DPM Contracts for Sale of Chelopech Pyrite Concentrate to Xiangguang Copper Co.

December 05 2012 - 8:45AM

Marketwired Canada

Dundee Precious Metals Inc. (TSX:DPM)(TSX:DPM.WT.A) ("DPM" or "the Company") has

entered into an agreement with Xiangguang Copper Co. ("XGC") for the sale of up

to 200,000 tonnes per year of pyrite concentrate to be produced at DPM's

Chelopech mine in Bulgaria (the "Agreement") during Stage 1 of its gold in

pyrite recovery project (the "Project"). The total annual concentrate supply to

XGC is expected to contain between 28,000 and 30,000 ounces of payable gold at a

cash cost of approximately US$1,200 per ounce. DPM will earn a payable amount

based on the gross value of the concentrate at spot prices, net of certain

transportation and processing costs.

"We are extremely pleased with this arrangement with XGC which secures a sales

outlet for our clean Chelopech pyrite concentrate," stated Jonathan Goodman,

President and CEO. "This not only generates cash flow on previously unrecovered

gold ounces for relatively low capital while we continue the evaluation and

execution of Stage 2 of our project, it also establishes that there is an

expanding market for our pyrite products." Mr. Liu, Chairman of XGC stated "XGC

is also very happy to provide solutions to DPM with its unique technologies and

skills. The cooperation between the two companies will be mutually beneficial

and complementary."

The reconfiguration of the Chelopech mill during 2013 will bring annual

production capacity of pyrite concentrate to 400,000 tonnes. The Agreement

provides for the purchase by XGC of up to 200,000 tonnes per year of pyrite

concentrate from Chelopech Mining EAD, a wholly-owned subsidiary of DPM and

owner of the Chelopech mine, from 2014 to 2016. There is also the possibility of

a further sale of up to 50,000 tonnes of pyrite concentrate during 2013, subject

to confirming the capability of the existing mill process equipment to produce

moderate amounts of pyrite concentrates in batch runs. Sales in 2016 are

conditional upon various global factors such as the gold price, shipping rates

and acid prices in China remaining satisfactory. The Agreement is subject to

requisite permitting, government approvals and completion of the mill

reconfiguration.

In addition, XGC has agreed to purchase 2,000 tonnes per month of Chelopech

copper concentrates, on market competitive terms, starting April 2013 for a

minimum of 12 months. Purchases will continue from March 2014, subject to three

months' cancellation notice by either Chelopech or XGC.

Background

Chelopech is an underground gold, copper and silver mine, which currently

produces a copper concentrate with metal recoveries averaging 55%, 85% and 42%,

respectively. The preliminary economic assessment, reported in the National

Instrument 43-101 Technical Report for the Chelopech Project, Bulgaria filed on

SEDAR on September 10, 2012, confirmed that through this Project there is

potential to recover most of the unrecovered gold, silver and copper. The bulk

of these unrecovered metals are mainly associated with the mineral pyrite, which

is currently rejected in the flotation process to ensure a saleable copper

concentrate. Once Bulgarian regulatory approval is received, reconfiguration of

the Chelopech mill will consist of the installation of a new flotation,

thickening and filtration system, creating a pyrite concentrate circuit.

Consequently, at the full mine production rate of 2 million tonnes per annum,

approximately 400,000 tonnes of pyrite concentrate, free of deleterious matter,

will be generated from the mill feed as a separate concentrate product in

addition to the copper concentrate already produced. The reconfiguration of the

mill is expected to take approximately twelve months and be completed by the end

of 2013 at an estimated capital cost of US$23 million. The sale of the pyrite

concentrate to XGC will generate initial cash flow while the remaining phases of

Stage 2 of the Project are being designed, permitted and constructed.

XGC is one of the largest modern copper smelting companies in China and in the

world. Its smelter plant, located in Yanggu, County of Shandong Province, China,

employs the advanced double flash smelting technology and is operated with high

cost efficiency and superior environmental standards. The smelter has designed

capacities of 450,000mt blister, 500,000mt cathodes, 1,400,000mt sulphuric acid

and 650,000 ounces of gold every year.

DPM is a Canadian based, international gold mining company engaged in the

acquisition, exploration, development, mining and processing of precious metals.

The Company's principal operating assets include the Chelopech operation, which

produces a gold, copper and silver concentrate, located east of Sofia, Bulgaria;

the Deno Gold operation, which produces a gold, copper, zinc and silver

concentrate, located in southern Armenia; and the Tsumeb smelter, a concentrate

processing facility located in Namibia. DPM also holds interests in a number of

developing gold properties located in Bulgaria, Serbia, and northern Canada,

including interests held through its 51.4% owned subsidiary, Avala Resources

Ltd., its 47.3% interest in Dunav Resources Ltd. and its 10.7% interest in

Sabina Gold & Silver Corp.

Forward-Looking Statements

This news release contains "forward-looking statements" that involve a number of

risks and uncertainties. Forward-looking statements include, but are not limited

to, statements with respect to the future price of gold and silver, the

estimation of mineral reserves and resources, the realization of mineral

estimates, the timing and amount of estimated future production and output,

costs of production, capital expenditures, costs and timing of the development

of new deposits, success of exploration activities, permitting time lines,

currency fluctuations, requirements for additional capital, government

regulation of mining operations, environmental risks, unanticipated reclamation

expenses, title disputes or claims, limitations on insurance coverage and timing

and possible outcome of pending litigation. Often, but not always,

forward-looking statements can be identified by the use of words such as

"plans", "expects", or "does not expect", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or

"believes", or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or "will" be taken,

occur or be achieved. Forward-looking statements are based on the opinions and

estimates of management as of the date such statements are made, and they

involve known and unknown risks, uncertainties and other factors which may cause

the actual results, performance or achievements of the Company to be materially

different from any other future results, performance or achievements expressed

or implied by the forward-looking statements. Such factors include, among

others: the actual results of current exploration activities; actual results of

current reclamation activities; conclusions of economic evaluations; changes in

project parameters as plans continue to be refined; future prices of gold,

copper, zinc and silver; possible variations in ore grade or recovery rates;

failure of plant, equipment or processes to operate as anticipated; accidents,

labour disputes and other risks of the mining industry; delays in obtaining

governmental approvals or financing or in the completion of development or

construction activities, fluctuations in metal prices, as well as those risk

factors discussed or referred to in documents filed from time to time with the

securities regulatory authorities in all provinces and territories of Canada and

available at www.sedar.com.

Although the Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors that cause

actions, events or results not to be anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to be accurate,

as actual results and future events could differ materially from those

anticipated in such statements. Unless required by securities laws, the Company

undertakes no obligation to update forward-looking statements if circumstances

or management's estimates or opinions should change. Accordingly, readers are

cautioned not to place undue reliance on forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Dundee Precious Metals Inc.

Jonathan Goodman

President & Chief Executive Officer

(416) 365-2408

jgoodman@dundeeprecious.com

Dundee Precious Metals Inc.

Lori Beak

Senior Vice President, Investor & Regulatory

Affairs and Corporate Secretary

(416) 365-5165

lbeak@dundeeprecious.com

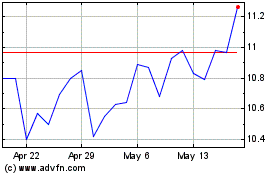

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

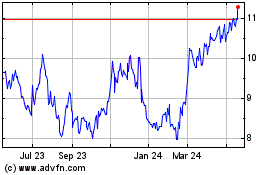

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024