Eloro Resources Ltd. (TSX: ELO; OTCQX: ELRRF; FSE:

P2QM) is pleased to announce that an expanded induced

polarization/resistivity (IP/Res) survey now covers most of the

Iska Iska Project, Potosi Department, Southwestern Bolivia.

East-west lines have been completed every 200m across and southeast

of the Santa Barbara mineral resource using a deep-penetrating

array of 50m and offset 100m dipoles to obtain a depth of

investigation approaching 400m. The new array and lower surface

elevations make it possible to image mineralization at elevations

below 3600m in an extension beyond the open southeastern side of

the pit that defines the initial mineral resource estimate (“MRE”)

(see Eloro press release dated October 17, 2023). In this survey,

chargeability highs across the volume already drilled for the Santa

Barbara MRE coincide with peaks in the grade of the polymetallic

Ag-Zn-Pb mineralization expressed as silver equivalent.

Dr. Bill Pearson, P.Geo., Eloro’s Executive Vice

President, Exploration commented: “We have had great success with

our borehole IP/Res program correlating mineralization between the

drillholes, but the surface IP/Res provides a 3-dimensional view

well beyond where we have drill hole coverage. The new

chargeability anomaly, extending southeastward from the open pit

that defines the MRE, adds at least an additional 600m of potential

strike length to the major mineralized structural corridor that is

up to 800m wide for an overall strike length of at least 2km. This

new target area has not been drilled. In addition, the

chargeability anomaly southeast of the pit is very strong,

suggesting that it is a prime target for outlining additional

higher-grade polymetallic mineralization.”

Figure 1 shows the same section that was

reported in the Eloro press release dated January 11, 2024. Green

solids indicate high grade mineralized zones where the silver

equivalent grade is greater than 50 g Ag eq/t. These high-grade

areas coincide very closely with high chargeability (> 20 mV/V),

confirming the correlation of grade with borehole IP between drill

holes inside the MRE pit.

The chargeability anomaly is open along strike

and at depth as exploration work has still not defined the full

limits of this remarkable mineralized system.

Figure 1. Cross Section along Line

56100N of the Chargeability Anomaly with areas with greater than 50

g Ag eq/t superimposed to show the very strong correlation. The

strong anomaly to the southeast is largely outside the open pit

defining the MRE and this area has not been drilled. Figures 2 and

3 show the location of the section line.

Figure 2 is a plan view of the model

chargeability at an elevation of 3700 m where the highest

chargeability outlined in red extends southeastward, well beyond

the MRE open pit shown in black. Drill hole pierce points at 3700 m

(grey circles) demonstrate that much of the high chargeability

anomaly has not yet been drill tested. Figure 3 is the same plan

showing the strong correlation of high-grade areas with the

chargeability anomaly.

Figure 2: Plan map of Chargeability

Model at 3700m elevation showing the extent of the chargeability

anomaly southeast of the open pit defining the MRE. Pierce points

of drill holes on the 3700 m elevation clearly show that this major

anomaly is essentially untested by drilling.

Figure 3 is a Plan Map of the same

Chargeability Model at 3700m elevation shown in Figure 2 with the

contoured 50 g Ag eq superimposed showing the strong correlation of

high-grade areas with the chargeability anomaly.

Qualified Person (“QP”)IP/Res surveys were

carried out by MES Geophysics using Eloro’s ELREC-Pro 10 channel IP

receiver and GDD 3600 watt IP transmitter. Dr. Chris Hale, P.Geo.

and Mr. John Gilliatt, P.Geo. of Intelligent Exploration provided

the survey design, preparation of the maps and interpretation of

data processed, and quality reviewed by Mr. Rob McKeown, P. Geo. of

MES Geophysics. Messrs. Hale, Gilliatt and McKeown are Qualified

Persons (“QP”) as defined under National Instrument 43-101 (“NI

43-101”).

The inaugural MRE for Iska Iska is outlined in

the NI 43-101 Technical Report (see Eloro press release dated

October 17, 2023) prepared by Micon International Limited.

Independent QPs for the Technical Report are Charley Murahwi,

P.Geo., FAusIMM, Richard Gowans, P.Eng., Ing. Alan J. San Martin,

MAusIMM (CP) and Abdul Aziz, Drame, P.Eng., all of whom are

independent QP’s as defined by NI 43-101. Mr. Murahwi completed

site visits in January 2020 and November 2022.

Silver equivalent (Ag eq) grades are calculated

using 3-year average metal prices of Ag = US$22.52/oz, Zn =

US$1.33/lb and Pb = 0.95/lb and preliminary metallurgical

recoveries of Ag = 88%, Zn = 87% and Pb= 80%.

Dr. Bill Pearson, P.Geo., Eloro’s Executive Vice

President Exploration and a QP as defined by NI 43-101 has reviewed

and approved the technical content of this news release. Dr.

Pearson who has more than 49 years of worldwide mining exploration,

development and production experience, including extensive work in

South America, manages the overall technical program, working

closely with Dr. Osvaldo Arce, P.Geo. General Manager of Eloro’s

Bolivian subsidiary, Minera Tupiza S.R.L., and a QP in the context

of NI 43-101, who has supervised all field work carried out at Iska

Iska.

About Iska IskaIska Iska

silver-tin polymetallic project is a road accessible, royalty-free

property, wholly controlled by the Title Holder, Empresa Minera

Villegas S.R.L. and is located 48 km north of Tupiza city, in the

Sud Chichas Province of the Department of Potosi in southern

Bolivia. Eloro has an option to earn a 100% interest in Iska

Iska.

Iska Iska is a major silver-tin polymetallic

porphyry-epithermal complex associated with a Miocene possibly

collapsed/resurgent caldera, emplaced on Ordovician age rocks with

major breccia pipes, dacitic domes and hydrothermal breccias. The

caldera is 1.6km by 1.8km in dimension with a vertical extent of at

least 1km. Mineralization age is similar to Cerro Rico de Potosí

and other major deposits such as San Vicente, Chorolque, Tasna and

Tatasi located in the same geological trend.

Eloro began underground diamond drilling from

the Huayra Kasa underground workings at Iska Iska on September 13,

2020. On November 18, 2020, Eloro announced the discovery of a

significant breccia pipe with extensive silver polymetallic

mineralization just east of the Huayra Kasa underground workings

and a high-grade gold-bismuth zone in the underground workings. On

November 24, 2020, Eloro announced the discovery of the SBBP

approximately 150m southwest of the Huayra Kasa underground

workings.

Subsequently, on January 26, 2021, Eloro

announced significant results from the first drilling at the SBBP

including the discovery hole from 0.0m to 257.5m. Subsequent

drilling has confirmed significant values of Ag-Sn polymetallic

mineralization in the SBBP and the adjacent CBP. A substantive

mineralized envelope which is open along strike and down-dip

extends around both major breccia pipes. Continuous channel

sampling of the Santa Barbara Adit located to the east of SBBP

returned 164.96 g Ag/t, 0.46%Sn, 3.46% Pb and 0.14% Cu over 166m

including 446 g Ag/t, 9.03% Pb and 1.16% Sn over 56.19m. The west

end of the adit intersects the end of the SBBP.

Since the initial discovery hole DHK-15 which

returned 29.53g Ag/t, 0.078g Au/t, 1.45%Zn, 0.59%Pb, 0.080%Cu and

0.056%Sn over 257.5m, Eloro has released a number of significant

drill results in the SBBP and the surrounding mineralized envelope

which along with geophysical data has defined an extensive target

zone. On October 17, 2023, Eloro filed the NI 43-101 Technical

Report outlining the initial inferred MRE for Iska Iska, prepared

by Micon International Limited. The MRE was reported in two

domains, the Polymetallic (Ag-Zn-Pb) Domain which is primarily in

the east and south of the Santa Barbara deposit and the Tin

(Sn-Ag-Pb) Domain which is primarily in the west and north. The

Polymetallic Domain is estimated to contain 560Mt at 13.8 g Ag/t,

0.73% Zn & 0.28% Pb at an NSR cutoff of US$9.20 for potential

open pit and an NSR cutoff of US$34.40 for potential underground.

The majority of the mineral resource is contained in the

constraining pit which has a stripping ratio of 1:1.

The Polymetallic Domain contains a higher-grade

mineral resource at a NSR cutoff of $US25/t of 132 million tonnes

at 1.11% Zn, 0.50% Pb and 24.3 g Ag/t which has a net NSR value of

US$34.40/t which is 3.75 the estimated operating cost of US$9.20/t.

The Tin Domain which is adjacent the Polymetallic Domain and does

not overlap, is estimated to contain a mineral resource of 110Mt at

0.12% Sn, 14.2 g Ag/t and 0.14% Pb but is very under drilled.

The Company has completed a 5,267.7m definition

drill program to upgrade and expand the higher-grade mineral

resource in the Polymetallic Domain and has commenced a preliminary

economic evaluation (PEA) led by Lycopodium.

About Eloro Resources Ltd.Eloro

is an exploration and mine development company with a portfolio of

gold and base-metal properties in Bolivia, Peru and Quebec. Eloro

has an option to acquire a 100% interest in the highly prospective

Iska Iska Property, which can be classified as a polymetallic

epithermal-porphyry complex, a significant mineral deposit type in

the Potosi Department, in southern Bolivia. A recent NI 43-101

Technical Report on Iska Iska, which was completed by Micon

International Limited, is available on Eloro’s website and under

its filings on SEDAR. Iska Iska is a road-accessible, royalty-free

property. Eloro also owns an 82% interest in the La Victoria

Gold/Silver Project, located in the North-Central Mineral Belt of

Peru some 50 km south of the Lagunas Norte Gold Mine and the La

Arena Gold Mine.

For further information please contact

either Thomas G. Larsen, Chairman and CEO or Jorge Estepa,

Vice-President at (416) 868-9168.

Information in this news release may contain

forward-looking information. Statements containing forward-looking

information express, as at the date of this news release, the

Company’s plans, estimates, forecasts, projections, expectations,

or beliefs as to future events or results and are believed to be

reasonable based on information currently available to the Company.

There can be no assurance that forward-looking statements will

prove to be accurate. Actual results and future events could differ

materially from those anticipated in such statements. Readers

should not place undue reliance on forward-looking information.

Neither the TSX nor its Regulation Services

Provider (as that term is defined in the policies of the TSX)

accepts responsibility for the adequacy or accuracy of this

release.

Photos accompanying this announcement are available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/9b618cf9-6f02-4d2d-983d-e26bf07b0d7e

https://www.globenewswire.com/NewsRoom/AttachmentNg/fcec81a1-d0db-437d-ac32-14bc08cacfa5

https://www.globenewswire.com/NewsRoom/AttachmentNg/45d8082a-ea76-4c16-bfd9-f5fe22f85675

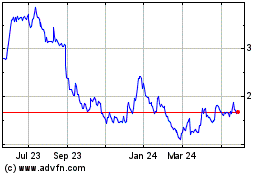

Eloro Resources (TSX:ELO)

Historical Stock Chart

From Oct 2024 to Nov 2024

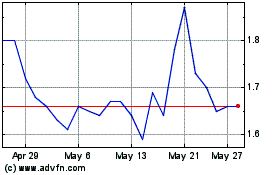

Eloro Resources (TSX:ELO)

Historical Stock Chart

From Nov 2023 to Nov 2024