E-L Financial Corporation Limited ("E-L Financial") (TSX: ELF)(TSX:

ELF.PR.F)(TSX: ELF.PR.G) today reported that for the quarter ended

June 30, 2011, it earned net consolidated operating income(1) of

$23.1 million or $5.23 per share compared with $7.7 million or

$1.31 per share for the comparable period in 2010. On a year to

date basis, E-L Financial earned consolidated net operating income

of $48.2 million or $10.97 per share compared with $20.1 million or

$3.83 per share for the comparable period in 2010.

-- E-L Corporate's $4.8 million increase in net operating income during the

second quarter and $4.4 million on a year to date basis compared to the

prior year was due primarily to increased dividends from the global

portfolios.

-- The Dominion's $4.7 million increase in the quarter's operating income

and $6.6 million on a year to date basis compared to the prior year

reflects improved underwriting results and an increase in investment

income. Improved underwriting results were driven by better automobile

claims experience.

-- Empire Life's $5.8 million increase in net operating income for the

quarter compared to the prior year was due primarily to improved

segregated fund fee income in the Wealth Management business segment. On

a year to date basis net operating income increased $17.1 million

compared to the prior year due primarily to better mortality and

surrender experience in the Individual Insurance product line in 2011.

Net operating income also improved due to a non-recurring loss in the

first quarter of 2010 related to a change in actuarial method. This

change in actuarial method was related to the January 1, 2010 transition

to IFRS.

Net income

For the three months ended June 30, 2011, E-L Financial incurred

a consolidated net loss of $11.4 million or $3.53 per share

compared with $38.1 million or $10.33 per share in 2010. On a year

to date basis, E-L Financial earned a consolidated net income of

$38.8 million or $8.58 per share compared with a loss of $19.4

million or $6.18 per share in 2010.

-- E-L Corporate's $7.5 million reduction in its net loss for the quarter

compared with the prior year was mainly due to an increase in realized

gains on available for sale ("AFS") investments. Income from investments

in associates was impacted by a $25.6 million impairment write down. On

a year to date basis, E-L Corporate's net income increased $20.0 million

compared with the prior year reflecting improvements in global stock

markets.

-- Both The Dominion's and Empire Life's net income increased for the

quarter and year to date compared to the prior year as a result of

improved operating income and an increase in realized gains on AFS

investments.

Comprehensive income

For the three months ended June 30, 2011, E-L Financial had a

consolidated comprehensive loss of $10.8 million or $3.38 per share

compared with $47.3 million or $12.65 per share for the comparable

period in 2010. Other comprehensive income ("OCI") was $0.6 million

or $0.15 per share compared with other comprehensive loss ("OCL")

of $9.2 million or $2.32 per share for the comparable period in

2010.

On a year to date basis, E-L Financial earned consolidated

comprehensive income of $35.0 million or $7.62 per share compared

with a loss of $25.8 million or $7.82 per share for the comparable

period in 2010. Consolidated OCL was $3.8 million or $0.96 per

share compared with $6.4 million or $1.63 per share for the

comparable period in 2010.

-- E-L Corporate's OCI decreased $6.9 million in the quarter and $8.2

million on a year to date basis compared to the prior year reflecting an

increase in realized gains being reclassified to net income during both

periods.

-- The Dominion's OCI increased $21.0 million during the quarter and $9.6

million on a year to date basis compared to the prior year mainly due to

net unrealized investment gains in bonds and debentures.

-- Empire Life's $4.3 million increase in OCL for the quarter compared to

the prior year was due primarily to the reclassification to net income

of a realized gain in 2011 versus reclassification of a realized loss in

2010. On a year to date basis OCL decreased $1.3 million compared to the

prior year due primarily to stronger Canadian stock markets in 2011 than

2010.

CONSOLIDATED SUMMARY OF COMPREHENSIVE (LOSS) INCOME

----------------------------------------------------------------------------

Three months ended June 30, 2011

---------------------------------------------

E-L The Empire

(thousands of dollars) Corporate Dominion Life Total

----------------------------------------------------------------------------

Net operating income $ 4,036 $ 9,090 $ 9,970 $ 23,096

Realized gain on available for

sale investments including

impairment write downs 3,180 5,113 3,283 11,576

Share of loss of associates (24,170) - - (24,170)

Fair value change in fair value

through profit or loss

investments (21,876) (21,876)

----------------------------------------------------------------------------

Net (loss) income (38,830) 14,203 13,253 (11,374)

Other comprehensive (loss)

income (20) 6,738 (6,120) 598

----------------------------------------------------------------------------

Comprehensive (loss) income $ (38,850) $ 20,941 $ 7,133 $ (10,776)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended June 30, 2010

----------------------------------------------

E-L The Empire

(thousands of dollars) Corporate Dominion Life Total

----------------------------------------------------------------------------

Net operating (loss) income $ (797) $ 4,350 $ 4,136 $ 7,689

Realized (loss) gain on

available for sale

investments including

impairment write downs (3,615) 1,923 (2,177) (3,869)

Share of loss of associates (22,716) - - (22,716)

Fair value change in fair

value through profit or loss

investments (19,250) (19,250)

----------------------------------------------------------------------------

Net (loss) income (46,378) 6,273 1,959 (38,146)

Other comprehensive income

(loss) 6,892 (14,254) (1,791) (9,153)

----------------------------------------------------------------------------

Comprehensive (loss) income $ (39,486) $ (7,981) $ 168 $ (47,299)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Six months ended June 30, 2011

----------------------------------------------

E-L The Empire

(thousands of dollars) Corporate Dominion Life Total

----------------------------------------------------------------------------

Net operating income $ 7,344 $ 22,479 $ 18,357 $ 48,180

Realized gain on available for

sale investments including

impairment write downs 4,305 13,140 6,061 23,506

Share of loss of associates (17,028) - - (17,028)

Fair value change in fair

value through profit or loss

investments (15,858) (15,858)

----------------------------------------------------------------------------

Net (loss) income (21,237) 35,619 24,418 38,800

Other comprehensive (loss)

income (2,607) 1,827 (2,998) (3,778)

----------------------------------------------------------------------------

Comprehensive (loss) income $ (23,844) $ 37,446 $ 21,420 $ 35,022

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Six months ended June 30, 2010

-----------------------------------------------

E-L The Empire

(thousands of dollars) Corporate Dominion Life Total

----------------------------------------------------------------------------

Net operating income $ 2,983 $ 15,882 $ 1,261 $ 20,126

Realized (loss) gain on

available for sale

investments including

impairment write downs (3,638) 2,280 2,463 1,105

Share of loss of associates (24,636) - - (24,636)

Fair value change in fair

value through profit or loss

investments (15,947) (15,947)

----------------------------------------------------------------------------

Net (loss) income (41,238) 18,162 3,724 (19,352)

Other comprehensive income

(loss) 5,596 (7,734) (4,278) (6,416)

----------------------------------------------------------------------------

Comprehensive (loss) income $ (35,642) $ 10,428 $ (554) $ (25,768)

----------------------------------------------------------------------------

(1)Use of non-GAAP measures:

"net operating income (loss)" is net income excluding realized gain (loss)

on AFS investments including impairment write downs, the Company's share of

income (loss) from associates and the fair value change in FVTPL investments

in the E-L Corporate portfolio, all net of tax. The term net operating

income (loss) does not have any standardized meaning according to GAAP and

therefore may not be comparable to similar measures presented by other

companies.

Contacts: E-L Financial Corporation Limited Mark M. Taylor

Executive Vice-President and Chief Financial Officer (416) 947-2578

(416) 362-2592 (FAX)

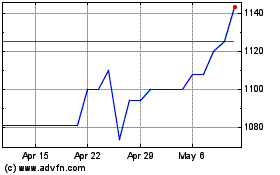

E L Financial (TSX:ELF)

Historical Stock Chart

From Oct 2024 to Nov 2024

E L Financial (TSX:ELF)

Historical Stock Chart

From Nov 2023 to Nov 2024