

+44 (0) 207 523 8000

JSE SPONSOR:

PSG Capital (Pty) Limited

Johan Fourie

+27 21 887 9602

Email: johanf@psgcapital.com

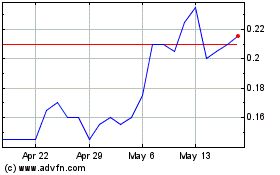

Eastern Platinum (TSX:ELR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Eastern Platinum (TSX:ELR)

Historical Stock Chart

From Nov 2023 to Nov 2024