Dundee Precious Metals Inc. Announces Terms of Equity Offering

November 07 2008 - 10:11AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

In connection with its previously announced public offering on November 6, 2008,

Dundee Precious Metals Inc. (TSX:DPM) (the "Company") announced today that it

has entered into an underwriting agreement with a syndicate of underwriters

co-led by GMP Securities L.P. and Dundee Securities Corp. and including BMO

Capital Markets, to sell 31,112,000 Units at a price of C$2.25 per Unit to raise

gross proceeds of C$70,002,000 pursuant to a short form prospectus. Each Unit

will consist of one common share of the Company (a "Common Share") and one-half

of one common share purchase warrant (each whole common share purchase warrant,

a "Warrant"). Each Warrant will entitle the holder to acquire one additional

Common Share at an exercise price of $3.25 per share for a period of seven years

following the closing of the Offering. In addition, the Company has granted the

underwriters an over-allotment option to purchase up to that number of

additional Common Shares and half-Warrants equal to 15% of the Units sold

pursuant to the Offering, exercisable at any time up to 30 days from the closing

of the Offering. The Offering is subject to certain conditions, including

regulatory and TSX approval.

The Company intends to use the net proceeds for ongoing operating requirements,

capital expenditures, including project capital for the Chelopech mine

expansion, and general corporate purposes.

The Offering is expected to close on or about November 20, 2008.

Certain statements contained in this news release constitute forward-looking

statements. Such forward-looking statements involve a number of known and

unknown risks, uncertainties and other factors which may cause the actual

results, performance or achievements of the Company's plans to differ materially

from any future results, performance or achievements expressed or implied by

such forward-looking statements. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as of the date

the statements were made, and readers are advised to consider such

forward-looking statements in light of the risks set forth in the Company's

Annual Information Form for the year ended December 31, 2007, a copy of which is

available at www.sedar.com.

This press release shall not constitute an offer to sell or a solicitation of an

offer to buy any securities in the United States. The securities have not been

registered under the U.S. Securities Act of 1933 any may not be offered or sold

in the United States absent registration or an exemption from the registration

requirements of the U.S. Securities Act of 1933.

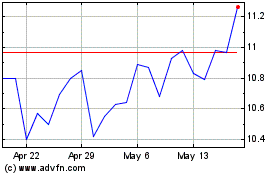

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

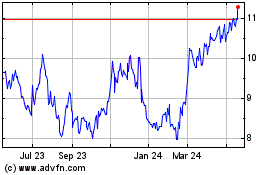

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024